Borrowers Facing Sharply Higher Rates

Astonishment as residential and commercial rates spike in the month of March

Author’s Note: I am just heading out for a week’s vacation. So today’s article is short, but important (I think so anyway). I’ll be back next week and throughout April with more commentary including an upcoming article about what happened to real estate values the last time interest rates went up, so to receive that make sure you’re subscribed below (if you received today’s article as an email, you are all set!). Have a great week, everybody.

Borrowers Facing Sharply Higher Rates

The landscape for borrowers is changing week by week (and sometimes day by day), as interest rates shoot up in response to robust inflation and the looming threat of the Federal Reserve dropping the hammer on the economy by ratcheting up rates. Economists now believe that even after last week’s 0.25% increase in its key rate, which was the first such increase in three years, the Federal Reserve is prepared to hike rates another six times before the end of the year. Not only that, but the increases might start to be more significant; Fed Chair Jerome Powell said earlier this week that they have not ruled out future hikes of 0.50% at a time. As a commercial lender, I am operating under the projection that Prime Rate, which had been 3.25% from March of 2020 until last week when it increased to 3.50%, will be 5.00% by the end of the year. This will put most new commercial loans at a starting interest rate of 5.75-6.25%.

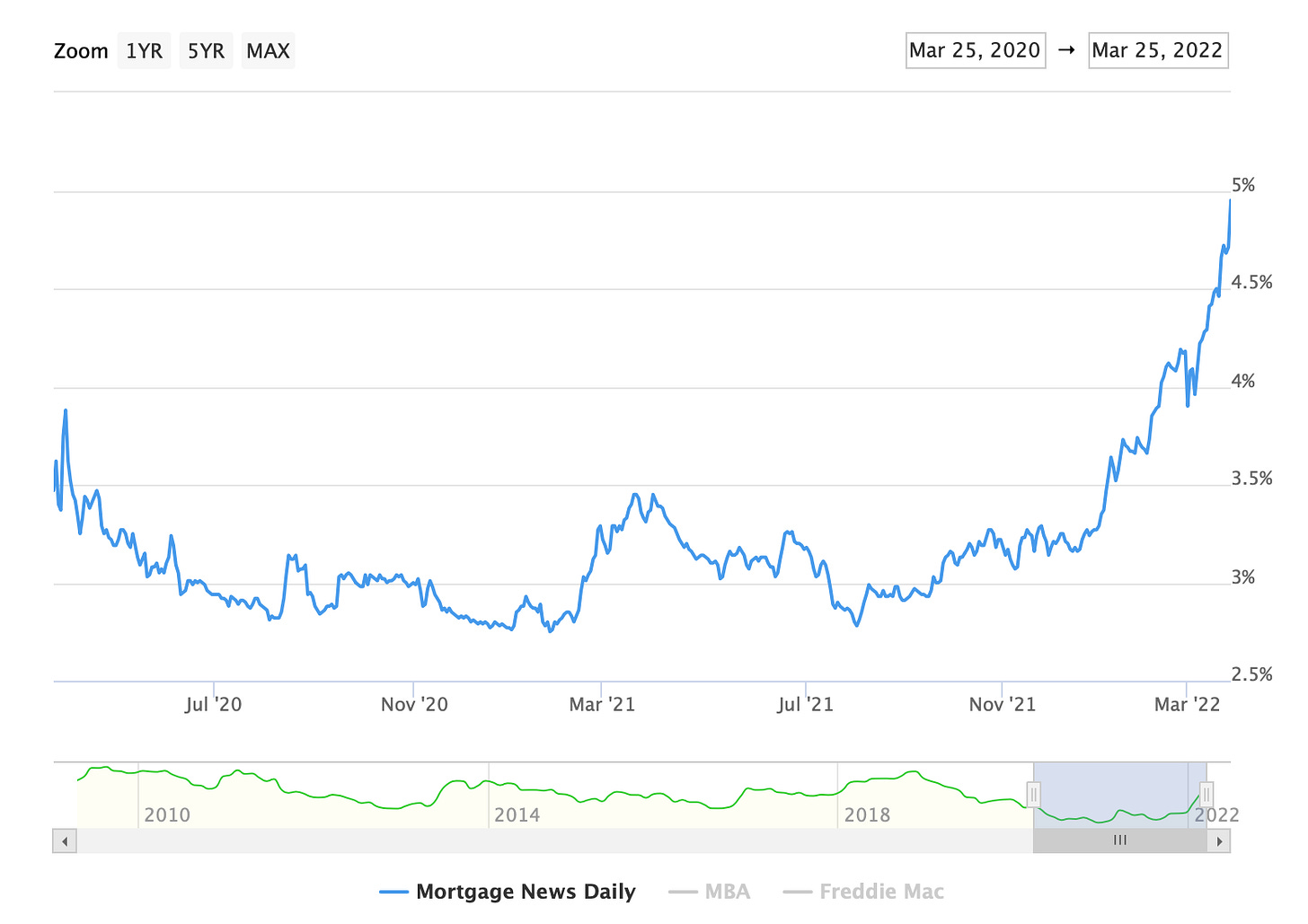

In speaking with clients this past week, several expressed emotions ranging from mild surprise to utter astonishment at how much rates have jumped. A typical commercial rate for a borrower with average qualifications a month ago might have been 4.50-4.75% fixed for the first five years; now it is generally 5.00-5.50% . On the residential side, borrowers were generally able to get a thirty-year fixed rate from 2.75%-3.25% for much of the last two years; as of this week, 30-year fixed rates are now pushing 5.00%. Below is the chart for the average rate on a 30-year fixed mortgage per Mortgage News Daily, which illustrates just how quickly and significantly rates have risen:

Construction Loans

Loan requests for construction projects, both residential and commercial, have been particularly brisk over the past year. No doubt this is largely due to the lack of available inventory on the market, particularly for single-family homebuyers. Faced with few options to buy on the exiting market, many are choosing to build instead. Unfortunately, however, people who want to build their own home are now faced with not only a tight labor market among contractors and high prices for materials, but also now an increased cost of borrowing in the form of higher rates. The only silver lining is that rising rates might cool things down a bit and open up the home-buying market to those who have been waiting. Frustrations abound, though.

Upcoming Topics

I am working on an article right now about what typically happens to real estate values amid such robust inflation and sharply rising interest rates. I’m always eager to hear what other topics are people interested in. Please comment below or send me a message at bsprague1@gmail.com. I’ll be back next Sunday with a new article. Have a great week, everybody.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.