Home Prices Start to Fall

Welcome to The Sunday Morning Post! If you’re new here, you might enjoy these recent articles:

Rental Market Flashes a Sign of Loosening

Dumb Luck and Golden Handcuffs

What Top CEOs are Saying About the Economy

Please consider sharing The Sunday Morning Post to help expand our audience and community. And if you have a topic you’d like to be covered, just drop it in a comment below or email me at bsprague1@gmail. I will try to get to as many as I can.

Home Prices Start to Fall

Amid sharply rising interest rates, inflationary pressures that have people on edge, and an easing of pandemic-era migrations that saw Americans leaving big cities in favor of the country’s smaller cities and more rural areas, home prices nationwide are now starting to fall. What does this look like? Where are prices dropping the most? And how far could things go? Let’s dig in.

A Look at the Data

On Tuesday of this past week, the Federal Housing Finance Agency released data showing that home prices fell nationwide by 0.7% in August. Although home prices were still up 11.9% over a 12-month period from August 2021 to August 2022, the drop in the month of August represented the second straight month of declines after robust gains month by month and year over year since the start of the pandemic and really for most of the last decade.

In reacting to this week’s data release, Len Kiefer, Chief Economist for Freddie Mac, highlighted in a tweet the stark difference in the trajectory of home prices vis a vis the rate of change over just a three-month period:

Further evidence of the beginning of a decline in home prices is shown in the chart below from the St. Louis Fed showing the Case-Shiller U.S. Home Price Index going back to 1987. If you look all the way to the very right, uppermost corner of the chart, you can just barely see the tick downward of home values over the past couple of months:

I’m not a fan of what-goes-up, must-come-down analysis, but the chart above does even give me some pause as I think it is almost a certainty that in 12 months’ time this data will show a continuation of the recently started downward path versus any kind of a bounce back up. Whether that is a good or a bad thing depends a lot on where you sit in the housing market (more on that below).

