Advice to Homebuyers

Welcome to The Sunday Morning Post. Subscribe for free to join 726 others who receive ad-free content in their inboxes each Sunday morning. If you’re new here, you might enjoy these recent articles: What’s Happening with Interest Rates and Signs Inflation Has Peaked.

Advice to Homebuyers

Bidding wars, cash offers, offers above list price, dozens of open houses, precious little inventory: the housing market has been full of frustrations for buyers over the last two and a half years especially first-time homebuyers and low-to-moderate income homebuyers. There are signs, however, that the housing market is coming back to some sort of equilibrium. So even though buyers may still be feeling peak levels of frustration during these hot summer months, patience is key as things are improving for buyers.

Buying a home is a huge decision. Data earlier this year suggested that 70% of recent homebuyers have regrets. Making the wrong decision on a home purchase can set a person, couple, or family back years financially, and lead to even more frustrations just of a different kind. You want to get it right.

With all of that in mind, here is my advice to homebuyers, particularly first-time homebuyers and those in the low and middle portions of the price spectrum.

Inventory will improve

Right now, when a home comes on the market it seems there are dozens of buyers waiting to pounce. This can lead to stressful decisions on whether to rush an offer or to overbid just to get something. My advice at this point is to be patient because a lot more homes are going to be coming onto the market in the months ahead.

I am seeing anecdotal evidence that sellers who have been waiting to try to time to the top of the market are now rushing to sell, worried that the peak is here or may already have passed. Look at Denver, for example, as just one example of what is happening in some of America’s larger metropolitan areas, where according to the Denver Metropolitan Association of Realtors:

Every indicator points to the market shifting closer to a buyer’s market. The month-end active listings increased 21.53 percent last month….and up 81.5% year-over-year from 4,056 in July 2021.” (H/T Calculated Risk Blog).

I fully expect similar surges in inventory in communities around the country, large and small. This will provide buyers with more options, it will diffuse the competition among buyers out across more homes, and it will give people space to make less rushed decisions. While according to the St. Louis Fed the average home is staying on the market for 32 days, which is nearly the shortest amount of time since they started tracking the data, I fully expect by this fall, winter, and next spring, that the average days on the market will be notably higher thanks to both seasonal factors but also significantly more inventory being available.

Homes are being built

Further good news on the inventory front for buyers: homebuilders are building more homes currently than at any point since the Great Recession, as shown in the chart below. This inventory will either immediately or eventually come online. The one caveat to this, however, is that with rising interest rates in the past two months, the number of new-home starts actually decreased from recent peaks in May and June as you can tell from the far-right side of the chat, which if that becomes a trend will have a dampening effect:

Prices will ease

I am hesitant to say that home prices are going to drop significantly nationwide because I just think there are still plenty of reasons for strength including the fact that just this week the Labor Department released yet another red hot jobs report, which is a sign that we are actually not entering a recession despite frustrations about inflation and rapidly rising interest rates. The one caveat is that interest rates are rising more sharply and more significantly than anyone projected, and that is undoubtedly going to have an impact on home prices at some point.

There is plenty of evidence that the rate of increase in home prices is sharply decelerating, however, which I interpret as prices leveling out. In certain bubbly markets, which I wrote about two weeks ago, I do think prices will drop by as much as 20-25%. But in smaller markets, I think prices will level out for awhile with certain areas dropping by 5-10% and others continuing to modestly appreciate. But I don’t think we are looking at double-digit percentage year-over-year increases at this point, which has been the story for the last two years. My best guess is that home prices nationwide will be basically flat in August 2023 as compared to August 2022, which should provide some relief to prospective homebuyers worried about missing out if they don't buy now.

And again, in certain markets, prices will actually drop more. Need evidence? In King County in Washington State, which includes the Seattle Metropolitan Area, prices are down 11% since May.

