A Great Year Ends for the Stock Market; Expectations for 2025

Plus: Top 10 SMP articles from 2024

Disclaimer: information and narrative below is presented for educational and informational purposes only. Consult a CPA and licensed investment advisor before making any investment decisions. Each person’s circumstances are different.

A Great Year Ends for the Stock Market; Expectations for 2025

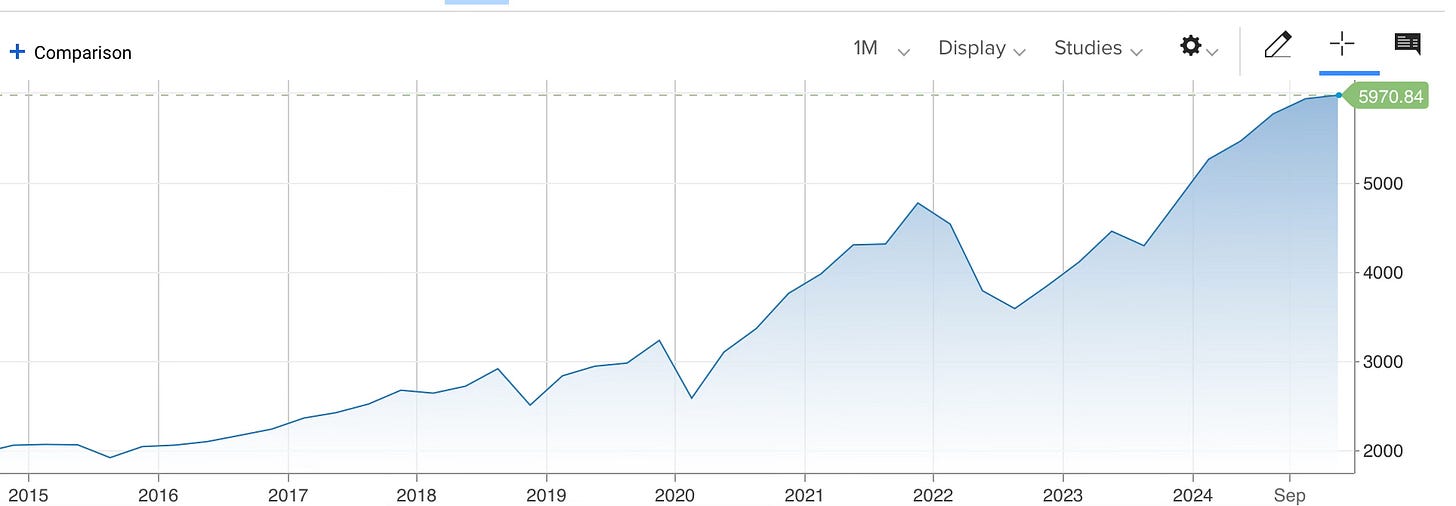

Stock investors should raise a glass to toast the year-that-was this New Year’s Eve, with robust gains coming across all U.S. market stock indexes and in nearly all sectors of the economy. Eleven of the twelve major S&P 500 investment sectors were up for the year (with two trading days left to go, as of the time of this writing), with the strongest gains coming in Technology (+37%), Communications (+35%), and Consumer Cyclicals (+28%). Laggards included Healthcare (+1%) and Materials (-2%), but you could almost have thrown a dart at the stock list last January and probably earned at least 15-20% on a reasonably well-diversified portfolio. The tech-heavy NASDAQ was up nearly 35%. Stock markets outside of the United States were mostly up for the year too.

So what’s not to love? The Roaring 20’s are back! The good times are here again, right? Well, while there are lots of reasons for optimism and excitement in the investment world as we turn the calendar to 2025, it is actually some of that very exuberance that should give pause and encourage investors to reset expectations going into a new year, at least as they pertain to stock market performance.

The Perils of Prediction

I almost never make specific predictions about the stock market. Why? For starters, no one knows what is going to happen in the markets over any short-term time frame. Things happen. The world spins. Wars unfold, pandemics spread, and the chaos of a billion variables turns in an unpredictable cloud of energy, activity, and momentum.

No one knows exactly where interest rates will be one year from now, or what the unemployment rate will be. No one knows what corporate earnings will be, and yes, where the stock market will end 2025. Analysts armed with almost unlimited data and all manner of resources didn’t correctly predict the stock market rise over the last year, for example. According to Bloomberg, not one major analyst came close to predicting the S&P 500’s 26% rise in 2025; in fact, no leading analyst predicted an increase of even half that much. Oops.

