Lawsuits Rock Realtors and What it Means for Home Sales

Thank you for reading The Sunday Morning Post! Don’t forget to scroll to the bottom for The Weekly Round-Up and a new feature, One Good Long Read.

A series of lawsuits has rocked the National Association of Realtors (NAR) plus several large real estate brokerage firms, potentially signaling major changes to the way homes are bought and sold in this country. The lawsuits come at a time the NAR has been in turmoil for other reasons including the resignation of its former president in August following allegations of sexual harassment and the subsequent resignation of his successor earlier this month, who referenced being blackmailed. Now a rival organization has formed that could even more fundamentally alter the real estate landscape. What does all of this mean for buyers and sellers? What are the implications for real estate agents? There is a lot to unpack. Let’s dig in.

What is the NAR?

The National Association of Realtors is the major trade group for real estate agents nationwide with over 1.5 million members. NAR transactions represent about 90% of the market each year so while sometimes a buyer or seller will go-it-alone, the vast majority of home transactions are done with the assistance of NAR members, who are conveyed the title of “realtor” by the organization. (As a quick aside, I once learned the hard way by referring to a new real estate agent as a “realtor.” A more seasoned NAR realtor across the table at this particular closing swiftly corrected me by pointing out the new agent, who was not a member of the NAR, was not actually a realtor but actually just an “agent.” Who knew???).

This past fall, the NAR was hit with a heavy verdict following a two-week trial in Kansas City, Missouri, which held that they had artificially inflated commissions on real estate transactions. The issue at hand was the sharing of commissions between a seller’s agent and a buyer’s agent. A commission is typically 5-6% on a home sale. More often than not, the two agents split the full commission. The jury found that this two-sided commission structure inflates commissions to an artificially high level. The NAR was ordered to pay the plaintiffs a whopping $1.78 billion in damages, an amount that could get pushed even higher upon subsequent review.

This type of commission arrangement is standard practice throughout the real estate industry. Proponents would argue that it fairly compensates agents on both sides of a transaction and incentivizes them to provide their expertise and assistance in supporting their clients during what can be a very complicated process. That both sides are financially motivated to complete the transaction ensures proper professional assistance, realtors would argue. In response to the verdict, an NAR spokesperson had this to say:

Buyers will [now] face even more obstacles in an already challenging real estate market, and sellers will have a harder time realizing the value of their homes. It could also force homebuyers to forgo professional help during what is likely the most complex and consequential financial transaction they'll make in their lifetime…Cooperative compensation helps ensure millions of people realize the American dream of homeownership with the help of real estate professionals.

Proponents of the lawsuit, however, argue that the NAR has a near-monopoly on the market for real estate transactions, and this has give them the power to inflate commissions to the detriment of sellers, in particular, who must generally pay for the services of an agent to assist with their sales. A core principal of the lawsuit was that sellers should not have to pay the buyer’s portion of a commission and that sellers rarely understand that the 5-6% commission they pay is being split as such.

What Comes Next

The Missouri lawsuit will likely be bogged down in appeals for several years. And indeed, upon news of the verdict in the Missouri case at the end of October, then-president of the NAR Tracy Kasper said, “This matter is not close to being final.” And yet, there are at least two other similar lawsuits working their way through the court system right now, both of which are more national in scope and could result in even more damages for the plaintiffs (i.e. people who have sold homes without the dual commission being properly disclosed).

So what does come next? Assuming the premise of the lawsuit and the Missouri jury verdict hold, there is likely to be a decoupling of commissions between buyers’ and sellers’ agents. Instead of sharing the commission, each party to a transaction may need to pay their agent separately based on a negotiated fee. This is likely to bring down the overall cost of commissions for sellers (who more often than not are paying the full commission now) and possibly could increase it for buyers (who as of now are sometimes not paying anything). It is also possible that instead of sharing a commission, the seller’s agent would give the buyer’s agent a referral fee or some kind, which might function somewhat like the current commission share, but which would have to be negotiated out. Agents could also offer their services for a flat fee, particularly on the buyer’s side, rather than based on a percentage of the transaction.

As these cases wind their way through the courts over the next several years, things are bound to be a little bit chaotic as the industry adjusts to a new paradigm. Different real estate agencies may try rolling out different plans in the months ahead, so it will be interesting to see what types of compensatory structures stick. Based on the research I have done on this and in speaking to various people in the industry, there is a belief that the typical commission paid by a seller in a transaction may ease from 5-6% to 3-4% as a result of the lawsuits and subsequent changes.

What About the Money?

Interested in getting your hands on a piece of that $1.78 billion in damages? Unfortunately for most people, the only people eligible in this particular case are people who sold a home in Missouri and parts of Kansas and Illinois from 2015 to 2022. But as noted above, there are some other lawsuits in the pipeline too with a more national scope, although I think it is safe to say that most likely the people who will earn the most from these lawsuits are the lawyers arguing the cases!

The Landscape Ahead

As if these troubles for the NAR were not enough, a new group has formed recently to try to crack the hold the 114-year-old NAR has on the very lucrative market for home-sale commissions. According to a recent report from NPR, real estate professionals Jason Haber and Mauricio Umansky, the latter of whom is a star of the TV show Buying Beverly Hills, have launched The American Real Estate Association and intend to raise $50-$100 million in start-up funds. As a way to distinguish themselves from the NAR, they intend to allow for more negotiation in commission fees, not require cooperation between buyer and seller agents, and will ask for $400-$500 in annual dues from members, which is about half of what realtors pay now to the NAR.

