Housing Market Preview 2024

Greetings and Happy New Year! 2023 was an up-and-down year for the real estate market with certain areas doing very well and others experiencing notable challenges. The stock market was way up in 2023, which I wrote about recently, and construction is generally higher, which I wrote about last week. For today, I wanted to start the year with a look ahead at what I expect to happen in the housing market in 2024. Today’s focus is on single-family homes. Stay tuned for a similar piece about the rental market later this month. As always, thank you for reading The Sunday Morning Post! Please consider sharing with friends and colleagues.

Housing Market Preview 2024

Whether up or down, sideways or flat, housing is one of the main drivers of the U.S. economy. By one estimate, housing-related spending represents 15-18% of GDP. As we saw during the Great Recession from 2007-2010, a bad housing market can drag down the entire economy. Conversely, a strong housing market like we saw from 2019-2022 provides a boost to the economy with notable multiplier effects in other industries like retail sales (e.g. appliances, fixtures, etc.), trades (e.g. electricians and plumbers, construction contractors, etc.), and even restaurants and entertainment.

I think, for example, about when a bank does a loan for a new home purchase how many people touch that transaction from start to finish. Real estate agents, appraisers, inspectors, title companies, lenders and various bank staff like underwriters and processors; there are a lot of parts to a real estate sale, all of which involve employment and compensation, much of which is then spent again and again in the local economy. This is, of course, how economies work. So when assessing the overall direction of the national economy and its future health, understanding trends in the housing market is crucial.

Looking Back on 2023

I first want to quickly look back at the major trends and variables that impacted the housing market in 2023 and also assess my own predictions and analysis from last year’s housing market preview article, published this time last year.

The key variables in 2023 were interest rates and inventory. As shown in the chart below, the average 30-year fixed rate mortgage went from around 6.50% to start the year to nearly 8.00% by the fall before easing back down into the high 6’s (in January 2022 the rate was around 3.00%; much of the increase in rates was in 2022). The rate surge from January 2022 through October 2023 pushed a lot of would-be buyers to the sidelines, which slowed down the number of transactions considerably.

The other impact of high interest rates was that they have caused many would-be sellers to simply stay put. Whether you call it golden handcuffs or the interest rate lock effect, people were reluctant to move and give up interest rates in the 2’s and 3’s on their existing mortgages (or no interest rate at all from a paid-off home) to buy into a high-priced market with an interest rate in the 6’s or 7’s. As a result, low inventory plagued the housing market all year long. Although single-family home construction increased throughout the year, it was not enough to counteract the low inventory of existing homes for sale.

