On Friday, shares of Apple Inc. (AAPL) closed near $194/share, an all-time high for the company. The record high itself was notable, but only the more so because Friday’s close was the first time that an American company has ever been valued at $3 trillion. That’s right, trillion, with a T. This makes AAPL more valuable than Exxon Mobil, Walmart, Coca Cola, Netflix, Nike, Disney, IBM, Ford, and Chipotle combined.

AAPL’s ascent to the $3 trillion level over the past few months has mirrored a surge in tech stock prices in general. Amazon is up 52% for the year. Microsoft is up 42%. Netflix is up 49%. Facebook/Meta is up 130%. Tesla is up a staggering 142%. Nvidia, which is now the world’s most valuable chip manufacturer, is up 196%! In fact, the NASDAQ as a whole, which is a tech-heavy stock market index, is up 32% for the year, which is its largest gain in the first half of any year since 1983.

As we hit the end of the fiscal year (Happy New Year, accountants and CFOs!), I thought it would be nice to do a bit of a mid-year check on stock prices, yes, but also real estate values, rents, and more.

Stocks

As mentioned, the NASDAQ is up 32% for the year. The S&P 500 is up 16% with the Dow Jones up a more modest 4%. Nvidia, Facebook/Meta, and Tesla make up three of the top five best performing stocks on the S&P 500 for the year so far, joined by two cruise lines: Carnival and Royal Caribbean. The bottom five for the year so far on the S&P 500 include Zion Bancorp, KeyBank, and the biggest loser of them all this year: Advanced Auto Parts, which is down 52%. Among the Dow Jones, top performers include SalesForce, Apple, and Microsoft, while the worst performances are Amgen, 3M, and Pfizer, the latter of which is down 23% for the year, making it the worst performing stock among the 30 companies represented on the Dow Jones Industrial Average.

Why are stocks in general doing so well this year? For starters, the economy remains pretty strong despite ongoing concerns about inflation. But with inflation easing down without an overly detrimental hit to the labor market (yet, at least), there are hopes that the economy will roll along even once inflation is fully in check. Not only does a strong economy boost consumer spending, which is good for stocks, but the decline in inflation should allow the Fed to ease off on its interest rate hikes, which would helpful for companies that want to borrow money to expand or re-capitalize.

Suffice it is to say it has been a good year for stocks. The surge in tech stocks, in particular, may also be a sign that these stocks were oversold in 2022; all of the companies noted above as being the top performers in 2023 were big losers in 2022. Excitement in the industry about the implications and profit opportunities related to A.I. may also be boosting tech stocks. But, keep in mind that just as these stocks bounced back after being down so much last year, so too could they drop after being now up. The expression is buy low, sell high, not buy-once-it’s-already-up, so tread carefully on chasing stocks and industries that have already been performing well this year.

Home Prices and Listings

Location, location, location is a mantra in the real estate business, but the same can be said of home prices for the year so far. Bill McBride, who writes the Calculated Risk Blog, notes the Freddie Mac House Price Index is basically flat when comparing year-over-year numbers (+0.4% through May, which is the most recent month for which data is available). There are notable geographic disparities, however. McBride writes:

The largest seasonally adjusted declines from the recent peak were in D.C. (-9.1%), Idaho (-7.2%), Nevada (-7.1%), Hawaii (-5.5%), Arizona (-5.2%), Utah (-4.9%), Washington (-4.3%), California (-3.7%), Oregon (-3.6%) and Wyoming (-5.0%).

Of the thirty individual cities showing price declines, the largest declines are being seen in Boise (-11.4%), Austin (-11.2%), Carson City (-8.4%), and various other locales mostly in California, Nevada, Wyoming, and Idaho. Of note, not a single city in the northeast makes the list of the biggest losers and, in fact, home prices are marginally higher in the northeast today than they were a year ago. Here in Maine, prices were up statewide by 6.57% in May 2023 as compared to May 2022, although the number of transactions was down by 20% according to the Maine Association of Realtors.

