Thank you for reading The Sunday Morning Post! I am glad you are here. If you’re new and would like to receive these articles each week, just click Subscribe below. If you are already a subscriber, please consider sharing with friends and colleagues.

Even as high interest rates and multi-year inflation have wrecked havoc on the housing market, there are some very good stories to be told out there about the state of American homeownership. Take this, for example: the percentage of American homeowners who are delinquent on their mortgages has fallen to a 17+ year low. According to data from the St. Louis Federal Reserve, just 1.72% of single-family mortgagees are delinquent, which is the lowest rate since the second quarter of 2006. The delinquency rate was just over 10% as recently as 2012, but has been on a fairly steady decline ever since. Why is this so? And what does it mean for the housing market? Let’s dig in.

The State of Homeownership is Strong

Low delinquency rates are a result of several key factors, most notably a strong labor market and rising wages. In last week’s Weekly Round-Up (found at the bottom of each week’s main article), I referenced the most recent Gallup poll, which showed Americans are feeling gloomy about the economy and their own place in it. But despite the bad vibes out there, unemployment remains at historically low levels and wages have been rising faster than inflation over the past year. Homeowners are generally feeling secure these days, particularly those with pre-2021 mortgages, which are often in the 3.0% range or better. With all of these things in mind, delinquency rates are naturally going to be low.

Another reason why current home mortgagees are showing comparative strength over previous time periods is that bank underwriting standards for home loans got tighter following the Great Recession. To the detriment of some would-be homeowners who may have been on the line from an underwriting standpoint and perhaps did not get approved for home loans in the last 10-12 years, the tighter standards did, in fact, create a stronger nationwide portfolio of homeowners, which has subsequently manifested itself in lower delinquency rates. In other words, some of the homeowners that would have been delinquent today did not actually qualify for or obtain mortgages to begin with and so never got them.

Lastly, various rules and restrictions against foreclosures by banks during the pandemic plus generous forbearance programs allowed struggling homeowners the chance to stabilize from 2020-2022 who might otherwise have become delinquent or even foreclosed upon. This help during the pandemic absolutely made a big difference in preventing problems both then and later.

Foreclosure Statistics

According to the research firm ATTOM, just 0.26% of U.S. homes faced foreclosure in 2023, well below historical levels. Foreclosures peaked in 2010 at a rate of 2.23%, which may seem like a small percentage, but it actually represents nearly 3 million properties. That is slightly more than 1 in 50, which is quite a lot! The chart below shows the trends over the past 15+ years:

According to ATTOM, foreclosures were the highest in New Jersey, Illinois, and Delaware last year. Although nationwide foreclosures were a tick higher in 2023 versus 2022, it is important to remember that this upward trend is coming out of a historically low time period of foreclosures when there were, in fact, foreclosure moratoriums in place during the pandemic. So I wouldn’t read too much into the uptick other than we are seeing a slight trend back towards historical normalcy (more on this in an addendum below).

On the commercial side of things, foreclosure activity also remains low. Per ATTOM, there were just 635 commercial foreclosures in January 2024. To me, that seems like a very low amount when you consider just how many commercial properties are out there, which is reflective of a commercial real estate market that has been generally strong for the past half decade or more. That being said, foreclosures on commercial office space are on the rise, which is attributable largely to major changes in the ways we work; traditional office spaces (think cubicles and phone centers) are just not in high demand and lease rates have plummeted, putting some of these building owners in peril..

Although I do not speak for my employer in these articles, I can say from where I sit that loan portfolios are very strong right now and delinquency rates are, indeed, extremely low. And beyond delinquencies, actual foreclosures are few and far between.

What It Means for the Housing Market

Over the past year or two I have referenced “the golden handcuffs” numerous times. I won’t dwell on that more today, other than to quickly reference my belief that home inventory is very low on the market because people are simply staying put to avoid giving up 3.0% mortgages or better to move into a higher-priced market with a much higher interest rate.

A second variable at play with regard to the limited inventory of homes for sale, however, is that there are just not that many existing homeowners in peril right now. Falling behind on payments and facing foreclosure is a powerful motivator to sell. But these distressed sales are not just happening, at least not at the rate they typically and historically have occurred in the past. I don’t have a specific statistic to reference on this, but I am guessing a delinquency rate of 5% instead of the current rate of 1.72% would probably lead to hundreds of thousands if not millions of more homes for sale in a calendar year as homeowners are pushed to sell rather than be foreclosed upon.

It may seem crass to talk about delinquencies and foreclosures in this way; a foreclosure is a jarring and destabilizing event in the life of a family, couple, or individual homeowner. But without some natural turnover of homes from these types of sales, the housing market continues to be starved for inventory. If you believe that human activity functions on somewhat of a bell-curve with predictable rates of certain activities, there are a large number of sales that were meant to have happened but didn’t that have now artificially contracted the inventory of homes for sale. Lacking inventory, home prices have skyrocketed.

