Realtors and Others Beg Fed to Stop Raising Rates

Thank you for reading The Sunday Morning Post! Each week I write from my perspective as a commercial lender here in Bangor, Maine. Check back each Sunday morning or subscribe below to get the articles in your inbox.

With mortgage applications at their lowest levels since 1996, the National Association of Realtors joined up with the National Association of Homebuilders and the Mortgage Bankers Association this past week to express their “profound concern” about further interest rate hikes and the general uncertainty in the economy due to an unstable interest rate environment. Said concern took the form of a letter to Fed Chairman Jerome Powell, in which the group said the Fed’s actions over the past 18 months have “exacerbated housing affordability and created additional disruptions in the real estate market.” The group called on the Fed to make a clear public statement that it does not contemplate further rate hikes. The Fed, of course, is slated to raise interest rates at least one more time between now and the end of the year. You can read the full letter here, if you are so inclined.

Actually, they are correct

Long-time readers of The Sunday Morning Post may be familiar with my previous discussions about inflation and interest rates in which I said very early on that the Fed was wrong about inflation being transitory (i.e. temporary), and then later when I said the Fed was wrong to keep raising rates as aggressively as they have been. My reasons for this latter concern remain and are twofold. First, I believe inflation is now not as robust as the CPI data indicates (it definitely was early on, though) And second, there can be and often are unintended consequences of excessive government action.

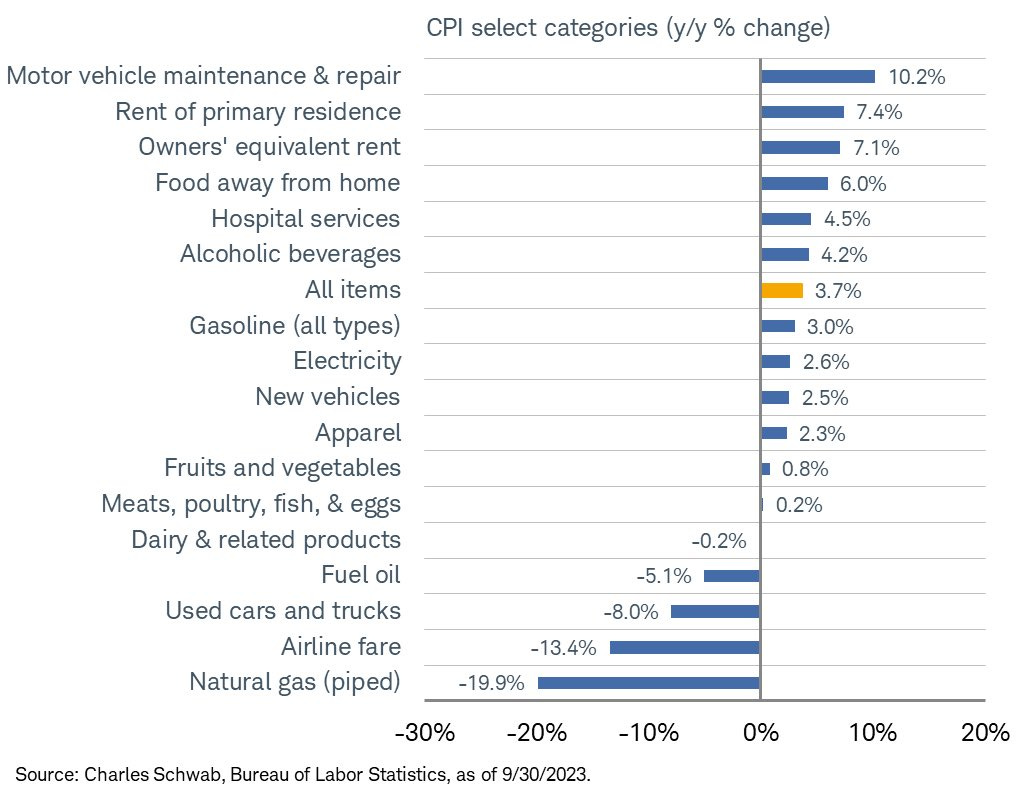

Let me take these points briefly one at a time. On the former, this past week’s CPI report showed inflation running at a rate of 3.7% over the past twelve months. Although this is above the Fed’s stated goal of a 2.0% ongoing inflation rate, I am convinced that the data is skewed by lag times in certain categories especially shelter, which includes both home prices and rent. There is clear evidence that shelter prices have leveled off or are even declining. As I wrote about last week, home prices nationwide through August were up 3.9% and rents were basically flat. Yet in Thursday’s inflation report, shelter inflation was 7.2%, making it the second most robust category of inflation trailing only transportation, which was up 9.1%. Shelter actually makes up about 30% of the overall inflation statistic, so the mismatch between what the CPI is reporting and what shelter prices are actually doing, which is moderating, suggests the current CPI inflation number is actually not correct and inflation is lower than the reported 3.9%. Shelter lags for several reasons including simple delays in data aggregation, but also because home prices are based on Purchase & Sale Agreements that were often signed 2-3 months ago or more, and apartment lease renewals are only done typically every 12 months, so price changes are not realized until those renewals come up.

So real inflation right now is probably close to 2.0%. And if all of the other CPI categories stay the same for the next few months but the shelter category catches up with actual conditions on the ground, the actual CPI reading will actually be 2.0% or even less by the end of the winter or the spring. And that is without any further action from the Fed necessary.

