Lumber Futures Drop 22% in Three Weeks

Still up 51% YTD and 250% in 12 months - but what comes next?

Author’s Note: Welcome to The Sunday Morning Post newsletter! If you are new to the newsletter, click below to Subscribe for free and you’ll get an article in your inbox each Sunday morning. Thank you to everyone who has subscribed and shared so far. Forwarding the email or posting the link to the article on social media helps to spread the word. Thank you!

Lumber Futures Drop 22% in Three Weeks

In the past year, lumber prices have skyrocketed. Robust consumer demand for home renovation projects and new home construction combined with tightened supply due to COVID-related supply-chain issues and other factors have pushed lumber prices up over 250% in the past year.

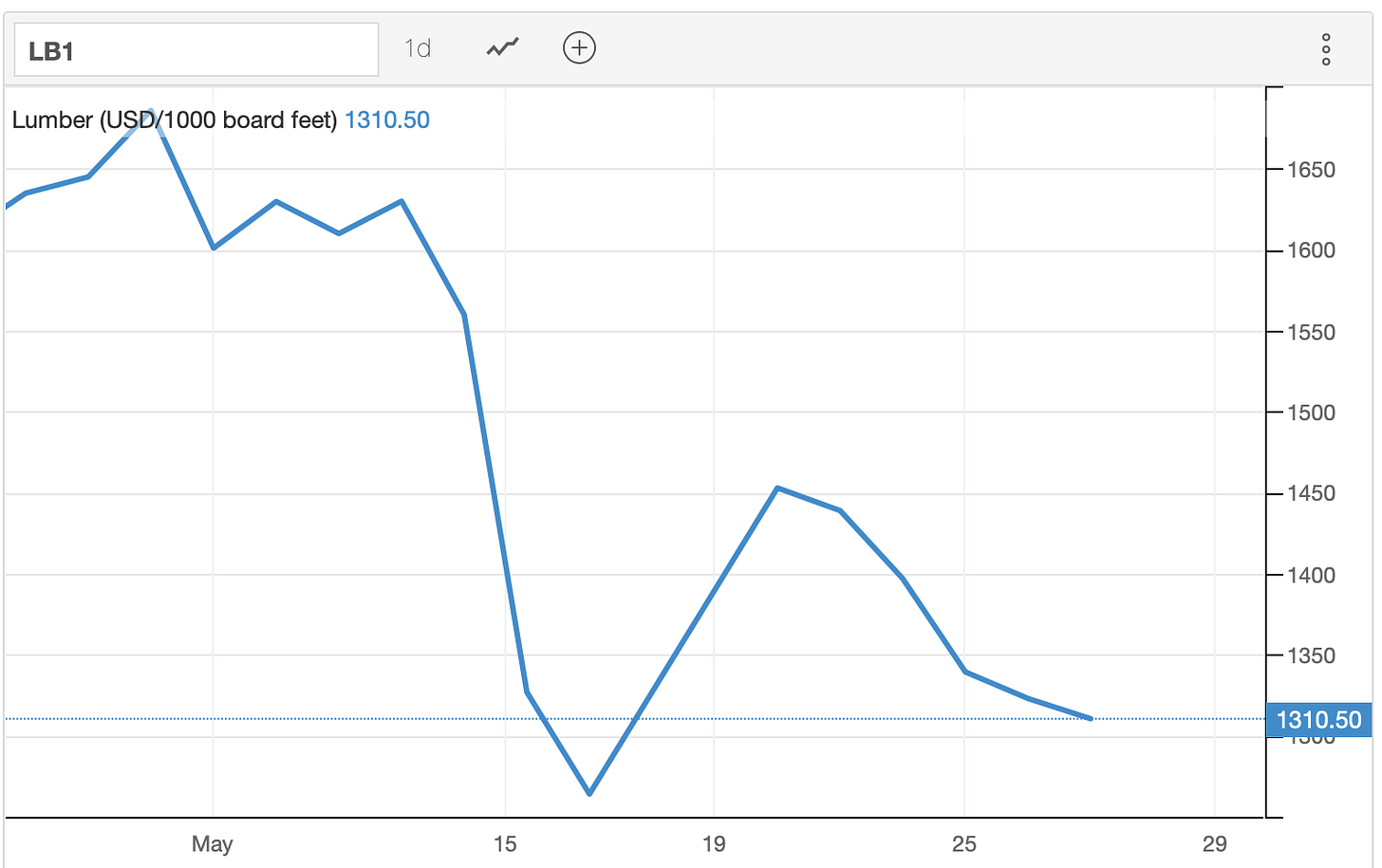

But there may be hope for consumers and developers who have been waiting out the feverish rise in prices: as shown in the chart below, lumber futures have tumbled over 20% in the past three weeks. Why is this happening and what does it mean? Let’s dig in.

