Could Inflation Roar Back to Life?

Now is the winter of our discontent Made glorious summer by this son of York - opening lines of Richard III, by William Shakespeare

While the honeymoon glow burns on for many supporters of Donald Trump, who has quickly and systematically moved to dismantle various government agencies and departments, millions of other Americans look on in horror at the rapid dismemberment of so many commonly accepted practices and procedures.

Somewhere in the middle, there is a growing discontent.

Take, for example, the latest consumer sentiment reading from the University of Michigan, which was published on Friday. Results came in worse than expected. The survey registered the second straight month of declining sentiment and the poorest overall reading since July. Furthermore:

The decrease was pervasive, with Republicans, Independents, and Democrats all posting sentiment declines from January, along with consumers across age and wealth groups.

Also embedded within this survey was data showing that Americans’ expectations of future inflation are back on the rise after steadily declining for much of the past two years. Per the report:

Year-ahead inflation expectations jumped up from 3.3% last month to 4.3% this month, the highest reading since November 2023 and marking two consecutive months of unusually large increases. This is only the fifth time in 14 years we have seen such a large one-month rise (one percentage point or more) in year-ahead inflation expectations.

Are American consumers correct? Is inflation about to rebound after being more or less brought under control over the past two years?

Fed Chair Jerome Powell seems to think so. At the Federal Reserve’s January meeting, he did nothing—no rate cuts, no major shifts—but he did make one thing clear: there is a risk that inflation stays “somewhat elevated,” or could even start accelerating again.

Why? And what would it mean for borrowers and savers?

There are three major variables at play: the state of the economy, tariffs, and politics.

The State of the Economy

There are a lot of what if’s for the economy under the second presidency of Donald J. Trump. Does general deregulation, a laissez-faire attitude towards the tech industry, a more lax view on mergers and acquisitions, and the rise of AI lead to economic boom times? Many are banking on the affirmative. But in all that, there is a risk of things overheating, which could turn inflation upward.

As I frequently write in these pages, the state of the economy depends a lot on the view from where you sit. Unemployment remains low (4.0% per this past week’s monthly report), and wages are still growing (up 4.1%). Housing costs are still high, however, both in terms of rents and home prices, and although overall inflation has slowed, the prices of so many of the goods and services that ordinary Americans depend on have not come down. Corporate earnings have been mixed. And while stock markets have been resilient, cracks are forming beneath the surface.

All in all, it’s hard to tell right now which direction the economy is going, which validates the Fed’s current “do nothing” stance on rates. It’s almost backwards to think about, but if the economy does very well (at least certain segments of it), it risks bringing back high inflation. For inflation to cool, the economy would need to cool, as well. And we have a president who certainly does not want the economy to cool, inflation risks be damned.

Tariffs

Trump has made no secret of his intention to impose new tariffs, particularly on China and our friends to the north and south in Canada and Mexico. He is already pushing for sweeping trade restrictions, a move he claims will protect American workers, but one that economists warn could drive up costs on a range of goods. Higher tariffs mean higher prices, and higher prices mean inflation—this at least according to economic textbooks and the accepted wisdom of economic theory.

Concerns about tariffs are likely the top reason why consumer sentiment in the University of Michigan survey is falling. This may be particularly true in states close to the Canadian and Mexican borders, who do a fair amount of cross-border selling, not to mention the big industrial states of the Midwest who reach into international markets. If tariffs do raise the cost of goods and services here in the United States, that is basically the definition of inflation, and something both consumers and policymakers will have to contend with.

Politics

There is a simmering battle taking place between the Trump White House and the Federal Reserve. The Fed is meant to be independent, but we have a president who has repeatedly called that into question. In his first term, Trump openly criticized Powell for not cutting rates fast enough. He has also suggested he could remove the Fed Chair, which is really only meant to be possible in the case of malfeasance (and not just due to differences in philosophy or strategy). Now, in his second term, Trump has been intensifying the pressure to cut rates again. On January 23rd, appearing via video to the World Economic Forum in Davos, Switzerland, Trump said, “I’ll demand that interest rates drop immediately.” He also called for interest rates to drop around the world.

This past week, when asked about those comments, Federal Reserve Chair Powell said, “I’m not going to have any response or comment whatsoever on what the president said. It’s not appropriate for me to do so.” Powell has previously stated that Trump cannot remove him, and that he would not resign if asked to.

Trump has wasted no time in removing other federal officials, and it will be interesting to see how the next few months play out between Trump and Powell. If Trump is somehow successful in removing Powell by decree, legal action, or some other type of political pressure, he would certainly install a new Fed Chair who would be beholden to Trump and his desire to cut rates. This could provide a short-term boost to the economy (and, likely, the stock market), but these same lower rates would very likely be inflationary, as well, to say nothing of undermining the principles of the Fed’s independence from political whims and preserving a system of checks and balances.

What to Watch For

So, what should we be watching for in the weeks ahead?

First, any new tariff announcements. If Trump follows through on his rhetoric, markets could react sharply, and inflation expectations (and, indeed inflation itself) could rise further.

