Rental Market Preview 2025

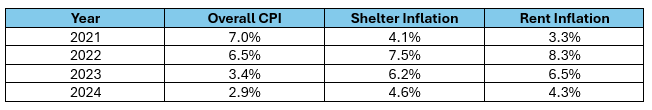

Shelter has been one of the most pernicious categories of inflation in the Consumer Price Index (CPI) over the past four years. Including both home prices and rents plus some smaller, less-weighted items such as hotels, motels, and school room and board, shelter has outpaced the overall CPI, particularly since the beginning of 2022:

By these numbers, a rent price of $1,300/month on January 1, 2021, would have turned into $1,615/month by December 31st, 2024. That may sound like an incremental difference to some, but it represents nearly $3,800/year, which is no small amount to millions of renters who are struggling with rising prices in other areas of their lives, too, like at the grocery store.

The impact of shelter inflation has been so damaging to many Americans because it not especially easy to trade down to lower cost alternatives. If your rent goes up by 20%, there are lifestyle costs to moving to a lower priced alternative or to moving in with additional roommates or family members, not to mention the costs of time, disruption, and actual expense it takes to physically move.

There is some hope on the horizon for renters, however, and reasons for caution for real estate investors (more on the investor perspective in the latter half of this week’s article). Markets react and evolve, and the rental market is no exception. Some of the variables that led to such starkly rising rents are leveling out and, in some places, starting to reverse.

Hope for Renters

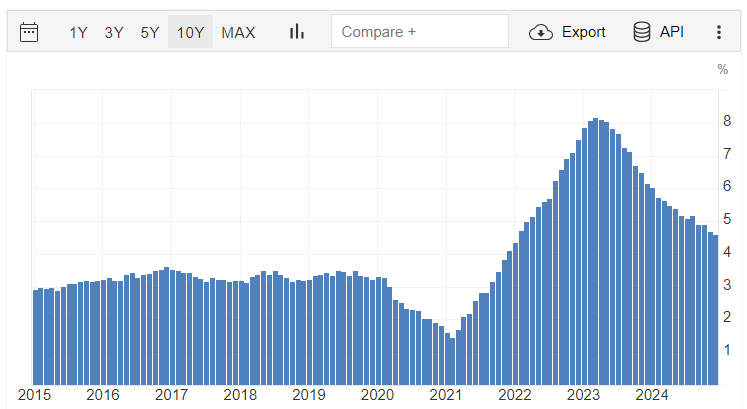

One important thing to understand about rents is that the rapid rise in rents from 2021-2023 was abnormal and, in many ways, artificial. The chart below shows the percentage change in rents on a year-over-year basis, illustrated monthly. As you can see, from 2015-2020, rents were remarkably stable, typically averaging increases of 3.0-3.5% per year. There is then a drop in the early days of the pandemic during the haze of uncertainty and peril in the initial months.

Rents started to surge at the beginning of 2021. Why? I won’t dwell too deeply on the reasons today because each one could fill pages of articles, but the main drivers in rent increases at this time were:

People could not travel or spend on other discretionary items like entertainment, so they focused on their home lives instead. This led to increases in home prices, but also increases in rents as people moved up-market. There were also significant movements of people around the country, including those who moved geographically to work remotely, all of which jolted the rental market.

A massive period of under-building following the Great Recession eventually caught up to the country, and at the exact time more inventory was needed, not many new units were coming online. Local regulations, code restrictions, and NIMBYism have played a role in this too.

Landlords and property owners reevaluated the landscape, I believe, and realized that they could charge more for rents. It should be noted, too, that expenses for property owners really started to increase during this time too, including for things like insurance, property taxes, and repairs. The costs have been passed along to tenants, but property owners also sensed that demand was growing, and they raised price in response to it.

Summarizing the above in basic economic terms, demand increased as supply stagnated (and even declined for other reasons, including some properties being converted to AirBNBs/vacation rentals, or being scooped up as second or third homes and staying semi-vacant). When demand goes up and supply does not, prices rise, which is what we saw.