The second reason I don’t make firm predictions about the stock market is that at the current time, I simultaneously believe the stock market is due for a 10-20% pull back (and we will very likely have it at some point in 2025), and that over the long haul, stocks are a safe and profitable investment. If your time horizon is long-enough and you don’t do anything stupid like sell at the bottom or pull your money out when the going gets tough, you’re likely to make money in the stock market. So in some ways, it’s silly to debate (or predict) a short-term pull-back when the overarching trend that supersedes all the smaller mini-trends is that stocks do tend to pretty predictably go up (again, over a long time horizon).

But I do see some worrying signs out there right now, which are more related to human psychology than corporate performance or politics (although those latter variables matter, too). Investors do not seem very cautious right now, which is the exact reason I am getting concerned. As Warren Buffett has said, “Be fearful when others are greedy, and be greedy when others are fearful.” From where I sit, there is much more greed in the market these days than fear.

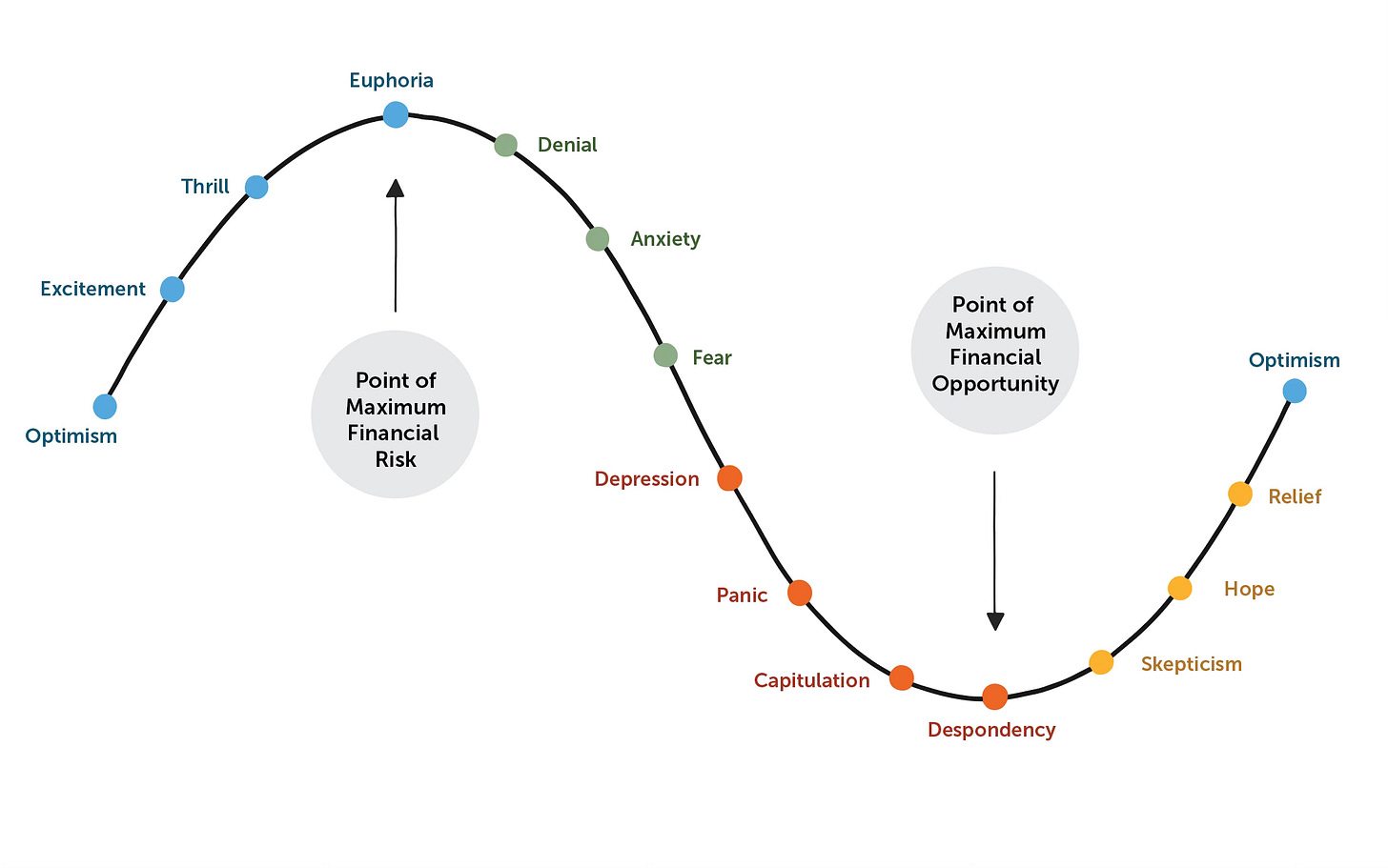

I have shared the chart below before on these pages, and I’m doing so again here because it provides a helpful template to understand the emotions of stock market investing:

This pattern repeats itself over and over in history. Sometimes the cycle takes days, weeks, or months, and sometimes it takes years or even a decade or more, depending on the investment or index at hand.

