Rent Relief Programs Are Not Distributing Enough Funds

Lessons Learned During PPP Should Now Be Applied to Rent Relief

Welcome to The Sunday Morning Post! Each Sunday morning I post an article I’ve written about the economy and finance with a focus on real estate and investing. Just click Subscribe below to join the community. Subscribing is free and you’ll get consistent ad-free content in your inbox each week. Thanks for being here.

On August 25th, the U.S. Treasury Department reported that 89% of COVID rental assistance had not yet been disbursed. In other words, only 11% of the of the $46.5 billion meant to keep people in their homes and support landlords had actually ended up in the hands of renters and property owners as of the end of August. This is disgraceful.

Problems with the rollout abound, including a lack of sufficient technology to accept and process applications. Relief programs have generally been run by the states and municipalities, many of which hired out third party vendors to run their processes. Because of competitive bid procurement requirements, the process of actually selecting a vendor for many states was often a long one, which delayed relief checks from going out. In fact, the state that has distributed the most COVID relief funds for renters so far is Texas, which waived its competitive bid process and in doing so saved several weeks if not months of delay.

Apart from the technology issues, many landlords and tenants simply do not know how to access funds or that funds are even available. A recent study by the Urban Institute found that more than half of renters and 40% of property owners are unaware of the available relief programs or do not know how to access them.

Another problem with these programs is that many of them require landlords and tenants to apply in tandem. Not everyone has a good relationship with their landlord, however. And the most problematic and delinquent tenants are also often the most difficult ones for landlords to communicate with. I have spoken with a number of landlords who have wanted their most delinquent tenants to apply for rent relief and have even provided them with all of the necessary information to do so, but the tenants have been unwilling to do it, instead remaining being on their rent and generally non-responsive. This has been all the more feasible for tenants to do given the extended eviction moratorium, which in some cases has left landlords left holding the bag with little recourse.

One of the main problems with these rent relief programs, however, is that the applications themselves are quite cumbersome. I attended a conference in San Francisco several years ago on technology in government, and one of the speakers (who I am sorry to say I have forgotten the name of) had a great line: “If you’re falling from a plane, you need a little piece of paper that says ‘pull this cord’ and not an 96-page PDF. But what do we give people when they need help? Big PDFs, and we say ‘here you go, I’ve helped you.’”

In terms of the current rent relief programs that are out there, applications sometimes have many sections and require significant documentation about an applicant’s reduction in income due to COVID-19, which can be hard for people to prepare or produce. Most of these relief programs base eligibility on being under a certain threshold of the area’s average median income, which next to no one knows how to actually calculate. It’s far too easy for a frustrated applicant to simply give up rather than complete the application process.

This problem of complicated paperwork is not unique to rent relief programs and their applicants, either. I have spent the past 15 months+ working with business owners, non-profits, and sole proprietors to fill out PPP applications and then also the subsequent PPP forgiveness paperwork. One of my conclusions: people are terrible at paperwork. I would estimate at least 60% of the PPP forms our bank received had errors or omissions with them. Fortunately for PPP applicants, however, these applications were reviewed by a bank before being submitted to SBA for final approval, and lenders and other bank staff were able to help people to accurately complete their applications as well as advise them on the intricacies of these programs (when such information was available from SBA).

No such help exists for renters and landlords as far as I know other than maybe being able to randomly connect with someone from the SBA or a congressional office, all of whom are completely inundated with inquires on all manner of topics these days.

(As an aside, I have burned into my brain exactly where to look on each PPP application for mistakes. First, there were two spots that needed the applicant’s initials, which no one ever noticed. Second, in a long line of questions when the answers to every question were supposed to be “no,” the second to last question was whether the applicant is a U.S. citizen. Many people simply went down through the whole list and checked “no” on everything, not realizing that this one question near the end was going to require a “yes.” In a third spot there were several lines the applicant had to initial, but many people simply put a check mark or an X, which voided the application. These three items aside, the majority of PPP applicants simply did not calculate their Average Monthly Payroll correctly, which was the key number that determined the PPP loan amount. Without the help of bankers, so many of these PPP applications would have been rejected or stuck in processing queues for months).

Lessons Learned from PPP

It does not take much speculation to appreciate that businesses applying for COVID relief have more political cache with policymakers than renters and landlords. Banks were even compensated by the U.S. Treasury for facilitating PPP applications, which incentivized them to help; although, to be sure, most banks were happy to help in the interest of good customer relations with their customers and because the relief funds were just so helpful to the businesses and non-profits that bank with them. I can verify that facilitating PPP loans has been a ton of work for our bank, but worth it because of how immensely helpful they were to our customers and the communities we serve. But it was this help that made the PPP process so much easier for applicants, comparatively speaking, than the current rent relief programs.

Even now, however, months into the rent relief programs, there are still lessons that can be taken from the PPP process that could help get more money into the hands of renters and landlords and faster.

