Inflation Cools to Slowest Rate in Two Years

What it means for interest rates this summer

This week’s monthly report of the Consumer Price Index showed continued movement downward in the inflation rate, with the price of goods and services coming in 4.0% higher year-over-year. Although that rate is still above the Fed’s goal of a long-term 2.0% inflation rate, the 4.0% reading was the lowest since March 2021. This deceleration of inflation provides some hope to price-weary consumers. And, in fact, according to the University of Michigan Survey of Consumers, consumer sentiment improved by 8.0% this month to hit its highest level in the past four months. The survey did note, however, that “A majority of consumers still expect difficult times in the economy over the next year.”

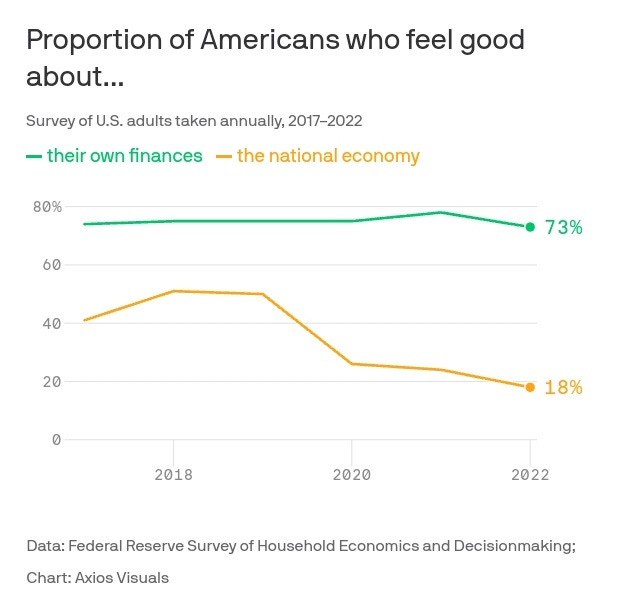

Just as a brief aside, I happened upon the chart below recently, which shows the juxtaposition between how people feel about their own finances versus how they feel about the economy as a whole. The percentage of people who feel good about their own finances has remained remarkably stable over the past five years even amid the turbulence of the global pandemic (although I do think the survey is administered only annually, and if it were done monthly I am sure the months of March-June 2020 would have shown quite a dip as Americans were feeling pretty perilous about their finances at the start of the pandemic until the benefits of stimulus set in). The gap below, I believe, is a result of the ubiquitousness of algorithm-driven social media that rewards negativity with virality and a media industry that is beholden to page clicks and social media engagement for revenue. Negative stories get more placement and the algorithms provide them with more oxygen, which impacts our collective feelings about the state of things:

But back to this week’s inflation report: the biggest declines both month-over-month and year-over-year have been in energy costs. Fuel oil was down 7.7% from April to May and down a pretty substantial 37.0% year-over-year. Used vehicles are also down 4.2% year-over-year, but have been ticking back up over the past couple of months. Some other areas showing month-over-month declines include airline fares (-3.0%), household furnishings (-0.6%), and eggs (-13.8%). The great Egg Crisis of 2022 is behind us, I guess. Sporting goods (-1.1%), boys and girls footwear (-1.0%), and pet services (-0.6%) are also some of the other miscellaneous areas showing declines. One area that probably is worth some further discussion and analysis is health insurance costs, which according to this week’s report are down 20.5% year-over year. It certainly doesn’t feel that way, though.

To the upside, food prices continue to go up, clicking in at +0.2% for the month and +6.7% for the year (despite the cracking of the egg market). Various services also continue to rise in value, including transportation services (+10.2), a category that includes vehicle repair, veterinarian services (+11.0%), legal services, (+7.3%) and haircuts (+4.9%). There really are quite a lot of categories.

One final note about the data, shelter costs including rent continue to rise according to the CPI: up 0.6% for the month and 8.0% year-over-year. However, there is also ample evidence that rents are leveling off and even declining in some parts of the country. Once this data lag settles out, the shelter category in the CPI should moderate or even go negative, which will contribute to an overall lowering of the top-line CPI number as shelter makes up over 1/3rd of the entire index. Of note, the typically hawkish Fed Chair Powell said this week about the housing market, “We now see housing putting in a bottom and maybe moving up a little bit. We're watching that situation carefully."

What it Means for Rates

Ideally, the Fed would like to see housing costs (as well as overall inflation) come down further, which spells a bullish case for more interest rate hikes if the Fed does not see prices continue to moderate enough to their liking. The Fed did decide to pause this week, however, from another immediate interest rate hike. Undoubtedly slowing inflation was a key reason why. To the Fed’s advantage, the labor market continues to hold up remarkably well, leaving the path open for a potential soft landing where inflation is reigned in without overly detrimental impacts to the labor market.

But, comments from Chairman Powell were negative at least to the eyes of borrowers, as he signaled two more rate hikes later in the summer and, perhaps most notably, said that he does not expect there to be rate cuts anytime soon, commenting, “It will be appropriate to cut rates at such time as inflation is coming down really significantly. And again, we’re talking about a couple of years out.” Those with exposure to variable rates should be mindful, as should those in the housing market in general that things are likely to remain tight for the the rest of this year and into 2024.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. © Ben Sprague 2023.

Weekly Round-Up

Here are a few things that caught my eye around the internet this week.

Lance Lambert of Fortune Magazine shared an interesting chart on Twitter showing price changes for homes in the first five months of the year. Red represents falling prices and blue represents rising prices. The geographic disparity is real. I expect by the end of the year the chart will have a little bit more red and some of the counties that are in pale red now will eventually be dark red while some of the counties in blue will be lighter blue or even light red.

According to WalletHub, Americans paid down their credit card balances by $24 billion in the first quarter of 2023, which may sound like a lot, but it was actually the second lowest paydown figure in the past decade. Americans have an average of $9,654 of credit card debt per household, up 8.39% since last year. Twelve of the top twenty cities for credit card debt per household are in California with the ten below topping the list:

Here in Maine, eviction filings are up by more than 50% this year. The rise is largely attributable to rising real estate values and a lack of housing supply, plus, I think the petering out of stimulus funds and rental relief programs including eviction moratoriums, which mostly ended in 2021. Read more via Robbie Feinberg of Maine Public in partnership with the Bangor Daily News.

One Good Read

I am bringing back a feature I used to do every once in awhile: One Good Read. This is where I will post one article or written piece that I think is worth your time. This week’s piece is “The Case for Selfishly Managing Time,” by Mike Allen, Erica Pandey, Jim VandeHei, published on Axios, which features a line near and dear to my heart, “Most meetings could or should be half their scheduled time.” Amen. Read more here.

Have an article you think readers of The Sunday Morning Post should read? Send it to me at bsprague1@gmail.com.

Have a great week, everybody!