Shipping Costs Rise Amid Global Tension

What it means for inflation and the overall U.S. economy

Shipping costs around the world have more than doubled in recent weeks as global tensions in the Middle East impact transportation and trade routes. The problem is particularly acute in the Red Sea, a route through which 30% of the world’s container ships travel. Houthi attacks have significantly disrupted the Red Sea shipping corridor, causing shipping companies to either take an alternate route around the southern tip of Africa or to pay for costly additional insurance or actual military security. It spells trouble for the cost of goods here in America as well as throughout the world at a time when the end of a multiyear battle with inflation has finally appeared to be within reach. Perhaps more importantly, the disruption of trade routes has been the catalyst for more than one full-on war throughout history, with the costs of those wars in both dollars and human lives reaching untold levels. With the larger conflict between Israel and Hamas showing no signs of deescalating anytime soon, this is a perilous moment indeed.

What’s Going On. And Who are the Houthis?

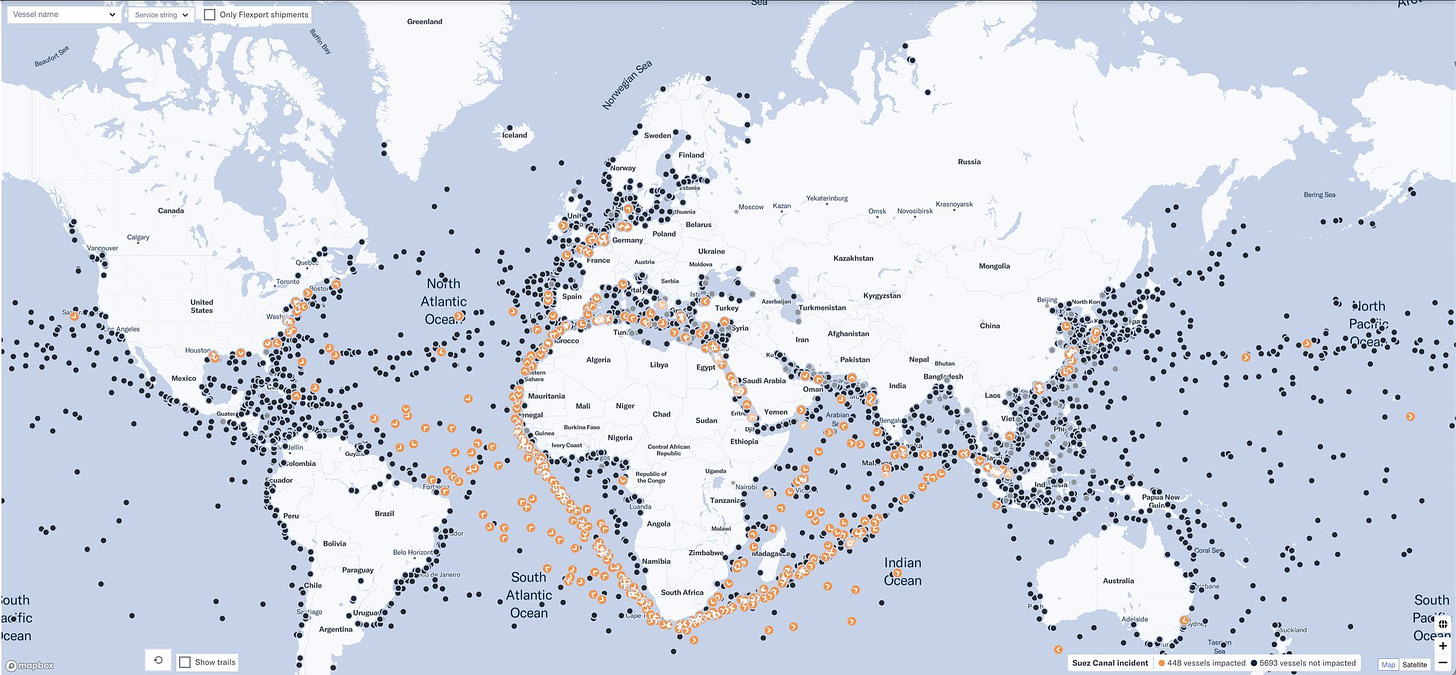

According to Ryan Peterson of Flexport on Twitter/X (with a hat tip to The Sunday Fix) based on data and mapping from January 6th, 95% of the container ships that would normally have gone through the Red Sea are traveling around the tip of Africa instead. The “alternate route” ships are the ones in orange below:

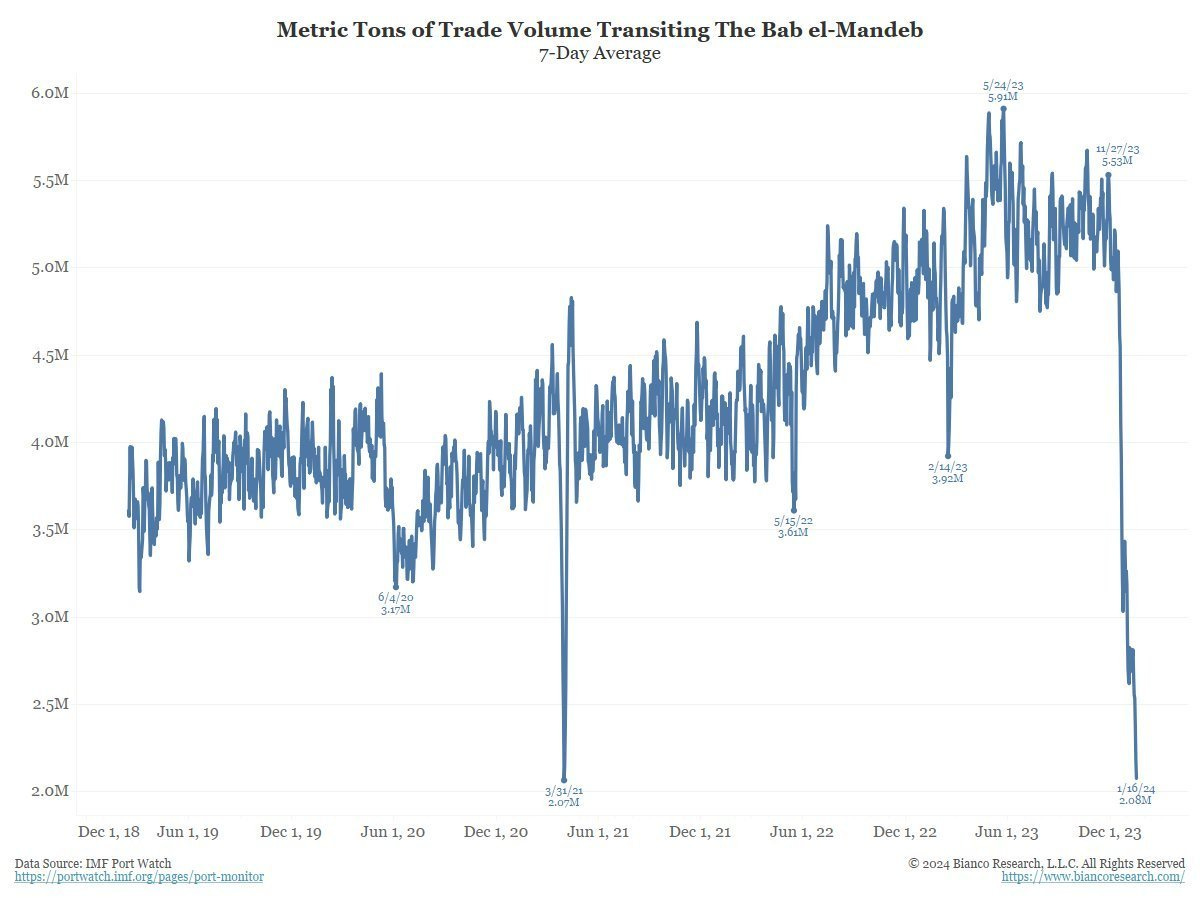

The costs of taking an alternate route are substantial. According to Reuters, “Rerouting a ship around Africa adds roughly 10 days and $1 million in fuel costs for each one-way voyage between Asia and Europe.” As we saw during the pandemic, disruptions in the global supply chain market can have significant impacts to the cost of goods sold. The chart below shows the metric tons of volume passing through the Suez Canal. The clear drop during the pandemic is clearly evident, as is the drop off in the current time:

At the present time, the added costs appear to be mostly being absorbed by the producers of goods, who typically build for the uncertainty of global tensions in their budget models, but at some point those costs will be passed on to consumers to the extent that producers are able to do so.