The one main idea that has recently come up has been to let tenants self-attest to their financial need. As noted above, it is just too challenging for people to be able to document a reduction in income. Not everyone has their tax returns or income statements at the ready, and others are sometimes working 2-3 jobs or have switched jobs multiple times over the last two years, which makes providing pay stubs and other forms of documentation especially tricky. In a memo on August 25th, the Biden Administration authorized states and municipalities to do just that, but whether they actually are still remains unclear.

There is always going to be a balance in any sort of relief program between the speed of getting funds out to people who need them and perfect compliance with program guidelines. The problem with self-attestation is, of course, that an applicant could just lie. There would have to be some sort of penalty for fraud that is clearly noted to applicants in the hope that even the threat of severe consequences would be enough to engender voluntary compliance.

You can have perfect compliance and have barely a single dollar go out to anyone who does not “deserve” it, but practically speaking that application process would be so slow and cumbersome that people including the vast majority of applicants who do actually need the funds would simply not apply or it would take so long that people would have fallen into financial peril long before they ever receive the relief fund. This is largely the process we have had up until now. But emergency relief programs need to be speedier.

Believe me, I understand the pitfalls of having a relief program that does not have ironclad protections in place to prevent fraud and abuse. But let me offer a precedent for why self-attestation is actually fair in this case: it’s exactly what was done with PPP! For PPP loans below $150,000, which was the majority of them, when it came time for the SBA to stamp them with full forgiveness, the forgiveness application did not require full documentation of how all of the funds were spent. It also did not require payroll reports or even documentation of the number of employees who were still working for the company, which was, of course, one of the most important metrics for this program because full forgivability was contingent upon maintaining the same headcount of employees and not laying people off to cut costs.

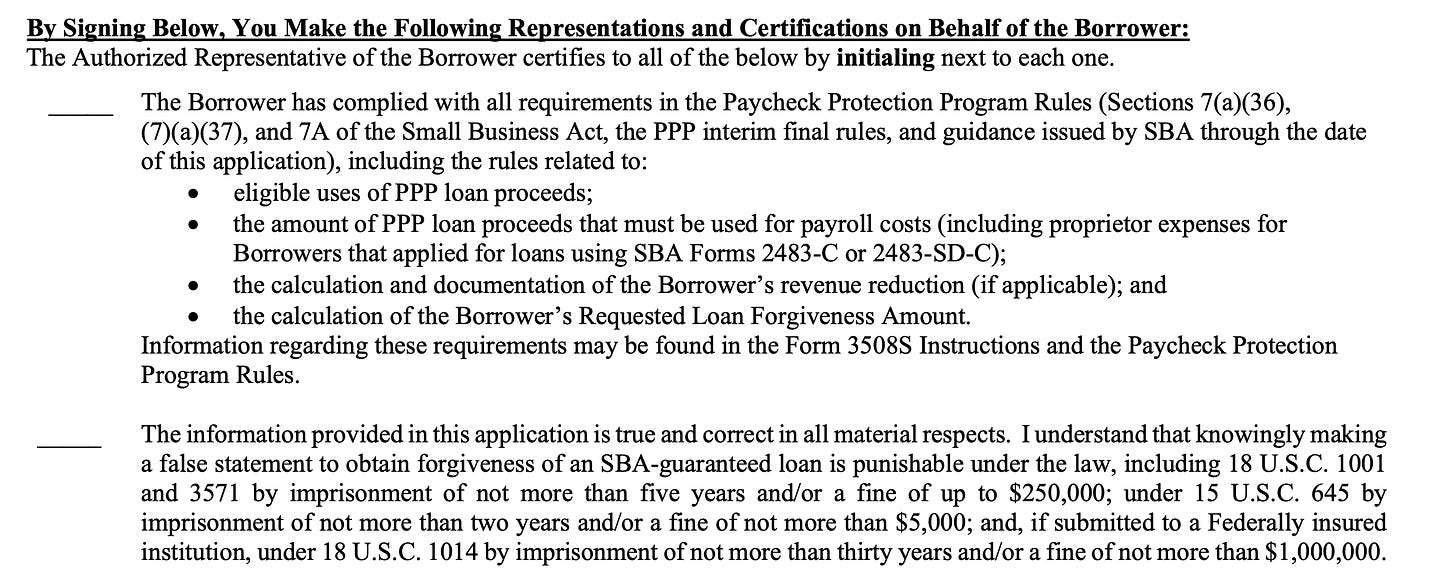

In addition to some basic information from the applicant, what was actually needed to obtain full PPP forgiveness was a simple self-attestation that PPP funds were used within the guidelines of the program. Here is the relevant section from the actual PPP forgiveness application, which merely asks for initials on two lines:

That’s it! There are no payroll reports required, no financial statements, no paper trail, and no further documentation required unless the SBA were to request it by auditing the forgiveness application, which I have seen them do from time to time with no rhyme or reason that is apparent to me about who they are choosing to audit.

