Rental Market Preview 2024

Greetings! My name is Ben Sprague. Each week I write about the economy with a focus on real estate and investing. Subscribe below to get my articles in your inbox each Sunday morning. Thanks for being here.

Rental Market Preview - 2023

Rising rents and an overall housing crunch have been on the mind of policymakers from Bangor to Bakersfield over the past few years. Municipal ordinances and even statewide code changes to allow for multiple units on the same parcel, incentive programs to encourage new construction, and, in some places, rent control: it’s suddenly all on the table.

And it’s true that renters have had a tough few years. After growing on an annual basis by 2.5-3.5% for most of the 2010s, rents according to Consumer Price Index reports jumped by 4.2% in 2021, 8.3% in 2022, and to the regret of renters, another 6.5% in 2023. A $1,200/month rent would have turned into a $1,442/month rent from the beginning of 2021 to the end of 2023 if it tracked those percentages. Approximately 34% of American households are renters, and with increases in rent outpacing both wage growth and inflation in other key areas of spending, rising rents have caused stress and financial hardship to many.

And yet, the pendulum swings. Despite the 6.5% growth in rents last year, which is well-above the historical average, evidence abounds that 2024 will be different. Relief looms for renters, and while there is little evidence of a pending housing or rental market crash, there are plenty of cautionary headwinds for real estate investors who specialize in rental properties.

One year ago in an article previewing the rental market for 2023, I wrote:

I do not think we are necessarily in for a real estate crash in the rental market. The housing gap is just too wide and as long as it remains so expensive to buy a home there will be millions of Americans who will have no choice but to rent instead. Millions of Americans are of course renters by choice, too, including a large number of high net-worth Americans who do not want to be anchored to a home or to one geographic area for too long.

But the headwinds are there…I do not think this will play out as rapid property devaluation or a complete crashing of the market, but rather a significant tightening of margins and more challenges maintaining tenants as they are likely to have more options and to enjoy a more competitive rental landscape. This, of course, spells good news for tenants, but residential real estate investors should continue to test their assumptions, challenge their models, and diversify their assets as the market does continue to change.

I don’t want it to sound like I am punting on this year’s preview article, but in trying to craft a thoughtful opening to today’s piece, my general feeling is all of the above, but more so. In other words, the trends that emerged in 2023 are likely to continue in 2024, only more so. Let’s look at a few of the key variables:

Inventory

As I wrote about in December, construction of new multiunit rental properties slowed in 2023 thanks to rising interest rates that made it harder to finance projects and a tight labor market for construction and trades. There are also some lingering supply chain issues that make it expensive to build right now. But as Lance Lambert of ResiClub pointed out recently, the number of new rental units that are coming online in 2024 is expected to be the most since Richard Nixon was president!

The chart below shows the number of new multiunit (defined at 5+ units) projects under construction. Remember, this is a different statistic than the number of multiunit starts, which notably declined in 2023. As you can see, the huge multi-year surge in new multiunit construction is evident out of the trough following the Great Recession. There was also a secondary surge in new units under construction that began during the pandemic:

(For more on the reasons why both rents and new rental construction have risen so much in the last decade, you can read previous articles about it from The Sunday Morning Post archives here, here, and here.)

But all of these units under construction take time to complete. According to the Census Bureau’s Survey of Construction, the average multi-unit construction project is taking 17.5 months from start to finish, and that is once approvals and permits have been obtained, a process that can take some time itself. Here in the Northeast, the average length of time from the start of construction to the end is the longest in the country at 19.8 months, which I attribute largely demographics: there aren’t enough younger workers in this part of the country particularly in the building trades, and the tight labor market means longer projects. Seasonality is also a big part of it too, of course, as it is more challenging to build in the north in the winter months, which can lengthen a project for sure.

The big takeaway here on the inventory question, though, is that there is going to be a surge in new rental units hitting the market in 2024 and even into 2025. This will provide tenants with more options, which will ease pressures on rents as competition for tenant acquisition returns to the market. This is not something property owners have had to deal with much over the last few years. It would not be out of the question if property owners and landlords eventually have to start offering concessions to prospective tenants including, first and foremost, reduced rents, but also attractive incentives like some amount of time (e.g. one month, 60 days, etc.) of free rent in exchange for signing a long-term lease.

