Early Summer Heat Checks

I have some trivia to start the article this week that you can use to impress your friends around the grill, beach, or backyard on the Fourth of July. The question is, what is the midpoint of the year? You might think as I did when I began writing that it is June 30th, which is the day this article is being originally published. Or perhaps it is midnight on July 1st, which would make for six months in the rearview and six months ahead.

In fact, the exact midpoint of this year in particular is midnight on July 2nd (i.e. the middle of the night between the end of July 1st and the beginning of July 2nd). July 1st this year is the 183rd day of the year. Its completion means there are 183 days behind us, and 183 days to come. Why do I say “this year?” Because this is a leap year. In the 75% of years that do not include a February 29th, July 2nd is the 182nd day of the year, so the exact midpoint in a 365-day year is the 182 1/2 day, which would be noon on July 2nd (this is just based on the calendar; I’m not getting bogged down in the difference between a solar year or a calendar year; at least one credible answer on Quora seems to suggest the midpoint is 2:54:23 pm on July 2nd.

That’s a roundabout introduction to say that it is hard to believe we are halfway through the year. I thought I would use the space today to provide some general updates on the economy, housing statistics, the stock market, and more to get you queued up for the summer ahead. Here are the quick hits:

Inflation: year-over-year inflation in the most recent report was 3.3% . This is higher than the Fed’s goal of 2.0%, but lower than the 4.0% rate one year prior or the 8.6% rate one year prior to that. The Fed has remained hawkish on inflation, but has signaled they do expect to make one interest rate cut of a quarter point before the end of the year. A report out just this past Friday shows personal consumption spending was up an even more modest 2.6% year-over-year.

Incomes and Employment: annualized wage growth was pacing 4.87% in April, which is the most recent month for which data is available. Although numerically positive, this is actually the slowest growth rate since the pandemic. The same personal consumption report referenced above showed personal incomes up by 0.50% last month, which is actually a little bit stronger than what was expected, although not by much. Strong income growth feels like a positive thing, but it is also a contributory factor to the persistence of inflation. The unemployment rate for May was 4.0%, still a historically strong number, but a tick up from the rate of 3.7% at the start of the year. Another trivia question: which two states currently have the lowest unemployment rates? Answer: North Dakota and South Dakota, both at 2.0%. There are also just two states that clock in with unemployment rates above 5.0%: Nevada and California. The unemployment rate from where I write in Maine is 3.0%, which puts us in the upper middle third of states.

Stock market: the bull market continues. After tallying a 24% gain in 2023, the S&P 500 is up about 15% so far in 2024. Fueled by gains in the technology sector, the NASDAQ is up a whopping 21% year-to-date while the Dow Jones is up a more modest 3.5%. The Technology and Communications sectors are carrying the way on the stock market overall, posting gains of 28% and 26%, respectively. Utilities, Financials, and Energy are all up 7.5-9.0%, with Healthcare, Industrials, and Consumer Discretionary all posting decent gains that only look modest in comparison to the fast running Technology sector. The only S&P 500 sector that is down for the year so far is Real Estate, posting a modest loss of 4.14%.

