The first quarter of 2023 is over. Four banks that began the year in seemingly good standing - Silicon Valley Bank, Signature Bank, Silvergate Bank, and Credit Suisse - are no more. The Dow Jones Bank Index of publicly traded companies involved in the banking sector is down 13% for the year while the NASDAQ Bank Index, which includes a broader list of components including many smaller banks, is down 22%. This is while the S&P 500 as a whole is up 7.5% and the NASDAQ is up 17.7%.

Amid all of that volatility, however, there are signs that the housing and rental markets are continuing to normalize after a frenzied few years. What does this look like? And what does it mean for those involved with the real estate market? Let’s dig in.

Deceleration in the East, Declines in the West

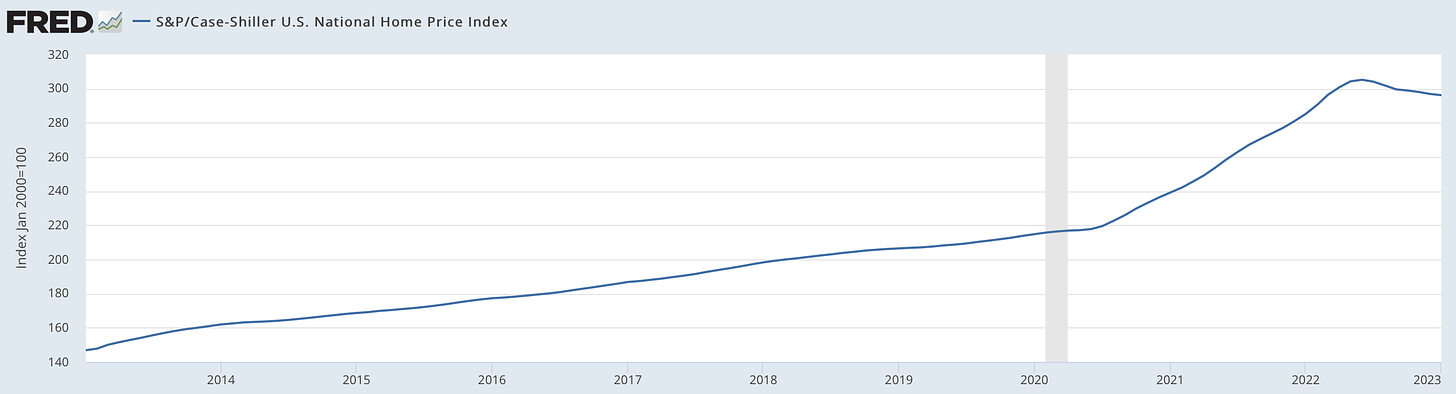

The chart below shows U.S. home prices over the last ten years according to the closely watched S&P/Case-Shiller U.S. National Home Price Index. According to the data, although home prices were still technically up in January 2023 versus January 2022, there is a clear downward trajectory in recent months. In fact, prices have declined for seven months in a row through January, which is the most recent month for which data is available. It is likely that the next few months of data will show continued declines.

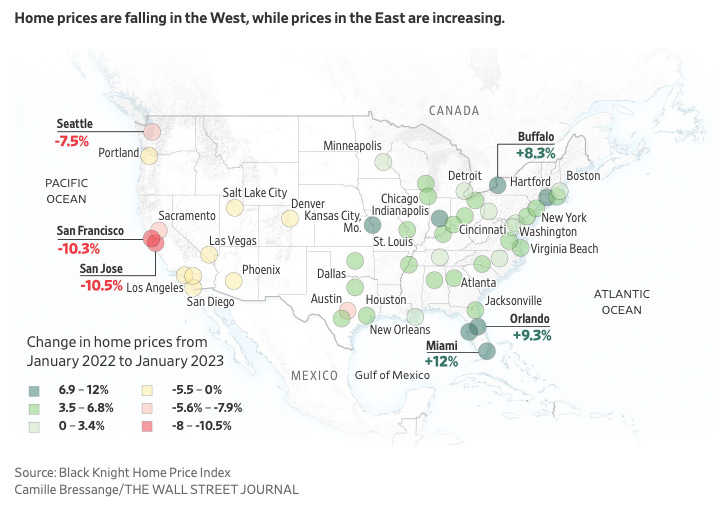

So depending on how you look at the data (year-over-year vs. month-over-month) prices are either dropping or decelerating. But the interesting thing is how the data looks when broken down geographically. Taylor Marr from RedFin shared an interesting graphic on Twitter this week showing the stark differences from east to west:

My advice would be continued patience if you are a buyer, especially if you are in the west, where prices are declining somewhat rapidly at this point. It is likely in my opinion that prices in many of these western cities drop by another 10-20% over the next year as the market continues to correct. If you are in the east, patience is still a virtue as I don’t think the bifurcated market from west to east will last; prices will come down in the east eventually too. I fully expect prices in the east to continue to decelerate and then likely drop by 5-10% at some point in the months and year+ to come.

