Fed Survey: Banks Loosening Credit Standards for Certain Loans

Every week a mountain of economic data is released that major investment firms, journalists, academics, and data nerds like me pour through to get a read on what is happening in the economy and which direction things are going. Sometimes the numbers are hotly anticipated and widely analyzed, like the Consumer Price Index readings that are released monthly, which can shed a light on the potential for inflation or lack thereof, or employment figures, the readings of which can move markets significantly in one direction or another as they are interpreted as a key indicator of the overall strength of the economy.

One set of data that is not so hotly anticipated? The Senior Loan Officer Opinion Survey on Bank Lending Practices, which is released quarterly and is noticed and anticipated by nearly no one. This report compiles the answers to survey questions by senior loan officers at banks around the country and is typically about as interesting as it sounds.

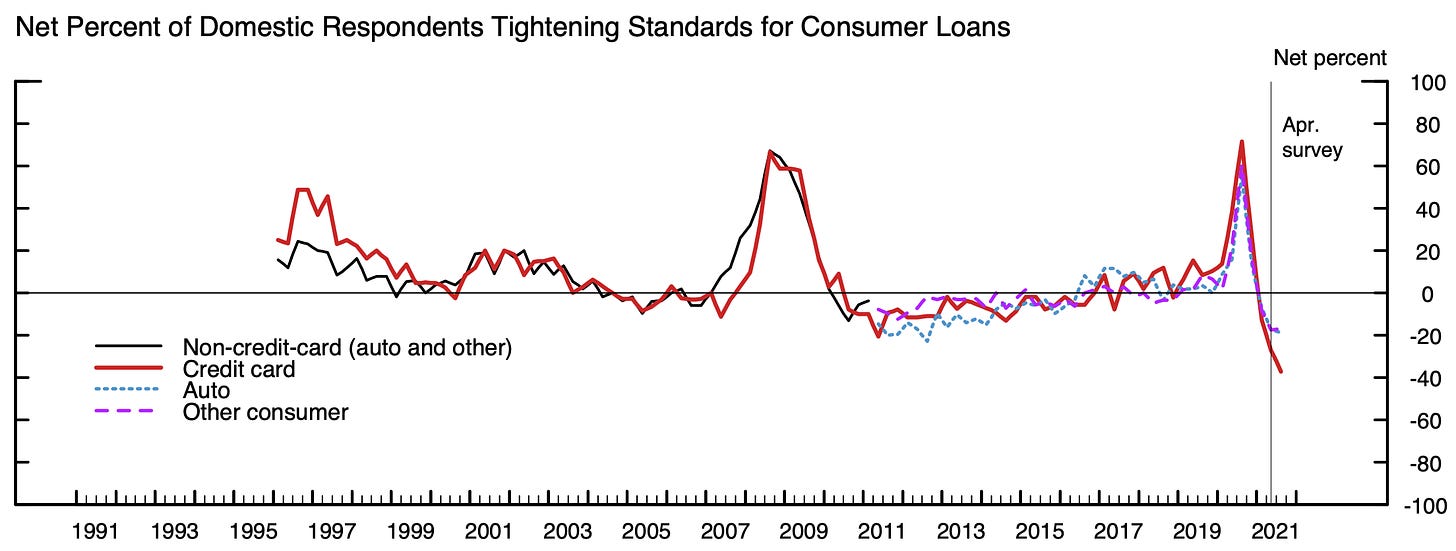

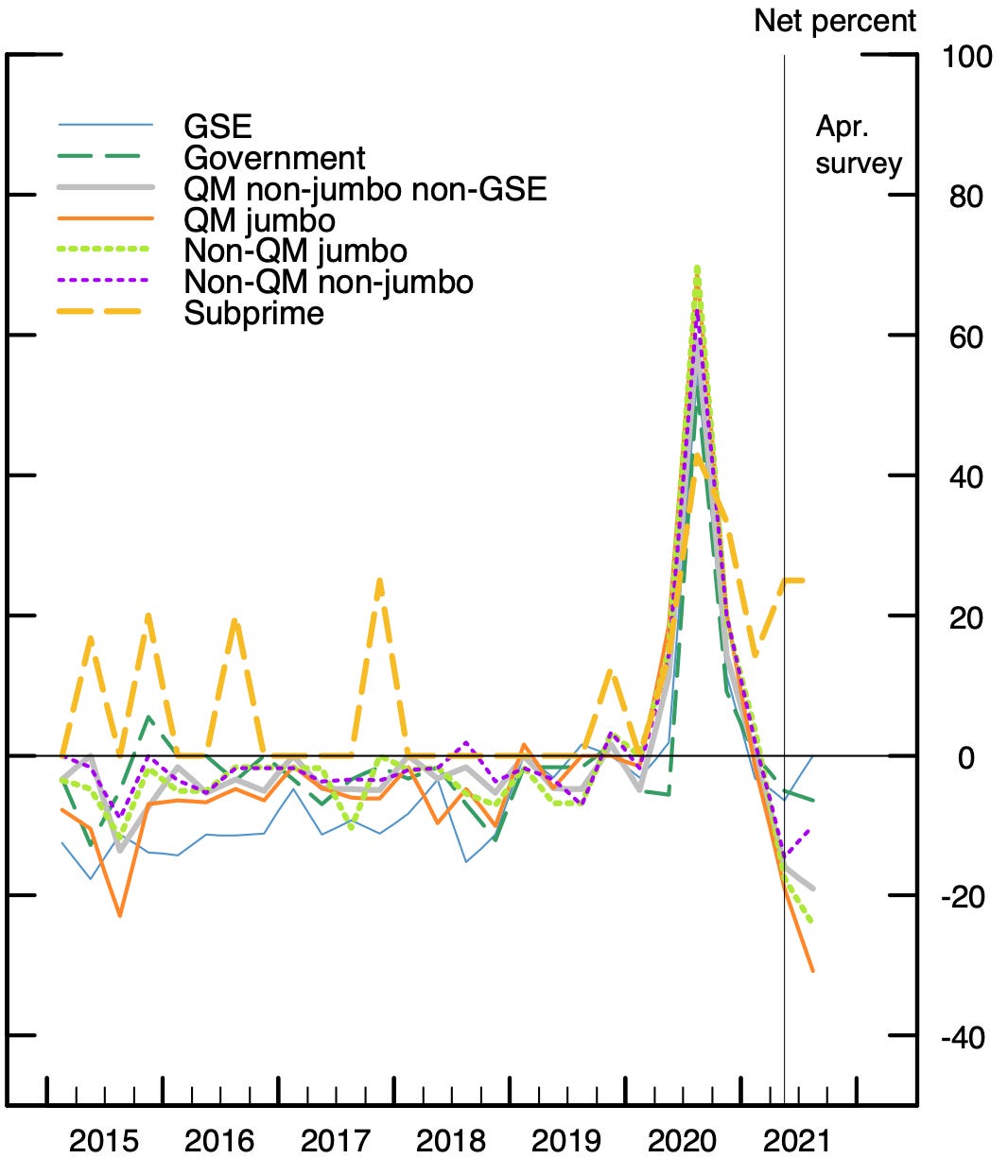

The latest survey was released this past Tuesday to little fanfare as usual. As I read through it, though, I noticed a couple things that made me go hmmm. First and foremost, banks across the country are loosening credit standards for certain loans, including consumer loans and credit cards, as illustrated in the chart below:

The label of the Y-axis on the right side of the chart is a little bit confusing, but “Net percent” reflects the difference between banks that are tightening credit standards and loosening them. The fact that all four of the colored lines have dropped below the horizontal X-axis means that more banks are loosening their credit standards for personal, auto, and other types of consumer loans including credit cards than are tightening them.

