Stock Market: The Pandemic is Almost Over

Stay-at-home stocks get clobbered as the world continues to reopen

Dr. Scott Gottlieb, who is a former FDA Commissioner and someone whom I have followed for the length of the pandemic for his insights and perspective, said on CNBC’s Squawk Box on November 5th, “The end of the pandemic at least as it relates to the United States is within sight right now….by January 4th this pandemic might well be over.” This does not necessarily mean that COVID will be completely gone as even Dr. Gottlieb noted that it may always be with us, but what is likely is that even in an endemic phase COVID-19 will be highly treatable and entirely manageable.

It should be disclosed that Dr. Gottlieb is a board member at Pfizer, which has been at the forefront of the vaccination race since the outset. On this particular day in which Dr. Gottlieb was being interviewed on CNBC, Pfizer had just made an announcement about their new antiviral pill that can be taken once a person starts showing symptoms of COVID-19. The Associated Press summarized as follows:

On Friday, Pfizer released preliminary results of its study of 775 adults. Patients who received the company’s drug along with another antiviral shortly after showing COVID-19 symptoms had an 89% reduction in their combined rate of hospitalization or death after a month, compared to patients taking a dummy pill. Fewer than 1% of patients taking the drug needed to be hospitalized and no one died.

These are extremely impressive results. In fact, the results were so significant that the independent medical researchers monitoring the Pfizer study recommended stopping the study early as the pill was so effective it would have been unethical to continue versus making the results public and seeking FDA approval for the drug (not to mention stopping the use of the placebo/dummy pills for the program participants who were diagnosed with COVID so that they might actually be helped). Unsurprisingly and appropriately Pfizer stock surged on the news.

So what does this have to do with the stock market as a whole? Well, the market has been on a tear since temporarily bottoming out in the spring of 2020 at the outset of COVID-19. The S&P 500 is up 26.54% so far in 2021, which has followed a gain of 16.26% in 2020. A bounce-back economy, waves of COVID-related stimulus funds dispursed around the world including here in the United States, and record-low interest rates have had stocks roaring. Stocks are also generally seen as a leading indicator, which means they do not necessarily tell the story of what is happening at the present moment, but are rather a predictor of what investors expect to happen in the months and years to come. The fact that stocks continue to surge suggests investors including institutional money see blue skies ahead for the U.S. economy.

