Black Friday Isn't What it Used to Be

Black Friday: a distinctly American tradition like no other. But does Black Friday still have the same impact today as it did 20+ years ago, both in terms of the financial boost to retailers and the cultural influence on society? Or is Black Friday fading away, a la other perennial American (actual) holidays like Arbor Day (now mostly subsumed into Earth Day) or May Day (largely forgotten by the younger generations). In other words, is Black Friday still a thing?

Preliminary numbers for retail sales on Black Friday 2024 show growth over 2023, with overall sales up 3.4%. But there is bad news for brick-and-mortar retail shops, however, as traditional in-person shopping was only up 0.7% while online sales were up 14.6% year-over-year on Black Friday. So by the sales numbers along, particularly if you zero in on online sales, Black Friday is still a big day in the retail world. But what of the mad rush and frenzied shopping scenes that have so characterized the “holiday” in times past?

Before we touch on that, a brief history of the day:

The Origins of “Black Friday”

The term "Black Friday" wasn’t always synonymous with shopping sprees and doorbuster deals. Its origins are rooted in chaos, financial fallout, and a kind of grim humor. The earliest recorded use of the phrase dates back to 1869, when a financial crisis erupted after two speculators tried to corner the gold market. Their scheme unraveled on a Friday, causing a market collapse and subsequent economic despair.

The connection to retail came much later, evolving in the 1950s. In Philadelphia, police officers used the term "Black Friday" to describe the day after Thanksgiving because of the mayhem it brought to the city including overcrowded streets, swarms of shoppers, and a spike in traffic accidents and shoplifting. The term captured the frustration and frenzy of the time, though merchants weren’t too keen on the negative branding.

Over time, savvy marketers reimagined the term to reflect the day's financial upside for businesses. In accounting, being "in the black" signifies profitability, and this positive reframing stuck. By the 1980s, Black Friday had transformed into a nationwide retail bonanza, ushering in the holiday shopping season with both irresistible deals and a faint echo of its chaotic roots (or not-so-faint if you were a security guard fighting off the frenzied mobs). By the 1990s, the Black Friday chaos was on, with frequent and far-flung examples of mad shoppers rushing the doors in search of deals, stampeding anything in their way.

One final point on the history here: it does also seem to be somewhat conventional wisdom that Black Friday is named as such because it is approximately the point in the year when retailers have met all of their expenses for the year and all remaining sales through December 31st are pure profit (i.e. they are “in the black”). I don’t know if that is actually true for most retail stores today, although it is a nice story and an interesting spin on the term “Black Friday.”

First Mover Status + Evolution of Habits

There is another term in retail (and other fields, as well, like politics, music, sports, etc.) that reflects the advantages of being early on a trend or a cut ahead of the competition: first-mover status. Some retailers over time have tried to pounce on this vis a vis Black Friday by opening their doors even on Thanksgiving Day itself. To counter this, some states (including from where I write here in Maine) have reacted by banning stores with over 5,000 square feet from being opened on Thanksgiving (with exceptions for some grocery stores). Smaller stores including gas stations and convenience stores can be open, but the Walmarts and Targets of the world have to stay closed. This is so that store employees can spend time with their families on the holiday, and is also perhaps due to a somewhat heartwarming belief among lawmakers that there should be limits to corporate permeation into our lives.

But with the rise of online sales, “Black Friday” is no longer a single day. Target, for example, launched its Black Friday sales on the Sunday before Thanksgiving this year. Most other retailers did the same. In some ways, therefore, if every day is Black Friday (for a week at least), no single day is Black Friday.

“Cyber Monday” is also now more of a thing. That National Retail Foundation coined the term in 2005, with the idea that after the rush of in-person shopping on the day after Thanksgiving, many people would be back at work on the subsequent Monday and could be prodded to spend their day online shopping. With the rise and ubiquitousness of online shopping not to mention the apparent willingness of many distracted workers to shop on the job, the term and the concept stuck.

Now the whole mess of holiday shopping before and after Thanksgiving kind of blends together. So the idea of heading out on the morning after Thanksgiving has perhaps dimmed a bit in recent years. Perhaps also some people have just realized that elbowing their way through box stores the morning after Thanksgiving isn’t, well, quite as much fun as it used to be; they could be home shopping multiple retailers while in their pajamas sipping coffee or hot chocolate instead. It’s just not worth the traffic, the fatigue, and the fights to shop in-person, for many anyway.

And, in fact, Cyber Monday sales now outpace Black Friday sales, a sign that the trend has solidified and that it is not likely to reverse. More than likely, Black Friday will remain popular with shoppers for big ticket items like appliances, furniture, and computers. But for all the rest, the efficiency and value of online shopping whether it be on the actual day after Thanksgiving, the Monday following Thanksgiving, or some other time altogether, is likely to dominate retail sales. I wonder if Black Friday is likely to fade away as a cultural oddity, or, as it has become in my own family and extended family, if it will simply be an excuse for a nostalgic trip by moms and daughters to check out the in-person deals at Target together and grab a Frappuccino at Starbucks before heading home for a post-Thanksgiving nap.

Further Implications

There are further implications to the decline in brick-and-mortar retail. Cities and towns (like the one I live in) that depend on property tax revenue from big box stores not to mention traditional shopping malls face perilous budgetary challenges from declining property values as brick-and-mortar retail.