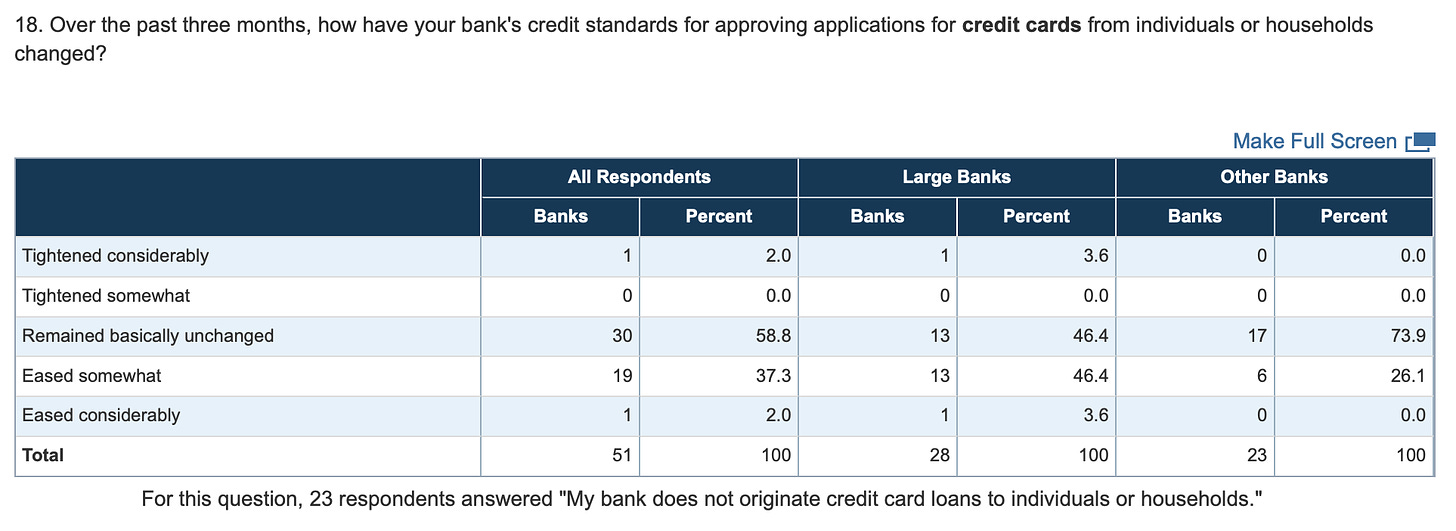

With regard to credit cards, only one of the 51 senior loan officers who were surveyed said they were tightening standards for credit cards while 19 said their standards were easing somewhat and one said they had eased considerably. In other words, nearly 40% of banks surveyed are currently loosening their underwriting standards for credit cards. Here is the raw data, which also curiously shows that larger banks are getting a bit looser with their credit standards (50.0% “Eased somewhat” + “Eased considerably") than smaller banks (26.1%):

This shift could be interpreted a couple of different ways. First, the loosening of standards over the past few months has come after a period of tightened lending standards during the first half of 2020 when banks were particularly cautious as COVID-19 first got underway. The loosening of credit in the past few months is a sign of the pendulum swinging back to equilibrium as the economic downside of COVID-19 was not nearly as significant as many expected thanks in large part to global stimulus programs including right here in the United States. Pent-up consumer demand and the easing of supply chain issues have the economy on a decidedly upward trajectory and banks are easing their standards in response to the strong demand from customers for loans and credit cards.

Loosening credit standards can be helpful in boosting the economic recovery as doing so provides liquidity to the market. In the throes of the 2008 financial crisis, banks became very tight with their lending and this contraction robbed the economy of much needed liquidity as global financial markets were mired in turmoil.

But there is another side of this story too, which is that by lending more freely, banks are adding more risk to their balance sheets. We saw in 2008 what can happen when banks become over-leveraged and the bottom falls out: the losses are significant for banks and their direct customers, but a contagion effect ripples through the economy and creates a downward spiral that impacts all industries and sectors, not just banking.

What I see happening in the coming months is that consumers will take on more debt as they are more easily able to obtain personal loans, credit cards, and mortgages. If there is an economic downturn at some point, which inevitably there will be, Americans will be more leveraged with greater debt. This means they will have less flexibility to maneuver economic hurdles like job losses, stock market drops, and volatility in other asset prices like home values.