Why does it matter? Well, the Fed has been quite hawkish about inflation. Various Fed officials are on the record as saying interest rates will need to be high for quite some time in order to rein it in. I am convinced, however, that further interest rate hikes will be more damaging to the economy. Higher interest rates slow things down, which is, of course, the Fed’s whole purpose in raising them. But a slowed down economy also results in people out of jobs as business activity declines. That is rough on individuals and families as people lose their sources of income. Businesses, too, will struggle through decline economy activity. And there is no reason to do further damage to the economy (and with it the labor market) when inflation is already getting back to the 2.0% level.

On my latter point above about the unintended consequences of government action, playing around with interest rates too much has created an unhealthy and artificial housing market, which is one of the main points made by the realtors and others in their letter to the Fed. Many younger and first-time homebuyers are not able to buy homes because prices and interest rates make it too high. And what is one of the main reasons prices are too high? There is no available inventory of homes-for-sale because no one wants to move because they do not want to give up their pre-2022 interest rates of 2.00-3.00% to buy a higher priced home at an interest rate of 7.00-8.00%. So everything is frozen, and things will continue to be challenging and inefficient in the housing market until rates start to come down.

What Should the Fed Do

If I were the Chairman of the Federal Reserve, I would simply do….nothing. At the moment, at least. The steady series of interest rate hikes over the last 18 months must be allowed time to play out. But my first instinct would be to consider cutting rates rather than raising them further. Is it time to cut rates yet? Not yet. But it is also not time to hike them further.

Weekly Round-Up

One quick note before the links, sometimes people in the real estate business are surprised to learn that lenders such as myself don’t work on commission. The reason for confusion is that so many people in the real estate industry including realtors and mortgage brokers (who are different than more traditional banker/lender types) ARE paid per transaction. My job as a banker is arguably EASIER when there are fewer transactions. So my perspective in today’s article that the Fed should reduce interest rates is not meant self-serving. To be sure, realtors and others do better when there are more transactions taking place and a lot of them are starting to hurt with volume being down. But my reasons for believing the Fed should cut rates are purely based on my analysis of the situation, and not because my own income would be higher with more transactions.

Anyway, here are a few things that caught my eye this week.

Marcus Buckingham makes the case for love as a guiding virtue in business, saying:

I’ve spent my career studying excellence, beginning, back in 1990, with a Gallup study of the very best housekeepers in Walt Disney World. I’ve looked to uncover what the world’s best managers, leaders, teachers, and salespeople have in common, and I’ve researched what drives the most engaged teams and the most loyal customers. Throughout thousands of these qualitative focus groups and interviews, there’s been one force that most powerfully drives customer and employee behavior. This force is love.

Read more in Harvard Business Review here.

More on the various readings of different CPI categories from this past week’s report. H/T Liz Ann Sonders on X.

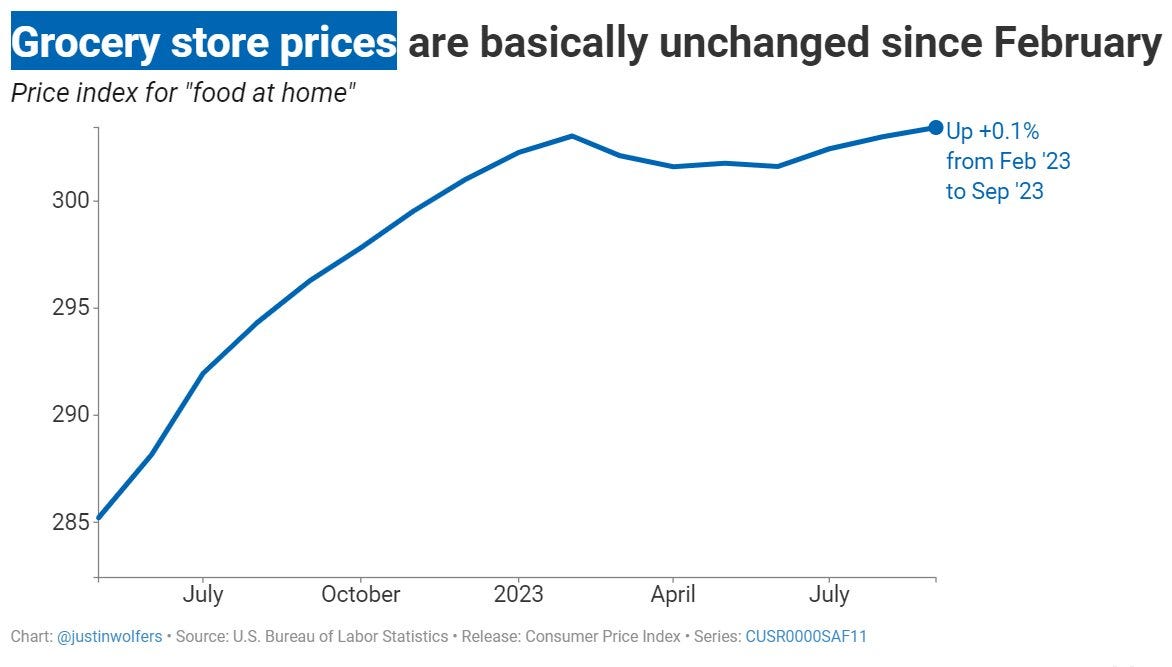

Grocery prices, while still up year-over-year, have been basically flat since February, which is good news for American households. H/T Justin Wolfers on X.

My thoughts are with all of those suffering in Israel and in the worldwide Jewish community. A man with connections to my hometown of Bangor died early in the Hamas attacks last weekend at an Israeli outpost while on duty. My heart also grieves for the lost of innocent lives in Palestine, as well as for the tragedies of war to come for perhaps years if not generations to come. But the heinous and horrific attacks on civilian targets including women and children by Hamas in Israel were incalculably evil and should be condemned by all.

See you next week, everyone. Thank you for reading.