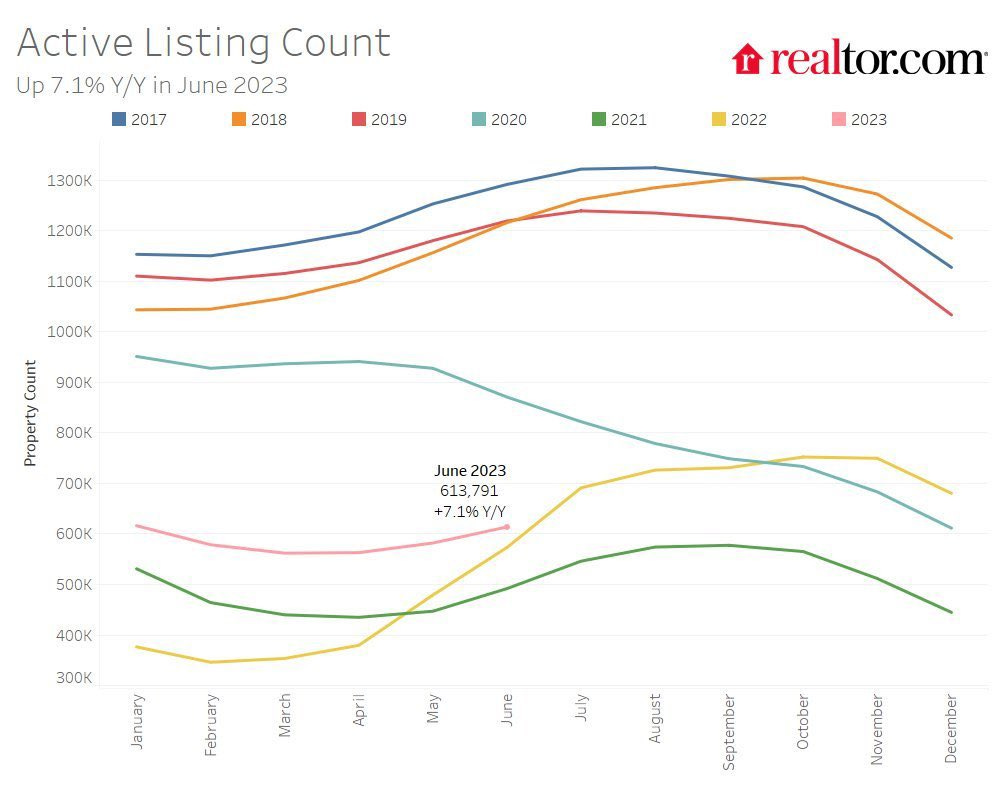

There may be some signs that inventory is coming back to the market with Realtor.com marking a 7.1% increase in inventory in June 2023 year-over-year, which puts the number of homes for sale in June 2023 above the levels seen in June 2022 and June 2021. This is a good sign for a real estate market running on fumes for lack of available homes to sell.

Rents

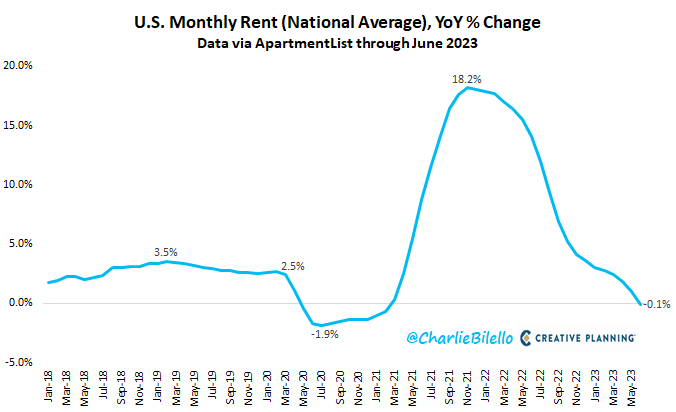

It is starting to become evident in the data that rents are easing, which is good news for price-weary tenants and something for real estate developers and landlords to be mindful of. According to CoreLogic, rent growth has eased for twelve months in a row to an annualized rate of 3.7% in May. One year ago in May 2022, by comparison, year-over-year rent growth was 14.2%. It may be a sign that the rental market is starting to find equilibrium. All of the U.S. metro markets in which CoreLogic tracks rental data saw rent increases of less than 10% through May on a year-over-year basis except Las Vegas, which actually saw a decline.

Because shelter including rents makes up a large portion of the overall Consumer Price Index, the fact that rents are easing up is a strong indicator that overall inflation will also continue to decline as the rental numbers usually lag by several months; once rent decline are sufficiently baked into the CPI, the overall CPI number will drop.

Much like with home prices, certain rental markets are going to be different and the most overheated markets are likely the ones that will decline the sharpest. With that in mind, Paul Williams notes that rents in Austin, Texas are dropping faster than the national average, down 2.4% year-over-year. The data set you use matters too, as Charlie Bilello reports on data from ApartmentList.com showing rents are actually down by 0.1% nationwide in May, which is a more significant decline than the CoreLogic rate of 3.7%. Either way you look at it, rents are easing up:

Interest Rates

The cost of borrowing remains high relative to the previous few years. Lance Lambert of Fortune reports the average 30-year fixed mortgage ticked above 7.00% to 7.02% on Friday as we headed into the holiday weekend. Rates on auto loans, credit cards, and virtually every other type of loan also remain elevated. Side note: I am eagerly awaiting new data on credit card interest rates. The most recent data I have is from February 2023, which showed the average nationwide credit care rate at 20.09%, an all-time high. I expect new data for June to come out shortly, which will likely show yet another all-time high in credit card rates.

What Comes Next

The Fed has been pretty hawkish about interest rates and inflation and has indicated that even if inflation continues to move towards its stated goal of 2% on an annualized basis, the Fed is likely to keep rates at an “elevated” level for quite some time. It may be at least 6-12 months still before any meaningful decline in rates. I still think home prices are likely to ease throughout the country including here in the northeast, and I believe rents will continue to moderate as a massive wave of new supply comes online over the next year.

As always, thank you for reading The Sunday Morning Post. I hope everyone has a great and happy Fourth of July.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. © Ben Sprague 2023.

Weekly Round-Up

Here are a few articles and links that may interest you:

Rick Sharga shares data that home flipping remains profitable, but the number of flips nationwide has declined for four quarters in a row.

Dana Anderson of RedFin reports that Phoenix, AZ, which is in the crosshairs of climate change and struggling to provide enough water for its residents and businesses, remains the top spot for relocating homeowners. Read more here (h/t Daryl Fairweather on Twitter. This feels like a Greek drama playing out, in many ways.

Pickleball, wildly popular among Boomers and other older Americans, may be contributing to rising healthcare costs. Via Joe Weisenthal in Bloomberg:

Earlier this month, shares of big health insurance companies fell after UnitedHealth Group Inc. warned that healthcare utilization rates were up. At a conference the company had said that it was seeing a higher-than-expected pace of hip replacements, knee surgeries and other elective procedures.

In a new note out Monday, UBS Group AG analysts led by Andrew Mok offer a surprising theory about one factor that could be driving a higher pace of injuries: pickleball.

With Pickleball participation on the rise, so too are Pickleball-related injuries.

Two years ago the kids wanted to choose a topic for me to write about. I told them I’d write about whatever they wanted. Their choice? The Statue of Liberty. Here is that Independence Day article from 2021: 15 Things You Might Not Know About the Statue of Liberty.

Have a great week, everybody, and a very happy Independence Day!