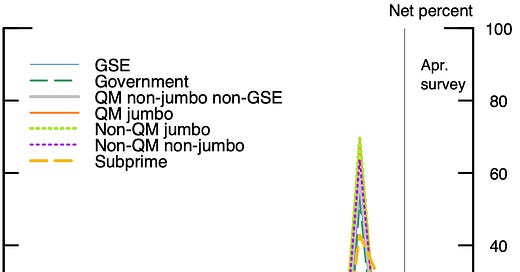

And speaking of homes, what does this week’s fed survey reflect about credit standards for home loans? They are dropping, as evidenced in the chart below:

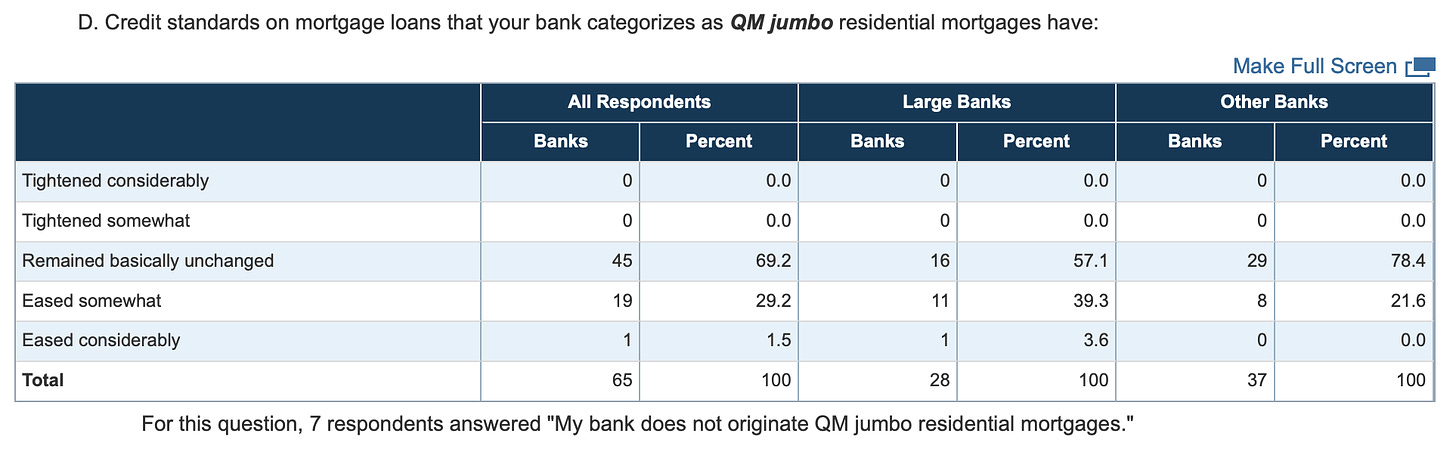

The steepest net percent decrease in credit requirements among the different types of home loans is in Qualified Mortgage Jumbo Loans, which, in other words, are loans for qualified borrowers above the amount that Fannie Mae and Freddie Mac will guarantee, which for most counties in the United States is $548,250. Sifting through the lingo and parlance on this, this means that banks are getting looser in their offerings of loans to people with good qualifications who want to buy large homes; if you are well-qualified and want to buy an expensive home, banks want to talk to you. Of the 65 senior loan officers who responded, not a single one reported tightening standards for this type of loan while 19 reported their credit standards were easing somewhat and one reported their credit standards were easing considerably:

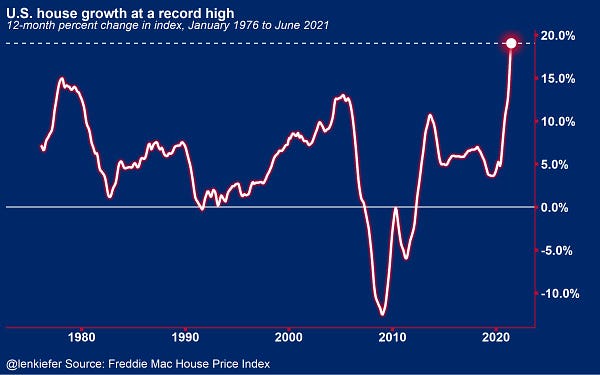

So what? People who are well-qualified want bigger loans for larger homes. Why does that matter? As I wrote as recently as last week, I think the housing market has room to run. I expect demand for homes to stay strong for at least the next 18 months, which is when I expect interest rates to start rising.

