Poor Consumer Sentiment: a Flashing Buy Signal?

Welcome to The Sunday Morning Post! Each week I write about the economy with a focus on real estate and housing. Subscribing is free.

Warren Buffett, one of the most successful investors of all time, is famously fond of saying, “Be fearful when others are greedy, and be greedy when others are fearful.” In other words, when everyone is feeling great about something it is usually the time to pull back and when everyone is scared or on the sidelines, it’s time to get aggressive.

This is easier said than done, of course, as it is difficult to time the top of the market and it is even more difficult to time the bottom. You almost need to do the exact opposite of what your emotions are telling you to do: it is very hard to pull the trigger to buy, for example, when a stock has been getting clobbered for weeks, just as it is difficult to sell something that has consistently gone up in value.

Stocks in 2022

Stocks are down pretty significantly so far in 2022, with most major indeces down 10-20% for the year with the tech-heavy NASDAQ down by just over 25%. Americans at the moment are fearful about inflation and the potential of a pending recession. Gas prices and rapidly rising costs at the grocery store, on utility bills, and elsewhere are blowing holes in people’s budgets and leaving many feeling more than a little unsettled. (See my 6/12/22 article, “The Summer of Discontent.”)

So what’s an investor to do? Well, if you believe as Warren Buffett does that the best time to invest is when other are panicking, this is the time to buy.

Consumer Sentiment as a Contrarian Indicator

The University of Michigan has been tracking consumer sentiment since the early 1950s. The University of Michigan Consumer Sentiment Index is benchmarked for a figure of 100 to be equal to consumer sentiment in 1966, which is for some reason when they decided to benchmark it. The lower the number goes, the worse consumers are feeling. The recent high water mark was a reading of 101.0 in February 2020 and, of course, we all know what came next. The number plunged to 71.8 by June 2020 before rebounding to 88.3 the following April. However, sentiment has been dropping ever since as Americans are feeling increasingly pessimistic and disgruntled.

When you consider periods of economic uncertainty or politically turbulent moments in this nation’s recent history including skyrocketing inflation in the early 1980s, the Dot-Com Crash of the late 1990s, September 11th, the Great Recession, and the early days of the COVID-19 pandemic, it is notable that the lowest reading in U.S. consumer spending in the history of the poll is actually the current June 2022 number, where Consumer Sentiment sits at 50.0 in the University of Michigan survey. In other words, American consumers are feeling worse than ever, literally. From the most recent report:

Consumers across income, age, education, geographic region, political affiliation, stockholding and homeownership status all posted large declines [in sentiment]. About 79% of consumers expected bad times in the year ahead for business conditions, the highest since 2009. Inflation continued to be of paramount concern to consumers; 47% of consumers blamed inflation for eroding their living standards, just one point shy of the all-time high last reached during the Great Recession.

If you’re invested in the stock market either directly or through your 401(k) or 403(b) it’s time to sell with so many bad things going on, right? Maybe not.

An Historical Review

There have been just five other times since 1980 when the Consumer Sentiment reading has dropped below 65.0:

May 1980 (51.7)

March 1982 (62.0)

October 1990 (63.9)

May 2008 (59.8)

August 2011 (55.8)

In four out of five of these examples, stocks (as based on the returns of the overall S&P 500) actually rose significantly over the next twelve months:

May 1980: +16.06%

March 1982: +46.97%

October 1990: +26.38%

August 2011: +24.32%

There was only one example in which stocks dropped over the next 12 months following a Consumer Sentiment reading that dropped below 65.0, which was during the Great Recession in 2008-2009:

May 2008: -28.19%

However, during this 2008-2009 time period it should be noted that consumer sentiment generally stayed in the 50’s until February 2009. At that point, from March 2009 to February 2010, the stock market actually doubled, an astonishing 100%+ rate of return as the economy started to sluggishly rebound from the preceding drop. In fact, this was the fastest doubling of the stock market in history and it came on the heels of when American consumers were feeling pretty bleak.

What Comes Next

All usual disclaimers should apply here about how I am not a licensed investment advisor or financial planner and that each person should consult with their CPA, an actual financial planner, and others when making investment decisions as each person’s circumstances are different. This article is meant to be education and not a form of specific advice.

However, what I believe is that the stock market is likely to be choppy in the months ahead, but that a lot of the bad news on the economy has already been baked in. Could stocks plunge another 25% over the coming months? Possibly. But there are some actual good things going on in the economy too. On Friday, for example, the jobs report showed that the economy continues to add jobs at a record clip. I also think there are even more example of inflation decelerating a bit, which I wrote about in more detail last week, which should give some relief to consumers. Even interest rates surprisingly dropped last week as the 30-year fixed mortgage rate declined from about 5.70% to about 5.30% (although I think it is likely this goes back up soon).

Keep in mind, too, that the stock market is generally considered to be a leading indicator; current stock prices do not represent conditions as they currently stand, but are actually based on traders’ expectation of future results. Stocks can fall even when things appear to be going well because investors are anticipating that stormier days could be ahead. In the same way, stocks can (and often do) rise even even when things are bad because investors believe the future for certain companies or the stock market as a whole is going to be better than the way things currently stand.

Is Consumer Sentiment a leading, concurrent, or trailing indicator? It depends on who you ask. On the one hand, the University of Michigan Consumer Sentiment poll specifically asks Americans about their views on the next 6-12 months, so the poll data might be considered a leading indicator. But what most economists will tell you is that Consumer Sentiment is a lagging indicator in that it is capturing the way Americans are feeling about how things have been going and not how they will be going in the future. And with inflation, the still-lingering pandemic, toxic politics, and the War in Ukraine, there has been plenty for people to feel bad about in the preceding months. This is why despite the fact that the U.S. economy is still adding jobs at a record pace, Consumer Sentiment is in the tank.

