Pockets of Deflation

The economic talk for the past two years has been all about inflation, but as I commonly say in these articles, the pendulum swings. It may be hard to believe, but references to deflation are starting to pop up here and there, including just last week in comments from Walmart CEO Doug McMillon, who said his company was planning “to manage through a period of deflation” in the coming months. Do prices actually ever go down? What would it take for the U.S. to see meaningful deflation? And would that be a good thing? Let’s dig in.

Is Deflation Good?

Deflation is often seen as a bad thing, at least in economics textbooks, because it can be a sign of slowing consumer demand. If people are pulling back on spending because they can’t afford the goods and services that are for sale, that is a bad sign for those individual consumers in terms of their own financial health and also for the economy as a whole. Just as inflation can spiral out of control, so too can deflation; when consumers spend less, stores and shops earn less, which means they potentially have to cut back on their own spending including wages, which means people are potentially out of jobs, which means they have even less disposable income to spend in stores and shops (and so on and so forth). Everything is connected.

In the short-term, however, a drop in prices can certainly be a good thing, particularly when prices are so high to begin with thanks to a number of artificial boosts to the economy, such has been the case over the past few years, including: interest rates that had been ratcheted especially low from 2020-2022, several rounds of government stimulus including multiple rounds of forgivable PPP loans for businesses, and various other odd-ball reasons like the paralyzed housing market and even alleged collusion and price fixing in places like the egg market and elsewhere in the economy.

Deflation (or at least disinflation, which is a slowing of the inflation rate rather than an actual drop in prices) is a welcome thing if it merely represents a return to normalcy. And, indeed, the Walmart CEO put a pretty positive and PR-savvy spin on the possibility of deflation by acknowledging that it could tighten their margins but saying, “We welcome it, because it’s better for our customers.” (This is not an ad for Walmart, that is just what he said. And Walmart is a bellwether for the overall economy, like it or not).

Has Deflation Already Started?

Over longer time periods, certain things do tend to become less expensive. Consider almost any item of technology, for example. A computer that sold for $2,000 in 1998 would be much less expensive today, and more powerful too. I remember my one big purchase for myself after I graduated from college in 2006 was a new big screen TV. I could barely afford it at the time. I bought it at the Best Buy at the corner of Newbury Street and Massachusetts Avenue in Boston, a store which no longer exists. My college roommates helped me lug it up three flights of stairs and install it. That TV has made it seven different moves since then. Over Thanksgiving just this past weekend my kids played Wii on it with their cousins in our basement, where it lives on as no longer the primary household TV but a perfectly functioning (though a bit heavy) device. Long story short, the TV was way more expensive in 2006 than a comparable unit would be today, as illustrated in the chart below:

Of note, the items that ordinary families spend the most on (e.g. healthcare, food, housing, etc.) are the ones that have inflated the most since 2000. The chart does show, however, that the prices of certain things can sometimes come down even if this particular type of deflation is more attributable to advances and efficiencies in technology rather than more nuanced economic trends.

On a more micro-level, however, there is evidence that some prices are actually decreasing. Last month’s CPI report offered the following:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in October on a seasonally adjusted basis, after increasing 0.4 percent in September…Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

An inflation rate of 3.2% on an annualized basis and flat inflation month-over-month is certainly a big positive step in the battle against inflation, which should allow the Fed to pause on further interest rate hikes at least for the time being. But further down in the data there was evidence of, in fact, deflation! Three categories of spending showed drops in year-over-year prices including:

Medical care services (-2.0%)

Used vehicles (-7.1%)

Energy (-4.5%)

This is great news! Especially on the energy front as so many people here in the north begin to hunker down for winter. Piped gas service, which is a subset of the Energy category above, actually showed a decrease in prices year-over-year of 15.8%.

I continue to believe that inflation will be flat for quite some time going forward. I would not be surprised if inflation hits the Fed’s stated goal of 2.0% by the first quarter of 2024 and then actually approaches 0.0% later in the year. Why? Not only are various goods and services now normalizing or actually declining in price, but the Shelter category, which represents a full third of the CPI number, lags by several months; the reality on the ground is that home prices and rents are flat or even dropping in many parts of the country, and yet the October CPI report shows Shelter still inflating at 6.7%. It will take a few months for the real numbers to show up in the data. As Shelter inflation is squashed to zero, which I expect will happen within the next 3-6 months, the overall inflation number will be similarly flattened.