The problem for the overall economy, however, not to mention individual homebuyers and their banks, will be what happens when the economy drops again either as a mild correction or, someday, a full on recession. What happens if some of the people getting approved for jumbo loans now who may be well-qualified currently in a strengthening economy are suddenly out of work? And what happens if this coincides with rising interest rates, which would dampen the real estate market especially for large homes? If people who are buying large homes now can no longer afford them and there is diminished demand for large homes? That’s not a good combination.

I don’t want to make it seem like the July Senior Loan Officer Opinion Survey on Bank Lending Practices is the inflection point in all of this or that is it more dramatic than the previous paragraphs might indicate. But it is something to keep an eye on especially if trends towards loosening credit standards continue.

To round things out, there is actually good news in the report for those who might be inclined to have a more bearish perspective. Sharp-eyed readers of the chart above showing the changing credit standards for the various types of home loans will note that there is one category of loan in which credit standards are actually tightening: sub-prime loans. These are home loans for people who would not typically qualify under normal underwriting requirements (i.e. the riskiest borrowers). This could reflect a couple of things, which is that maybe banks learned their lessons following the 2008 financial crisis and are simply more reluctant to lend to sub-prime borrowers, or perhaps it is that with rising home prices the less-qualified buyers are getting squeezed out of the market and banks are just not as willing to take risks on them as there so many other stronger buyers to work with. It is probably a little bit of both, but the fact that banks do not seem to be going out of their way to offer sub-prime loans is, in fact, a sign of strength for the current housing market and indication that banks are still trying to manage risk. It’s not a free-for-all out there, at least not yet.

I will be coming back to this quarterly in the future, so make sure you’re subscribed to The Sunday Morning Post newsletter to get my research and analysis in your inbox each Sunday morning. Thanks for reading. Please also consider sharing on social media or through email to help spread the word.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking above.

The Weekly Round-Up

Here are some links to things that caught my eye this week:

Ec 10 professor at Harvard likes the Friday jobs report:

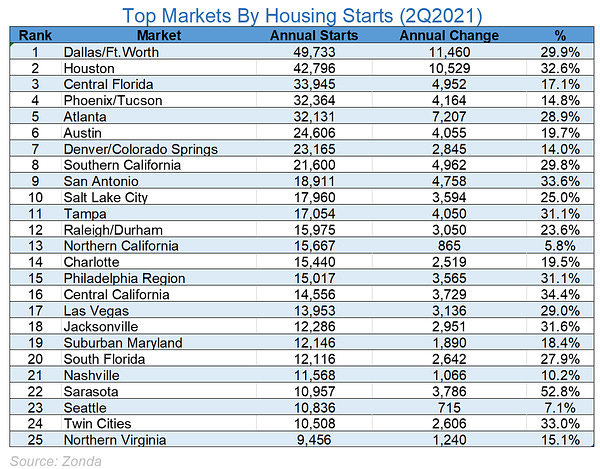

Dallas was the top homebuilding spot in the country in the second quarter:

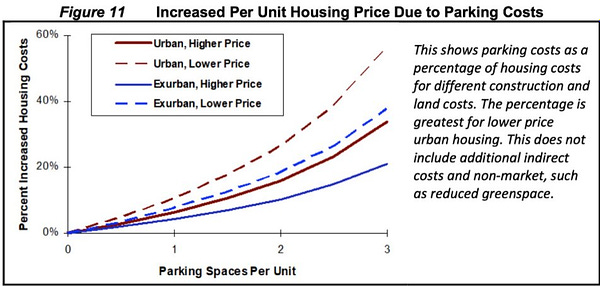

Some additional info about minimum parking requirements, which I wrote about in June:

MaineBiz reports that Maine’s median home price is $276,000. Maureen Milliken looks at what you can get around the state for that amount: https://www.mainebiz.biz/article/heres-what-you-get-for-276000-in-maine-real-estate

As if you needed more proof, the housing market is hot:

And now for something completely different, I am running for School Committee. I myself am a product of the Bangor School Department here in Bangor, Maine and now my wife and I are raising three kids who will be coming through the Bangor schools as well. I’m eager to step up and I look forward to making my case to the voters of Bangor in the weeks to come:

Got news tips or story ideas? Email me at bsprague1@gmail.com. Have a great week, everybody.