What About Now?

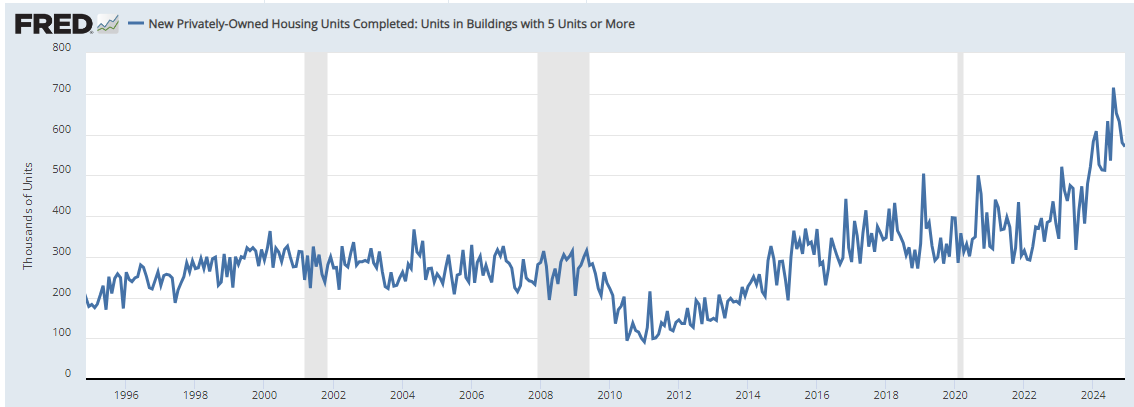

But as noted above, markets evolve. On the supply side of the equation, there has been some modest catch-up. More new units are coming online. This has been the result of both private development (i.e. for-profit construction by builders and property developers) and, increasingly, quasi-governmental construction spurred on by municipal and state partnerships among local housing authorities, non-profits, and municipal and state bodies.

The chart below of new multiunit unit construction (defined as units building with 5+ units), is quite interesting and shows the notable increase in new construction by private developers since the early 2010’s. What this represents is an increase in supply of apartments and rental units:

As these newly constructed units have come online, they have helped to take some of the frenzy out of the rental market. Is the landscape for tenants and would-be renters all rainbows and butterflies? Of course not. Prices are still quite elevated relative to a few years ago. But, according to some data sources with methodologies that are different than the ones used by the Bureau of Labor Statistics when calculating CPI, rents have already leveled off and are starting to drop, particularly in certain markets. According to the Apartment List National Rent Report released earlier this month, rents dropped nationwide by 0.6% in 2024. Per the report:

Since the second half of 2022, rent prices have continued to ebb and flow with the seasons as they typically do, but with the overall trajectory trending modestly downward. Following a period of record-setting rent growth in 2021 and the first half of 2022, the national median rent has now fallen below its August 2022 peak by a total of 4.8 percent. But despite the cooldown, the typical rent price remains 20 percent higher than its January 2021 level.

After several years in a row of robust increases, the fact that rents were even close to flat in 2024 is noteworthy and represents a temperature change, for sure, if not a reversing pendulum. Apartment List also noted that in November 2024, 88 of the 100 largest cities in the country saw rents fall.

Where have rents dropped the most? In exactly some of the places where new supply of units (i.e. construction) has increased the most. I wrote about Austin, Texas, last March. You can find that article here. In that piece, I noted research from John Burns Research & Consulting showing that Austin had the fourth most newly constructed apartments and new apartments in the works of any metro area in the country; the area saw 17,000 new units completed in 2023 and nearly 43,000 new units under construction. That is a lot of new supply!

Now rents in Austin are dropping. According to RedFin (via KXAN NBC), rents dropped 12% in the Texas capital from November 2023 to November 2024. It is pretty simple: as supply increased, rents declined, which is lesson for any community leaders out there looking to help rents level off or even decline - the best and most effective way to do that is to support more construction of new units.