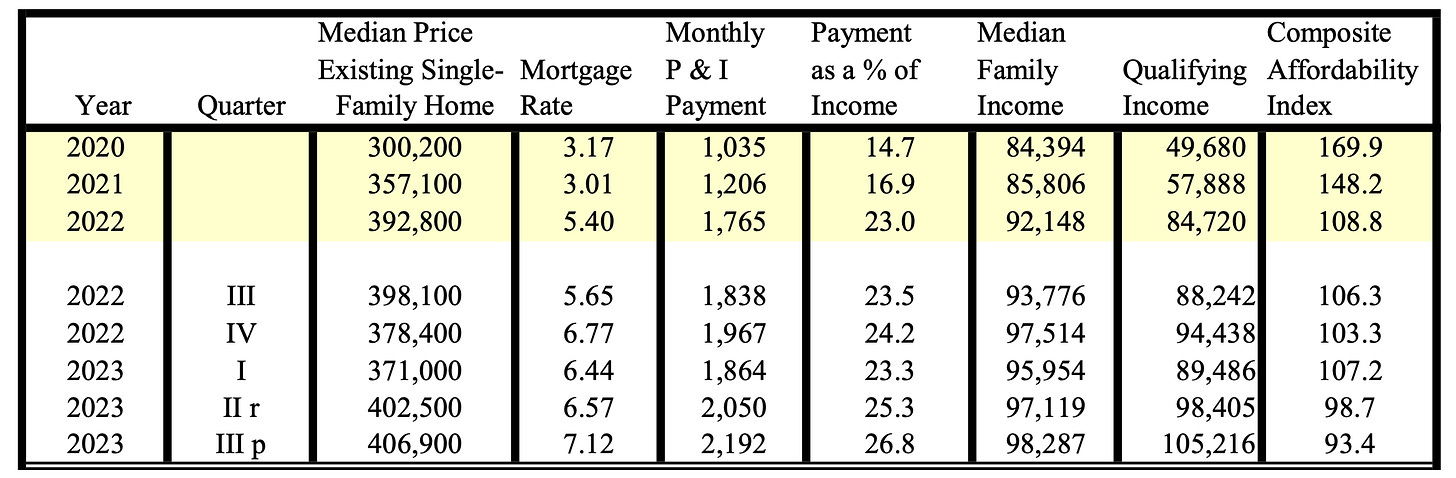

The triple punch for buyers this past year was that with a combination of high interest rates, which made homes less affordable, and low inventory, which meant there were fewer choices, home prices generally remained pretty high in most markets. There was not a corresponding price decrease as interest rates rose, in other words. As a result, the Housing Affordability Index reached its all-time worst levels in 2023. Per the National Association of Realtors, the monthly payment of principal and interest on a median home hit an all-time high of 26.8% of the median family income in the third quarter of 2023. As recently as 2020, the monthly payment as a percentage of family income was just 14.7%:

All of these variables led to a 10+ year low in the number of homes transacted. According to most data I have seen (including via the CalculatedRisk Blog, which is a great read if you are interested in these types of things), new home sales were pacing to be under 4 million total for the year. This would be well-below historical averages and the lowest rate in over a decade. As you can see in the chart below, sales in 2023 were fewer than every single comparable month versus 2022 (although the gap is narrowing a bit).

Revisiting the 2023 Preview

For my 2023 Housing Preview predictions, I give myself a B grade. The main thing I got right was a prediction of how interest rates and inventory would be tied together, saying:

Another factor at play is that millions of existing homeowners are locked into fixed-rate mortgages around 3.00% or even less. What is the motivation to sell? Unless people can turn the sale proceeds into a cash purchase of a new home or have other assets to be able to pay for a home out-of-pocket, the need to otherwise finance a new home acquisition with a bank loan disincentivizes moving right now. People who might be passively interested in moving or thinking about moving up-market might simply decide not to because of this lock-in effect…

I also correctly acknowledged that the Fed would still be in the driver’s seat for 2023:

There was a saying I used to keep in mind when I was working as an investment advisor: Don’t Fight the Fed….what is the Fed signaling today and how will it impact the real estate market? Clearly, the message from the Fed is that there will be some pain in the economy until inflation gets under control. And the pain that will be felt will be most acutely experienced by people in certain industries, including real estate.

Where I missed (at least partially) was in my prediction that home prices would decline nationwide and in all markets. Prices remained surprisingly buoyant, which I attribute to the low inventory and the lock-in effect not to mention an economy that was stronger throughout the year than most people (including me) expected it to be. When so many people are working and wages are rising, it is no surprise (at least in retrospect) that prices stayed up.

So about those prices: what is the tale of the tape for 2023? Well it all depends on what data you look at. According to data from the St. Louis Federal Reserve, the median home price in the 3rd quarter of 2022 was $468,000 and in the 3rd quarter of 2023, which is the most recent month for which data is available, it was $431,000, which represents a decline of about 8.0%. Yet according to the CoreLogic/Case Shiller Home Price Index, home prices were up 4.77% in October 2023 versus October 2022. Quite honestly I don’t know what is to account for the difference between the Fed’s data and CoreLogic/CaseShiller, other than there must be some difference in methodology. Safe it is to say that home prices were generally flat in many parts of the country, rose in some areas including the Northeast and South, and dropped in parts of the West. In certain markets including San Francisco and Palo Alto, for example, home prices were down more than 10% according to data from Zillow. In Austin, Texas, home prices were down about 4%.

What Comes Next

One of the driving variables in the housing market for 2024 will again be interest rates. But unlike 2022 and 2023, interest rates in 2024 are almost certain to come down. If you are a new reader to The Sunday Morning Post or just missed this particular article last month, I would point you to my discussion of the expected decline in interest rates that I wrote on December 17th rather than rehash it here. But what this likely means for residential borrowers is that the average 30-year fixed rate should continue to ease down to the 6.0% range by the end of 2024. Commercial borrowers should see a similar decline, although commerical rates typically correlate with residential rates but 100-150 basis points higher. This would put commercial rates including for rental properties in the 7.00-7.50% range by year’s end. I’ll have more on this in an article previewing the rental market and commercial borrowing more broadly for 2024 in an upcoming post.

