If you’ve recently renewed your car insurance and found yourself doing a double-take at the bill, you’re not alone. Across the country, drivers are seeing premiums soar. In fact, in each of the past several monthly Consumer Price Index reports, auto insurance has been the #1 most inflating item. From August 2023 to August 2024, auto insurance was up a whopping 16.5%, outpacing all other goods and services by a wide margin (other than gardening and landscaping services, which were up by 13.5% year-over-year; a story for another day, though).

It’s not a simple story as to why car insurance has gone up so much in price. I spoke with several insurance agents over the past week to learn more, and while the explanations might not make the costs any easier to bear, the reasons behind the cost increases show just complex the world of insurance pricing has become.

1. Inflation and Rising Repair Costs + Car Technology

One of the most straightforward explanations for the rise in car insurance costs is inflation. As the price of everything from car parts to labor has increased, insurers have had to account for the higher expenses involved in repairing vehicles after an accident. Even minor collisions now come with hefty price tags thanks to the complexity of modern cars, which are equipped with advanced technology like sensors, cameras, and specialized materials. Last spring, for example, I had a large pebble strike my front window after it got kicked up by an oncoming truck in the other lane. It sounded like a bullet when it hit the window, and made an immediate imprint in the glass that later expanded to to an eight-inch seam requiring a full windshield replacement. The job at the glass shop took a full day, not because of the challenge of putting in the new glass, but because they had to have someone come over from the nearby Toyota service department to recalibrate the front facing camera that helps with lane assist.

To me, the consumer that day, the cost for the work appeared to be $0 because of a glass replacement rider in my auto insurance. And yet, I’m sure I was paying for it through rising premiums. A glass replacement (or a bumper replacement, or a chassis alignment, or any one of a hundred other adjustments or repairs) might include integrated safety technology that requires precision work. All of this adds to the cost of claims, and insurers, in turn, are adjusting premiums upward to cover these escalating costs.

2. More Accidents and Distracted Driving

Despite advancements in vehicle safety, the number of accidents has been rising in the years coming out of the pandemic. One of the major culprits behind this increase is distracted driving. With smartphones now being ubiquitous, many drivers are engaging in behaviors that take their attention away from the road like texting, checking social media, and flipping through their devices for music, podcasts, or just to search the web. According to one data point, distracted driving kills an average of 9 people per day in this country.

This surge in distracted driving has led to more frequent accidents, and with more claims being filed, insurers have had to raise rates to offset the increased payouts. Even for drivers with clean records, the overall trend means premiums are climbing across the board.

3. Severe Weather and Climate Change

Extreme weather events are becoming more common and more severe, and this is having a direct impact on insurance costs. From hurricanes and floods to wildfires and hailstorms, natural disasters are damaging vehicles in large numbers. As insurers face growing costs from these weather-related claims, those expenses are reflected in the premiums we pay even if you don’t necessarily live in an area that is directly affected. In states particularly vulnerable to natural disasters such as Florida and California, the impact on car insurance rates has been especially pronounced. But even in areas less prone to extreme weather, the overall trend is pushing rates higher nationwide. (From the archives: I have written about trouble in the real estate insurance markets in Florida and other places here and here previously).

4. Fraudulent Claims

Insurance fraud, while not the biggest factor, also contributes to higher premiums. Fraudulent claims (whether they involve staged accidents or exaggerated damages) cost the insurance industry billions of dollars each year. To offset these losses, insurers adjust rates for everyone. This means that even the most responsible drivers are indirectly paying for the dishonest actions of a few.

This is not just an issue here in the United States, either; a British study recently found that there were nearly 85,000 fraudulent vehicle insurance claims in 2023, costing the country over one billion pounds.

5. Normalization from the Pandemic

I spoke to one insurance agent recently who told me one reason why car insurance has increased so much in the past few years is that it came down so much in 2020 and 2021. “Now the insurers are trying to make it back,” he told me. Among the reasons why auto insurance dropped several years ago was that there were fewer cars on the road during the early days of the pandemic, and thus fewer accidents and fewer claims. Competing insurers also offered rebates to customers in order to retain, often giving discounts of up to 15-20%. As rates of driving rebounded, however, the insurance companies realized that they had perhaps cut rates too much (especially in the context of the other variables noted above), and thus started to play catch-up.

Insurance companies are not typically seen as the sympathetic characters out there, and I’m not trying to play defender here for what is an industry worth trillions of dollars, but insurers are operating in a challenging environment with rapidly changing variables that impact pricing models. To remain solvent and capable of paying out claims when accidents happen, they’re adjusting those models. This is not necessarily an act of greed, but a reflection of the economic and social realities they’re grappling with.