Yemen has been in the midst of a long Civil War between the Houthi rebels and a military coalition backed by the previous government. The United Nations called the situation “the world’s worst humanitarian crisis” in 2023, in which millions of people of Yemen are displaced, hungry, and dying. The Houthis, which are are officially known as Ansar Allah, are a Shia Islam political and military group that controls much of the country including the capital. The group is backed by Iran and carries the slogan, “God Is Great, Death to America, Death to Israel, Curse on the Jews, Victory to Islam.” Since the October 7th attack on Israel by Hamas, the Houthis have sought to leverage the instability in the region and have launched a series of attacks on ships in the Red Sea, which has not only been disruptive but has also led to the loss of life. Two U.S. Seals have also been lost at sea after falling into the water during a January 11th nighttime operation to seize Iranian weapons that were being shipped to the Houthis.

What Happens Next

Various nations have begun to offer military protection for their country’s container ships passing through the Red Sea. The photo below was released by the French Navy showing one such escort.

It appears clear the United States is not inclined to be pulled into a war with the Houthis, which could only serve to escalate the overall ongoing crisis in the Middle East and unite the disparate groups and often-warring factions in the region against a U.S.-led coalition. There are reports already, however, that the Houthis, who had been struggling to win over hearts and minds in Yemen by failing to provide basic services and to pay government workers, is now seeing a spike in recruitment and new support, attributable largely to the leverage the Houthis and others have tried to build following the October 7th attacks in Israel and the subsequent aftermath.

After issuing an ultimatum that the Houthis end their attacks on ships in the Red Sea, an ultimatum that was flatly ignored, the U.S. launched airstrikes against the Houthis starting on January 11th. These were notable in that they took place inside of Yemen, broadening the United States’s involvement in the Middle East. Trying to undercut a perception that these airstrikes were the start of a more formalized campaign, Pentagon Deputy Press Secretary Sabrina Singh said at a briefing, "We do not seek war….we are not at war with the Houthis. Actions we are taking are defensive in nature." The Houthi leader, on the other hand, said that it was “a great honor" to be "in direct confrontation" with the United States and their partner nations including Israel and the United Kingdom.

The risk, of course, is that things do continue to escalate. The battle, such that is, between the U.S. military and the Houthi rebels is not much to speak of; the U.S. is so vastly superior and infinitely more well-resourced that it is not a question of victory or defeat at least in military terms. But the question does exist, however, about how the battle grows between the U.S./Israel coalition and the forces against it, most notably Iran, Hamas, and their various allies in the region. The concern is that the various conflicts in this part of the world are not only intensifying but are also becoming linked together, which could not only result in a catastrophic loss of lives of both civilians and military target, but could continue to pull the United States even further in. Indeed, on Saturday night just hours before this article was posted, The Washington Post published a report saying that the Biden Adminstration is planning for a more lengthy campaign against the Houthis than was perhaps initially planned, saying:

The Biden administration is crafting plans for a sustained military campaign targeting the Houthis in Yemen after 10 days of strikes failed to halt the group’s attacks on maritime commerce, stoking concern among some officials that an open-ended operation could derail the war-ravaged country’s fragile peace and pull Washington into another unpredictable Middle Eastern conflict…

…Officials say they don’t expect that the operation will stretch on for years like previous U.S. wars in Iraq, Afghanistan or Syria. At the same time they acknowledge they can identify no end date or provide an estimate for when the Yemenis’ military capability will be adequately diminished.

So it appears that the United States might be in this for the long haul, or at least the intermediate-to-long haul.

