I have two sets of very good friends who have both been in the market for a new home for much of the past year (or more). Each of them has expressed to me at different times this summer that they have essentially given up. Fresh data out this week illustrates the reasons why: the challenges for new homebuyers in the current market are essentially unprecedented.

Interest Rates

According to Mortgage News Daily, the average 30-year fixed interest rate topped out this week at 7.49% before settling in at 7.39% to end the day on Friday. This rate range is the highest it has been since the year 2000, when rates edged just over 8.00% before easing into a 5.50-6.50% range for most of the next decade. The sharply higher cost of borrowing over the past 12-18 months is something I’ve written about almost weekly for the last year, so I won’t dwell on it here, other than to say it has pushed a huge chunk of buyers to the sidelines. In fact, according to the National Association of Realtors, the number of home sales in July was down by 800,000 nationwide year-over-year, or about 17%.

As a quick aside, it has been a tougher time to be a realtor of late with the number of transactions down and the number of realtors up. As of January, there were an estimated 2 million licensed real estate agents nationwide, a figure that is at our near all-time highs. The state with the most licensed real estate agents? Florida, which as I wrote about last week is a real estate market with its fair share of storm clouds on the horizon. But with about 647,000 active listings nationwide right now, there are three times as many real estate agents as listings.

The number of transactions will continue to drop for the next few months. According to the Mortgage Bankers Association, mortgage applications were off by 30% last week as compared to the same week in July 2022. Since sales lag applications, with applications being down it is not likely that sales rebound anytime soon. The fact that transactions are down by 17% but applications are down by 30% suggests the next few months will be especially chilly in the home market.

Prices

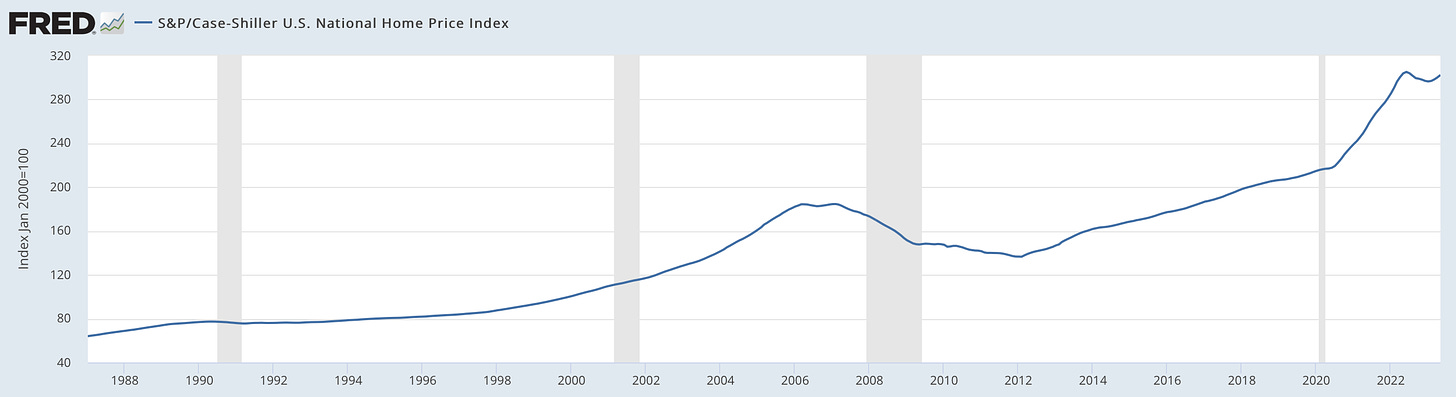

Interest rates alone are not the only thing causing would-be homebuyers to throw in the towel, however. The other major variable is prices, which have, in fact, decelerated a bit and are even starting to ease down in some markets. But still, home prices are at historical highs, as shown in the chart below of the S&P/Case-Shiller U.S. Home Price Index:

Inventory

As if the double punch of high prices and painful interest rates is not enough, the last kick in the pants for would-be homebuyers is a staggering lack of inventory. The National Association of Realtors reports the number of homes listed for sale is off by 14.6% as compared to last year, and that was based on an already-low number for 2022 well under usual numbers for this time of year. There are just not many choices for buyers out there right now, which further restricts activity.

What Comes Next

All of these variables are, of course, linked together. Prices are high because there is so little inventory available. Inventory is low because interest rates are so high and existing homeowners are not moving, thereby not adding to the pool of available homes for sale. People are not moving because prices and interest rates are both so high. What a mess.

The Fed has been battling hard to bring down inflation for the past year, and many people are acknowledging that the Fed has done a far better job than was expected in that many did not think inflation would get down to where it is now (3.2% as of July) without more of a downturn in economy including job losses, which have not happened. But time will tell as to how a more prolonged period of high rates may impact things. Fed Chair Jerome Powell reiterated just this week that rates are likely to remain high, saying in a speech at Jackson Hole, Wyoming:

We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

But effects can lag. And the rates remaining high for so long is going to have an effect on the economy, no doubt about it. Anecdotally speaking, it feels like things are slowing down in certain areas of the economy already for sure.

To ease the frozen housing market, however, I believe the Fed will ultimately need to lower interest rates. There are always unanticipated consequences of government actions, and the unintended result of the current high interest rate regime is that people are not moving, which has made it almost impossible for would-be homebuyers to find a place to buy.

The challenge is particularly acute for first-time homebuyers and others who are just getting started out because the price hurdle is so high. Many younger homebuyers have just not had enough time in their lives yet to have a pool of assets strong enough to make a down payment on a home or to be sure of having the resources to pay for repairs, renovations, property taxes, and insurance. I haven’t seen data on this, but I suspect a fairly sizable portion of home purchases by younger borrowers these days include a gift of down payment funds from family members, which is lucky for those particular buyers themselves, but pretty galling to others mired in this challenging market without being the fortunate beneficiaries of such gifts.

Home ownership is a fundamental tenant of the American Dream. It not only provides stability in where one lives, but it also helps to build equity and wealth, wealth that is often shared and passed on between generations. If ladders to this aspect of the American Dream are not available to younger Americans today and those looking to purchase their first home in general, it raises the fundamental question about whether the dream is even attainable. For the next year or so, the situation for would-be homebuyers is not likely to improve, which has many simply giving up while they wait things out.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. © Ben Sprague 2023.

I’ve been away much of the last week, including reuniting with my college roommates in Salisbury, Massachusetts for the past three days. I will get back into the Weekly Round-Ups after Labor Day. Have a great week, everybody!

Great commentary Ben. Nice conversational style. Can't buy but happy to swap. And to refer of course.

Looks like the construction industry is in for a hard time. Here in Australia, home builders are gong insolvent at a rapid rate, partly due to being caught completing their book of contracts as the price of materials inflates. Thousands of homes incomplete. Bad news for buyers and banks.