What About Wages?

As I wrote about this summer, wages growth is finally outpacing actual inflation. That trend has held for the past few months, as shown in the chart below where the blue line is wage growth and the black line is overall inflation:

Much like overall inflation, wage inflation also now appears to be moderating, coming in at an annualized rate of 5.2% in October vs. the 3.2% inflation rate. But still, the gap is in favor of workers after inflation ran hotter than wages for about two years from March 2021 to March 2023.

The benefits or perils of wage inflation all depend on where you sit. If you are a worker, obviously the more wage growth the better. For the Federal Reserve and economist-types (to to mention upper management at a lot of businesses big and small), wages that spiral higher risk reigniting inflation. It sounds silly to say, but when people have more money, they spend it. When people spend, the economy benefits. When the economy benefits, it risks overheating, which gets us back to where we have been for much of the past three years.

At least for the moment, however, the Fed must be very relieved to see inflation moderating without an overly detrimental hit to the labor market. The path to a soft landing is there. Certain sectors of the economy including real estate or anything reliant on low interest rates are in the most peril and may already be in recession if you can consider individual industries to be in recession even if the overall economy is not. For the overall economy, however, we are in the season of thanks, patience, and joy. A sprinkling of deflation-talk is welcome news.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that I found interesting this week that I thought might interest you too including a little bit more color on today’s topic:

Social Security recipients can expect a 3.2% cost-of-living-adjustment in 2024. This moderation comes on the heels of an 8.7% increase in 2023 and a 5.9% increase in 2022. The 8.7% increase was the greatest since 1981.

The CEO of Home Depot, which is similar to Walmart as a bellwether for the overall U.S. economy, also said last week that “the worst of inflation is behind us.”

Via Mike Zaccardi on X/Twitter, Natural Gas futures are at 27-month lows.

Via Lance Lambert on X/Twitter, Morgan Stanley expects home prices to drop by 3% in 2024 with “growth in inventory offsetting the growth in demand.”

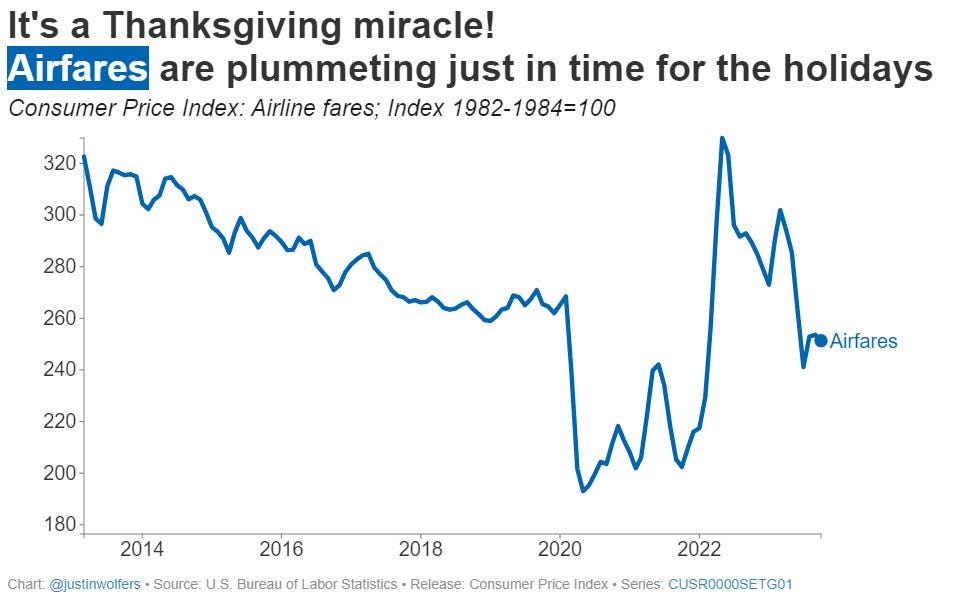

Via Justin Wolfers on X/Twitter, airfares are also down.

The Most Wonderful Time of the Year…

My wife and our youngest prepare the first of what will be dozens of batches of Christmas and holiday cookies this season. Have a great week, everybody.