Economic Recovery in Peril as Delta Variant Spreads

Consumer confidence plummets in August; oil and copper also down

Economic Recovery in Peril as Delta Variant Spreads

“I don’t know why everyone is making such a big deal about COVID again,” a friend said to me recently as we discussed the rules for masks in school. To her, as to many, it seemed that by the this past spring and early summer we had made it through the worst and COVID-19 was effectively behind us. I fully admit that I have long been looking forward to September as the time when we were supposed to all be able to breath a bit of a sigh of relief: schools would be back in session running as normal, we would be able to go to fall football and soccer games and not have to worry about sitting six feet apart, people could eat in restaurants and hang out in bars without worrying, and cases would have dwindled to a random drip if not be squashed to zero altogether.

It does not seem like that will now be the case.

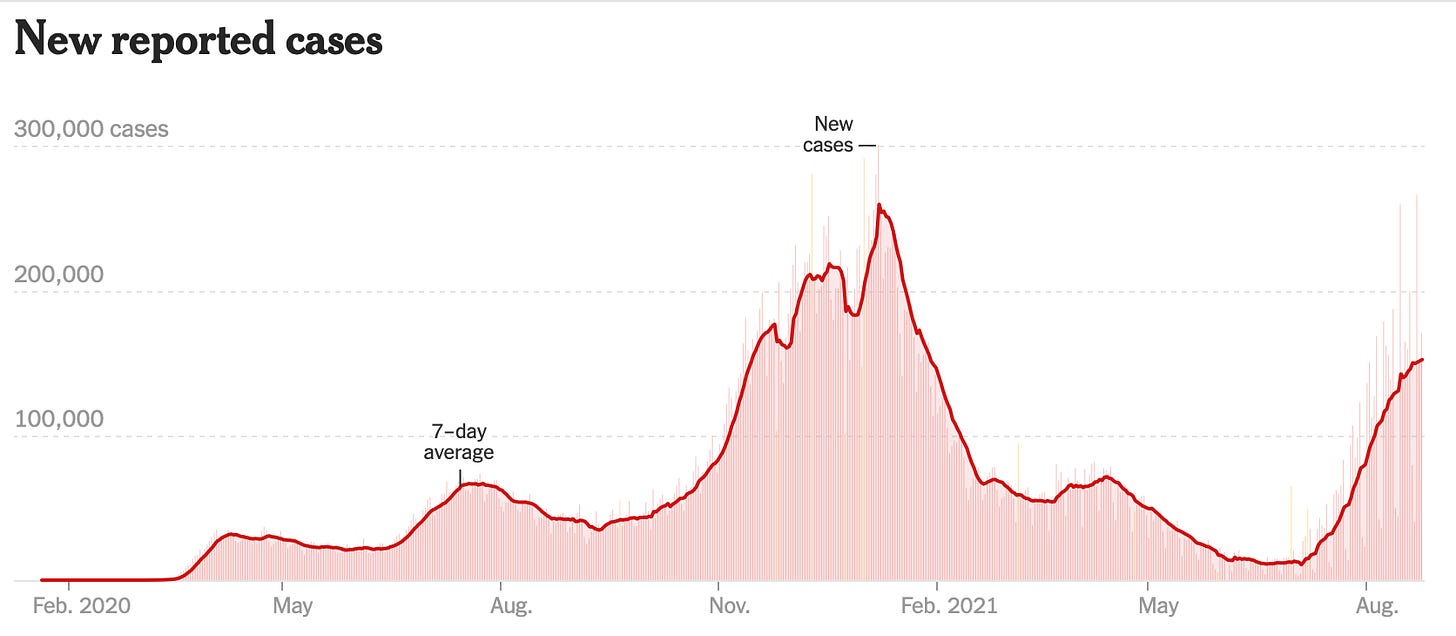

On July 5, the seven-day moving average of daily new cases nationwide was 10,608 according to the New York Times COVID-Tracker. This was the low point. Here we are less than two months later and there have been an average of over 150,000 new cases per day over the past week. Over 21,000 of those cases have been in Florida, over 16,000 have been in Texas, and next comes California with nearly 14,000 new cases per day. Over 1,000 Americans are now dying on a daily basis. Only 52% of all eligible Americans are fully vaccinated. Cases here in the United States are now approaching the worst levels of the pandemic, which has been a shock to all of us who thought or hoped as recently as two months ago that this was basically over.

Economic Impact

If you haven’t been vaccinated yet, I doubt anything I write here is going to convince you to. I think you should, though. My wife and I got vaccinated as soon as we possibly could and we’ll get our kids vaccinated as soon as the FDA signs off on the vaccines for children under the age of twelve.

My article today is not about convincing people of the efficacy of vaccines, however, important a topic as that may be. The topic here is about how the spread of the Delta Variant now has the U.S. economy teetering on the edge of a drop even after a year of steady recovery from the depths of lockdowns, quarantines, and economic turmoil in the spring and early summer of 2020.

