Rising Gas Prices Could Cool Inflation After Some Short Term Pain

Author’s Note: Thanks for reading and for being a part of The Sunday Morning Post community. I appreciate you being here.

It is traditionally believed that wars lead to inflation. Natural resources are cut off, supply chains are disrupted, and nations that were perhaps once friendly enough to do business with one another instead become closed off: these are all catalysts for higher prices as the costs rise for all manner of goods and services.

I am of the opinion, however, that these traditional assumptions about wartime inflationary pressures might not play out the same way in the current day when we look at the impacts from the Russian invasion of Ukraine. In fact, the seeds of cooling inflation may have been planted even though consumers around the world including here in the United States are already experiencing some short-term pain. The reasons have primarily to do with energy prices. (Note: this should not be interpreted as a positive result of the Russian invasion or as any sort of silver lining; the invasion is unequivocally bad through human, moral, political, economic, and environmental lenses).

The Short Term

Over the short-term, rising gas and utility prices are undoubtedly inflationary in nature. Prices rising is, in fact, the definition of inflation, so as prices rise in the short-term it is going to have an impact on behavior. Drivers are going to pay more to fill their tanks or to travel. Businesses that use oil to produce goods and all types of businesses that pay for shipping and transportation are going to face increased costs, at least a portion (if not all) of which they will pass along to consumers in the form of higher prices. So in coming days and weeks, it is going to feel like inflation is running particularly hot.

According to AAA, as of March 5th the average price for a gallon of regular unleaded was $3.922 nationwide, up from $3.597 just one week ago, up from $3.435 a month ago, and, up from $2.752 a year ago. Those are increases of 9% in a week, 14% in a month, and 43% in a year. People are already feeling this.

I took the two photos below out my office window at our First National Bank branch in Brewer, Maine on February 22nd (top) and March 5th (bottom) showing a jump in a gallon of regular unleaded from $3.499 on February 22nd to $4.099 on March 5th, an increase of 17% in less than two weeks. My coworkers who were in Brewer on Friday told me the price went up 30 cents from the beginning of the day to the end of it.

Last spring, I spoke with logging/forestry expert Eric Kingsley about an article I wrote about rising lumber prices. Eric said something to me in our discussion that has stuck with me ever since: the solution for high prices is high prices. In other words, higher prices naturally counteract themselves because as prices go higher, there is less demand from consumers, and price pressures ease and potentially reverse. And moreover, when prices that consumers are willing to pay is high, more market participants enter the field, and prices often end up leveling off as a result of increased competition and greater supply.

So what’s happening now as gas prices rise? Two things: people have less money now to spend on other things and many are already altering their behavior including travel plans. Anecdotally speaking, gas rising above $4/gallon here in Maine this past week came up in conversation after conversation as people lamented the cost of filling their gas tanks. For a lot of people, if it costs $65 to fill a gas tank this week when usually it costs $45, that means there are twenty fewer dollars to spend on going out to eat, buying extra groceries, or saving for summer travel. When you multiply that impact out in untold millions of anecdotes economy-wide, and you get ripples of impact through all types of businesses and industries across the whole country.

The Longer Term

Over the longer term, these ripple effects, I believe, are likely to lead to an economic pullback. I don’t think we are facing a dropping off of a cliff or anything to the extent of the Great Recession. After all, just this past Friday, the latest jobs report showed that 678,000 jobs were created in February and the unemployment rate is sitting at 3.8%. These are strong figures and illustrate a labor market that is not pointed towards recession. There are, in fact, many signs of strength.

But what will happen when consumers nationwide have less to spend because they are putting it all into their gas tanks (not to mention their home heating and electricity bills). Consumers could pull back from spending on other goods and services, which means businesses will generate less activity, which, of course, has all kinds of ripple effects including less hiring, potential layoffs, axing of expansion plans, and diminished real estate activity. There is a real contagion risk of more significant economic peril if consumers start to pull back.

What Comes Next?

So, what comes next? I think we are in store for several weeks of pain from red hot inflation. And then as consumers internalize the impact from these rising prices and alter their own activity, the economy as a whole is going to have a moment of cooling off. Combined with the fact that the Fed is almost certainly hiking interest rates by at least a quarter point later this month, which is meant in no small part to help cool inflation, and you have a lot of catalysts for a pullback. The sugar high of economic stimulus has also continued to wane as the direct payments to taxpayers and business relief programs like PPP and EIDL are more firmly in the rearview mirror with each passing month. As it does not appear that any more direct stimulus is likely or even needed at this point, consumers are going to be on their own against rising prices and general economic uncertainty not to mention geopolitical uncertainty as it is difficult at this point to say how long the war in Ukraine will last and what its lasting impact will be. The next several weeks and the next few months are likely to be a bit of a roller coaster.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram.

Weekly Round Up

Here are three things that caught my eye this week that I wanted to share with you.

Bank of America analysts this week noted the rapid pace of inflation in commodities. Ukraine is a major exporter of wheat, iron, and oils, which, of course, are all used in many different products. The chart below compares the current crisis to other previous wars, which shows that, indeed, wars tend to be inflationary.

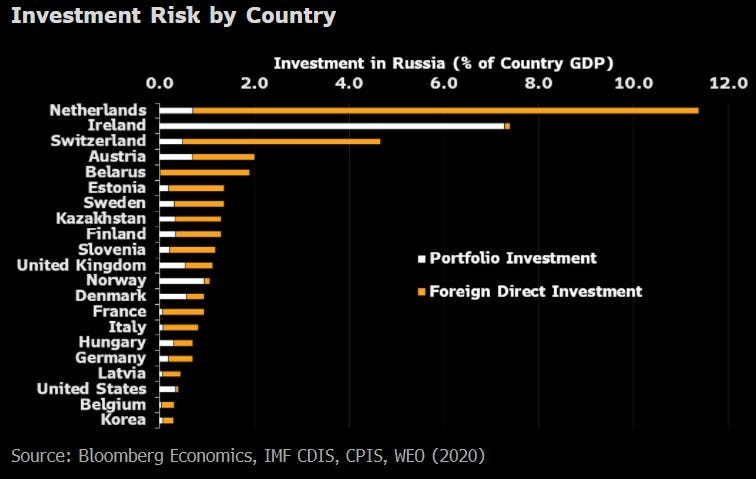

Bloomberg says that Ireland, The Netherlands, and Switzerland have the most direct exposure to the Russian economy. The United States is well down the list. It is worth noting that the Russian stock market has been closed for over a week.

Rick Palacios Jr. from John Burns Real Estate Consulting flagged an unexpected drop in demand for deck projects. An aberration or a sign of consumer demand for home projects easing up? An interesting data point either way.

Have a great week, everybody!