Welcome to The Sunday Morning Post! Each week I write about the economy with a focus on real estate and banking. If you are a new reader, please subscribe below to get my articles in your inbox each Sunday morning. Thanks for being here.

Last week I wrote about how delinquency rates on home loans and commercial loans are at historically low levels. Late loan payments let alone actual debt defaults are practically non-existent right now, which you would think would make for happy bankers and the continued free flow of funds. But such is not the case. In the same way the bluebird afternoons of summer turn into crisp autumn evenings, so too do the fickle economic breezes blow.

To the Fortress

According to the Fed’s most recent Senior Loan Officer Opinion Survey (SLOOS), about half of those loan officers surveyed said their banks were tightening their lending standards. Not a single loan officer said their bank’s standards were loosening. Yet there is a strong labor market and inflation has been dropping. Just this week the Federal Reserve decided not to raise interest rates again at least for the time being, which provides a little bit of certainty to the market for the next couple of months. What’s not to like? Why would banks be tightening up?

Well, the SLOOS also asks loan officers this very question. Among the reasons given, the following were the most common:

Less favorable or more uncertain economic outlook (94%))

Reduced tolerance for risk (69.1%)

Deterioration in their bank's current or expected liquidity position (59.2%)

Worsening of industry-specific problems (56.3%)

Increased concerns about the effects of legislative changes, supervisory actions, or changes in accounting standards (54%)

Decreased liquidity in the secondary market for these loans (50%)

Deterioration in their bank's current or expected capital position (36.7%)

So in a nutshell, it’s the economy, stupid. Banks are hunkering down for what is expected at some point to be an economy in recession. That will mean job losses, less consumer spending, and less stable borrowers who are at more risk of defaulting on their loans whether those be personal or commercial. Undoubtedly the high profile bank failures of Silicon Valley Bank, First Republic, Signature Bank, and Credit Suisse earlier in the year contributed to this anxiety. While there were unique variables at play within the walls (and within the balance sheets) of each of those entities, the overarching risk of underwater long-term, low-yielding assets is something that bank boards from Boston to San Francisco must be worried about, including increasingly thin net interest margins when comparing deposit yields to loan rates.

How Are Banks Responding

The question of whether our economy is about to hit the skids is a fair one, but beyond the scope of today’s article. What I can say, however, is that banks are acting like we are headed for a downturn. The tightened underwriting standards are a part of that (of note to rental property investors, which I know a lot of my readers are, 63.3% of the loan officers surveyed said their bank’s underwriting standards for multiunit residential properties have tightened either somewhat or considerably).

But apart from that, banks are also making use of certain tools to guard against risk even further, including:

Decreasing loan-to-value ratios for new lending (i.e. if a bank would normally lend up to 80% LTV, the bank may now only be lending 70-75% LTV).

Adding a interest rate premium to the loan pricing (62% of those surveyed in the SLOOS said they were doing this)

Decreasing the maximum balance of Lines of Credit (40% of those surveyed said they were doing this)

Adding deposit requirements for borrowers to maintain a certain amount of cash in the bank, often 10-25% of the loan balance at all times.

Shortening the maturity of loans. Instead of, say, a 20-year term on a commercial loan, the bank may only offer a 15-year term, which thereby requires the borrower to pay the loan down faster.

What It All Means

If you are looking to borrow money from a bank in the months ahead, it is going to be tougher. Not only are interest rates pretty high relatively speaking, but banks are using tighter underwriting standards and adding in things like the requirements above. Banks are in the business of risk, and right now they are seeing a lot of risks out there, which could make for frustrated borrowers who need capital and liquidity.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this week that I thought might interest you too:

The chart below via Parcl Labs shows the percentage of single-family homes that are owned by investors with at least 10 units. Percentages are higher in the south and midwest.

Non-Fungible Tokens or NFTs, which were all the rage in 2020-2021, are now virtually worthless. Read more via Miles Klee of Rolling Stone, who says, “95 percent of NFTs wouldn’t fetch a penny today — a spectacular crash for assets that reached a trading volume of $17 billion amid a frenzied bull market in 2021. The study estimates that some 23 million investors own these tokens of no practical use or value.” I called this in December 2021, by the way.

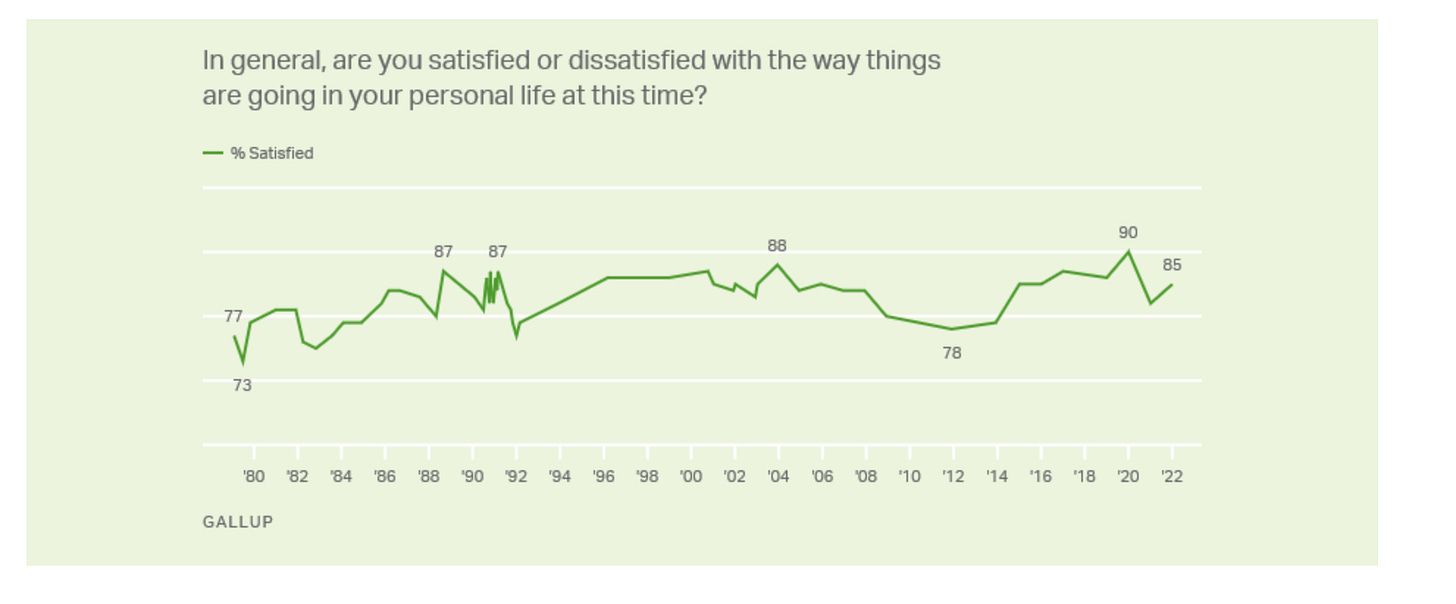

Americans may be pessimistic about the overall economy, but 85% of us are satisfied with their personal lives, a figure near all-time highs. Via Gallup.

Source: Gallup

Have a great week, everybody!

Ben, is this the story that is about to evolve: https://www.youtube.com/watch?v=Jq_6RKHJIIA

SLOOS is so predictive, and so overlooked. Nice note!