Consumer Confidence figures are reported regularly and provide a key indication of how Americans are feeling about their personal finances and the state of the economy as a whole. The Consumer Confidence Index is calculated monthly and is a closely watched report. Its readings can move entire markets because, for better or worse, we are a consumer-driven economy and people spend, travel, borrow, and invest more when they are feeling good about things.

So how are consumers feeling these days? Not great. Per Reuters:

The University of Michigan said its preliminary consumer sentiment index fell to 70.2 in the first half of this month from a final reading of 81.2 in July. That was the lowest level since 2011, and there have been only two larger declines in the index over the past 50 years. Those were at the depths of the 2007-2009 recession and during the first wave of shutdowns in April 2020 at the beginning of the pandemic.

Americans have a lot to be concerned about right now including the rapidly rising cost of housing (both among homebuyers and renters), the possibility of inflation, and general supply chain issues that can lead to frustrating delays on everything from cars to bathtubs.

But I also don’t think it is any coincidence that this sharp drop in consumer confidence has happened right as the Delta Variant began sweeping our nation. According to Richard Curtin, Chief Economist for the University of Michigan’s Surveys of Consumers, via NBC News:

Consumers have correctly reasoned that the economy’s performance will be diminished over the next several months, but the extraordinary surge in negative economic assessments also reflects an emotional response, mainly from dashed hopes that the pandemic would soon end.

In other words, not only are people feeling anxious, they are also feeling disappointed. This was supposed to be over! And now things are unequivocally going in the wrong direction.

Other indicators have mirrored consumer confidence readings in their softening. Oil prices dropped for seven trading sessions in a row through Friday, August 20th, a sign of worries about global demand (although, to be sure, gas and oil prices are influenced by both macroeconomic factors and the specific decisions by OPEC on how to limit or loosen supply; oil did bounce back a bit this past week as participants may have felt like last week’s pullback was overblown. A tropical storm in the Gulf of Mexico also has investors feeling jittery about supply, which pushed prices of oil higher on Friday).