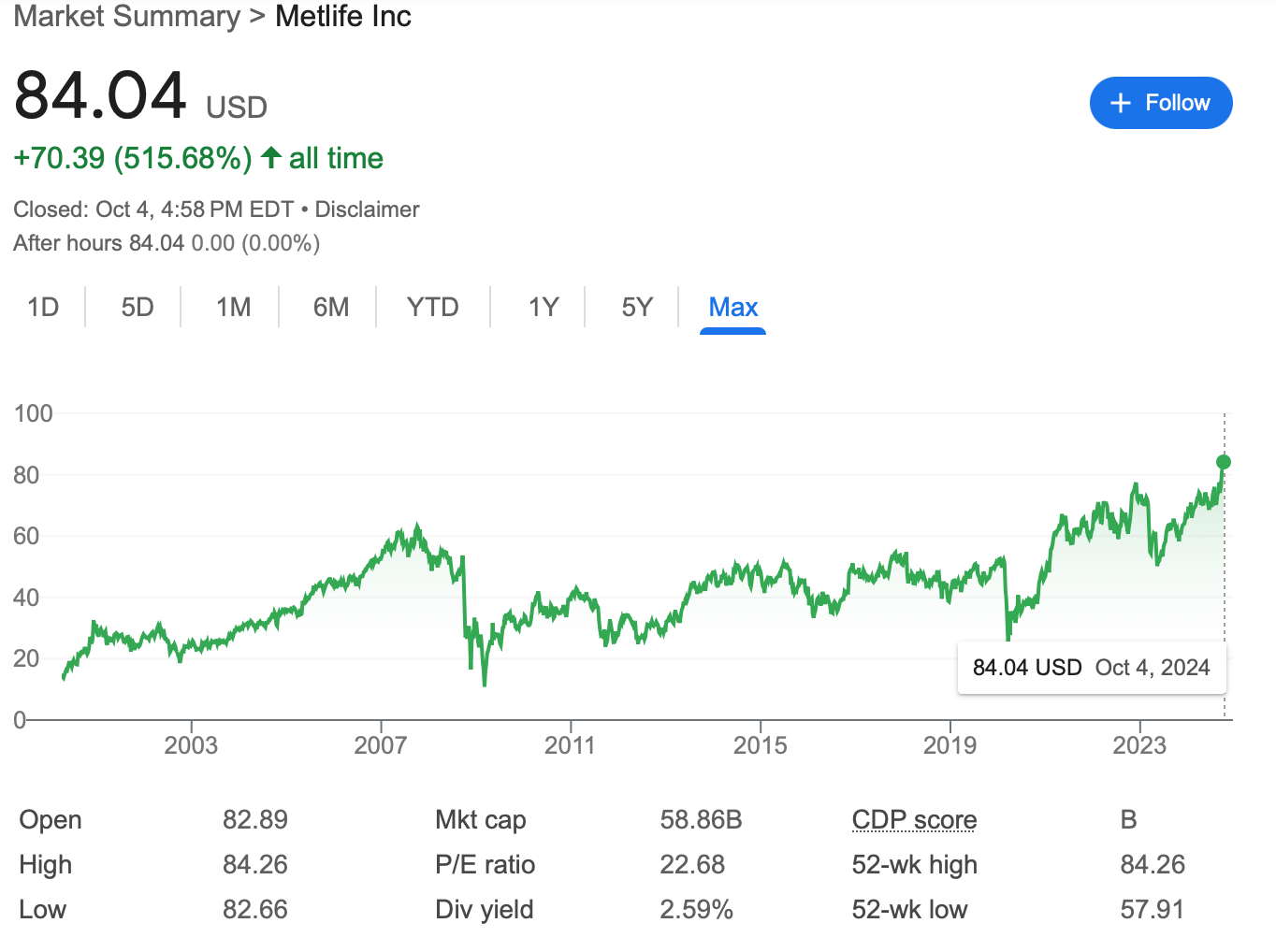

That being said, there are numerous publicly traded insurers who are trading at or near all-time highs. MetLife Financial, for example, literally hit its all-time high on Friday afternoon.

Final Thoughts

In the end, the rising cost of car insurance is the result of several complex and interrelated factors. From inflation and more frequent accidents to extreme weather and increased technology in cars that requires precision repairs, it’s clear that the environment for insurers has become more challenging and they’re passing those challenges on to consumers in the form of higher premiums. That said, the record-high profits are hard to ignore.

Will insurance costs eventually come down? Well, the pendulum does swing. But many of the variables noted above are not necessarily going away and are actually likely to get worse. Insurers may get better at pricing risk, and those that manage risk the best will be able to offer the most competitive prices and perhaps drag prices down industry-wide, or at least decelerate them. If you are in the camp that believes the rising premiums are a form of price gouging, I suppose the hope is that increased competition in the industry could lead to better outcomes for consumers. But it is tough when it is a product that people are required to have. Perhaps some of the same technology that has made the repairs more expensive will also ultimately lead to safer drivers, which could bring insurance costs down eventually.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few highlights from the past week:

Friday’s jobs report was surprisingly strong: 254,000 new jobs were created in September, and the unemployment rate inched down to 4.1%.