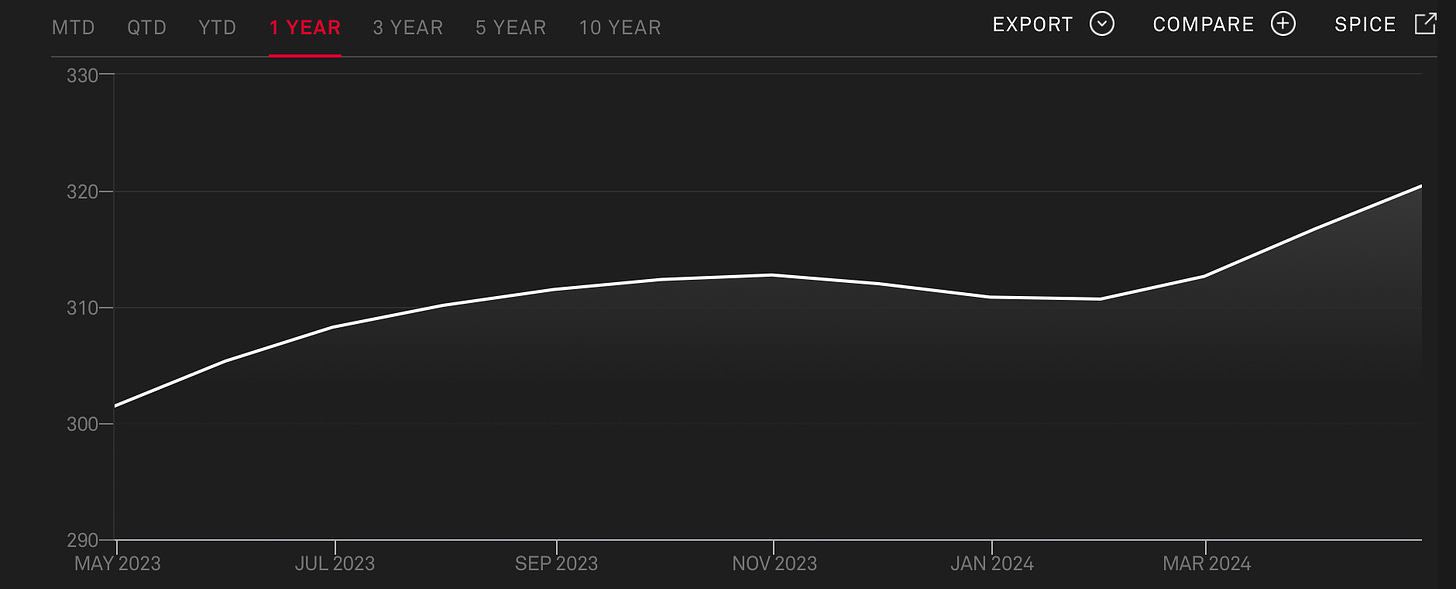

Home Prices: from September to December 2023, home prices nationwide were easing modestly downward. The trend did not last. Since January, home prices have ticked back up about 3.0%, which makes for a year-over-year increase of about 6.3%., per S&P CoreLogic Case-Shiller.

Interest Rates: the average 30-year fixed interest rate is 7.07%, a tick up from 6.73% to start the year, per Mortgage News Daily. The high point came last October as rates approached (and in some parts of the country, surpassed), 8.0%. Commercial rates are similarly high, which makes for a tough borrowing environment for prospective homeowners and businesses alike.

Treasuries: the ten-year Treasury Note closed the month at a yield of 4.392%, up from 3.866% at the start of the year, although down from an April peak of 4.739%. The yield on the thirty-year Treasury is only modestly higher at 4.553%.

Home Construction: the rate of new single-family home construction has stayed pretty steady this year with an average of 675,000-695,000 new units under construction all year so far on a seasonally adjusted basis. This is down from a peak of 830,000 new units in 2022, but new home construction is still happening at a faster clip than at nearly any point since the Great Recession (other than during that 2022-2023 peak).