Household Formation and Rents

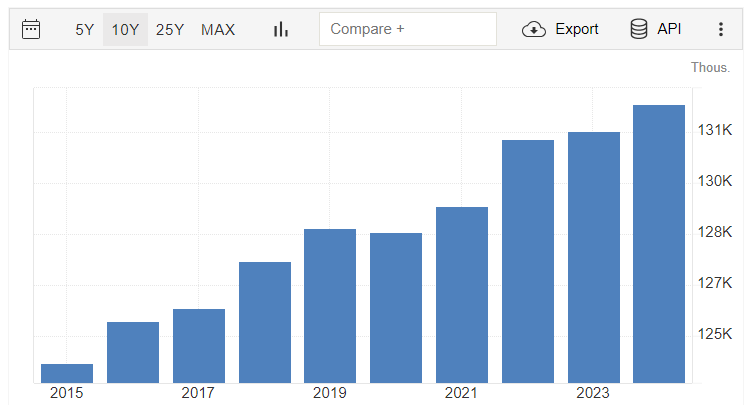

Natural human behavior is an important part of the story on rents, too. As the pandemic progressed, many people moved into places on their own because they did not want to live with roommates, or they just made lifestyle decisions (often boosted by Federal stimulus money) to live somewhere else. The chart below shows the number of households in the United States. There is actually a rare drop in 2020, as people actually moved back in with family at the outset of the pandemic, oftentimes leaving the larger metro areas like New York and San Francisco, to return home to more isolated areas. But then, the number of households increased:

The increase in the number of households from 2020 to 2022 was from about 128.5 million households to just over 131 million. That might not sound like a lot when you are talking about a nationwide scale of things, but an increase of 2.5 million households in two years does actually represent a demographic surge. Where were all those people going to live? The inventory of new homes to buy wasn’t increasing rapidly enough at the time (part of the reason why home prices, too, jumped so much during this time period, i.e. supply and demand), so there ended up being all of this new demand in the rental market.

Since 2022, however, the number of households has only increased from about 131 million households to just over 132 million. This is almost half of the increase we saw in new households over the two years prior. That slowing in household formation is like the spoilers on an airplane’s wings coming up as the plane lands on the runway, effectively slowing things down. Demand is easing for new rental units, and so prices are easing, too, which we are seeing in the data in the CPI and even more notably in other methodologies like the Apartment List report.

Vacancy Rates

Another data point that helps to shed light on the status of the rental market is the vacancy rate. Historically, rental vacancies have typically been 7-8%. Vacancies bottomed out in the latter half of 2021 and the first half of 2022 at 5.6%, which was a historically low figure. Since then, vacancies have increased to 6.9%.

What does this mean? Rising vacancy rates are likely tied to the increase in new supply, as noted above in the discussion about construction. They could also be a result of tenants being more patient in the face of rising rents, whether that be to stubborn resistance to higher prices or a lack of ability to pay constantly rising amounts for rent. More open units does mean more choices for tenants, and less upward price pressure as the competitive leverage flips a bit from property owners to tenants. For real estate investors and property owners, of course, rising vacancy rates mean less income, as a unit sitting empty is not generating rents.

The Investor Perspective

I’ve written this in the past, so I’m paraphrasing myself, but there was never really a better time in recent history to invest in rental properties than 2020-2022. Money to borrow was cheap because the Federal Reserve (and, in turns, banks around the country) lowered interest rates at the outset of the pandemic in an effort to prop up the economy. Simultaneously, rents increased notably. And lastly, properties appreciated in value, so not only did real estate investors get the benefit of rising rents, but also of rising property values.

Some of that is now leveling off and, in some markets, starting to reverse. To begin with, money is no longer as cheap. Whereas borrowers for rental properties might have found banks willing to lend at 4.0-5.0% from 2020-2022, today banks are lending from 7.0-8.0%+. Consider the difference in math from 2020 to today. Borrowing $400,000 at 4.5% in 2020 on a 20-year amortization would result in a monthly payment of $2,530. That same property today has likely appreciated in value by at least 30%, so we’ll call it a $520,000 loan in 2025. The interest rate would now likely be in the 7.75% neighborhood, which generates a monthly payment of $4,189, a staggering increase of 66% over the monthly payment in 2020. No matter how much rents have risen, the math has gotten really tight and, to some, non-viable for making the cash flow work for certain rental properties.

