Decelerating Inflation Provides Hope for Borrowers, Real Estate Market

Yet layoffs begin in earnest throughout the economy

The S&P 500 surged 5.5% on Thursday with the tech-heavy NASDAQ jumping an astonishing 7.4%, making it the best day for stocks since 2020. For the NASDAQ, it was the 14th best day in the history of the index on a percentage basis. These strong single-day results come after about four weeks of rebounding numbers in the stock market since their mid-October lows.

Why the jubilation on Wall Street? After months of worsening inflation, Thursday’s CPI report showed a clear deceleration in year-over-year and month-over-month inflation, which brought great relief to investors for two reasons.

First, the report clearly signaled that we may have passed peak inflation and prices may be cooling on all types of goods and services, which, if the trend holds over the next several months, will provide relief to consumers and help to stabilize what has felt like an increasingly perilous economy. And second, if inflation is indeed leveling off, it will soften the Fed’s urgency to continue raising interest rates, which it has been been steadily and aggressively doing over the past eight months in order to slow down the economy. These rate hikes have been wrecking havoc on the real estate market and have completely changed the residential and commercial borrowing environments, all but grinding things to a complete halt.

Immediately following the CPI report, interest rates on 30-year fixed rate residential mortgages dropped significantly with the average nationwide rate going from 7.22% to 6.62% according to Mortgage News Daily. The yield on the ten-year U.S. Treasury Note dropped more than 0.30% on Thursday, which was the biggest one-day drop since 2009.

A Deeper Look at Thursday’s CPI Report

The items that continue to rise in value will be of no surprise to everyday Americans, who have been seeing some of the most common and necessary expenses unfortunately rise the most over the last year; gasoline (+17.1%), electricity (+14.1%), and food (+10.9%) all continued to increase on a year-over-year basis. On a more positive note, however, other items that have also risen significantly had notable month-over-month declines from September to October: Natural Gas (-4.6%), used cars (-2.4%), apparel (-0.7%), and medical care (-0.6%) all dropped.

Shelter, which includes both new and existing home sales and rent, showed a month-over-month increase of 0.8% and a year-over-year increase of 6.9%, which is obviously still concerning for homebuyers and renters, but as I’ve written about a lot recently, home price data typically lags by several months and there is evidence that rents around the country are already leveling out and in some markets are starting to decline. I am convinced that future CPI reports are going to show a deceleration in shelter inflation, which has been one of the biggest drivers of overall inflation over the last two years. Since shelter is such a large component of the overall inflation statistic, when shelter costs show a leveling off or decline, so too will the overall inflation number decline.

There are also a number of key commodities including lumber, cotton, and copper that are down pretty significantly over the last year:

Layoffs Begin

For stock market investors, the week was unequivocally positive (although the S&P 500 is still down 17% year-to-date and the NASDAQ is down even more).

For those involved with the real estate market either as buyers or real estate agents or some other related profession, the aforementioned one-day drop in residential interest rates from 7.22% to 6.62% provides some short-term relief and could stimulate some new activity after a significant slowing of transactions. As I wrote about last week, residential mortgage applications at Wells Fargo (and likely many other banks) are down 90% on a year-over-year basis, so the market has really frozen up thanks in large part to these very high interest rates.

But there has been other news of late that has not been so positive, which is that waves of layoffs are starting to take place in various industries nationwide. I would put the layoffs into three categories: (1) real estate market layoffs, (2) bloated company layoffs, and (3) economic slowdown layoffs.

In the first category, banks and mortgage brokers nationwide are starting to make massive layoffs mostly in their residential lending and processing departments. So too are online home sellers like RedFin, which laid off 862 or 13% of its workforce this past week, and Zillow, which announced 300 more layoffs in October after saying a year ago they would cut 25% of their staff. With volume down so significantly, you just don’t need as many people to do the work. (Note: my perspective on local community banks including the one I work at is that these types of layoffs are not happening in the same way, as many of these banks were not so overstuffed with employees to begin with the way some national banks might have been, and perhaps more importantly community banks just have a different and more positive relationship with their employees than some of these bigger national entities).