If the U.S. Treasury and SBA made it so easy for businesses, non-profits, and other employers to successfully apply for PPP funds and subsequent forgiveness, states and municipalities administering rent relief programs should make it equally as easy for tenants and landlords to obtain relief funds. Randomly auditing applications would not identify every case of possible fraud, but the mere existence of an audit possibility would help screen out some fraudulent behavior before it even occurs. Considerations would also have to be made for people who apply for these programs without actually understanding the rules and who may not be eligible, which we also saw with PPP applications quite frequently at the bank where I work. No one should face stiff penalties or jail time for not understanding application guidelines especially considering how complicated most of these programs actually have been. I can confirm that plenty of businesses applied for PPP loans without realizing that they were not actually eligible for whatever reason, and more often than not these were innocent mistakes of simply not understanding cumbersome program requirements.

COVID Relief, or Lack Thereof

One final note on this topic, landlords and property owners were not actually eligible themselves for PPP loans, something a lot of people do not understand. Rental property owners and landlords have gotten a lot of bad press lately. Politicians and other social justice advocates routinely demonize property owners as greedy, uncaring, and undeserving of the income generated from their properties.

Of course, in any category of people or profession there are going to be bad apples whose behavior and hard-heartedness gives all the good ones a bad name. And property ownership is no exception. No one deserves to live in a slummy apartment with an uncaring or abusive landlord, and stories do abound of exactly the wrong types of people owning rental properties and taking advantage of their tenants whether through manipulation, abuse, or absenteeism. This can leave tenants, who are often in vulnerable or precarious positions, to fend for themselves when issues arise.

But in my experience, there are a lot of local landlords and mom-and-pop type property owners who actually do things the right way: they are responsive to their tenants, they invest in their properties, and they care about the well-being of their communities and the people in them including their own tenants. I know one local landlord who specifically sees property ownership as “an opportunity to do good,” as he has put it. He is especially supportive of refugees and those who have moved to the community without any connection or people who are especially down on their luck.

Now, I realize as a banker who does loans for rental property owners, prospective borrowers are always going to put forward their best side to me so I do probably have a biased view, but I believe the typical landlord or rental property owner is much closer to the image of this person I described above than he or she is to the media and politician-driven stereotype of the money-grubbing, heartless fiend. Sure, there are bad landlords out there, but there are also a lot of caring ones who maintain their properties and provide people with a place to live and many of them have gotten a bad rap over the past year.

With all of the billions of dollars of COVID-relief funds that have been out there, more should be going to renters and ultimately to landlords and property owners. Many of those in both categories have struggled over the past year, and policy makers as well as the state and municipalities running the programs need to expedite improvements to make the funds more readily available.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

September 12th

Like all Americans who are old enough to remember, I can tell you exactly where I was on September 11th. I was a senior at Bangor High School in Mr. Ames' Current Issues and Global Studies class. I remember him and Mr. Pelletier going back and forth to the teachers' lounge, trying to stay calm but with a serious look in their eyes. Later in the morning TVs were on in the classrooms, students were huddled in small groups throughout the school, and it's cliche to say, but the world had changed.

It's probably not correct to say that September 11th brought any silver linings, but I do remember the feeling of unity, togetherness, and patriotism in the days that followed. I remember hundreds of Bangor High School students wearing white arm bands several days after, gathering in Broadway Park for a vigil, and everyone generally caring for one another and treating each other with grace and compassion.

I have been trying to come up with appropriate words all week to mark the 20th anniversary, but honestly I feel sad in many ways, mostly because of how far away we are from that post-September 11th feeling of American unity. God willing there will never be a day as terrible at 9/11 again, but I also can't remember smaller and happier events since then that brought even a small dose of that same spirit of unity.

Everything is politicized today. There are trenches and battle lines drawn on everything. Politics, sports, and definitely things like vaccines and masking: it's honestly exhausting just to log into Facebook today and scroll through to see what people are talking about and who is blaming whom for what. Like, COVID-19 could have been a unifying event for this country as we are all impacted by it, but it feels like we've never been more divided. Hurricanes, the Olympics, wars, and other world events: there is nothing anymore that makes us feel like we are together as one. Instead we are cynical, distrustful, and angry with one another. It feels like we are living in different worlds sometimes.

I feel like an astronaut shouting into outer space on this, but if people could only find a way to tap into those few days and weeks after September 11th and remember there is more that unifies us Americans than divides us, we would all be better off. At least for one day I hope that people can remember that and just take a pause and a deep breath. On this sunny September morning that feels almost exactly like it did 20 years ago, that is what I am going to try to do.

Given space and data limitations, there is no Weekly Round-Up this week, but check back next Sunday for another article and some links to what is happening in the economy. Got news tips or story ideas? Email me at bsprague1@gmail.com. Please consider sharing this article by forwarding to a friend or posting to social media to help spread the word about The Sunday Morning Post.