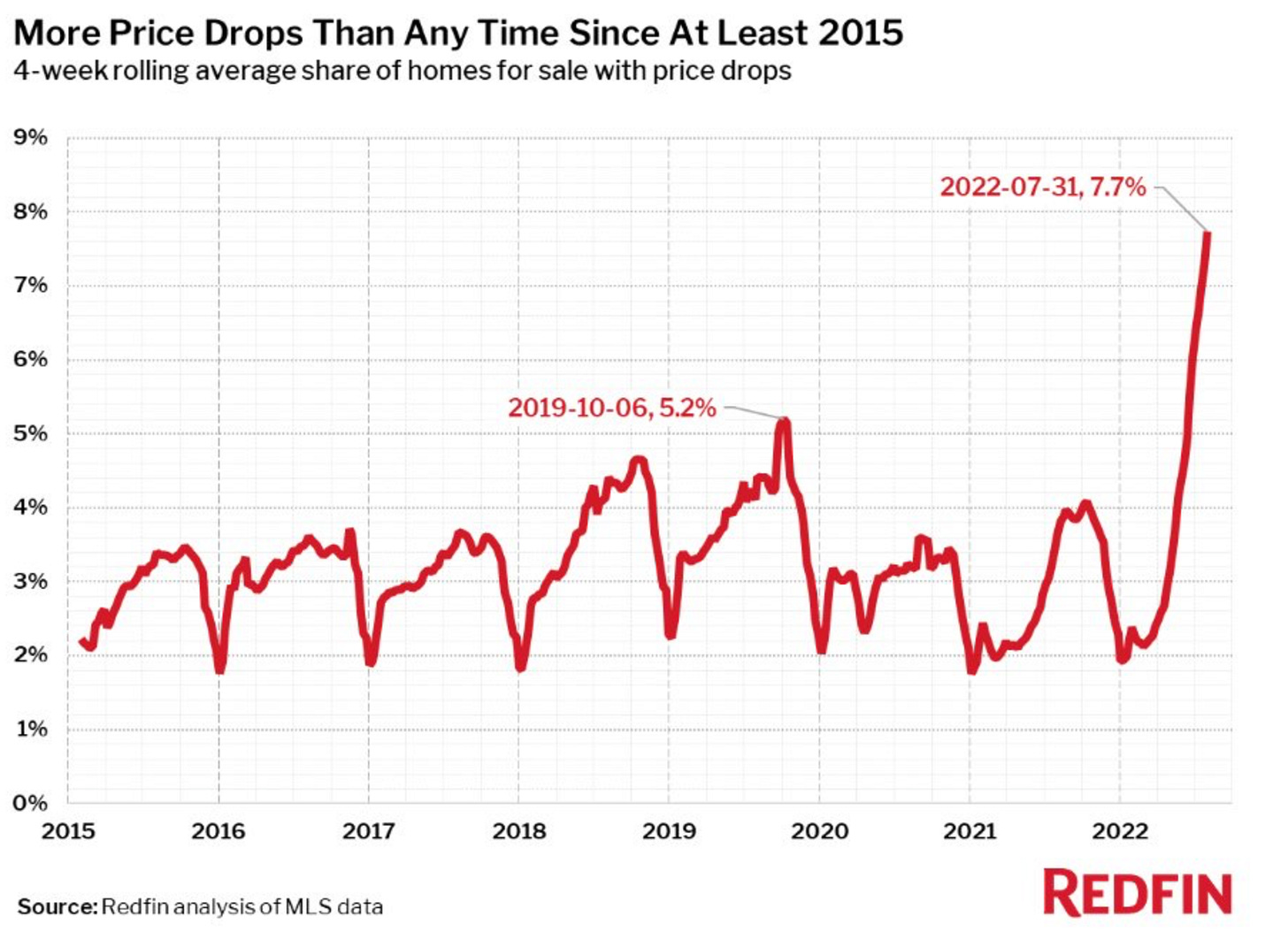

One further sign of hope on the price front, price reductions on current listings are spiking, via Lance Lambert of RedFin.

Investors are pulling back

For the past three years, it has felt that three out of every four commercial loan requests that come across my desk has been for a rental property including everything from single-family rentals to AirBNB properties to multi-units and mobile home parks. That volume has really declined in recent months, however, which I attribute to both very high prices and sharply higher interest rates. These properties just do not cash-flow as well when an investor is paying 20-30% more as a purchase price than they might have, say, three years ago, and then has an interest rate of, say, 6.25% (today) vs. 4.25% (last year). The margins are too tight. So a lot of investors are starting to stay on the sidelines in the rental purchase market, which is a good thing for prospective buyers looking for their own single-family residence or a duplex or triplex that they can live in and rent out the other unit(s). The more interest rates rise, which they are expected to continue to do, the less purchases investors will make (other than those that are so strong they can buy with cash rather than needing to finance; those investors will always be in the market for homes).