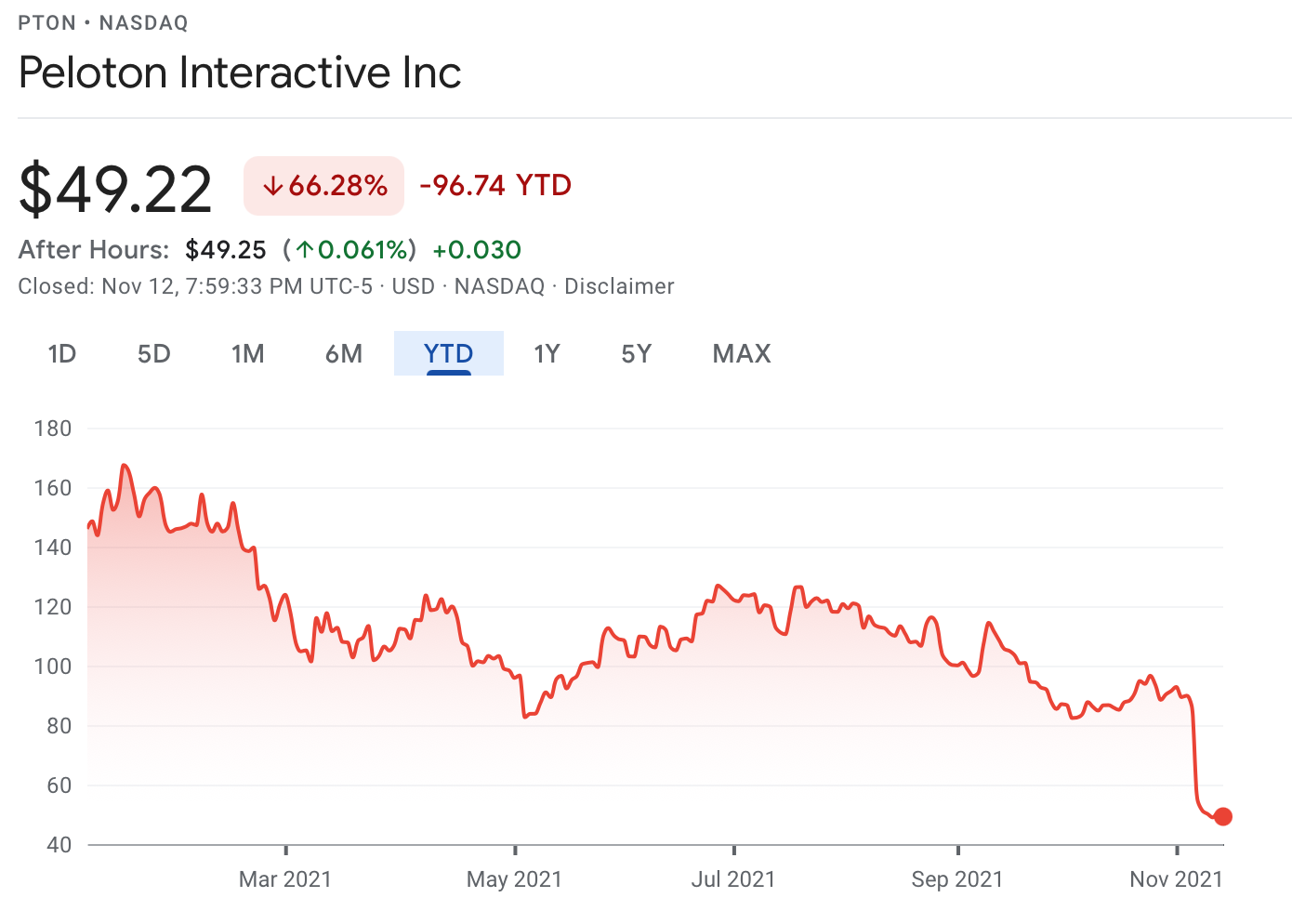

It is interesting to note, however, that certain stocks have not been doing as well of late. Among the worst performers? Companies that specialize in stay-at-home products. Consider the following year-to-date stock movements:

Peloton: down 66.28% so far in 2021:

Zoom: down 31.17% in so far in 2021.

Clorox (yes, Clorox): down 17.18% so far in 2021.