Of note, here in Maine from where I write, according to the Maine Association of Realtors home prices in February were still up 10.7% over February 2022, but the number of transactions fell by 19.4% due to rising interest rates, patient buyers, and perhaps most importantly, a significant lack of available inventory. There are just not that many homes for sale, which I continue to believe is a function of the golden handcuff effect of pre-2022 mortgage holders not wanting to move and in the process give up 3.00% or better interest rates

The Rental Market

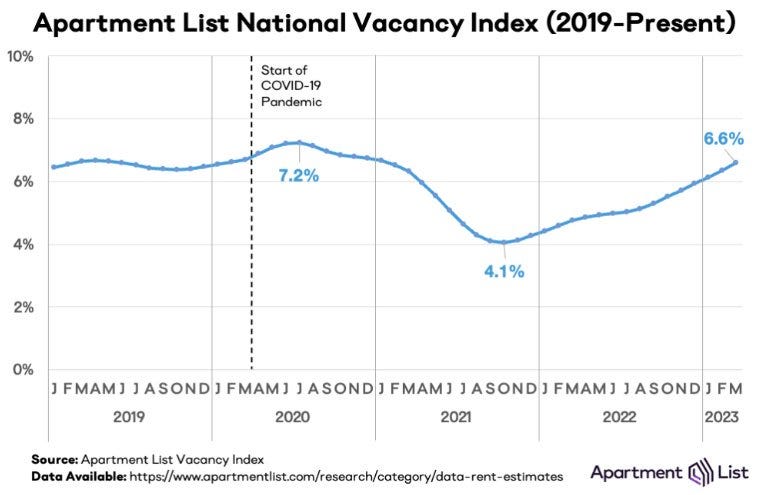

There are signs that the rental market is normalizing after rapid run-ups in rents over the last few years and historically low vacancy rates. On the latter point, vacancy rates are ticking up according to Apartment List , clocking in at 6.6% in March, which is the highest level in two years.

On the question of rent prices themselves, rents are currently increasing at an annualized rate of 2.6% rate according to Apartment List. This puts rent increases in line with pre-pandemic levels. I can tell you from my work as a commercial loan officer, I have seen a lot of pro formas come across my desk from developers and investors projecting annual rent increases of 5% for the next decade; such will not be the case. Rents in many markets are likely to remain flat or even drop.

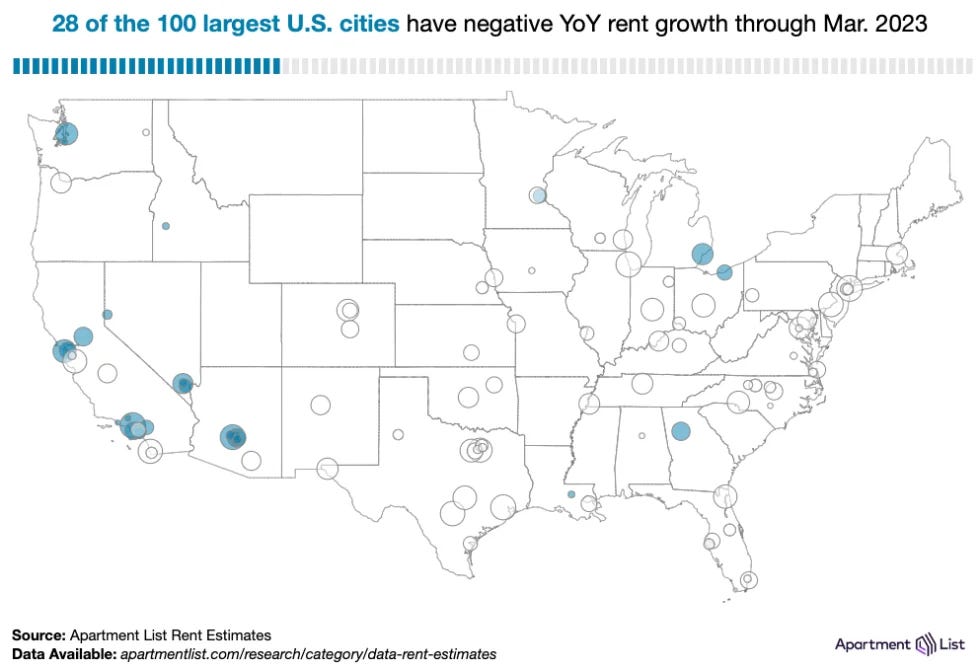

There is a geographic disparity in the rental data as well, much like the housing market. Apartment List’s chart of the 28 cities that showed negative year-over-year rent growth (i.e. price declines) also trends towards the west in the same way that home prices have also dropped more significantly in that part of the country:

So while it should be noted that according to this data rents continue to rise in 72 of the 100 markets for which data is available, there are cracks in the rental market for sure. Landlords and property owners should be wary, while tenants and prospective renters should have some hope that the feeding frenzy of the last few years is now over.