It would be natural for current realtors (or real estate agents, whatever terminology you want to use) to be concerned about how all of these changes will impact their own incomes. This is an especially important question following a year in which the real estate environment was marked by declining sales and therefore fewer transactions, plus a flood of new agents from 2019-2022, which further spread out the pieces of the pie. The intent of the lawsuits is undeniably to bring commissions down and to save the ordinary American consumer (in this case, buyers and sellers of homes) some money. So it may be that commission income is not quite as robust at some point in the future. One report from the aftermath of the Missouri verdict suggested commissions could drop by as much as 30%.

That said, in a market economy, people find a way. It may be that a referral fee structure replaces shared commissions, or that agents and agencies find that a fee-for-service model works better than a commission structure. I have never worked as a real estate agent, but the ultimate advice I would offer, though, is that trust and transparency always add value to skilled execution, and the real estate professionals who do it the best will never lack for clients willing to pay for their services. As transactions tick back up in 2024 after a down year in 2023, the best and most sought after realtors will continue to thrive.

Stay tuned as we come back to this story again later in 2024 as the courts continue to digest these various questions in what is a $100+ billion/year industry.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

The internet - curated for you! Here is what caught my eye this week.

American Express stock (AMEX) jumped almost 10% this past week as credit card balances and credit card interest rates have both soared to all-time highs, as I wrote about in June. Net revenues for AMEX have grown by 11% in the last year, although credit card write-offs are also up. AMEX CEO Stephen Squeri said on an earnings call this week that they expect “not a recession, but a slightly slower economy” and that the AMEX business model should hold up regardless of how the economy does.

Recent data for home sales in December showed a 8.0% jump in sales over November and a 4.2% jump over December 2022. The uncharacteristic-for-the-season jump should give some hope to real estate agents looking for more transactions as it is a sign that both buyers and sellers are coming back to the market after a stagnant few months. View the numbers via Odeta Kushi on Twitter/X.

Goldman Sachs is predicting FIVE interest rate cuts by the Federal Reserve in 2024 with the first one coming in March.

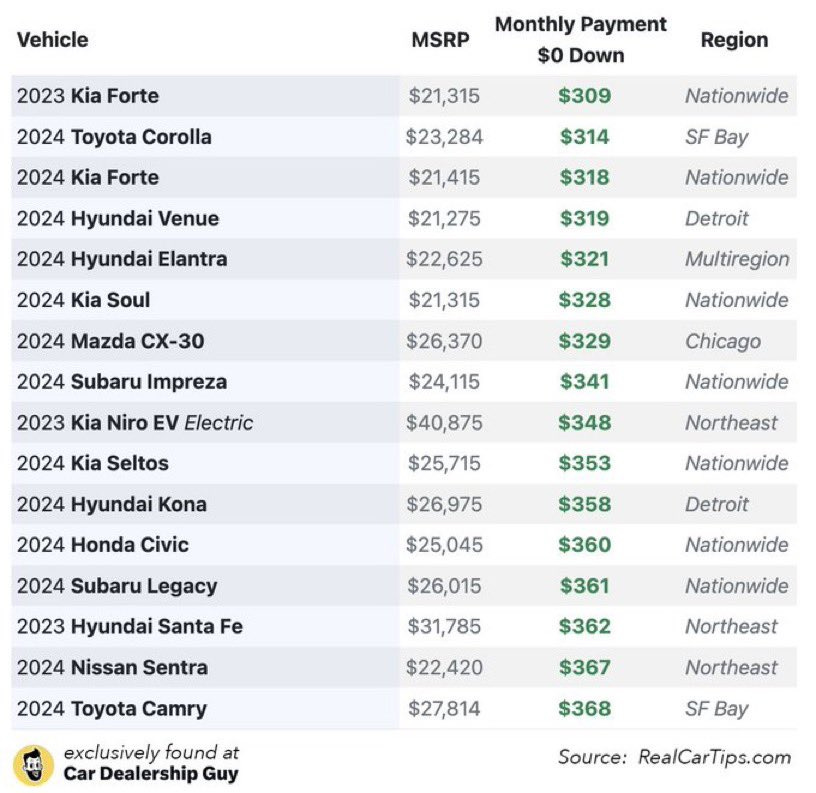

A Twitter/X account I follow for data on the auto industry posted the best lease current lease deals. Hint: Kias, Toyotas, and Hyundais.

One Good Long Read

A new feature - each week I will share a deep read/long read with no particular topic or theme in mind - just a piece of journalism or academic literature that I think people will enjoy or appreciate. Long live longform journalism!

“The Really Big One,” by Kathryn Shulz. The New Yorker. July 13, 2015.

The fascinating story of the Cascadia subduction zone, which is a fault line north of the more famous San Andreas. Using geological evidence, written documentation from 5,000 miles away Japan, and Native American oral history, researchers have traced a previous cataclysmic earthquake to 9:00 pm on January 26 in the year 1700. The context of such an earthquake carried forward to today and to an area where millions of people now live is chilling.

From the piece:

We now know that the Pacific Northwest has experienced forty-one subduction-zone earthquakes in the past ten thousand years. If you divide ten thousand by forty-one, you get two hundred and forty-three, which is Cascadia’s recurrence interval: the average amount of time that elapses between earthquakes. That timespan is dangerous both because it is too long—long enough for us to unwittingly build an entire civilization on top of our continent’s worst fault line—and because it is not long enough. Counting from the earthquake of 1700, we are now three hundred and fifteen years into a two-hundred-and-forty-three-year cycle.

On that happy thought, have a great week, everybody!