Second, signals from the Fed. Conventional wisdom has been that the Fed would cut rates by 25 basis points (i.e. for all intents and purposes, 0.25%) two or three times in 2025. That conventional wisdom is sitting on the back of a shelf right now, however, collecting dust. It now feels possible that rates will only be cut once or twice this year, or possibly not at all. And further, there have been whispers of rate hikes instead of cuts if Powell and his team of Fed Governors get antsy about the potentially inflationary impacts of tariffs and some of Trump’s other fiscal policies and de-regulatory outlook.

This would be particularly alarming for borrowers, especially those who are seeing fixed rates adjust to become variable or rates that are re-fixing after an initial three- or five-year fixed period. Interest rates were dropped to rock bottom levels from 2020-2022 as a way to help prop up the economy, but many of the commercial and personal loans that were taken out during this time only had five-year fixed periods. Those borrowers may be going from interest rates in the 4’s to interest rates in the 7’s or 8’s as loans adjust, which will have a significantly detrimental impact on their cash flow and net margins.

Lastly, it is important to be mindful of consumer behavior. If sentiment continues to decline, spending could follow, increasing the risk of a slowdown. Again, there is almost a backward way of thinking about inflation vis a vis the overall economy: if spending goes down and the economy slows, it would actually be good from an inflationary standpoint, and could lead to interest rate cuts to help stabilize things. This would be potentially good news for borrowers, but only if the relief from lower rates is not counteracted by the detrimental impacts from a slowing economy.

For now, the economy is holding steady, but the foundation is shifting. The fight over inflation, interest rates, and trade policy is just beginning.

The Sunday Morning Post is always free, never pay-walled, and contains no ads. To learn how you can support this work and keep these articles free from clutter, become a paid supporter here or click to read more here.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this wee:

The Wall Street Journal had a pretty interesting podcast episode this week about the struggles at Vail Resorts. It’s a story about skiing, but also about how to price a product correctly, regardless of industry. Long story short, Vail Resorts offered a season-long pass but priced it too cheaply, which led to their mountains being overrun by skiers, which undermined the user experience, cheapened the brand, and led to major blowback. You can listen to it here or wherever you find your podcasts.