Vacancy Rates

Vacancy rates remain below historical averages, but a recent uptick does start to tell a story of an evolving rental market. Vacancies are closely tied to inventory: when inventory goes up, so too do vacancy rates. The chart below shows rental vacancy rates going back to the 1960s:

A sharp decline in vacancies from a high of 11.1% at the peak of the Great Recession in 2009 is evident, with vacancies bottoming out at 5.6% in the summer of 2022. But in the third quarter of 2023, which is the most recent month for which data is available, rental vacancies ticked up to 6.6%, which was the highest vacancy percentage in over two years. With significant new inventory coming online in 2024, it is likely that rental vacancy rates will increase further to 7.0-7.5% by the end of the year. This is not enough to dramatically alter the rental market, but it is a variable worth keeping in mind especially if vacancies keep trending upward. I expect that once vacancies start to hit 8.0% or above, landlords in some markets will start to have to offer incentives, although possibly not here in the Northeast quite yet, where there is modest, if any, population growth.

The Economy and Household Formation

The economy remains surprisingly resilient despite a surge in interest rates meant to slow it down over the past 18 months. The unemployment rate in December was 3.7%, which continues to be near historical lows. If the economy continues to hold up, so too will the rental market because tenants are better able to afford their rents and people make lifestyle choices including to live on their own or with fewer roommates in a strong economy, much of which contributes to a tight rental landscape with buoyant rents.