How Do Futures Work?

The futures market (also known as simply “futures”) exists to enable businesses, farmers, and other investors to hedge their bets and guard against certain risks. There is an actual functional purpose to the futures market; it is not merely speculative or predictive. If you are a farmer with one crop, soybeans for example, you might use futures contracts to guard against an unexpected drop in prices due to drought or pests.

Some types of futures contracts are merely financial in that there is no actual exchange of products, but other futures contracts actually lock the contract holder into delivering or buying a certain amount of a product on a specified date at an agreed-upon price. That contract provides certainty to the soybean farmer, for example, in that he or she knows they will be able to sell their soybeans for that price. One risk to the farmer is that he or she could predict the market incorrectly and they could have actually sold their soybeans at a much higher price, but the futures contract acts a bit like an insurance policy and the lost surplus revenue is like an insurance premium for guarding against the downside risk, which if particularly significant could ruin a farmer’s season or maybe even lead to bankruptcy.

The Predictive Nature of Futures

Futures exist for many different types of commodities including corn, cotton, soybeans, lumber, and many other products. Futures also exist for stock and bond markets. Although U.S. stock markets open at 9:30 am EST, prices are influenced by events happening around the world and it is a daily occurrence for a news anchor on one of the financial networks to say prior to the market opening something like, “U.S. futures point to a lower opening this morning.” In this case it means the market is poised for a drop at the opening bell. In the case of equity markets, futures in the very short-term are highly predictive.

Long-term predictions are not always as accurate as with a greater time horizon there are more unexpected things that can happen. But futures prices still do typically encapsulate market participants’ prediction for where prices are going. In an article about the predictive nature of futures, the St. Louis Fed calls them “an imperfect crystal ball” in that they provide predictive data, but they are not always correct.

Keeping in mind there is great complexity to futures markets, it is simple enough to say for the purpose of the current conversation that when futures are rising, it means that investors expect prices of the actual underlying asset or index to go up. And, of course, when futures are falling, it means that investors are expecting prices to drop.

Lumber Futures

The price of lumber futures does not necessarily represent the price of lumber at Lowe’s or Home Depot on that very same day, but it does provide data as to where market participants think prices are going. In their comprehensive overview of how lumber futures specifically work, CME Group provides a great summary in noting:

The futures markets assimilate current information about the underlying commodities, and in the process of trading, prices are negotiated that indicate levels above which buyers will not buy and below which sellers will not sell. Random Length Lumber futures do not create cash prices; they do, however, generate a current view of an equilibrium price. If buyers are more eager than sellers, prices tend to go up. When the opposite is true, prices tend to go down.

So what do we make of the recent drop in futures prices? It’s easy to overreact to market moves, but a drop of over 20% in three weeks is notable. Market participants, which can include everyone from builders, lumber sellers, and investors with no underlying interest in the lumber market other than for speculative investment purposes, are signaling that they expect prices to drop.

Will Lumber Prices Actually Drop?

Five weeks ago I published an article in which I laid out some of the reasons why lumber prices have surged so significantly in the last year. You can read that article by clicking here. But to summarize the many factors, over the past year we have seen:

Increased consumer demand

Tightened supply due to COVID-19 and a misreading of the market one year ago at the outset of COVID by producers

Tariff wars with Canada

Regional issues like a beetle infestation in Canada and unique weather events throughout the United States

I also predicted that prices would pull back as at a certain point people will just not continue to buy into the frenzy, saying:

Market forces on the demand side of the equation should take hold at some point too. As prices continue to rise, consumers will pull back from renovation projects and new home construction will soften. Even as demand is currently robust, there are some anecdotal examples of developers pulling back on projects and waiting for prices to stabilize and perhaps decrease. Market peaks whether they are in stocks, tulips, or lumber can reverse quite quickly with a return to normal prices, which is what some developers who have started to pull back from new projects are counting on.