On top of that, and a topic I plan to return to in the coming weeks, the costs of many of the other inputs in the investor’s cash flow have also risen significantly in the past few years. It is not just higher interest costs that are making the math hard. Property tax, insurance, the cost of repairs - it’s all much higher today than it was 5+ years ago, let alone 15-20 years ago. Property owners can try to pass a good portion of that along to tenants, but eventually they can only pass along as much as the market demands.

The Year Ahead

I expect trends that took hold in 2024 to continue in 2025, namely, easing off of rent prices. I would not be surprised to see nationwide rents down 3-5% or more in the year ahead. There will be significant variability by market, however. Supply and demand will be key.

There is hope for tenants, though, in that new construction continues to bring new units to the market, resulting in greater choices and less upward pressure on prices. For real estate investors, you should be mindful of how supply is changing in your markets. If you live in an area like Austin, Texas or other communities that are seeing a lot of new construction, you should be mindful of the potential for downward pressure on rents. If you live in an area without much new construction, rents may stay elevated.

The other overarching variable is the economy, and as I said last week, it is anyone’ best guess where things are economically speaking a year from now. But the worrisome thing for both tenants and property owners alike is if the economy swoons and renters are struggling to keep up with the monthly leases. That would spell bad news most importantly from a human perspective for those trying to make ends meet, and certainly to property owners and real estate investors as well.

A Final Aside

Tens of thousands of California residents have been displaced and thousands of homes and other structures have been destroyed by wildfires, some of which continue to burn even at the time of this writing. It may seem trite to talk about the impact of the fires on the real estate market, yet there is already evidence that rents are skyrocketing in the Los Angeles area in the face of such sudden and staggering demand from displaced residents. According to one report, rental units that had been previously on the market as vacant, are now being rented for 15-20% higher than their previous list values. Demand has surged and supply has literally burned to the ground - this is undoubtedly a formula for rising prices.

The real estate market in southern California will be impacted for years to come by the current crisis. It is a topic beyond the scope of today’s article, but relevant in that a displacement of people of that magnitude will have ripple effects, and not just on the west coast. I spoke to a realtor here in Maine this week, for example, who said she was already seeing fresh inquiries from people in California wanting to move to Maine (a place that is refreshingly free of most types of natural disasters).

Beyond the immediate impacts from movements of people, displacement, and destruction of homes, the housing market as a whole (and really, the country as a whole including our policymakers) will need to address questions about insurance. Many California homeowners have noted their insurance policies had been cancelled prior to the fires. The rocketing high cost of insurance in places in Florida has been more than a little concerning, as well. Flood insurance programs are pretty significantly underfunded, and storm surges are only getting more prominent.

With the cost of homeownership (and rental property ownership) rising so much thanks in part due to the rising cost of insurance, it will have far-flung impacts on prices, inventory, and more. All that, and more, in the coming weeks here in the pages of The Sunday Morning Post.

The Sunday Morning Post is always free, never pay-walled, and contains no ads. To learn how you can support this work and keep these articles free from clutter, become a paid supporter here or click to read more here.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Great summary Ben! If you want any real-world examples of investor costs rising, I'd be happy to share a few case studies. The items you mentioned, property tax, repairs, insurance. Definitely up. I would also add the cost of property management, capital expenses and utilities are also elevated. Many towns in our area (Bangor, ME) recently were mandated to re-assess property values which was a big driver in the property tax increase. Many property owners saw 33% or more increases in property tax in one year. If rents decline, 2025 could squeeze some investors quite a bit in two directions - 2025 will also be one of the first years that investors who use commercial loans will start to see their 5yr adjustable rate mortgages jump in rate from say a 4% rate in June 2020 to 8% in June 2025.

Great article and spot on.