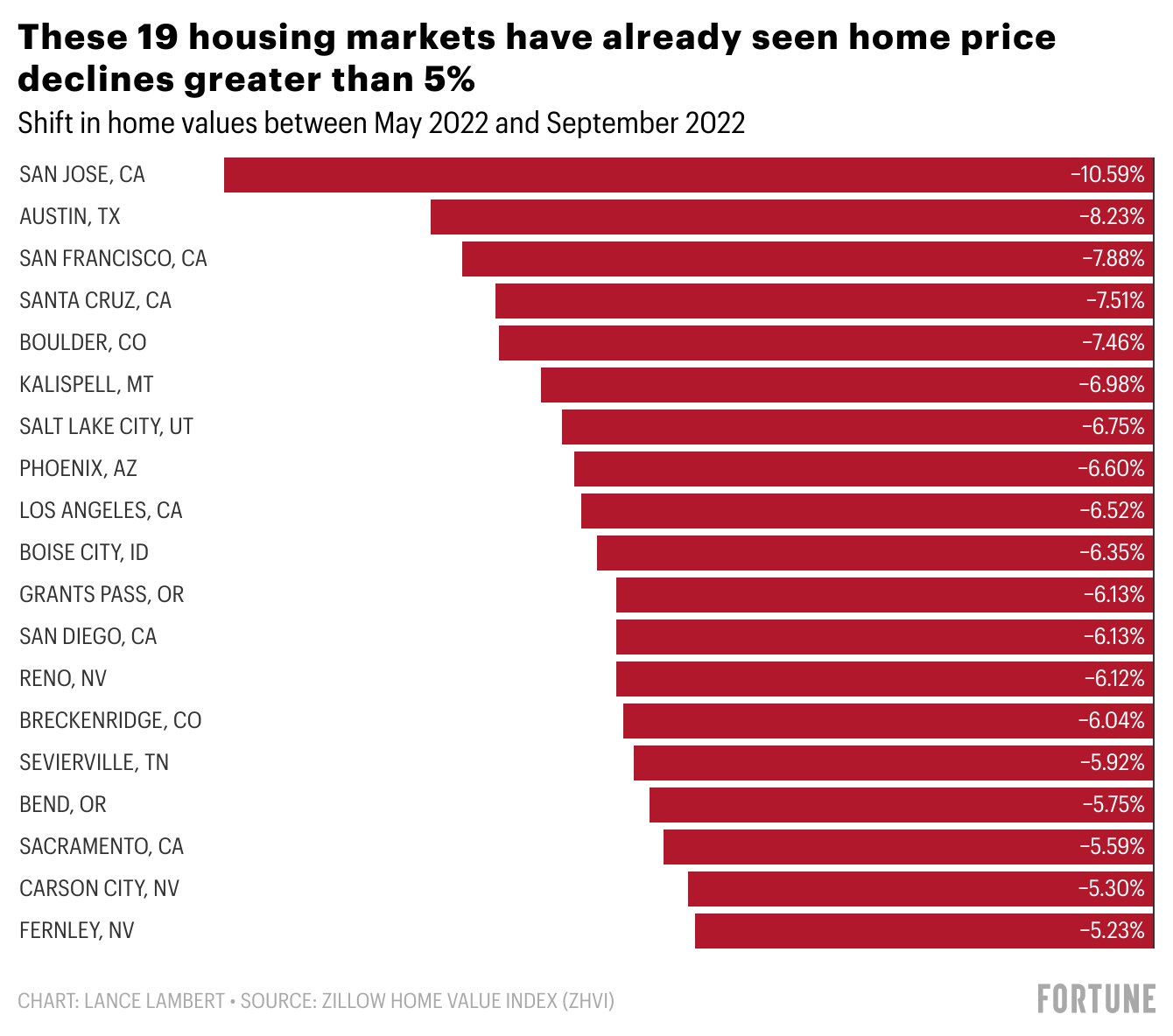

Where are home prices declining the most? According to Lance Lambert of Fortune, it is in the following markets, many of which were the biggest gainers during the pandemic:

Of note to readers in the northeast including here in Maine, none of the markets noted above are really anywhere close to the northeast and the Federal Housing Finance Agency August data noted above actually shows an increase of 0.4% in the northeast month over month, although the rate of increase is definitely slowing. In Maine specifically, according to data from the Maine Association of Realtors, the median home price did actually drop from $354,000 in July to $340,000 in September to $330,000 in October, which is certainly evidence of a bit of a trajectory, although some of that decline may also be seasonality.

How Low Will Things Go

As physicist Niels Bohr once said, predictions are hard, especially about the future. The truth is that no one knows exactly where home prices will be a year from now. But my prediction based on the analysis that I do is that by the end of October 2023 as compared to October 2022 home prices nationwide will be down 10-15%. In certain markets like the most bubbly ones of the pandemic-era, prices could be down 20-30%.

I base this one two major variables that are actually intertwined: interest rates and the state of the overall economy. What I am seeing in my work as a banker and from talking with real estate professionals all day long is that the housing market is grinding to a near halt. Would-be buyers are exiting the market either because they are priced out by higher rates or they are nervous about the overall economy and just don’t want to take the plunge on a major life decision (i.e. buying a house) in such an uncertain moment. With an absence of buyers, which represents declining demand, prices too will decline.

Keep in mind this statistic that I’ve shared versions of in the past: as interest rates rise, millions of Americans are simply unable to obtain mortgages:

And it does not seem like interest rate are going back down anytime soon. The Federal Reserve is particularly hawkish right now, which if you’re a long-time reader of The Sunday Morning Post means that rates are not coming down until inflation is fully nipped in the bud. The housing market is suddenly much different than it was six months ago. If you want to know when it will normalize again, follow the monthly CPI/inflation reports: the Federal Reserve will not decrease interest rates (and may not even stop hiking them) until monthly CPI/inflation reports show inflation at a rate of 3-4% and ideally at the Fed’s targeted long-term level of 2%. And that might take another 6-12 months in part because even though the housing market is changing fast, the data lags by several months.

Who Wins and Who Loses

One’s thoughts on declining home prices depend a lot on where one sits in the overall housing market. The winners will be potential buyers including those who have been especially patient over the last few very challenging years, with the caveat to this being that if you are now priced out of getting a mortgage it doesn’t really matter if there is more inventory available and modestly cheaper prices.

The losers of declining home prices are numerous: sellers, first and foremost, who may have missed the peak to sell in the spring or summer at sky-high prices with robust buyer demand. The risks right now are also high for recent buyers who end up with buyers’ remorse or who need to sell sooner than expected for a move, job change, or other life event; some of these recent homeowners risk finding themselves upside down with a home that is worth less than they paid for it within the last 24 months and a potential dearth of would-be buyers to take it off their hands.

Other potential losers include those in the real estate business: real estate agents who will have fewer transactions and therefore fewer commissions, mortgage brokers and title companies, and those with tangential businesses that touch on the real estate field. It could be a tough couple years ahead for homebuilders and contractors, too, as the rising rates are hitting those would-be homeowners who are borrowing from banks to build.

What is really needed, of course, is for the housing market to find an equilibrium. The pace of activity and soaring prices from 2020 to early 2022 was certainly not that, but neither would things be at equilibrium if activity were to fall off a cliff.

But getting to equilibrium is easier said than done. Just as it is hard to make predictions about the future, it is too easy to make judgments about the past. Would policymakers have traded an economy that survived the pandemic for soaring real estate values and red hot inflation? Possibly. But looking back it is likely the case that interest rates were held too low for too long and the catch-up that the Fed is playing now is, indeed, likely to cause some pain.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.