And for all the stress, hubbub, and flying elbows that come from the most extreme Black Friday shopping experiences, there is something lost, I think, as the majority of shopping moves to the internet. Yes, there is often value and efficiency in online shopping, but something, too, is lost when neighbors and fellow community members do not come together in the aisles of a local shop or, perhaps even more importantly, use their dollars to support their fellow neighbors’ small business endeavors. That, of course, is a topic that could fill many articles, and indeed has. Perhaps more on the plight of the local small business owner in the pages of The Sunday Morning Post in the months ahead. For now, Merry Christmas, Happy Holidays, Happy Hanukkah to our Jewish Friends, and best wishes for a happy and relaxing season.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

The Sunday Morning Post is always free, never pay-walled, and contains no ads. To learn how you can support this work and keep these articles free from clutter, become a paid supporter here or click to read more here.

Weekly Round-Up

A few links and ideas to make you smarter and more well-informed:

Preliminary data from the University of Michigan Consumer Sentiment Survey shows improving feelings for five straight months. Interestingly enough, despite the recent optimism among consumers, consumer sentiment has never returned to pre-pandemic levels. View that charts here.

More on retail: buy-now-pay-later mechanisms from the likes of Klarna and Afterpay are becoming more common. Research shows they contribute to increased spending by consumers. But policymakers are worried that this is leading to people spending beyond their memes, which is particularly troubling in a time when credit card debt is at an all-time high. Buy-now-pay-later can be helpful to retailers in that it boost spending, but it can also be difficult to manage. Read more here via Dionysius Ang and Stijn Maesen in Harvard Business Review.

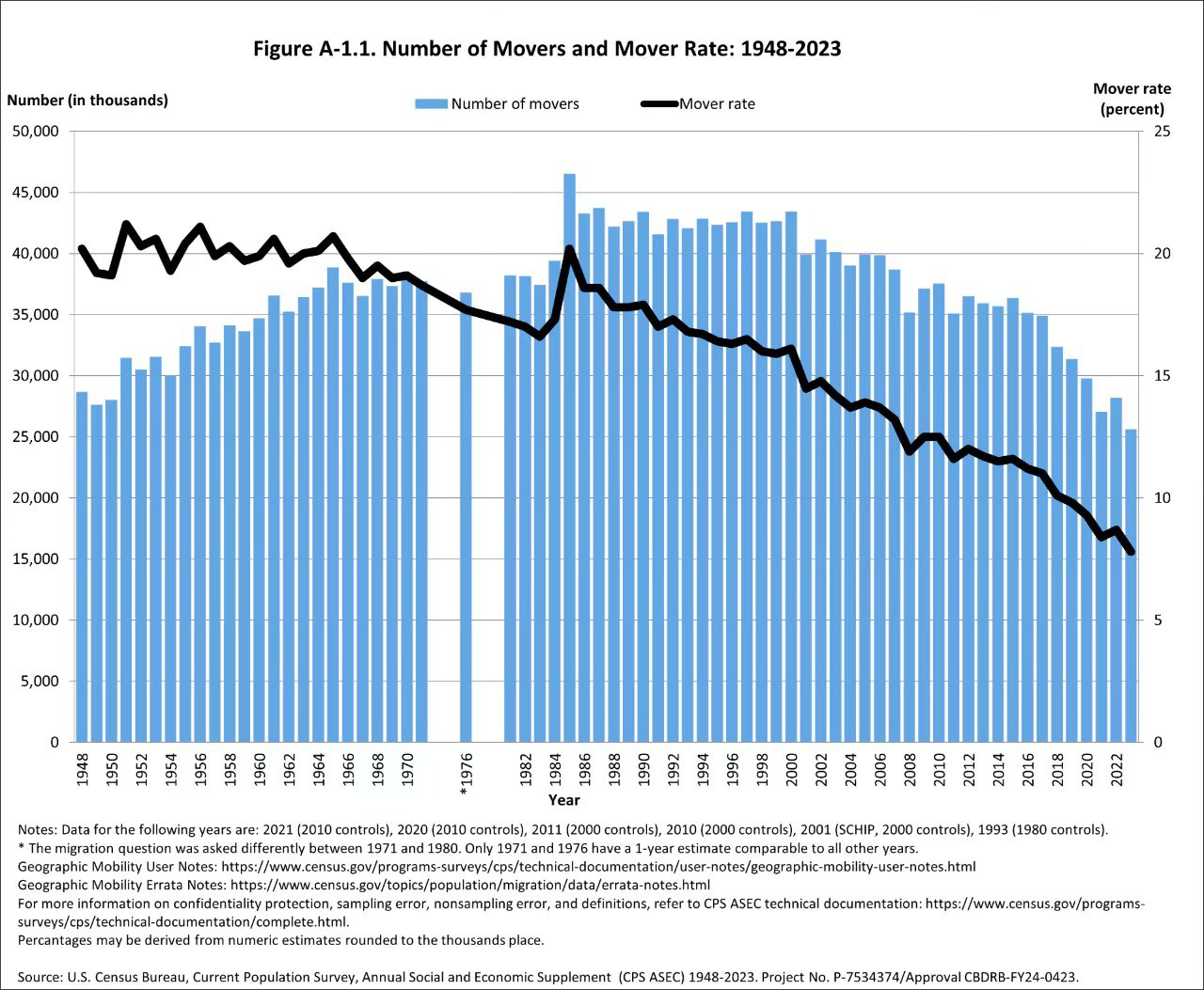

Fewer Americans moved last year than in any year in the last 70+ years. The percentage of Americans who moved is also at an all-time low (at least as long as the data has been tracked). This is no doubt due to the mortgage rate lock-in effect, among other variables. The chart below is based on U.S. Census data and was shared by Jed Kolko on X.

Have a great week, everybody!