Rental Market Flashes a Sign of Loosening

Average rent declines slightly, though vacancies remain low

Welcome to The Sunday Morning Post! Subscribe below to get my articles, research, and analysis on real estate and the economy in your inbox each Sunday morning. Thanks for being here.

Rental Market Flashes a Sign of Loosening

After rising over 10% in 2021, rents have continued to rise for much of 2022, with the average nationwide rent topping out at over $2,000/month for the first time ever in May according to a study by RedFin. Certain markets are hotter than others, with rents up 30% and even 40% in the last two years in places like Greensboro, Tempe, and Richmond.

There may be signs, however, that the rental market is loosening. First, according to the Bureau of Labor Statistics’ most recent inflation report, in August the year-over-year increase in nationwide rents was 6.7%, which is a significant increase historically speaking over any given 12-month period, but the rate of increase may be decelerating.

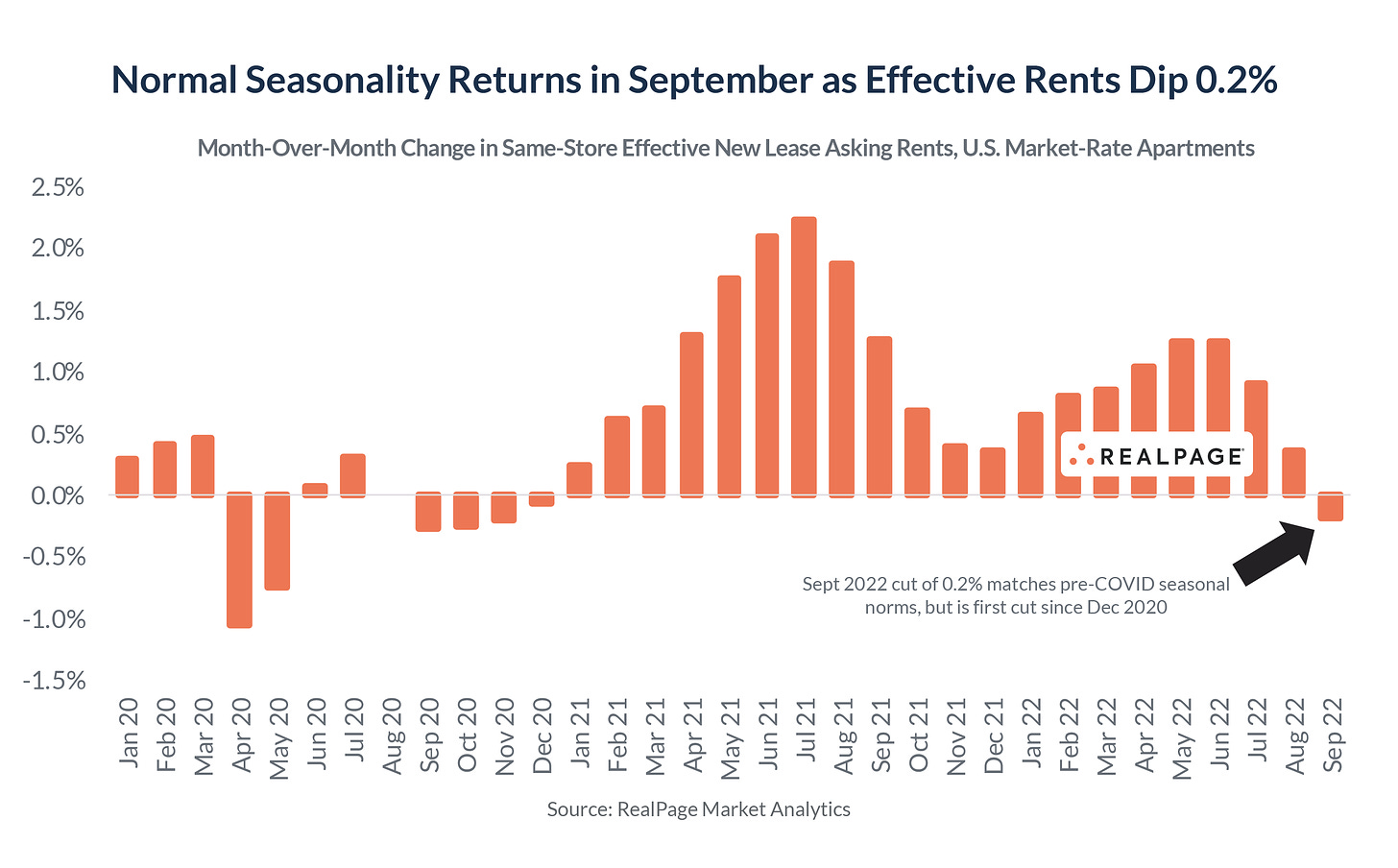

Further, according to Jay Parsons of RealPage.com, new lease prices actually dropped by 0.2% in September, which is the first recorded drop in rents since December 2020:

So What’s Happening

I believe there are several factors at play. First, and most significantly, renters are adjusting their behavior in the face of constantly rising rents. Many people can just no longer afford rents because of how high rent prices have gotten. They are adjusting by sharing units with others in order to split the rent and moving home to live with parents or other relatives in order to save on rent altogether (unless their parents are charging them…). These lifestyle adjustments contract the tenant pool, which softens the market.