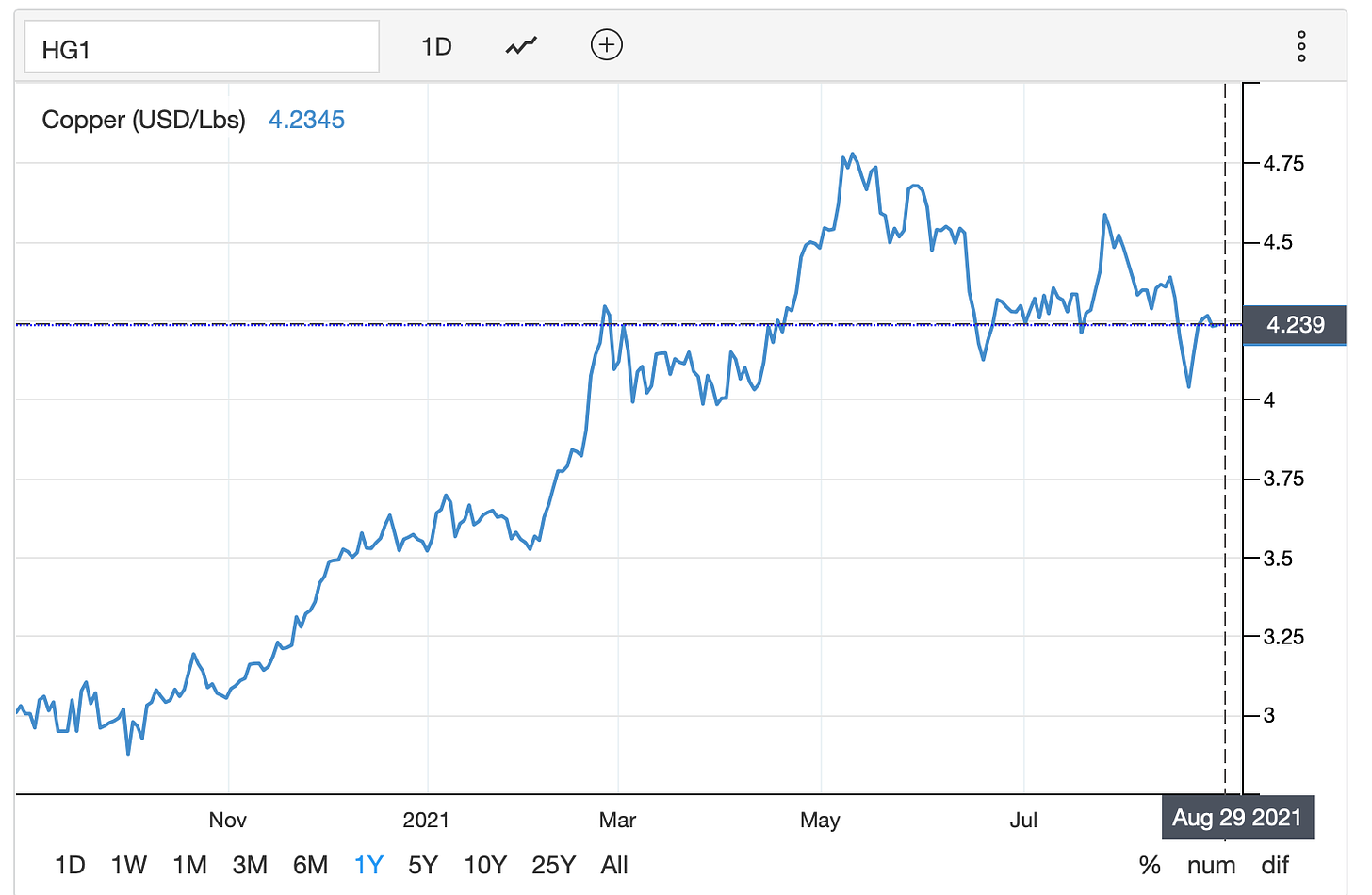

Copper prices have also dropped over the last several months. Copper is seen as a key indicator of overall economic health as it is used in all sorts of different products around the globe. The chart below shows copper prices for the past year. The significant rise through early May is evident, but so too is the faltering of copper prices over the past three months. Is this a market top or just a mild correction? Time will tell.

What Does It All Mean?

As noted above, there are certainly a lot of concerning things happening around the world right now including here in the United States that are not directly tied to COVID-19, but COVID-19 is still the driving variable behind so much of our collective activity and attitudes. The sharp rises in cases around the country is a bit staggering. Even here in Maine, which boasts the fewest COVID cases per 100,000 residents of any state in the country, doctors and other medical leaders are now sounding the alarm about a pending crisis.

Although many people and businesses certainly struggled and I don’t want to downplay the challenges people have faced, the overall U.S. economy did not crater over the first 12-18 months of COVID-19 as people originally thought it might. But this was largely because the federal government put forth unprecedented financial stimulus programs for both individuals, businesses, and other employers, which helped prop everything up. It does not seem like there is the interest, appetite, or funding to do additional rounds of stimulus to the extent that the federal government did during the first 12-18 months of the pandemic. So the economy is, more or less, on its own. If the Delta Variant is not brought under control, we could be in for a rough ride as summer turns to fall and fall turns to winter especially as weary Americans come to terms with the fact that COVID-19 is still very much among us and continuing to evolve and spread.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

I want to acknowledge the sad and tragic scene that has unfolded in Afghanistan over the past two weeks, particularly the bombing at the Kabul Airport and deaths of 13 U.S. service members and dozens of Afghanis. May their work not be for naught and may all remaining service members and those fleeing persecution be kept safe and may the swift hand of justice come down upon the perpetuators of the suicide attack.

Here is a harrowing first-hand account of one person seeking a way out of Afghanistan, via The Conversation: https://theconversation.com/an-afghan-american-scholar-describes-his-fear-filled-journey-from-the-chaos-at-kabul-airport-to-a-plane-bound-for-home-in-the-us-166387

Here are some other things from around the internet this week that interested me that you might find interesting too:

Homes in the <$200K range are becoming harder to find, which is not great news for low and moderate income homebuyers including many first-time homebuyers. Via Calculated Risk, “Half of new homes (about 50% in July) in the U.S., are in the $200K to $400K range. The fastest growing price segment over the last 2 years has been the $400K to $500K range.” In other words, there is not a lot of inventory below $200K. Read more here: https://www.calculatedriskblog.com/2021/08/new-home-prices.html

Portland, Maine is getting a new building that will be the tallest in the city once it is completed. It will have 263 new housing units, a boon for a city strapped for housing. Via Bangor Daily News: https://bangordailynews.com/2021/08/17/news/portland/portlands-newest-skyscraper-to-bring-housing-record-breaking-height/

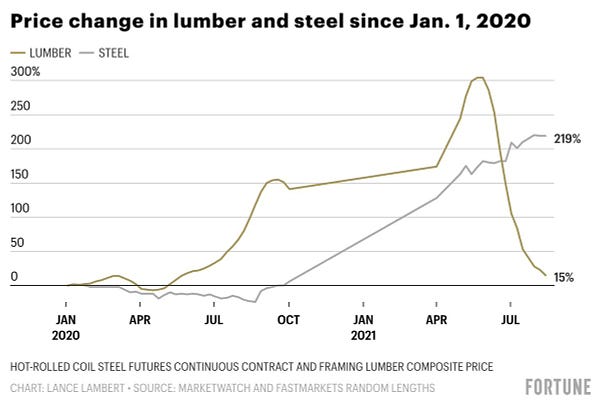

From Lance Lambert, the Lumber Boom is over. Steel runs on:

My photos of otters in Belfast/Penobscot Bay made the local paper: https://bangordailynews.com/2021/08/23/outdoors/watch-otters-stop-by-a-coastal-maine-brew-pub-to-entertain-the-patrons/

Got news tips or story ideas? Email me at bsprague1@gmail.com. Have a great week, everybody.