Property damage from Hurricane Helene is expected to be at least $15 billion, but actual claims paid are likely to be closer to $5 billion. Why? Most people don’t have flood insurance, and a big portion of hurricane damage is from flooding (so say the insurance companies). Many insurance policies in hurricane-ridden areas also have exclusions for damage from “wind-driven rain” and wind damage. Read more via Wall Street Journal. Yikes.

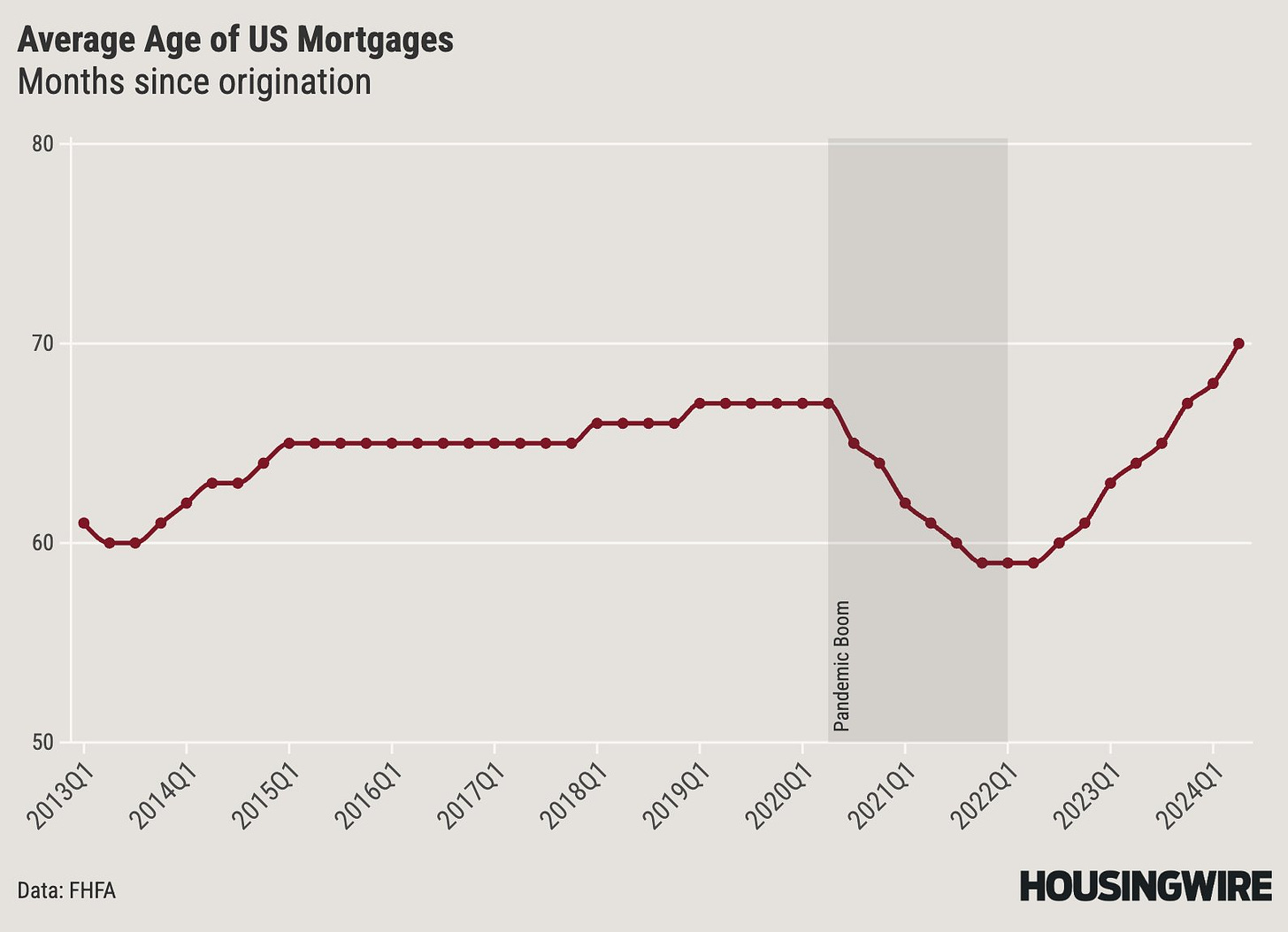

Mike Simonsen shared the visual below on X showing the mortgage rate lock-in effect, saying, “The Great Stay - a story told in mortgages. People used to keep mortgages for 5.5 years on average. Maybe you move or refi or pay it off. Then we all refi'd in 2021. Then we stopped refi-ing and stopped moving.”

Have a great week, everybody!

Very unformative note! Had a similar experience with my windshield - who knew the whole car had to be re-booted for a small crack? Hoping one or more insurers deploy better risk systems so that they can more accurately price imdividual policies in the future. A good use for AI?

For any1 interested in Sep CPI coming out tomorrow, here are my estimates with almost-perfect track record:

https://open.substack.com/pub/arkominaresearch/p/sep-2024-cpi-estimate?r=1r1n6n&utm_campaign=post&utm_medium=web