Credit Card Data Spells Trouble

Greetings! Thank you for reading The Sunday Morning Post, my weekly newsletter about the economy and more. If you’re new here, please consider subscribing to get my articles in your inbox each Sunday morning.

Credit Card Data Spells Trouble

There is a lot to like in the current economy, including an unemployment rate of just 3.7% and 339,000 new jobs created in May, which significantly beat analyst estimates. However, storm clouds continue to brew as inflation remains stubbornly high despite the Fed’s efforts to reign it in. Although the odds are good the Fed is going to at least take a pause in June from making another immediate rate hike, at least one additional increase is likely later in the summer and possibly two.

High inflation is having a two-fold effect on consumer spending. First, it is diverting spending from discretionary items to necessary goods and services like food, utilities, and healthcare. In the most recent Commerce Department report on retail sales, health and personal care spending was up 0.9% month-over-month and food and drink sales were up 0.6%, while spending on sporting goods, music, and books was down 3.3% and spending on furniture and home furnishings was down 0.7%. As excess savings built up during the pandemic continues to be spent down, American consumers are shifting their spending into the staples. Overall retail sales were up 0.4%, but this number lagged analyst estimates of 0.8% and signaled a pending slowdown. Just this week, quarterly earnings reports from Macy’s and Dollar General both noted declining sales as consumers focus on food and other necessary goods instead amid high inflation.

The other impact from inflation is that people are going to their credit cards to make ends meet. Consider this: per the April CPI report, inflation is running at a 4.9% annual clip, but the May jobs report showed that wages have increased by just 4.3% in the last 12-months. In other words, even though wages are rising, they are not keeping up with inflation. Americans are losing ground and they are using their credit cards to bridge the gap.

What the Credit Card Data Shows

Americans are about to collectively hold $1 trillion in credit card debt for the first time history. The chart below shows the steady run-up in credit card balances over the past ten years, with a swoon in the early days of the pandemic as Americans pulled back on their spending and were boosted by several rounds of fiscal stimulus, thereby reducing the need for credit cards.

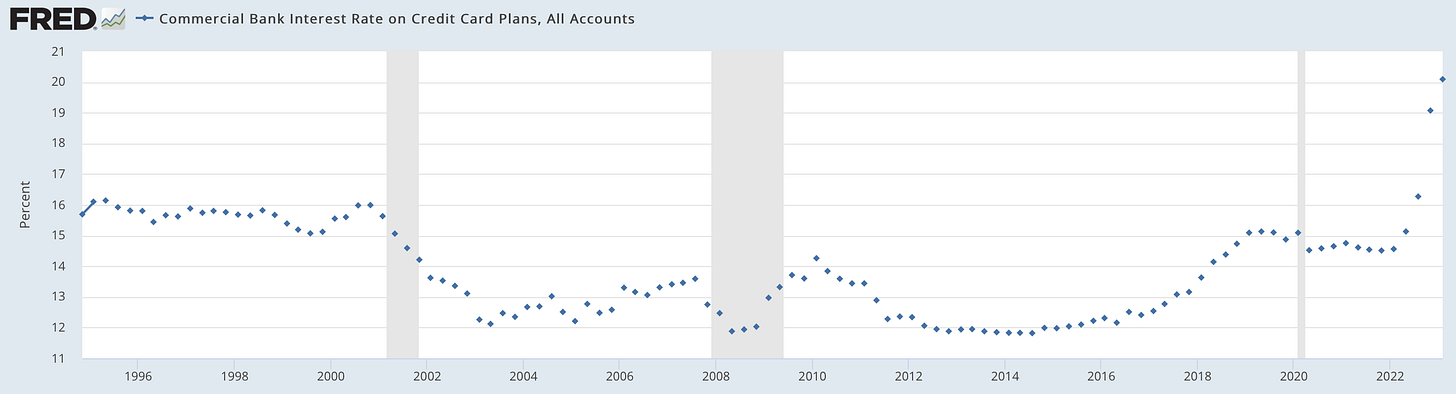

The compounding variable that makes this collective level of credit card debt so problematic is that credit card interest rates are also at all-time high levels. The chart below shows history of credit card rates going back to the mid 1990s. The recent surge in rates is staggeringly evident on the far right side of the chart where the dots jump sharply skyward. In February, which is the last month for which data is available, the average nationwide rate on a credit card topped out at just over 20% for the first time since the data started to be tracked:

Collective balances that are that high with rates that are also high with an unemployment rate that is historically low and likely to increase over the next 12-24 months as the Fed’s efforts to combat inflation have a contracting effect on the economy presents a worrisome picture. If the job numbers fall off at some point (which they will) and more Americans find themselves in financial peril, consumer debt at these levels is a ticking time bomb for the overall economy.

And, in fact, there is already evidence that credit card delinquency rates are starting to rise. As shown in the chart below, credit card delinquency rates bottomed out at 1.54% in the third quarter of 2021, but have increased steadily six straight quarters since then to a delinquency rate of 2.4% in the first quarter of 2023. That is still lower than it was just prior to the pandemic, but the trend is troubling especially in the context of such massive collective credit card balances held by Americans as a group and the extremely high interest rates:

What Comes Next

The soft landing path for the Federal Reserve to reign in inflation without impacting the labor market in an overly detrimental way is pretty narrow, but that is what they are trying to achieve. Unfortunately the most recent CPI report combined with this past week’s strong jobs report clouds the picture. Ideally the Fed would like to see a lower CPI number and, in fact, fewer new jobs created, which would show evidence of an economy that is moderately cooling (as opposed to overheating or, on the other hand, falling off a cliff). The stubborn CPI report combined with a hot jobs report give impetus for the Fed to continue with their prolonged path of interest rate hikes later in the summer, which likely means even higher interest rates for borrowers of all types (e.g. consumer, residential, and commercial) as well as a generally unsettled economy. If things start going in the wrong direction in the labor market and if delinquency rates on loans including credit cards continue to tick up, it could snowball pretty quickly with some real contagion effects to all areas of the economy.

Ben Sprague lives and works in Bangor, Maine as a Senior Vice President/Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Weekly Round-Up

Here are a few things that caught my eye this week:

Via Charlie Bilello, the market is pricing in at least two more Fed rate hikes later this year, but then a steady and prolonged decline in rates over the next 18-30 months. If this holds, it makes a strong case to go with a variable rate on any new borrowing; biting the bullet for the next few months could be well worth it if rates then steadily decline.

Home Depot is selling tiny-homes. The modern version of the Sears catalogue home? The model below is selling for less than $45,000 and can be delivered by mid-July.

Source: homedepot.com Checking back in on a theme I’ve touched on here and there, which is the impact of climate change on real estate development, Arizona officials are shutting off wide swaths of new residential construction. The reason? There is not enough water to support the future residents. Read more via The New York Times.

Hedge fund manager Bill Ackman wants JP Morgan President Jamie Dimon to run for president. Read more via Twitter.

Something to listen to: The Downfall of a Real Estate Empire via The Journal Podcast by The Wall Street Journal. This is a 16-minute episode about the story of a massive foreclosure process currently unfolding in Houston on hundreds of rental units owned by one man and his group of investors. Click here to listen.

Have a great week, everybody!

Seems a very sensible assessment to me. when companies start to adjust staffing due to higher rates and lower profits, many consumers with limited resources could get caught.