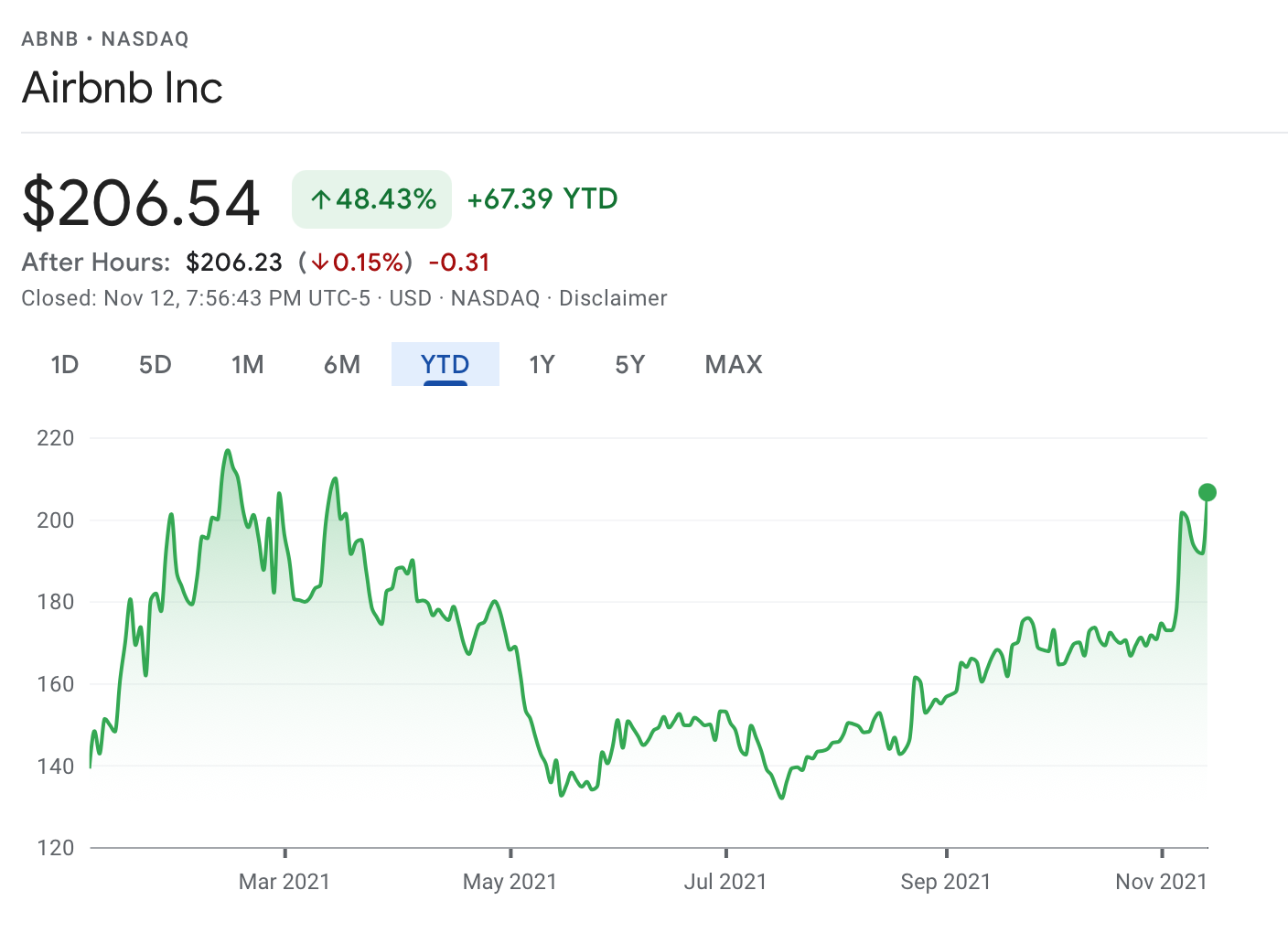

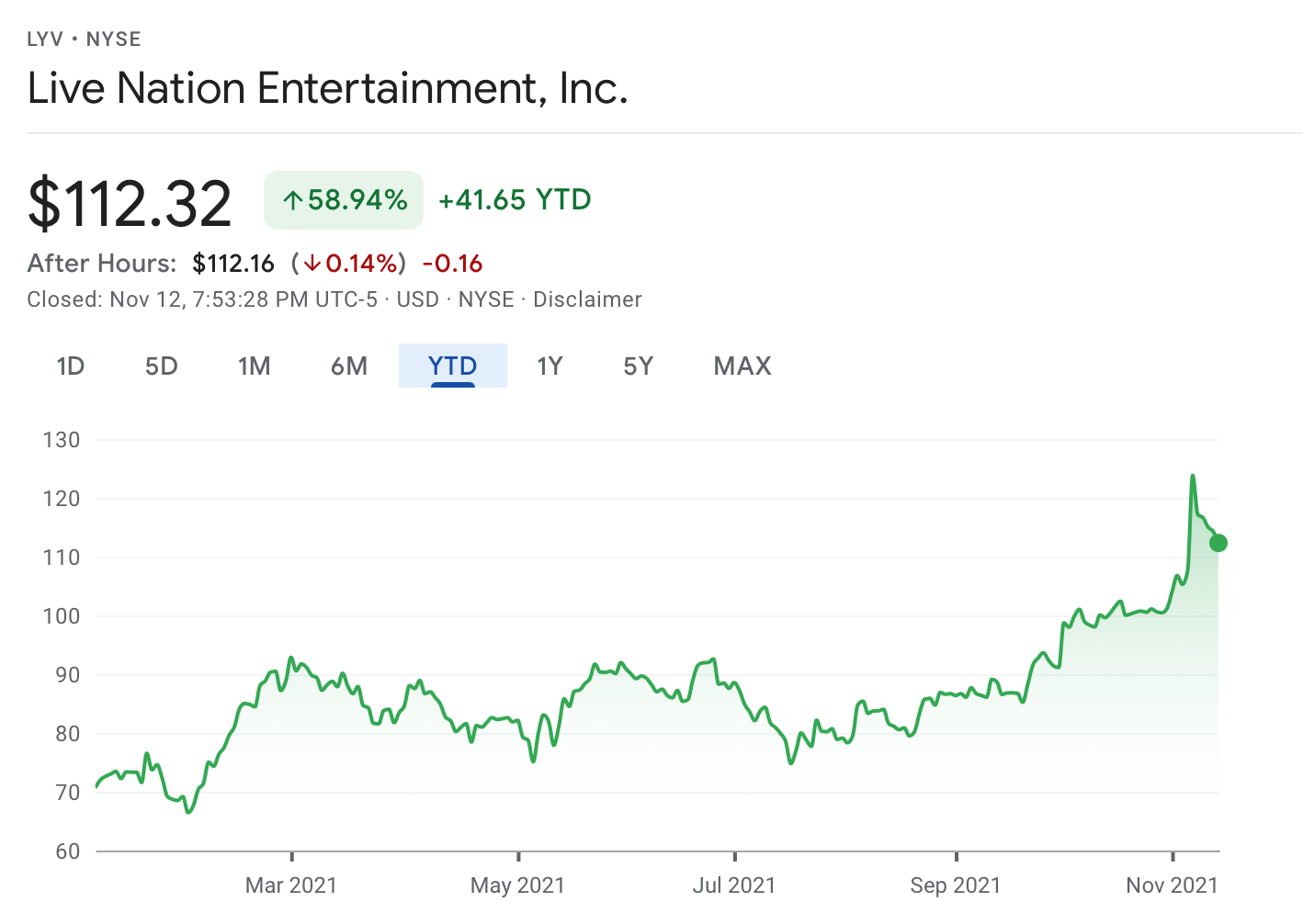

What stocks are doing well right now? Generally speaking, companies that will benefit as the world reopens. Consider the following:

Expedia: up 36.19% so far in 2021:

American Airlines: up 34.10% so far in 2021:

AirBNB: up 48.43% so far in 2021

LiveNation: up 58.94% so far in 2021

There are a lot of reasons why stocks go up and down in value and, generally speaking, there is never one clear variable. And to be fair, there are so many publicly traded companies out there that you can cherrypick from the lot to show just about any pattern you want. I would have thought Disney stock, for example, would be performing better these days, but it is down 10.16% for the year even as the overall market rises around it. Carnival Cruise Lines is up 9.72% for the year, which in normal circumstances is not a bad gain for 10+ months of a year, but it does significantly lag the market as a whole.

You can also manipulate data by choosing different time frames. With Moderna stock, for example, you could tell two completely different stories depending on which time frame you use. Moderna stock soars 106.92% in 2021! Moderna stock craters 28.09% in a month! Both of these exclamatory potential headlines are true as Moderna stock is up 106.92% year-to-date, but down 28.09% in the past month, which shows both how fickle the stock market can be and how it is possible to massage the data to tell two much different stories. Keep that in mind as you follow the financial news or