Multiunit Residential Construction Rolls Along

Single-family construction drops 21%; Multifamily construction increases 21%.

Greetings! I just have a short piece this week (with some interesting data). I am in New Hampshire with my family for a Memorial Day Weekend soccer tournament for our nine-year-old and his team. I hope everyone enjoys the long weekend and the unofficial kickoff to summer. May we all take a moment of reflection and gratitude for the men and women who have given their lives in service to our country, allowing us the chances for happy weekends of soccer and BBQs.

Multiunit Residential Construction Rolls Along

Last week I wrote about the beginning of a year of moderation in the construction industry, particularly with regard to the construction of single-family homes. Despite most commercial developers being subject to the same overacting variable that is slowing residential construction, which is a higher cost of borrowing due to notably higher interest rates, multiunit residential construction (defined as 5+ units) continues to roll along.

The chart above shows the last five years in construction starts of single-family homes (the upper red line) and multifamily residential properties (the lower blue line). There has never been a month since the data started being tracked in 1959 when the blue line has been above the red line, so don’t worry so much about the relative values of the lines; the important thing is the trajectory over the past year or so, which is zoomed in via the chart below, showing construction starts in these two categories over the past twelve months:

Construction of single-family homes is waning, while construction of multiunit rentals is up. In May 2022, there were 1,067,000 new single-family home starts on a seasonally-adjusted basis. In April 2023, there were 846,000, a decline of 20.7%. On the multiunit side, however, there were 447,000 new starts in May 2022. In April 2023, there were 542,000, an increase of 21.2% .

What to Make of It?

Whereas American homeowners considering whether to build a new home are going to be impacted by variables including the interest rate, for sure, but also general inflation, the overall condition of the economy, and questions of timing and personal circumstances, residential property developers are motivated largely by profitability. And everywhere you look over the last few years, there has been a housing crunch. Demand for residential rental units in all parts of the country, rural and urban, remains robust. And although there is some evidence that rents are stabilizing and easing up in certain markets, the landlords and property owners I speak with (admittedly who are almost all based in New England, which is not necessarily a representative sample) still report lengthy waitlists and numerous inquiries when a unit does become available. Demand for rental units remains strong, so developers and investors continue to build.

Multiunit construction is also benefiting from a decline in the prices of certain materials over the last year plus the loosening up of supply chain issues. These savings and efficiencies partially outweigh the greater cost of borrowing, although the cost of labor remains impacts the other side of the ledger too. But while broad-based inflation in things like food prices, gas, and travel impact Americans on an individual basis and may contribute to a delaying of plans to build a personal residence, these things are not as relevant to the budgets and projections of builders and developers.

Will it Last?

As long as there is such strong demand for rental units, construction of said units will continue. But there are reasons to anticipate at least an easing off of multiunit construction in the year ahead. One, of course, is the higher interest rates. Projects just do not cash flow as well and cap rates are not as attractive to investors and developers when the interest rate on their financing starts with a 7 or an 8 versus a year or two ago when it may have started with a 4 or a 5. A lot of the units being newly built today are probably based on plans that were developed in a lower interest rate environment and developers are now simply seeing them through.

The other thing about rates is that for much of the last decade people simply did not benefit from parking cash in a bank; yields on savings were non-existent. But now yields on CDs and money market accounts are up substantially. For a lot of developers, it might make more sense to earn 4-5% risk-free (and stress-free) for a year or two and wait out the real estate and constructions markets. Plus lot of investors and developers looked at rental income as a portfolio diversifier for much of the last few years, but the benefits of that income stream are more modest when there are other, much safer investments yielding what they are.

And finally, eventually the construction of all of these units will itself lead to a correction in the market. I have heard it described as “a crush of supply,” coming to market over the next year as all of these newly started units are eventually finished. That, combined with trends in household formation coming out of the pandemic, which I have written about before, suggest to me a significant easing of the housing crunch perhaps 2-3 years from now.

It is only incremental for now, but at least from where I sit you see a new group of duplexes over here, a big housing agency project over there, and a major private development of new units in the next town over, and then you multiply that out over similar projects for several years in a row, and suddenly the housing market will start to look different with all of this new supply. Plus you have a whole bunch of homeowners who are keeping their homes and renting them out rather than selling them when they move, which I am hearing anecdotally more and more, and you have even more rental supply coming online. This will be to the benefit of tenants, and something for current property owners and landlords and aspiring real estate investors to keep in mind.

Ben Sprague lives and works in Bangor, Maine as a Senior Vice President/Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Weekly Round-Up

Here are a few things that caught my eye around the internet this week that I thought might interest you too:

One week after Home Depot announced disappointing results that may portend an easing off in the construction and homebuilding markets, Lowes also released results showing a decline in net sales. But, contrary to Home Depot, Lowes shares actually rose 2% on the news as the drop in sales was less bad than predicted and the company’s earnings per share actually rose. Lowes CEO Marvin Ellison said the company expects “a pullback in discretionary consumer spending over the near term,” but “we think the medium and long-term health of this segment [housing and construction] is incredibly strong.”

After taking over First Republic in early May following its high profile failure and seizure by the FDIC, JP Morgan announced this week that about 1,000 First Republic employees would be getting fired, which represents about 15% of the First Republic workforce. Read more via Reuters.

If you want something to, here is a 16 minute podcast via The Wall Street Journal about plans for the IRS to let some taxpayers file for free directly through a government portal: https://www.wsj.com/podcasts/the-journal/irs-might-make-tax-season-a-whole-lot-easier/07cbc43b-d5bb-44c0-9ac4-bfac67cb3d07

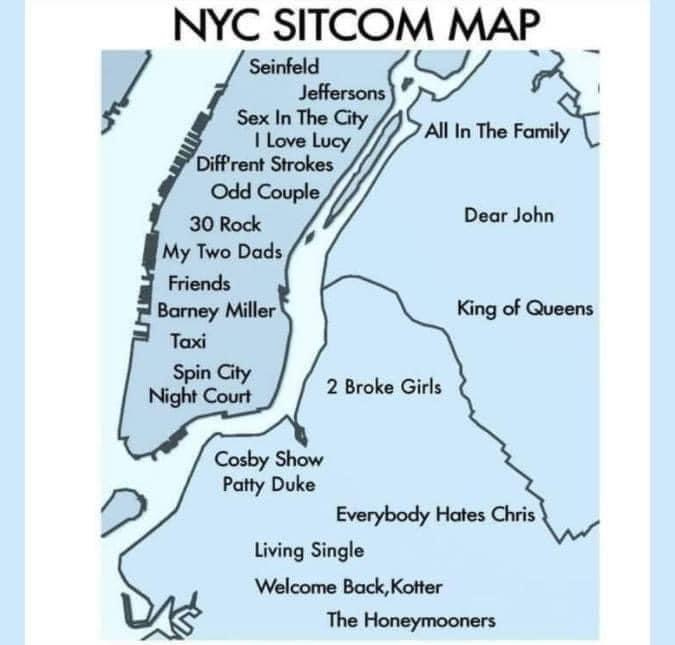

And now for something completely different, a map of New York’s TV homes. Sorry that I do not have the original source to credit:

Coming to you this weekend from Amherst, New Hampshire. Have a great week, everybody!