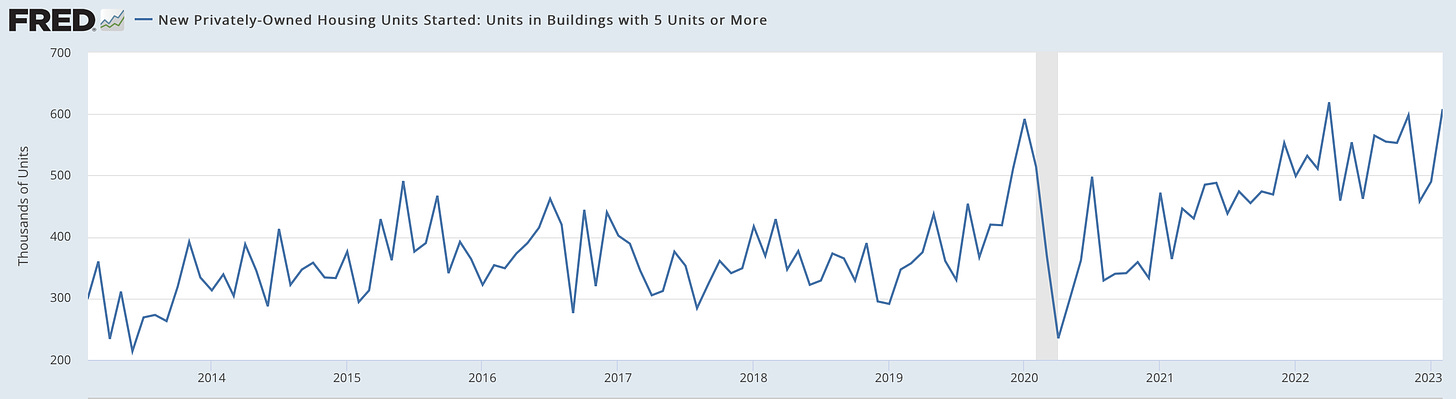

Keep in mind, too, a major variable for the rental market that I have written about in the past continues to lurk on the horizon, which is the massive wave of new supply of rental units that will be coming online over the next few years. The chart below shows the trend in multiunit construction (5 units or more) over the last ten years.

We have not seen this current level of multiunit construction in quite some time. In fact, it is not visible on the chart, which only shows the last decade, but the last time there was this much multiunit construction taking place was April 1986. This more than anything is why the rental market for both tenants and property owners will look significantly different in 2024-2030 than it did from 2016-2022. As renters make lifestyle adjustments in the face of rising rents and an uncertain economy and as this wave of new rental supply comes online, rents are going to continue to stabilize and likely drop for many across the country.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Weekly Round-Up

This week in the internet - curated by me, for you!

Via Michael Mankins in The Harvard Business Review, the cost of capital (i.e. to borrow) is approaching 9% for most large companies. When that it the case, it is better to invest in productivity and increasing revenues around the margins rather than investing in growth. Read more. “The era of cheap money is over,” Mankins says.

AI technology has gotten so good that scammers are able to use voice cloning software to make phone calls to people asking for money that sound just like their relatives. This is really scary when you think about it. So many people are vulnerable to these scams anyway, and now scammers are able to mirror the actual voices of other people. Many people will be taken advantage of as scammers prey on their vulnerability, compassion, and loneliness. Read more via Joe Hernandez in NPR.

Office vacancy is also on the rise, clocking in at a pretty whopping 18.7% through the end of 2022. The work-from-home tide may have receded a little bit as employees are called back to the office, but there has still been a fundamental shift in the way we work. Some of those offices are never getting filled again. H/T Liz Ann Sonders on Twitter.

AP White House Reporter Josh Boak has a tongue-in-cheek report about inflation within the White House. It’s everywhere.

One year ago I wrote about How to Fix Baseball. I am more optimistic about this baseball season than ever before (although maybe not of the Red Sox, who I doubt will go .500). The reason for my excitement is the implementation of the pitch clock, which may knock 20-30 minutes off the average game time. In an era of declining attention spans and endless distractions, less game time is more when it comes to baseball. Play ball!

Have a great week, everybody!

Nice post, just subscribed—that’s a new option for you?

You are missing the multiunit construction graphic referenced in the text.