watch the financial T.V. shows; their incentive is not necessarily to make you a better investor, but to keep you engaged and they do that with emotion and the manipulation of headlines and numbers. Data in the hands of a nefarious actor is potent especially in this era of disinformation.

Anyway, the paragraphs above are just a lead-in to a disclaimer that you should be careful when picking individual stocks and my article this week is meant for educational purposes only and should not be construed as investment advice. I do think, however, that the trend away from stay-at-home company stocks to reopening stocks is valid and perhaps has some legs to run.

Of course, now that the trend has been identified it is possibly too late to get in on it. Prior to working as a commercial lender, I was a licensed investment advisor for 6+ years. One of my favorite sayings that I would share with clients quite frequently was a story about Wayne Gretzky, who said he became the greatest hockey player in the world not by skating to where the puck was at that moment, but by skating to where it was going to be. And it is the same with investing. To be successful as an investor you can’t go where the money is now, but where the money is going to go. Easier said than done, of course.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Here are a few things that caught my eye around the web this week:

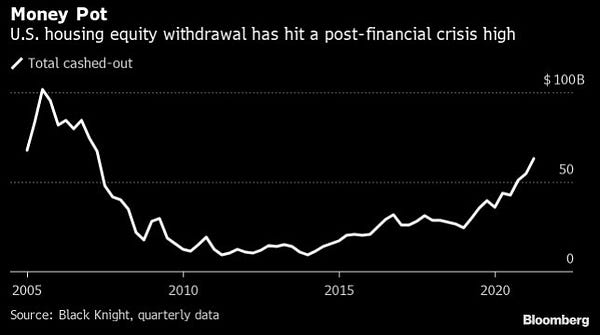

Fueled by continued low interest rates, people are tapping the equity in their homes at the fastest pace since 2007.