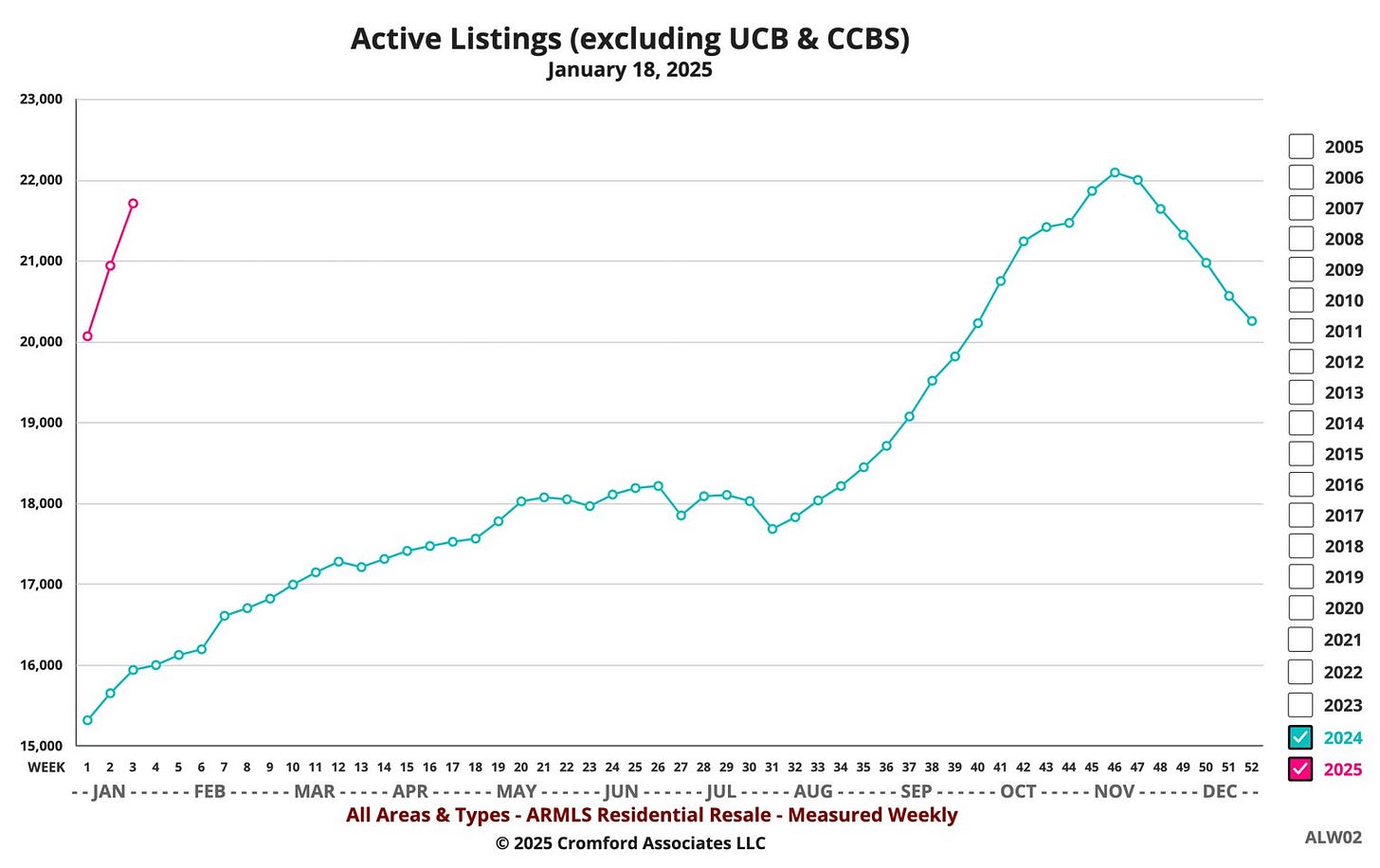

Per John Wake, who covers the Phoenix real estate market, home listings are up in 2025 over 2024, which is a sign of more active sellers but also more patient buyers. There were about 6,000 more homes for sale in the Phoenix market in January 2025 as compared to January 2024:

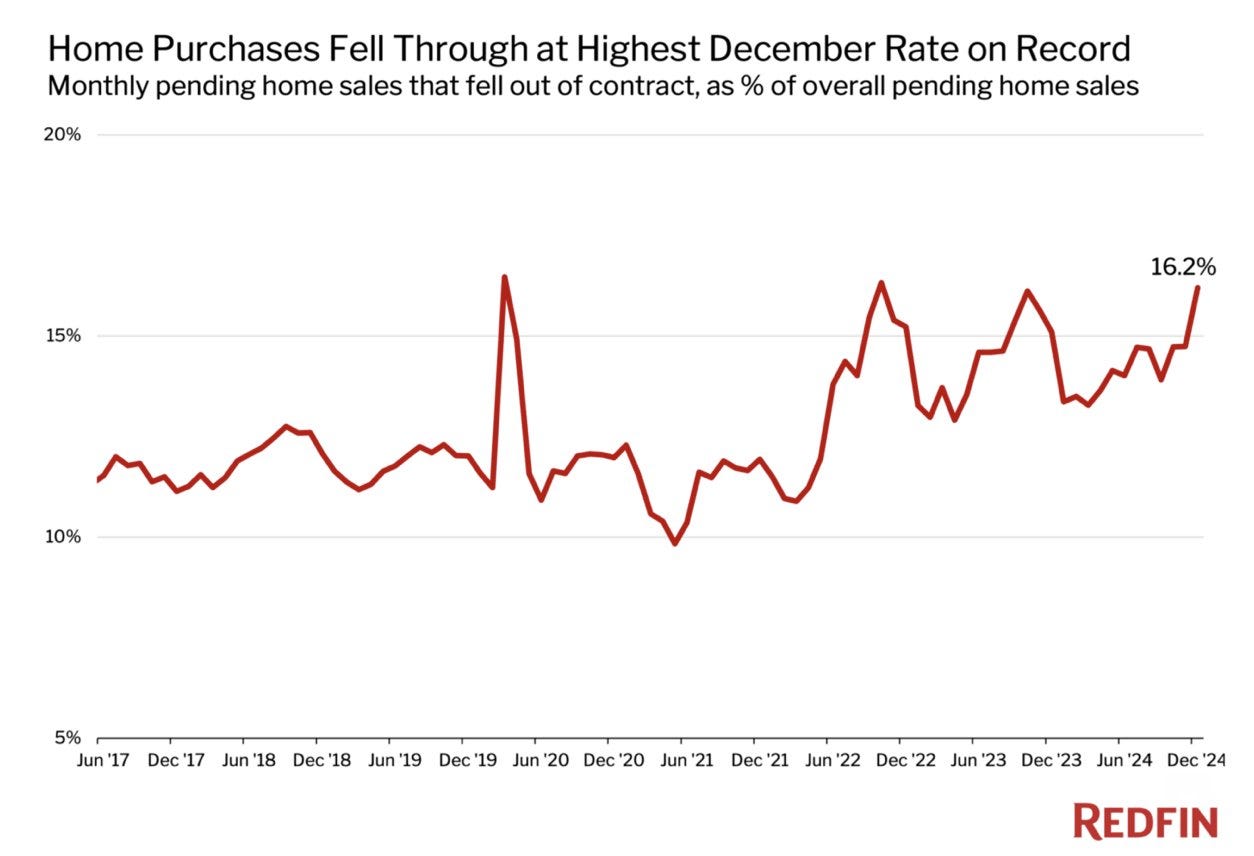

Per RedFin, 16.2% of home purchases were cancelled in December, which is a recent high. This may represent people getting cold feet, or people pulling out in order to try to time an interest rate drop.

In local news, I had a great time taking my daughter to the Father-Daughter Valentines Dance here in Bangor. Always a fun time. Happy Valentines Day to all and best wishes on the week ahead. See you next Sunday.