What is likely to be the effect of falling rates? Conventional wisdom is that when interest rates fall, prices rise. That is because a lower interest rate allows a borrower to purchase more home. However, I do not think this conventional wisdom will hold for 2024, and that is because of the aforementioned interest-rate lock-in effect. In some ways right now, the housing market is broken. This has been an unintended consequence of the Fed’s hawkish stance to raise rates as much as they have in order to control inflation. Keep in mind the Fed’s dual mandate is to control inflation and promote full employment; it is not to also engender a healthy housing market.

So right now the housing market is most unhealthy indeed. It will take a decline in rates to thaw it out. My expectation is that as rates drop, there will be a burst of pent-up supply from sellers who have been holding back. As this inventory hits the market, buyers will have more choices and increased leverage in negotiations. Price setting will flip from sellers to buyers, and prices will become more competitive (i.e. lower).

I really have no analytical data to support this hypothesis, it is just a gut feel based on the dozens of people I talk to in the real estate field each month as to what they are seeing out there. If you believe that human behavior is basically predictable, you have to be mindful that there has been this massive interruption to the usual sales that were supposed to have taken place over the past two years. Once the catalyst for that interruption (i.e. high interest rates) is removed, I expect it will be like a dam breaking free with a flood of new inventory on the market as the pent-up demand among sellers bursts forth. To use a possibly clunky analogy of air travel, after a period of time during the pandemic when people couldn’t travel, once those restrictions were lifted and the most dangerous time of the pandemic had passed, airline travel surged thanks to all that pent-up demand being released. So too will home sales re-emerge as the pent-up demand to sell carries forth.

Diving More Into the Data

There is, in fact, already some evidence that inventory is picking up. According to the National Association of Realtors, the number of homes for sale rose in November 2023 as compared to November 2022 by 0.9%. While that is not a big surge by any means, during a time of steadily declining inventory, a slight tick up is notable. As of November, there were 3.5 months of supply of homes on the market, up from 3.3 months a year ago. It will take much more supply than that to result in a drop in prices, but at least the trajectory is better.

Mike Simonsen from Altos Research reported recently that inventory was up 3.2% by the end of December and there were 11% more new listings that same week of December versus December 2022, saying, “There is something notable in the data from November and December: we're already getting early signals that we’ll have more sellers in 2024, and therefore more home sales.” Simonsen also noted that about 37% of recent sales have included price reductions, which is actually a normal-ish figure, suggesting supply and demand are reaching more of an equilibrium with one another. RedFin reported similar data, noting 35% of transactions include seller concessions. A market with few price concessions suggests sellers are still in control, but that is not totally the case.

Macroeconomic Factors

Of course, one large factor at play is the health of the overall economy. A surprisingly resilient economy in 2023 with a low unemployment rate, rising wages, and positive consumer sentiment helped to keep home prices boosted in 2023. I wrote this past Thanksgiving Week about how the Vibes-Are-Off in this economy, but then was pleasantly surprised to see in the December University of Michigan Consumer Sentiment survey that consumer sentiment jumped by 13.7%. Things may feel off, but people are at least feeling a little better about it.

The delinquency data for past due loans is showing some positive vibes, as well. Deliquency rates on single-family homes were just 1.72% in the third quarter of 2023, the lowest percentage since 2006. Not only does this show strength in the average American household budget, but it suggests there is not necessarily a surge in people selling because they need to. Mike Simonsen noted this in the Altos Research blog referenced above: there is not much panicked selling taking place at the current time, which would itself represent an increase in new inventory if it were to happen. Homeowners are generally pretty stable financially, at least at the moment, keeping in mind we all know what happened in the housing market in the immediate years after the last time delinquencies rates were this low.

Other macro-factors that are difficult to predict at this point include trends in workplace culture. There is some evidence that after a surge in work-from-home arrangements during the pandemic, some people are being called back to the office. That might result in some migration of people back to the larger tech hub communities in the west, which could boost prices in those markets but dampen things in the secondary and tertiary markets that people moved to in 2020-2022, although probably not enough to move the needle much.

One last factor I have written about before and will probably keep coming back to is the impact of climate. I worry about a systematic decline in home prices in Florida (because there is too much water) and Arizona (because there is not enough water). Not only might demand for homes evaporate, but the cost of owning a home continues to rise in these places thanks in large part to the rising cost of insurance due to natural disasters. Homeowners insurance in Florida, for example, is three times the national average and is up 102% just in the last three years!

