Investors Pulling Back from Homes

According to a Redfin study, investors bought nearly one in seven homes in America’s largest metropolitan areas last year, which was the highest level in decades. I’ve thought a lot about this over the past couple of years, and I think the growing share of investor participation in the housing market will be one of the lasting unintended consequences of a prolonged period of artificially low interest rates (which has now ended). Lacking yield options on traditional investments like CDs, savings accounts, and bonds, investors instead have been looking to diversify their portfolios with “safe” income-producing investments including rental properties. Private equity, large endowment funds, family funds, pensions: everyone has wanted a piece of the rental income pool over the past few years.

But now the landscape has changed. Purchase prices for homes (including multifamily rentals) around the country are higher, which makes it harder to find deals and to make them cash-flow as robustly once acquired. Interest rates are higher too, which means that those financing their real estate portfolios are going to have tighter and tighter margins especially if that financing has a variable rate component to it. High prices plus higher interest rates mean these rental property acquisitions by investors are just not going to be as profitable.

So it is not surprising at this point that investors are pulling back from the home/rental market. I am seeing it on a day-by-day basis in my job as a commercial lender. In 2020 and 2021 I would say more than half of the loans I did were for rental properties and today it is just no longer the case as this type of acquisition is slowing down a bit. It hasn’t shown to a stop by any means, but the volume of this type of loan is down.

The trend is happening nationally, too, especially with high profile institutional investors:

After buying nearly 10,000 homes in the third quarter of 2021, for example, Zillow announced in November that it would be now selling as many of those homes as it could. Zillow blamed a faulty algorithm for its buying of these thousands of homes, many of which it ended up selling at a loss, but regardless of the explanation this reflected an inflection point in the market.

Just this past week, Home Partners for America, a subsidiary of Blackstone, announced that it would stop purchasing homes in 38 U.S. markets. Per Lance Lambert in Fortune:

The pullback by Home Partners of America, which was purchased by Blackstone for $6 billion in 2021, comes as average joes and investors alike put their homebuying plans on hold. The result isn’t pretty: On a year-over-year basis, existing home sales and new home sales are down 20.2% and 29.6%, respectively.

The announcement by Blackstone-owned Home Partners of America also comes just as more Wall Street firms are realizing that the intensifying housing correction could translate into falling home prices. Last week, Fitch Ratings released a report finding that U.S. house prices are at risk of falling up to 15%. This week, Moody’s Analytics downgraded its outlook for U.S. house prices—projecting that a 5% to 10% price cut could manifest.

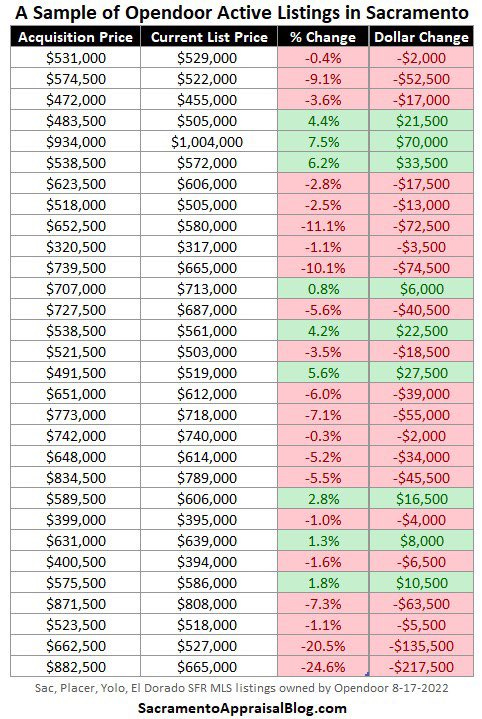

According to Ryan Lundquist, OpenDoor, which is an online tech company that buys and sells homes, has numerous properties listed for sale in Sacramento, California, the majority of which are being sold under the original OpenDoor purchase prices:

All of this is a sign of a market top starting its decline, and of so-called iBuyers that are trying to get out before things get worse.

What Comes Next

One’s point of view on the implications of this depends on where you sit in the current housing market. If you’re a potential buyer, the withdrawal from the market of so much institutional money is a good thing - less competition, a slower buying process that allows more time and thought, and more available inventory are the likely results. If you’re a seller, the cooling of the investor buyer pool could have negative consequences as it means there will be fewer and less aggressive buyers. If prices start to drop, which they are starting to do in certain markets, it could turn into a cascade and really spiral downward on sellers.

With that in mind, one thing is clear from where we sit in the waning days of summer 2022: the housing market is cooling fast. Some of these institutional players (like Zillow) are selling so they can cut their losses after buying too many properties in bubbly markets in the first place. Others, like the Blackstone subsidiary and Opendoor, probably see the writing on the wall that home prices are not going to show double digit gains in most markets in the 12-24 months ahead and that in many markets, prices will drop. Some of these investors are probably just trying to cut their losses by selling. Others that are pulling back from buying are likely doing so with the thought that a home that could be bought for, say, $300,000 in August 2022 might only cost $225,000 in August 2023. Why overpay?

Although I am in the business of doing loans and my company has a vested interest in lending to people, I think most mom-and-pop and other smaller real estate investors should proceed with similar caution in the face of some serious headwinds including the aforementioned high prices and high interest rates not to mention ongoing global economic instability and inflation including high utility prices that will hit property owners and tenants especially hard this upcoming winter. There’s a lot of trouble out there right now and although rental properties have been gold mines for investors large and small over the last several years, people should be mindful of the shifting winds of change in the real estate market.

For homebuyers in the market for their own personal residence, I continue to advice patience. If you find the perfect home at a good price in the neighborhood where you want to be, go for it. But if not, don’t buy the wrong thing as there will be much better opportunities and likely some easing prices in the months ahead.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.