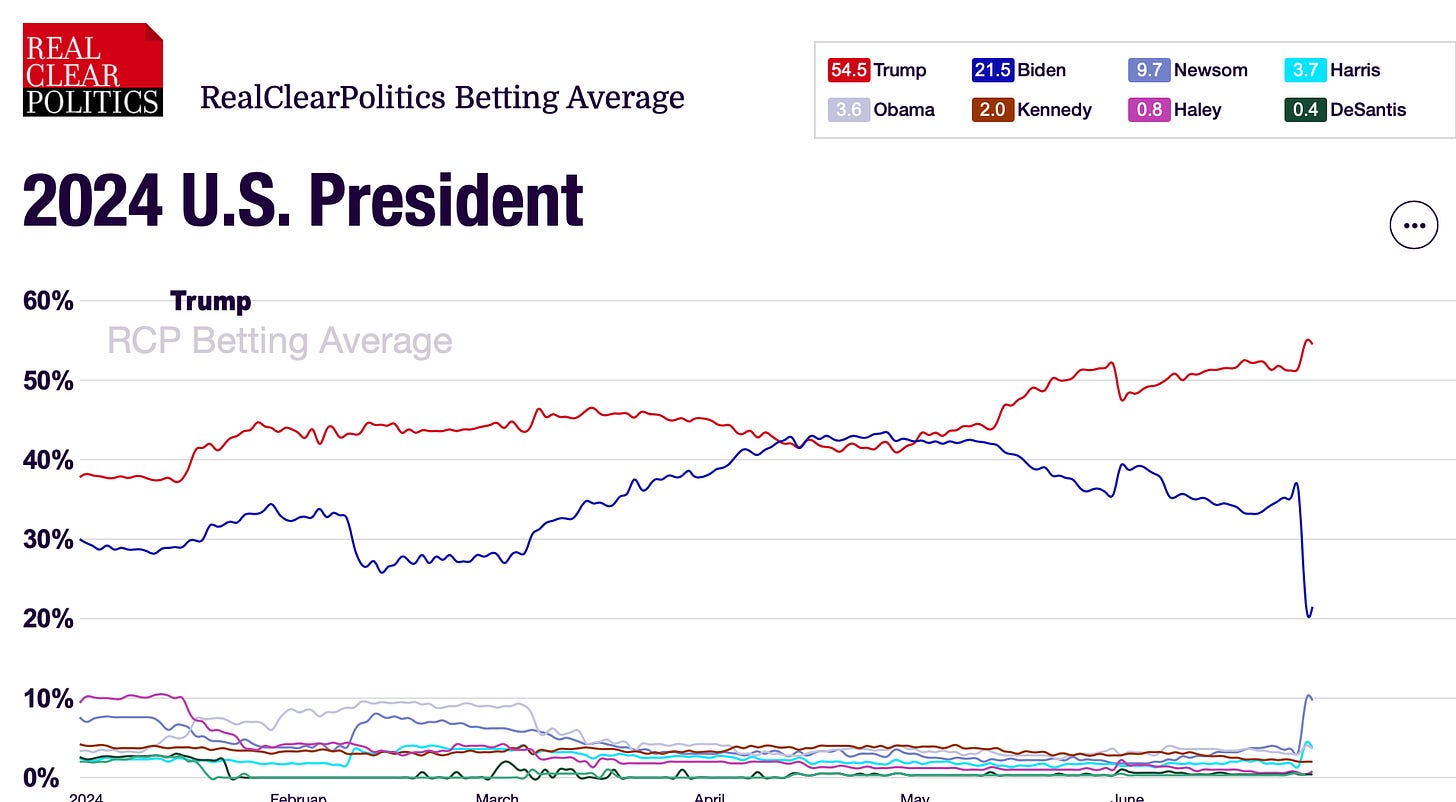

Presidential Election: after a disastrous debate performance this past week, oddsmakers give President Biden just a 21.5% chance to be re-elected in November. And yet former President Trump only gets 54.5% odds. Trump is clearly the favorite at this point, but the remaining odds go to California Governor Gavin Newsom, Vice President Kamala Harris, and various other long shots like Robert Kennedy Jr. and people who aren’t even running like Michelle Obama and Nikki Haley. The chart below shows just how impactful the debate was on President Biden’s re-election odds (the blue line).

There you have it. The economy continues to persist. There are causes for concern out there and people are definitely feeling like things are not going well, but the numbers across the board are generally holding up. I’ll be back next week with some thoughts on softness in the retail market, and am looking forward to a great summer ahead. Have a great week, everybody!

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.