In my opinion that is what is happening now. In my work as a commercial lender for First National Bank, every week I am seeing developers pull back from projects (although, to be sure, many projects are also continuing to advance and new financing requests come to us every single day).

The reasons for a pause by some developers are two-fold, both related to the rising costs of lumber and other building materials. First, projects just do not cash-flow as well if the up-front cost of construction or renovations are too high. A $500,000 construction project to build eight residential rental units, for example, might work great on paper, but if the cost to build those units is now $700,000, the cash-flow may not be strong enough for the developer to take the risk and the project can lose its viability.

Second, more and more it seems that developers are reaching the conclusion that prices of lumber and other building materials will drop in the coming months. Granted, people have been saying this for months now and prices for the most part have continued to relentlessly rise. I have noticed an attitude adjustment in the last few weeks, however, where developers are acknowledging that the current frenzy for materials is irrational at this point and there has to be a pullback eventually.

If you take the anecdotal examples I have seen as just one lender for a Maine-based community bank and multiply them out through the entire economy, it suggests that the demand side of the equation is pulling back, which as an Economics 101 textbook will tell you, will lead to a drop in prices.

There are also variables on the supply side of the equation that can lead to a drop in prices, most notably the ramping up of production and the corresponding increase in supply. As COVID restrictions end and mills throughout the United States expand their capacity to meet the heavy demand, the supply of lumber will increase and prices will ease.