As a brief (though relevant) aside, I have always been fascinated by World War I. As time has passed, aspects of the so-called War to End All Wars, have been largely forgotten in our collective public conscience, which is partly because of the more prominent and more recent World War II, which many Americans even today have a more direct connection with. The imagery and video from World War II are also considerably more modern than those of World War I. But World War I is very interesting to me for a variety of reasons including the fact that when it began, the nations of the world were still in some places rolling out actual cavalry with antiquated weaponry. Armies would line up across from one another, attacking head-on. But by the end of the war several years later, the most horrific weaponry and most brutal killing machines the world had ever known up to that point were in full effect, a modernization of warfare that would only intensify in speed and scope throughout the rest of the 20th century.

But why do I bring up World War I? Because the United States was, arguably, dragged into the fray because of disruptions to shipping. Yes, President Woodrow Wilson at the time spoke grandly of human rights, arguing before Congress on April 2, 1917 that “the world must be made safe for democracy” and should enter the fray “to bring peace and safety to make the world itself at last free.” While the promotion of peace and freedom for those who were oppressed was undoubtedly a key motivation for many including the President if we give the benefit of the doubt, it was actually the prolonged German U-Boat campaign against western ships carrying supplies back and forth to Europe that was perhaps the primary reason behind the United States’s entrance to the war. The most specific catalyst was the sinking of the Lusitania in May 1915, killing 128 Americans on board, but there was actually a prolonged and costly campaign by the Germans against United States ships and their allies that brought America into the fray. I am not sure if human rights alone would have been enough to bring the isolationist United States into World War I, especially since there were large groups of Americans at the time supportive of both the Russian and German sides of the war. It was largely the cost and overall disruption to the economy caused by the U-Boat campaign that most specifically led to the U.S.’s entrance into the war.

Final Thoughts on Inflation

Longtime readers of The Sunday Morning Post will know that inflation is a topic I come back to time and time again because it is so relevant to people’s lives and also because of its impact on interest rates, which then connect to many aspects of the economy including real estate. Inflation has been fast-approaching its normalized level of 2.0%, but the latest CPI report did show a somewhat unexpected uptick with the annualized rate of inflation going from 3.1% in November to 3.4% in December. That uptick alone probably caused Fed officials to push back any talk of rate cuts from the March-April timeframe to more of a May-June timeframe.

But now there is a real risk that global shipping challenges will impact prices that American consumers pay at the store. It may seem trite to talk about consumer prices when there is such a serious humanitarian crisis at hand, but it is highly possibly that global tensions now start to reverse the progress the Fed has made at taming inflation. It goes to show how closely the global economy is linked, and how challenging it is to predict exactly how things will go. Hopefully for the sake of human life, the cost of war, and the good of the U.S. economy not to mention that of the world, a more peaceful situation can somehow be attained.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this week:

The price of U.S. stamps is increasing from 66 cents to 68 cents. When the Forever stamps were instituted in 2007, they cost 41 cents, meaning the stamps have increased 66% over that time. For those excited about the possibility of buying a much of Forever Stamps as an investment, don’t go overboard: an investment in the S&P 500 in January 2007 would have been up about 337% in that same time, and that includes the immediate market drop during the Great Recession.

As we look ahead to a Presidential year, the number of Americans self-identifying as independent has reached an all-time high of 43%. Just 27% of Americans consider themselves to be Democrats, an all-time low, while a matching 27% of Americans consider themselves to be Republicans, which is near all-time lows.

The Economist discovers that “the vibes are off,” saying:

“The vibes are off” is a phrase that does not usually appear in rigorous economic analysis but has cropped up again and again in serious discussions about America over the past year. From an array of hard data, there is reason to think that people ought to be quite satisfied about the state of the economy: inflation has slowed sharply, petrol prices are down, jobs are plentiful, incomes are rising and the stockmarket is strong. But survey after survey suggests that Americans are in fact quite unhappy. They think that the economy is in bad shape and that President Joe Biden is mismanaging it. What gives?

Sorry, the full article is behind a paywall, but you get the point. Or you can read my “Vibes-Are-Off Thanksgiving” article from this past November.