Second, there are more rental units coming online, which means more choices for tenants through greater supply, which means a potential dampening of rent prices as the tenant pool is diffused over a larger pool of available units. I wrote in June about how multiunit construction was at a 35-year high, which I attribute to simple market forces:

Markets react and when there are as many people who need housing as there currently are and the profit opportunity is so significant, builders, developers, and others who are entrepreneurially-minded will rush in to respond, which is what is happening.

What has happened since June? After a bit of a lull in the summer, multiunit construction hit a new 30-year record in August, surpassing previous peaks:

This trend towards more multiunit housing being created will continue over the next few years particularly as the data referenced above is for multiunit housing starts, and a start can take anywhere from several months to a year or more to actually be completed. This will have a continued softening effect on market rents.

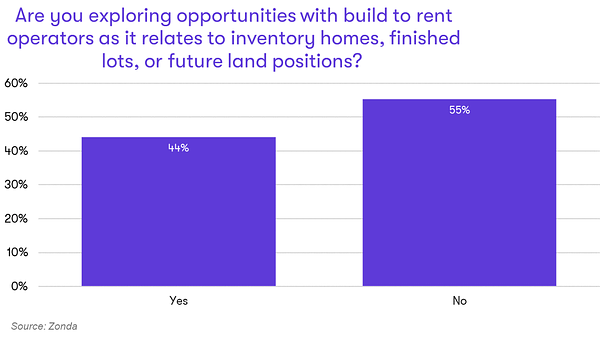

Lastly, a third factor at play is that the housing market has turned on a dime with sharply rising interest rates. What was a roaring sellers market is now a market devoid of buyers, leaving sellers potentially holding the bag. I have seen and heard anecdotal stories of sellers deciding to convert their homes to rentals instead, recognizing that the rental market is still strong (despite my tone above regarding the market softening). In the short-to-intermediate term home sellers may have a better chance of profit by renting their homes out for a year or two and waiting for interest rates to hopefully drop and for buyers to return. Housing economist Ali Wolf appears to be seeing this too, referencing a larger homebuilder who is converting a portion of their properties to rentals in the face of weak demand for purchases:

What it all adds up to for now (changing tenant behavior + new supply of units + conversion of for-sale properties to rentals) is the aforementioned 0.2% drop in September rents. As all of these variables are likely to have legs to run for the months or perhaps year or two to come, it is possible that rents will continue to ease, providing some modest relief to overstressed tenants and cause for concern for rental property owners.

Final Thoughts

I continue to believe that inflation is easing faster than the Fed is recognizing and that they are going to overdo it on interest rate increases. As I have written before, housing, in particular, which represents over one third of the CPI inflation reading, has changed significantly in the past three months, but the data lags several months behind actual conditions on the ground. The Fed is either not seeing this or choosing to ignore it. Meanwhile the prices of gas, cars, lumber and other building materials, as well as many other items are continuing to drop.

There are macroeconomic factors at play that could actually keep rents high, it should also be noted. For starters, 7.00% interest rates on 30-year fixed mortgages are pricing a lot of Americans out of the home-buying market who will thereby be forced to remain in the rental market (unless they can make other arrangements somehow). And vacancies remain very low. According to recent data, the vacancy rate for rental units remains at historical lows just below 5.00%. Among the rental property owners I speak with regularly, there are still lengthy waitlists and double-digit inquiries when a unit becomes available.

My advice to rental property owners, though, is to make sure you are challenging your assumptions and constantly reviewing your projections, especially in the face of rising interest rates and with the potential for swaths of newly constructed units coming online over the next few years. Over the past two years I think the only thing I have financed more of in my work as a commercial lender than the purchase of existing rental properties is the construction of new units. Those new units start to add up. A group of duplexes over here, a row of single-family rentals over there, a new five-unit property where once stood a single-family home: eventually you’ve got an entirely new rental market thanks to the hard work and skill of a lot of motivated developers and the passage of time.

From where we sit in October 2022, the rental market remains very strong. But the drop in September new lease prices and other macroeconomic variables are signaling that the rental market for both tenants and property owners may look different over the next three to five years than it has looked over the previous.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.