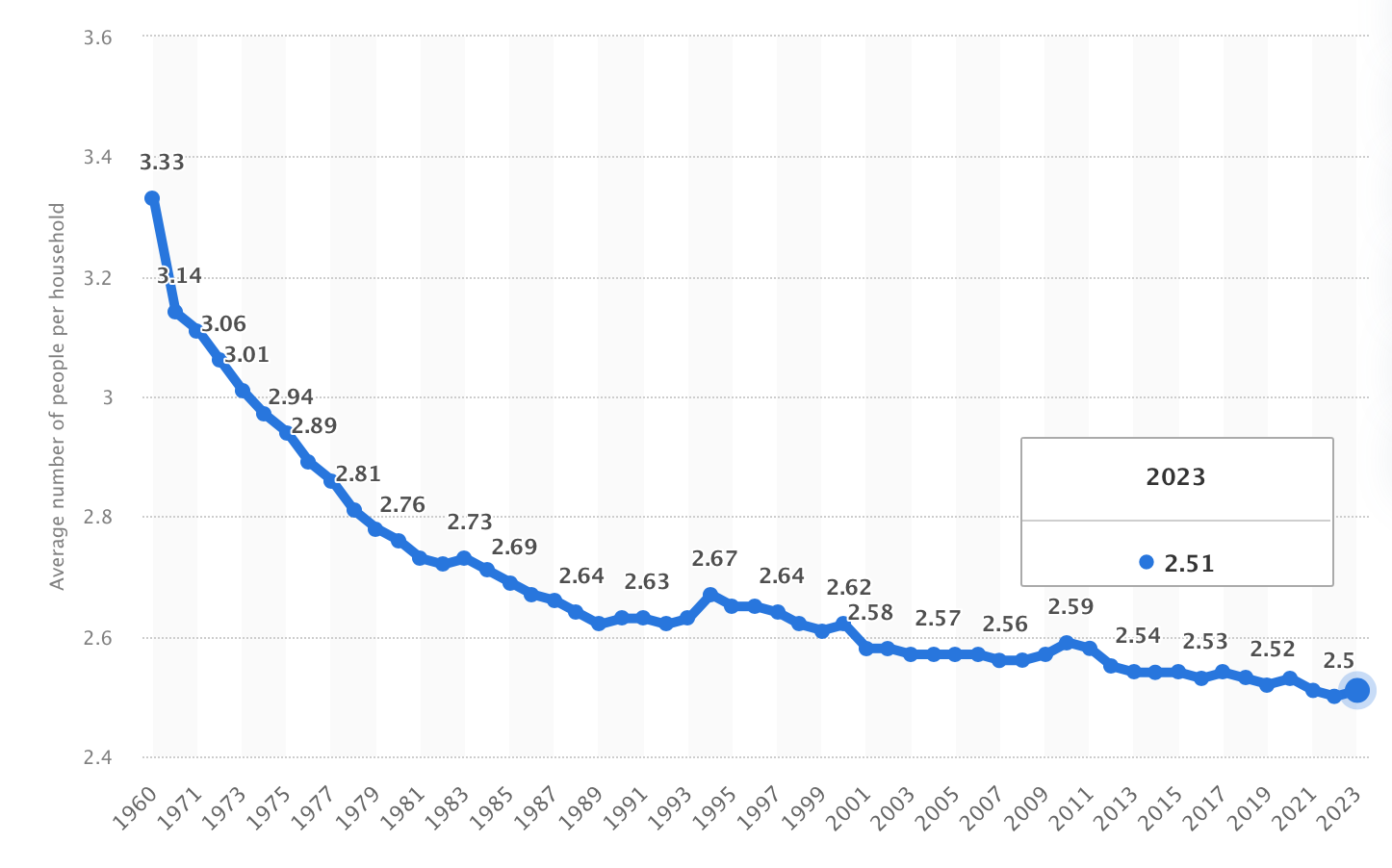

The chart below is one I have shared in the past that shows the number of people per household in the United States.

As I wrote in last year’s rental market preview article with regard to this same chart at the time:

The major driving force here is the declining birth rate; families just aren’t as large as they were generations ago. But, if we do have a down economic period, I would expect that historically low number of 2.5 people per household to tick up slightly. And this is a piece of data where even hundredths of a percentage point make a huge difference nationwide. You can see how the number of people per household increased from 2.56 to 2.59 during the Great Recession from 2007-2010. The rental vacancy rate during that same time period? It went from 9.5% in the second quarter of 2007 to 11.1% by the third quarter of 2009 before beginning its steady, decade-long decline. Down economic periods typically make vacancy rates go up as demand for rentals softens.

The number of people per household did tick up slightly in 2023 from 2.50 to 2.51. Household formation jumped during the pandemic as people made lifestyle decisions to live separately and because many people’s personal budgets were boosted by COVID relief funds and the deferment of student loan payments, among other variables. As those things are now in the rearview mirror, the number of people per household ticked up slightly. My hypothesis is that people do this in order to better afford rent by splitting it with more people in the same household or by people moving in with family members to save money.

Data from Statista shows the number of households increased by 770,000 from 2020 to 2021, by 1.98 million from 2021 to 2022, but by just 230,000 from 2022 to 2023. So rates of household formation have declined after the COVID-era surge for sure. What does this mean for the rental market? If there is an uptick in people living together rather than separately, it means there are fewer households overall that are renting. This means less competition among prospective tenants and a smaller pool of tenants for property owners and landlords to pluck from.

Rents

As noted at the outset, rents were up by 6.5% in 2023 at least according to the December CPI report. But there is clear evidence that not only is the rate of growth in rents decelerating, but rents are starting to drop in some places. The chart below shows the growth trend in rents, which are decelerating (i.e. the rate of increase is slowing) and will probably turn negative in the month ahead:

Keep in mind that even if the shape of that downward sloped remained constant, it would still have rents increasing for much of the next year, it would just be at a slower and slower pace.

Yet other methodologies and statistics show rents already dropping. Recent data from RedFin, for example, showed rents were down year-over-year for three straight months from October to December. A November drop in rents of 2.1% was the largest decline they have seen since 2020. Redfin Economics Research Lead Chen Zhao said on the topic, “High supply—more so than low demand—is driving rent declines.” RedFin also notes some regional disparities, saying:

The median asking rent in the Midwest rose 3.7% year over year to $1,434. Rents also rose in the Northeast, climbing 1.7% to $2,439. Meanwhile, rents fell 1% year over year to $1,632 in the South, and declined 0.6% to $2,346 in the West.

Rents are likely holding up best in the Midwest and Northeast because those regions haven’t been building as much as the South and West, meaning some landlords have less incentive to drop prices because they’re not dealing with as many vacancies.

ApartmentList.com shows similar numbers to RedFin, flagging five straight months of rent declines to end the year, noting:

The recent declines are in line with the rental market’s typical seasonal pattern, as fewer renters are looking to move at this time of year, although this year’s dip has been a bit sharper than what we normally see.