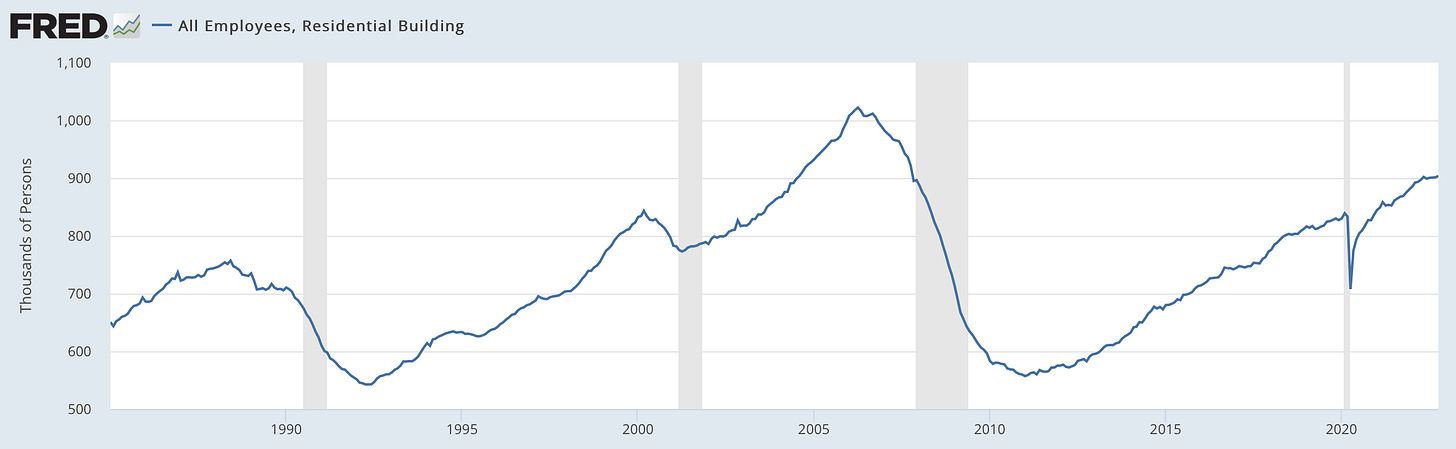

There are a lot of tangential businesses that may see layoffs related to the frozen real estate market, including real estate agencies, title companies, and insurance providers. At least at this point, however, there is no evidence of massive layoffs in the home construction market, as the number of employees in this field remains at a decade-long high according to data from the St. Louis Fed/FRED. Note the sharp decline when COVID first hit in the first quarter of 2020 and then the swift recovery:

In the second category of layoffs, there are a number of businesses particularly in the tech sector that may have over-hired over the past few years. Numerous tech companies started to enact hiring freezes as early as this past summer, and many other companies are now laying of significant numbers of workers in earnest including Facebook/Meta, which laid off 11,000 people this week, and Twitter, now owned by Elon Musk, which laid off 7,500. According to an online layoff tracker, over 120,000 workers in the tech field have been laid off in 2022, the vast majority of which have been over the past few weeks.

The Effect of Layoffs

At this point I do not see significant evidence of the third category of layoffs, which would be businesses that are not directly related to the real estate market or to the bloated tech industry (there have been a lot of layoffs in the crypto market, but that is a topic for another time). Hotels, restaurants, manufacturers, government workers including teachers, police, and fire: you name it, lots of places and industries are still looking for workers. But it is worth paying attention to things to see if that changes.

I heard a dark joke once in 2008 that went something like, “A recession is when your neighbor is laid off and a depression is when you are laid off.” The kernel of truth in that is that as an economy starts to turn over, people start to hear rumors of layoffs and might even know someone who got laid off, but then it eventually hits home when you yourself are laid off. For some people in certain of the most vulnerable industries, the best financial “life hack” you can make over the next year is simply to keep your job.

For the overall economy, waves of layoffs will have an effect. Sure, many of those laid off will find other work especially if the labor market remains very tight, but not everyone will. And some companies may not be laying people off, but they are not as aggressively hiring. Moreover, companies are sometimes cutting positions when are an employee leaves or retires rather than fill them. This might not count as a “layoff,” but it is still a cut position that has an effect on the overall labor market when multiplied out economy-wide.

People who are not working do not have as much money to spend, and for better or worse, we are a consumer-driving economy. There are ripple effects from lost wages as people cut back on vacations, eating out, and discretionary items not to mention the more pressing and urgent needs like food, homes/rent, and utilities. And as people get nervous about their jobs even if they are not facing an immediate layoff, they, too, are likely to cut back on their spending. That could be a significant variable in the overall economy as we look towards 2023.

Where Are We Now

To me, it feels right now like there are two ships passing in the night. One ship is the rising interest rates ship, and it is going in one direction as Fed officials seek to save the economy (from their perspective) by crushing inflation back to a 2% equilibrium. And on the other ship, you have the labor market, which after several strong years of overall tightness and rising wages, is going in the other direction, uncertain of what the coming months will hold.

The increasingly tight window the Fed is trying to navigate is whether it can engineer a soft landing by bringing down inflation without crushing the labor market. The layoffs are coming and, in my opinion, the Fed should ease off on further rate hikes to allow its previous increases time to have an impact otherwise it risks taming inflation at the expense of employment and, with it, the overall economy. But we will see what they do. At this point economists are predicting one more rate hike of 0.50% before the end of the year and at least one more similar hike in the early part of 2023.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.