My speculation, however, is that when the economy eventually does hit a skid, which it inevitably will at some point in the coming years, and more homeowners find themselves in financial peril due to reduced wages or lost jobs, the number of homes for sale will tick up rather dramatically, thereby creating pools of increased inventory and, with them, dampening if not declining home prices. Whether this manifests itself in a trickle of new inventory or a crashing of the floodgates remains to be seen.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Addendum - A Comment on the Media

I referenced above how foreclosure activity according to the ATTOM Report stood at just 0.26% of properties, which is a very low figure. Moreover, although foreclosures have seen a slight uptick over the past couple of years, it was largely coming out of an artificially low period of foreclosure activity thanks to foreclosure moratoriums during the pandemic. But “foreclosures tick up slightly but remain low” is not a very attention-grabbing headline. It is not the thing people get worked up about, anyway.

Today’s media outlets want page clicks and engagement. Engagement is most robust when people are feeling angry or outraged. It has been fascinating to see what they have done with foreclosure statistics. “Foreclosures continue to surge: Are they a threat to the housing market?” asks The New York Post. Yahoo Finance used the word “surge” as well, saying, “Home foreclosure activity in the US surged to the highest level since the start of the pandemic.” Nevermind that for much of the pandemic, foreclosures were barely possible under federal foreclosure restrictions. An increase in foreclosures from 0.11% in 2021 to 0.26% in 2023 does, in fact, represent a more than 100% increase in foreclosures in just a two year period, but that is not a fair way to portray the data. Nonetheless, that is how many media outlets do it, particularly when their motive is not the fair presentation of news but to make you feel worked up.

Consume media with cuation, and be mindful of when writers, those who write headlines, and media outlets in general play upon emotions for page clicks.

Weekly Round-Up

Capital One is buying Discover. This is likely to shake up the credit card market, which has been dominated by Visa and Mastercard for several decades. The Wall Street Journal had an interesting podcast on the topic earlier this week, which was a good explainer and also offered a nugget I did not realize, which is that Discover was originally launched by Sears Roebuck. Click here to listen.

Via Jennifer Sor, Morgan Stanley is warning against a 30% drop in U.S. office building values. Read more here via Business Insider/Yahoo News.

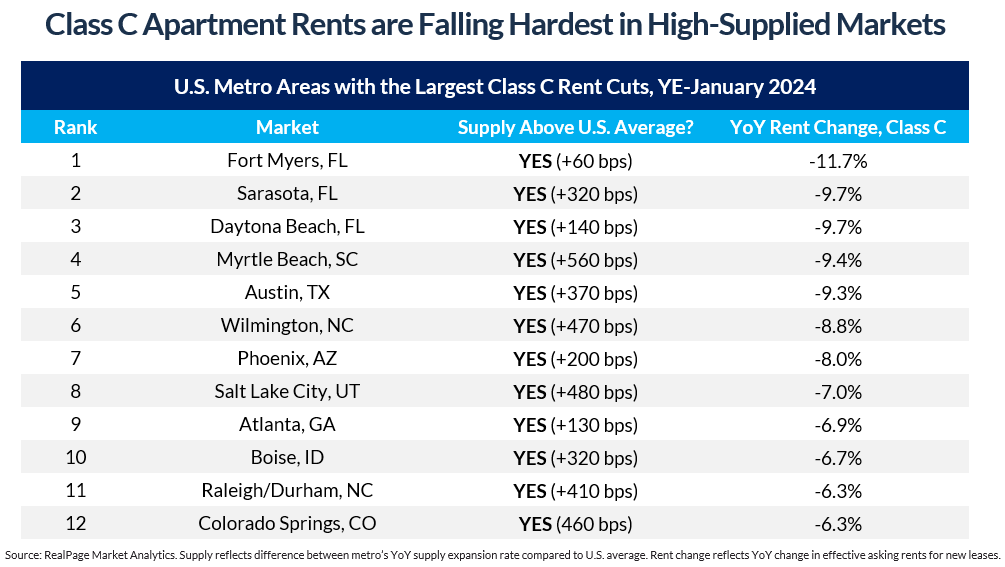

Jay Parsons shared data on X/Twitter this week showing that some of the communities were rents are falling the most are where the most high-end units are being built. The point is that an increase in supply anywhere on the price spectrum benefits everyone but expanding the pool of possible units and releasing pressure on overall demand:

One Good Long Read

From the October issue of GQ, Tom Lamont has an article entitled, “The Race to Catch the Last Nazis,” about those who are still working to bring Germans to justice who had a role in the Holocaust even these many decades later. He writes:

Back in the 1960s, Adolf Eichmann, one of the architects of the Holocaust, was tracked to Buenos Aires, where he was living in secret as a married father of four and was known locally as Ricardo. The Mossad agents who found Eichmann drugged, disguised, and then spirited him away for trial in Israel. Later that decade the camp commandant Franz Stangl was traced to a car plant in São Paulo by Simon Wiesenthal, the famed Holocaust survivor turned Nazi tracker. The postwar years produced sensational, daring stories of Nazis being brought to justice. These final years of the hunt are different. Quieter. Weirder.

It is a good read and worth remembering that, for many, the pursuit of justice never ends. Nor should it. You can read the article here.

Ben

Information from mortgage service companies indicates that GSE’s have been specifically required to grant extensions or modifications for delinquent residential mortgages - if that is true, then comparing the modifications YOY and their status after the mod, would be a better gauge of the potential underlying delinquency problem.