Interest rates are giving everyone pause

Rising interest rates are a two-sided coin. On the one hand, hundreds of thousands of potential homebuyers (if not millions) have been priced out of the market in recent months due to rising rates, which is obviously bad if you are one of these people. And then of course the rising rates mean the cost of borrowing is higher, which makes a mortgage pricier and more challenging from a cash-flow perspective for those who do still qualify. For the buyers who remain, there will be less competition, longer times on the market for home that are listed, and a less stressful purchasing process overall. If you are a buyer, pay attention to rates because the difference of, say, 0.50% can make a difference of tens of thousands of dollars over the life of a loan. Residential interest actually dropped somewhat unexpectedly over the last two weeks. It probably won't last, though.

COVID migrations are ending

In 2020, millions of Americans moved, many from the large tech-center communities in the west and places like New York City to more rural areas in the south, west, and northeast. I have to think that this migration is mostly played out at this point, however. Sure, there are always going to be restless Americans moving from state to state. But the motivation to move for COVID-related reasons is largely in the rearview mirror, which is good news for local buyers in some of these smaller communities who may no longer have to compete with as many out-of-state buyers scooping up properties at prices that are high for the local market, but low compared to, say, San Francisco or New York City.

So what’s a buyer to do…

To summarize the above, the key word right now for buyers is patience. More inventory is coming online soon and prices are likely to ease for a variety of reasons as noted above.

Buyers should also think about how long they plan to live in a home. If you plan to buy and then move again within 3-5 years, you should be especially careful. I do not think it is likely that prices significantly appreciate over all of the the next five years and there is always the risk that prices actually drop. This is the position a lot of homeowners got themselves into in 2007-2009; they wanted to move, but their houses were suddenly worth a lot less than their mortgage balances, which anchored people to their homes who oftentimes could no longer afford the payments due to variable interest rates increasing the monthly payment amounts combined with economic peril like job losses or other burdens.

Buying a home also has a lot of related costs associated with it, too, including closing costs on the loan and any immediate renovation costs on the home itself. If you’re banking on price appreciation over the next few years to help recoup those costs before selling, it’s not necessarily a sure thing.

If you are planning to buy your “forever home,” though, and you have a long-term time horizon, my advice is to pull the trigger if you get the right combination of locale, price, and the various amenities you want in a home. If you find the perfect home, go for it. Buyers should not wait for a 20% drop in prices because that is unlikely to happen over the next year (again, unless you live in a bubbly market like Phoenix, Boise, parts of Florida, etc). In other words, buyers should be patient, but also be ready to go if the right opportunity arises.

One final word of advice is that things don’t stay the same forever. Markets correct themselves. The housing market for the past several years has been irrationally exuberant. That won’t last forever so if you can stay patient, opportunities will be there for you even if the past two years have been full of frustrations.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.

Weekly Round-Up

Here are a few things that caught my eye around the web this week:

Via WolfStreet.com, mortgage delinquencies are on the rise:

Under the pandemic-era forbearance programs, homeowners that fell behind on their mortgage payments, or stopped making mortgage payments altogether, and then entered into a forbearance program, were reclassified to “current” instead of delinquent. They didn’t have to make mortgage payments, and could use the cash saved from those not-made mortgage payments for other stuff….But with forbearance programs over, mortgage delinquencies started to rise this year from the record lows last year.

Mortgage balances that were 30 days or more delinquent rose to 1.9% of total mortgage balances in Q2, up from 1.7% in Q1. It was the third quarter-to-quarter increase in a row, from the record low in Q2 2021.

Rental vacancies continue to hold at historically low levels, via Joey Politano.

Cancellations of new home construction is increasing to nearly one out of every four orders with homebuilder DR Horton according to Diana Olick of CNBC, which is likely the result of rising interest rates. I’ve seen a number of commerical deals not reach the finish line once they were started because the rate was so much higher by the end than it was at the beginning.

Please make sure you’re subscribed to get more content next Sunday morning. Have a great week, everybody!