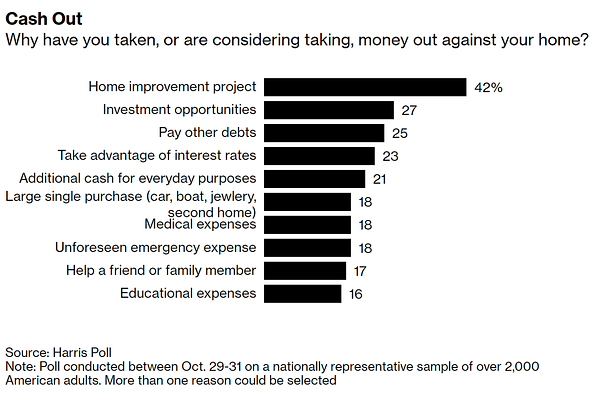

But, it’s not just to pay for home renovations. Ali Wolf points out that people are taking money out of their homes for all kinds of reasons, including paying off student loans and other debts:

Per MaineBiz, homes in Portland, Maine are selling in the shortest amount of time since their original purchase of almost any market in the country:

Owners of single-family houses and condos in the city sold them during July, August and September after an average of 3.39 years from purchase, according to a report released Thursday by ATTOM Data Solutions, a California-based real estate tracking company.

That tenure is the third-shortest among metro markets in the country. The shortest was in Lakeland, Fla., where the turnover time averaged 1.97 years, and Bremerton, Wash., ranked No. 2, with an average of 2.79 years.

Nationwide, the average time between buying and reselling was 6.31 years, according to data from the third quarter of 2021.

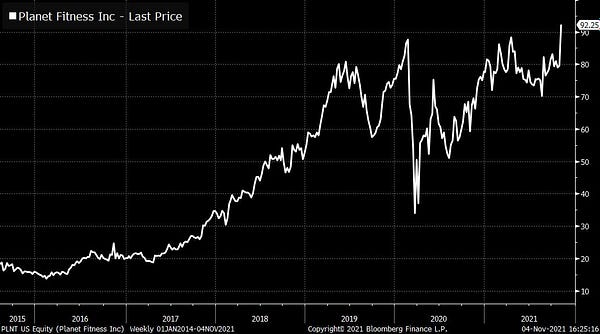

More on today’s topic: Planet Fitness stock is rising.

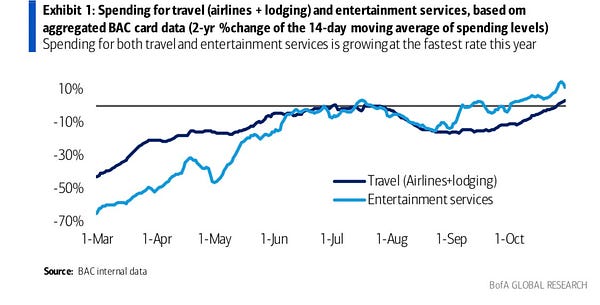

The world is re-opening:

One Good Read

If I could recommend just one thing to people to read this week, it would be this Harvard Business Review article, “The Busier You Are, the More You Need Quiet Time.” I frequently find myself in a constant state of noise from the busyness of work, community, and family life, all of which are very important to me, but all of which can combine to create a steady, non-relaxing hum. It’s important to find quietude every once in awhile, which I find not only helps me recharge and perform better in these other area of my life, but also helps me access a deeper level of thinking, which is helpful in all manner of things. From the article:

Recent studies are showing that taking time for silence restores the nervous system, helps sustain energy, and conditions our minds to be more adaptive and responsive to the complex environments in which so many of us now live, work, and lead. Duke Medical School’s Imke Kirste recently found that silence is associated with the development of new cells in the hippocampus, the key brain region associated with learning and memory.

Let’s all unplug for a little bit as we move into the holiday season. Have a great week, everybody.