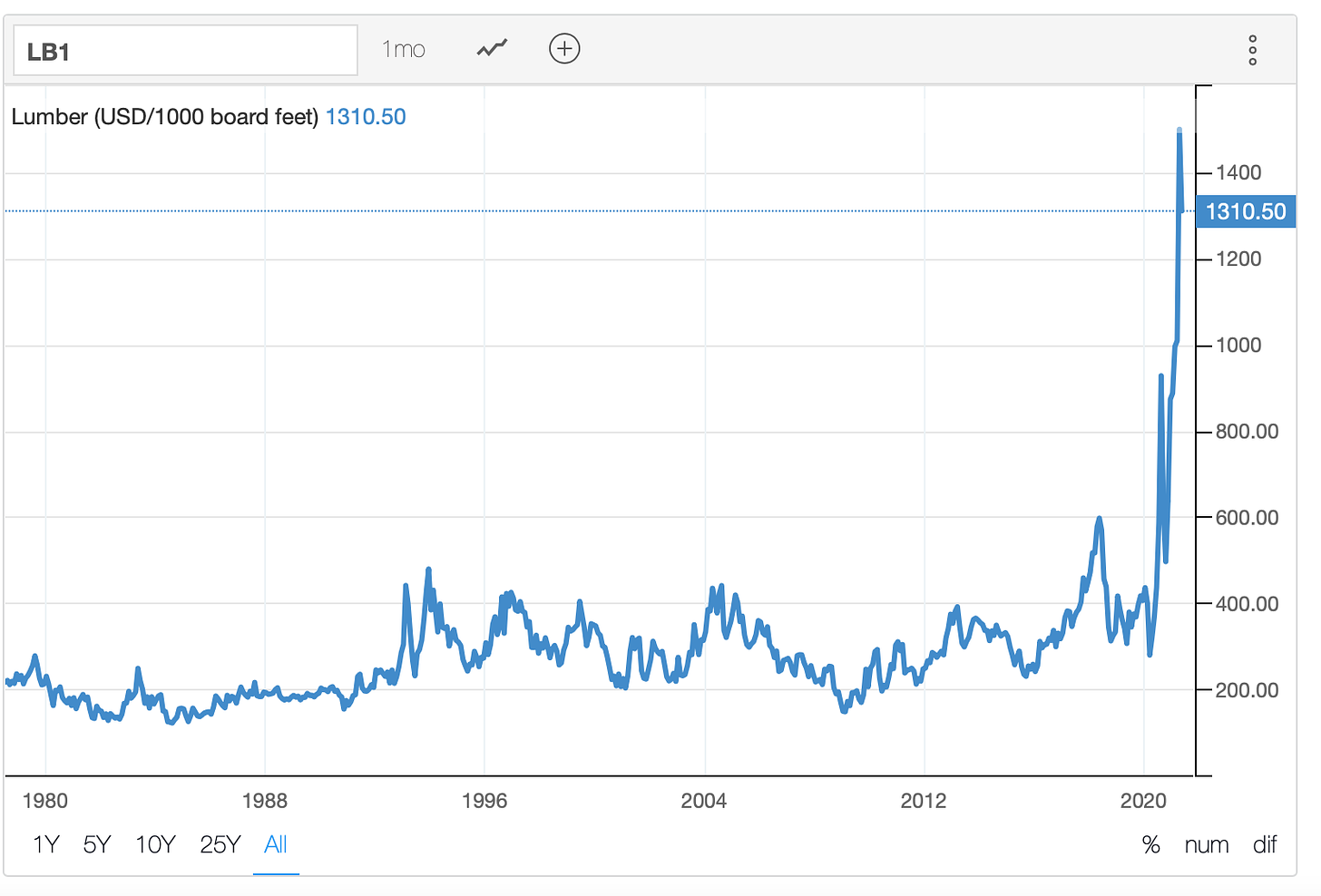

I am not an investment advisor and all of the usual disclaimers should apply about speaking to an actual licensed investment advisor, CPA, and attorney when making major decisions, but my advice is to be patient. Yes, interest rates are low and it is a great time to invest in real estate and other hard assets. But it is important to remember how historically abnormal current lumber prices are. Consider this chart, which shows future prices for lumber going back to 1978:

Placed in its historical context, the price spike in lumber over the past year is profound. Rarely has the future price for lumber ever been above $400 per thousand board feet so to be over $1,400, which we were earlier this month, is especially wild. The futures price for lumber actually peaked at $1,711 on May 10th! This is a bubble and bubbles always burst as the frenzy wanes (see: Tulips). Plus, markets tend to naturally correct themselves as market participants on both the supply and demand side react. I see that happening now. Will prices spike upwards again? Probably in the short-term there will be somewhat of a bounce, but there is also a lot of volatility here and the recent trend is downward. I expect this to continue with bounces and lags throughout. Builders and consumers should be patient.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to his weekly newsletter by clicking below.

The Weekly Round-Up

Here are a few things that caught my eye last week that I wanted to share:

The Portland Press Herald reports that Maine home sales continue to surge: https://www.pressherald.com/2021/05/24/maine-home-sales-up-36-in-april/

Bloomberg observes that the world is suddenly running low on everything, “Raising concern that a supercharged global economy will stoke inflation.” https://www.bloomberg.com/news/articles/2021-05-17/inflation-rate-2021-and-shortages-companies-panic-buying-as-supplies-run-short

Vanessa Romo from WGBH/NPR reports that a mint-condition 1933 Babe Ruth Baseball Card is expected to become the most expensive card sold at auction ever: https://www.wgbh.org/news/national-news/2021/05/21/iconic-mint-condition-1933-babe-ruth-baseball-is-expected-to-shatter-auction-records

Redfin CEO Glenn Kelman had a fascinating Twitter thread full of anecdotes that illustrate how wild the housing market is:

Mark Stephens observes the lifecycle of a strawberry:

The Sunday Morning Community

At the time of the publishing of this article, it is Memorial Day Weekend 2021. I’ve always resisted saying “Happy Memorial Day” as I think this should be a somber and reflective holiday. I’m not saying to forgo the BBQ’s and the traditional kicking off of summer (although it doesn’t feel like summer this particular weekend in Maine at least), but we have Veterans Day for a reason, Armed Forces Day for a reason, and Memorial Day for a reason: in the case of the latter it is to remember and honor those who paid the ultimate price for our country. I think each of these holidays should be recognized for its particular purpose rather than blending them all together. Just my two cents. I will end today’s newsletter with a photo from Black Bear Crane, which included the caption on Facebook, “All gave some, some gave all.”

I don't understand why some builders insist so strongly on using lumber that they will pay these crazy prices or cancel the construction. The community of people in the building industry, I guess, are just low-hanging fruit. Their smarter brothers and sisters went to law or medical school, and only the dummies went into construction. Their minds seem not to be open to reality. Steel framing works as well for hanging gypsum wallboard and the basic outside wall construction is a lot stronger when it is made from brick and/or concrete block as from wood 2 x 4s. There is no reason to chase the price of lumber higher and higher, and certainly no reason to cancel construction projects because of the runaway lumber prices. In fact, in many old world foreign countries, no one ever considers building houses or office buildings with wood. It is considered a relatively weak, shoddy material that can early get worm/termite eaten, and simply doesn't hold up over the centuries they expect their stuff to last.

Call me 619 332 1188