Boiling it All Down - and the Key Question: Prices

I expect home prices to stay basically flat or to modestly decline in 2024 in most markets. As noted previously, it would be intutitive that a decline in interest rates would lead to an increase in prices, but we have not been living in normal times. The great disrupting event, which was the COVID-19 pandemic and the subsequent ratcheting down of interest rates for an extended period of time, created an artificiality to so many things in the real estate market. Now that artificiality just needs time to pass through the system. As rates decline, inventory will increase, and prices will ease.

I also think buyers have become much more rational in the past 6-12 months, which should help prevent further price spikes. There was a frenzy of buying from 2020-2022, but a lot of the noise and emotion of that has quieted down. Buyers have become more patient, and aren’t willing to duel with one another as much for something that is not actually the right fit. There are definitely markets where things are still running extremely hot and I can only imagine the frustrations would-be buyers are still feeling, but a lot of the frenzy has petered out.

I do expect prices to fall more in the West, which is where prices rose the most from 2020-2022. Places like Phoenix, Denver, Boulder, and throughout California plus trendy communities with frothy real estate markets like Austin, Tampa, and Miami could be poised for further drops of 10-15%. Here in the Northeast, I expect prices to be basically flat in 2024. In Maine, the number of transactions was down by 5.5% in November as compared to November 2022, with prices rising by 9.23%. In Maine and the rest of New England, I expect inventory to start ticking up and for prices to start decelerating, then flatten, and eventually modestly decline.

Advice for Buyers and Sellers

My advice to buyers is to stay patient. A price drop of 20-30% is not coming, but neither is a price surge of that magnitude. The best thing a buyer can do is to stay rational and reasonable, not overpay due to any hot emotions out there, and to buy the right home in the right market. Buyers should also consider going with a variable interest rate, from which they will benefit anytime interest rates drop. If you need a home, you need a home. But I expect the buyers’ market will become steadily more palatable throughout 2024 and eventually into 2025, so if you can wait it still makes sense.

If you are a seller or prospective seller, this is still a good time for you. My advice is to stay out ahead of any potential surge in inventory, however. Homes on the market today still have relatively little competition, which makes for a cleaner sales process and gives the leverage of pricing power to the seller. It will not always be like that, though, and it is much harder to sell in a crowded market. Eventually if we do have an inventory surge, you don’t want to be on the wrong side of that wave. As long as you have plans on where to go, it’s always better to sell six months too early than six months too late.

Final Thoughts

So there you have it. It would be more exciting and probably generate more clicks if I suggested there is a housing market crash on the horizon and everyone should panic. But that’s simply not the case. Of course anything can happen and no one knows exactly what will transpire in the year to come, but I expect it to be one where the trends we have seen start to develop over the past two or three months continue, which means more listings, rising inventory, an easing down of interest rates, and a swing towards a more normalized real estate market where buyers and sellers find themselves approaching equilibrium. Eventually we will get to a true buyers’ market where it is the sellers who are feeling the pain, but that, dear readers, may need to wait until 2025.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here area a few things that caught my eye this week:

More than 75% of Americans say that violent crime is on the rise, but 2023 saw the greatest decline in homicides since the data started to be tracked. “It is historic. It's the largest one-year decline…It's cities of every size, it's the suburbs, it's rural counties, tiny cities, it's large cities. It's really a national decline." Read more via ABC News.

A group of researchers have published data in the Journal of Applied Psychology suggesting the best leaders are once who can effectively turn off their brains from work in non-work hours. Easier said than done, but their conclusions are as follows via Harvard Business Review:

Our research suggests that constantly thinking about work may hurt rather than help your performance as a leader. We found that not taking a break from work in the evening backfired for leaders, especially for those new to managerial roles, because it drained their mental resources. Instead, leadership effectiveness was highest on days in which leaders mentally turned off from work the night before and were able to recharge.

Aziz Sunderji, who writes the Home Economics newsletter on Substack, showed data recently that it is still more economical to buy than to rent, even with home prices being sky high. The breakeven point according to Aziz? Year 4. Read more here.

Via Ali Wolff on X, the Zonda homebuilder survey has builders feeling cautiously optimistic with expectations that prices will be flat or modestly higher in 2024.

Have a great week, everybody!