So why are places like RedFin and ApartmentList showing data that rents are on the decline while the Consumer Price Index report has them up by 6.5% through December? It is just differences in methodologies, but the differences are importnat. RedFin and ApartmentList data are based on data in real time, whereas the CPI data lags by a certain degree. I am more inclined to put stock in the RedFin and ApartmentList data, which, if it holds, suggests rents will be on the decline for much of the coming months barring some sort of reversal to the recent trend, which is unlikely because of all the new supply coming online, which is only likely to put wind in the sales of the trend.

Considerations for Investors

Different audiences will have varying reactions to the conclusion that rents are going to drop in 2024. For tenants not to mention policymakers, housing advocates, and others in that space, declining rents will be welcome relief after a challenging few years. But for real estate investors, which I know many of my readers are, there are reasons to be cautious. Margins are likely to get tighter for investors. On some properties and projects, margins may even turn negative. That is due to higher interest rates, the easing off of rent increases, and inflation in other areas including some that are specific to real estate owners like the rising costs of insurance and property taxes.

Another concern is that banks really tightened up their lending standards last year. I know from where I sit that we said no to many more deals than usual in 2023. This was not unique to our bank: in the Fed’s most recent quarterly survey of senior loan officers around the country, 65.5% of those surveyed reported their banks were either “somewhat” or “considerably” tightening credit standards for loans secured by multiunit residential properties. The remaining 34.5% of those surveyed said their standards were remaining basically unchanged. Not a single loan officer reported their bank’s standards were loosening. Standards generally tightened more at small banks than large.

It is hard to imagine a more attractive time to invest than 2020-2022 when interest rates were low, property values were still somewhat modest, and banks were more forthcoming with capital. I worry sometimes that newer real estate investors who are just getting started out are chasing a playbook that emerged from the 2010s and into that low interest rate environment from 2020-2022 without appreciating how much has changed in the past 18 months. The math just doesn’t work as well when the interest rate on the financing starts with a 7 or an 8 as it did when it started with a 3, 4, or a 5. The borrowing environment is significantly different now, which changes one of the major inputs in a project’s cash flow. I have this conversation with investors and borrowers regularly, and more often then not the newer real estate investors will tell me, “Well I will just raise my rents higher to cover the higher cost of borrowing.” No you won’t, because at a certain point the market will simply not bear it, especially with all of this new supply coming online. Property owners have had a lot of leverage in the past three years, but eventually if you raise rents too much, your tenants will walk.

Keep in mind that there are significant regional differences in real estate markets including for rentals. What is true in one place may not be true in another. The places that have seen the most new supply in the past year or two will see the most sharply declining rents while other places are likely to see rents hold up reasonably well. There is still a major housing shortage, and as I wrote at the outset there is little evidence that there is a major crash coming in either the single-family or multi-unit real estate markets. But the headwinds, particularly for investors, are there. To sum it all up, in 2024 I see rents flattening and starting to decline in many markets with a continued tough borrowing environment for most of the year even though rates will start to edge downward by May or June.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this week:

Via Patrick Sisson of Bloomberg, both Disney and Universal are building 1000+ unit housing developments for their workers in central Florida. Read more here. From the article, “Central Florida has seen some of the nation’s fastest pandemic-era rent increases, thanks to a confluence of job growth, migration and housing underproduction that has put a strain on residents. The average tenant in the region saw their monthly rent jump by $600 between early 2020 and early 2023.”

This past week’s CPI inflation report shows inflation running at 3.4% on a year-over-year basis, which was a little bit hotter than economists had predicted. The previous report had inflation running at 3.1%. This probably pushes the first Fed rate cut to May instead of March as the Fed will want to see inflation cool just a bit more before cutting.

Stanford Economics Professor Nick Bloom recently pushed data showing that the benefits of saved time due to working from home it not just due to a shorter commute: women save, on average, 12 minutes per day on grooming and men save 5. That is 3,000 minutes per year saved for women, or the equivalent of over two full days. Read the full report here.

Maine experienced two separate major storms this week that featured winds, snow and rain, and high tides along the coast and even on inland rivers. The photo below is from Bangor Daily News journalist Bill Trotter of the Seawall on Mount Desert Island. Wild.

Emily Burnham of the Bangor Daily News also had a story this week about a 100+ year old shipwreck that re-emerged under the iconic Sand Beach in Acadia National Park due to beach erosion in the earlier storm this week. You can read the fascinating story here.

Have a great week, everybody!