One of the key lessons here is back to the original point in today’s article - as an investor you have to think about the future and not the current day. Sure, there are a lot of challenges right now, but the stock market is already down double-digits for the year and a lot of that bad news has already been baked into stock values.

When I was an investment manager from 2009-2015, I used to give people the Warren Buffett quote as a framework for how to think about things, but I had another quote I liked to share with people too - it is from Wayne Gretzky, the greatest hockey player of all time, who said he was the best not because he skated to where the puck was, but because he skated to where the pick was going to be. The same is true for investing: don't skate where things are now, look ahead and skate to where they will be six months, 12 months, or 3-5+ years from now.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.

Addendum

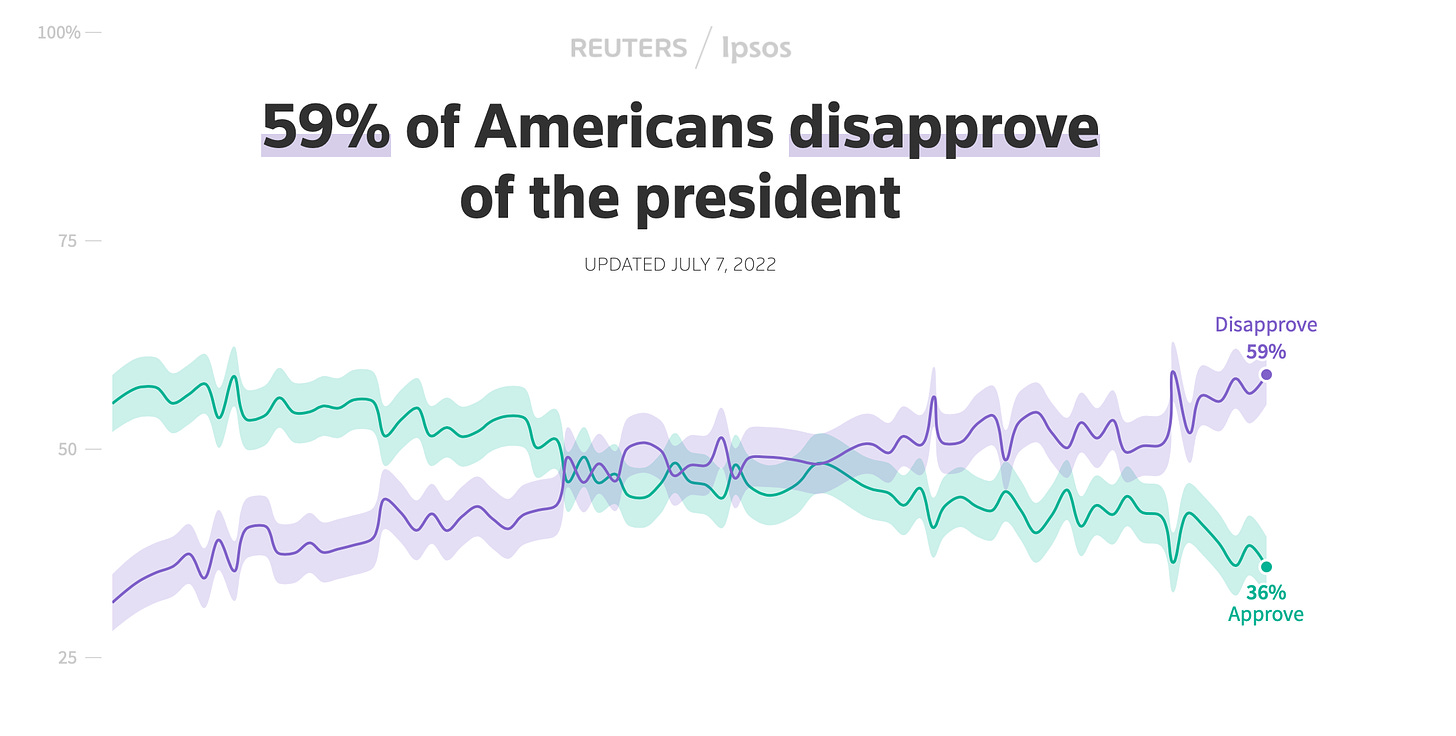

I typically stay out of politics in this weekly newsletter and the following is not meant to be political, but merely an observation. Views on political performance closely mirror consumer sentiment, and the political leader bearing the brunt of Americans’ frustrations today is President Biden, who has seen his approval and disapproval numbers almost exactly flip from January to today. According to Reuters, a full 59% of American now disapprove of the President’s administration, up from a disapproval level of just 32% in January.

This will have serious implications for the November mid-term elections if the Biden Administration cannot right the ship between now and then. The president's own party typically struggles in mid-term elections two years after the president is first elected anyway, so there is already a good deal of history working against Democrats for this November.

However, the Roe vs. Wade decision and Americans’ anger about January 6th are likely to counter this at least somewhat by motivating Democrats and many Independents (plus some moderate Republicans) to get out to the polls in high numbers this November to vote blue. I am starting to develop a piece anticipating a split government from November 2022 until the Presidential Election in 2024 with Republicans controlling one or both houses of Congress with President Biden still in the White House and what that might mean for the economy, so stay tuned for that.