If you look at the chart below for the S&P 500 over the past ten years, where do you suppose we are on the cycle right now? We are certainly not anywhere on the downward part of the cycle, and almost certainly in between thrill and euphoria.

Signs of Concern

Several challenges could affect market performance in the year ahead:

Interest Rate Uncertainty:

While inflation has eased, interest rates remain elevated, particularly for mortgages. High rates increase borrowing costs, potentially cooling economic activity and pressuring corporate profits.Geopolitical and Policy Risks:

Ongoing uncertainties include U.S. immigration and trade policies, the rising federal debt (and the need to continually increase the debt ceiling), and potential tariff disputes. Political unpredictability, particularly with an incoming president as volatile as Donald Trump (not to mention his high-profile confidants) adds further complexity.Valuation Concerns:

A handful of mega-cap stocks—the so-called “Magnificent 7” (Apple, Microsoft, Amazon, Alphabet, NVIDIA, Tesla, and Meta)—led much of 2024’s gains. NVIDIA, for example, surged 185% due to its leadership in AI technology. While these companies are fundamentally strong and each plays a dominant role in its respective industry, it is unrealistic to expect similarly high returns in 2025. Not only that, but a lot of the expectations of how a Trump presidency could positive impact stocks have already been essentially “baked in” through gains in the latter part of the year.Psychological Factors:

The prevalence of greed over caution is worrisome. Retail investors have poured into high-performing stocks, often chasing gains after the rally has already occurred. As Warren Buffett has wisely noted in a second, lesser known quote, “What the wise do in the beginning, the fool does in the end.” Too many investors are chasing gains right now; eventually the tide will turn on that.

2025 Stock Market Outlook

If pressed for a prediction, I would expect a choppy year ahead with modest overall returns. After two consecutive years of exceptional performance (+24% in 2023 and +26% in 2024), a breather seems likely. I would not be surprised to see markets drop by 10-15% in the first half of the year and then perhaps bounce back after a period of stabilization.

However, this is not a call to abandon stocks altogether. Investors with long-term horizons should remember the broader historical trend: Stocks have consistently outperformed other asset classes over time.

The tips below would be applicable in any year of investing, but are particularly important to keep in mind after the run-up in stock prices we’ve seen of late:

Diversification and Balance:

If you are near retirement or risk-averse, consider diversifying into bonds or other stable assets. The 10-Year Treasury Note currently offers a 4.6% yield—a respectable return with minimal risk.Patience and Preparedness:

Downturns are an inherent part of investing. Maintaining cash or low-risk assets allows you to capitalize on market corrections, buying stocks at lower prices when the time comes.Resist Emotional Decisions:

Avoid chasing momentum or reacting emotionally to market downturns. Staying disciplined and focused on long-term goals remains the key to investment success.

Final Thoughts

While 2025 may not deliver the extraordinary returns of the past two years, it will still offer opportunities for savvy and disciplined investors. As always, balance optimism with caution, keep emotions in check, and stay the course for long-term growth.

The other advantage of being in Treasuries or cash during a season of investing is that if the stock market does give us another opportunity like we saw in 2008-2009, you can be ready. Remember the chart above. The focus of people who look at that graphic is typically at the top of the cycle, at the moment of euphoria. But keep in mind the bottom of the cycle too. Hopefully we don’t experience a deep trough in 2025 a la 2008, but if we do, you’ll be happy to have kept some powder dry so you can buy in at the moment of maximum financial opportunity, i.e. the bottom.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

These were the Top 10 most read Sunday Morning Post articles in 2024.

As always, thanks for reading and sharing!

Ben Franklin and Long-Term Time Horizons (September 15th)

Are Homeless Camps Legal? (April 28th)

Multiunit Construction if Plummeting (June 23rd)

Amazon's Work-From-Home Reversal (September 22nd)

The Fed Cut. Why Did Home Mortgage Rates Rise? (October 13th)

What to Expect in the Trump 2.0 Economy (November 10th)

The Math of the Housing Crunch (February 11th)

The College Crisis (February 4th)

The Insular Thanksgiving (November 24th)

Why It's So Hard to Own a Restaurant Right Now (October 20th)

If you have topics you would like me to write about in 2025, send them along!

Have a great week, everybody! And a Happy New Year to all.