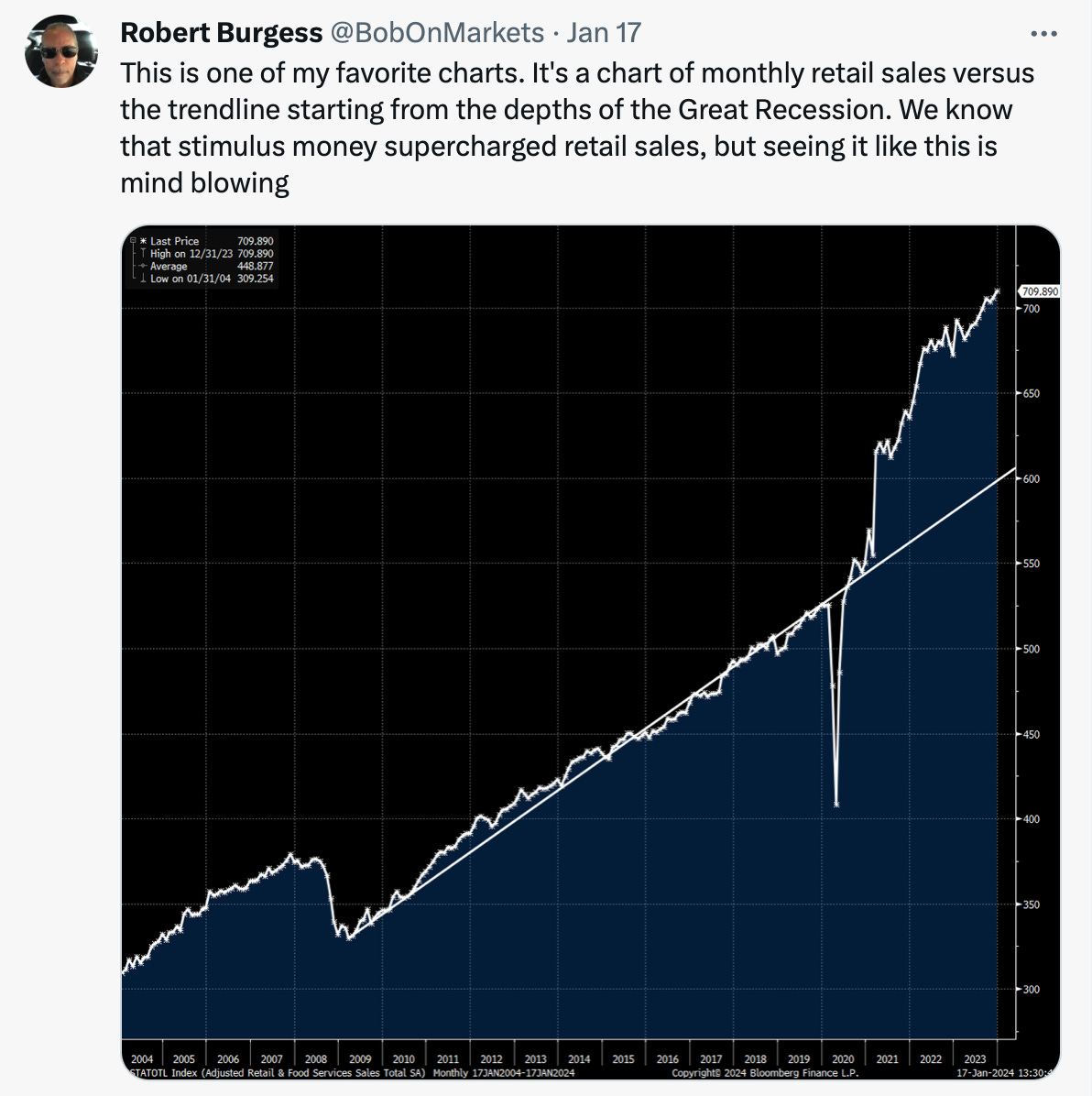

Bloomberg Editor and Columnist Robert Burgess shared a chart showing how much higher retail sales were during the pandemic, and how the bump has held.

Have a great week, everybody!

Like your focus Ben. Always look forward to a read about the pertinent issues.