The Greater Fool

It is a principle of economics that the true fair market value of an asset whether it be a property, stock, work of art, baseball card, or whatever, is the price at which two rational individuals are willing to transact it. The problem, however, is that human beings are rarely rational. We are at various times impulsive, impatient, anxious, greedy, delusional, or just plain bored. In short, we are emotional creatures. And emotions do strange things to us especially when it comes to money.

It is hard to sit on the sidelines when something is rapidly appreciating in value. Think of internet stocks in the late 1990s. As stocks like AltaVista, Netscape, and Pets.com kept rising in value, ordinary Americans started pouring money into them, which of course just perpetuated these stocks’ upward momentum. At a certain point the stock prices were completely separated from any intrinsic value of the company and traded purely on momentum. This is how bubbles form.

From the Sunday Morning Post archives: What Dutch Tulips Teach Us About 21st Century Investing, 5/9/2021

There is an alternative theory, or strategy, some might say, when it comes to investing in rapidly appreciating assets, however. In order to make a profit, a person doesn’t necessarily need to own something with much actual value to it or any real value at all; the person just needs to find someone who will buy it for a greater price. This is what is known as “The Greater Fool Theory.” No matter what something is worth, it is a good investment if you can find a fool to buy it for more.

With this in mind, investors can look to the momentum in a particular investment, try to ride that momentum upward, and sell for a higher price just days, weeks, or months after their initial purchase. And oftentimes, that person who is buying it is actually looking to do the same thing! That buyer wants to acquire it only to sell it for a higher price to someone else…to a Greater Fool.

Today’s Bubbles

Nowhere do I see the Greater Fool Theory at work more clearly today than in NFT’s, which is an acronym for “Non-Fungible Token.” I have read about NFTs’s for months now and admittedly I still barely understand them but let me try to explain it as simply as I can: an NFT is any digital asset, which could be digital artwork, a video clip, a picture, a story, etc., that is stored on a digital ledger, which is generally referred to as a “blockchain.” The benefit of owning an NFT is that there is only one of it; an image can be screenshotted, saved, and copied an infinite number of times, but there is only one original version with its own digital fingerprint, the rights of which are saved in code on one of these digital ledgers.

Whether NFT’s have inherent value is, to me, questionable. Dubious, even. And the sales of NFT’s have been wildly exorbitant over the last year. Consider the following:

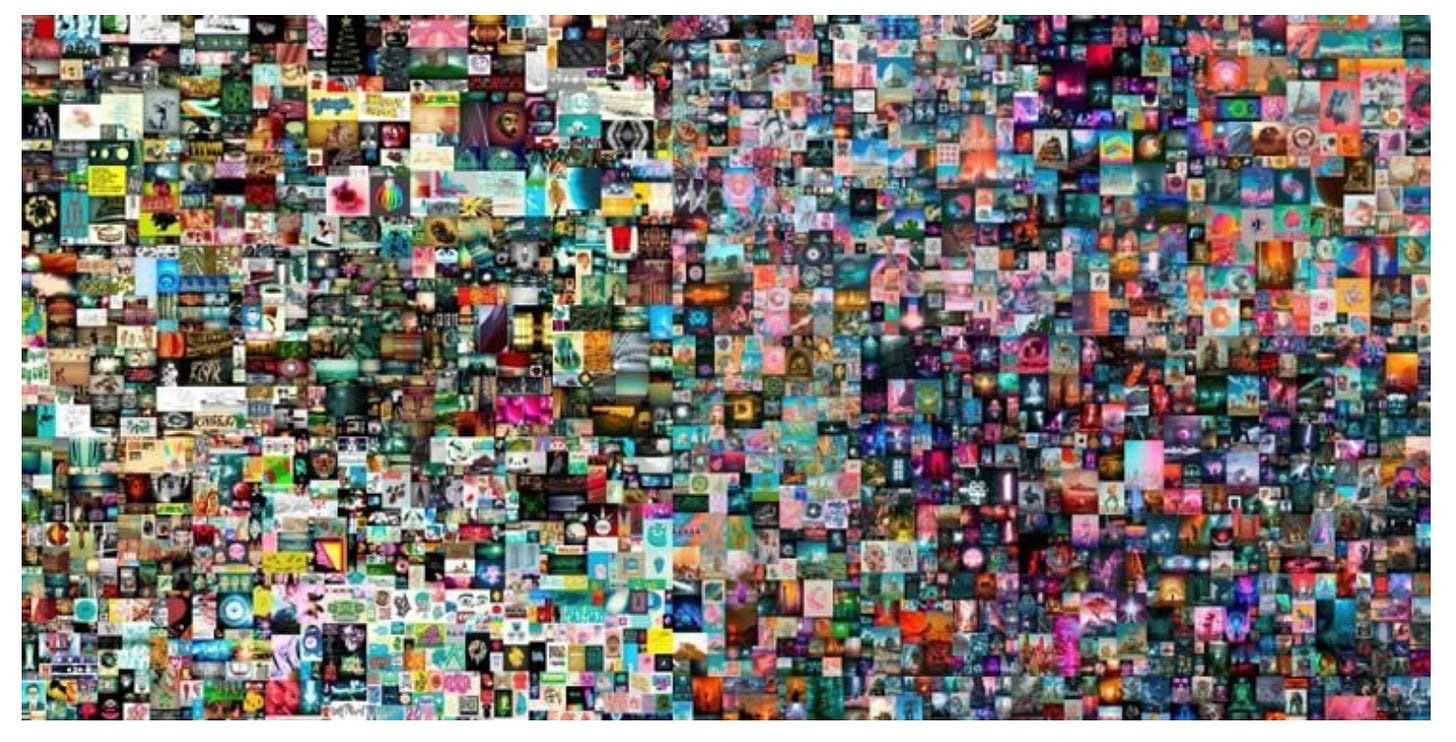

An artist named Beeple sold a compilation of his work for $69 million dollars. The piece was auctioned by the venerable auction company Christies, and the sale instantly made Beeple one of the most profitable artists in human history. Monet, Van Gogh….Beeple.

:”Everydays” by the artist Beeple, Source: ScreenRant.com So-called Cryptopunks, which Christies describes as “a collection of 24x24, 8-bit-style pixel art images of misfits and eccentrics. There are exactly 10,000 of them, each with their own ostensible personality and unique combination of distinctive, randomly generated features,” are now selling for $11 million a piece.

Founder and former CEO of Twitter Jack Dorsey recently sold the digital rights to his first tweet for $2.9 million.

There are also many smaller NFT’s selling for hundreds and thousands of dollars. Celebrities from Paris Hilton to John Cena to Wayne Gretzky are getting into the NFT game by creating their own digital assets. Bloomberg recently noted, however, that the celebrity NFT game does not appear to be going well so far:

Consider “Earth” -- one of several NFTs issued by [musician] Grimes in February. Depicting a cherub spearing the globe, perhaps in a reference to her baby with SpaceX’s Elon Musk, it was part of a collection that netted the artist (whose real name is Claire Elise Boucher) about $5.8 million after selling out in 20 minutes. While the cost to originally own one of the 303 limited editions was $7,500, one unit recently resold for just $1,200 in a stunning 84% drop. Likewise, a piece rapper A$AP Rocky sold for $2,000, showing him spinning around in space, in April just traded for about $900.

The Emperor Has No Clothes

From what I have read, studied, and followed on Twitter, proponents of NFTs are very serious about the utility and long-term viability as an asset class and investment. Undoubtedly they understand the complexity of it better than I do. And I am sure what I am about to write would read to them like an old man shaking his fist as the clouds. But in my opinion, we will someday look back (and maybe not that long from now) at NFTs as one of the great classic investment bubbles. Price appreciation is not being driven by intrinsic value of the assets; it being driven by the Greater Fool Theory. People are buying these things up because they believe they will rapidly appreciate in value and they think they will be able to sell them to someone foolish enough to pay even more for them. Many of these people have been deluded into thinking these NFT’s have actual value, so they in truth do not even realize they are being fools themselves.

The problem for investors in a situation marked by rapidly appreciation assets and at which the Greater Fool Theory is at play is that eventually you run out of fools. When a marketplace has no buyers, prices can and do reverse pretty quickly. Look at internet stocks during the Dot Com boom in the last 1990s and early 2000s: from March 2000 to October 2002, the NASDAQ, which is overweighted with technology stocks, dropped 78%. Many companies lost nearly all of their market value and some went out of business altogether. Pets.com, for example, which was one of the most famous stocks of the dot-com era, was established as a company in November 1998, had a famous Super Bowl ad and related marketing campaign, went public and started trading on the stock market in February 2000, and was out of business by November 2000. The stock was $11/share at the time of its February 2000 IPO and had dropped to 19 cents/share on the day it declared bankruptcy just nine months later.

What Comes Next

I want to make clear that I am not a financial advisor and this article is just meant for discussion purposes and for general education. Nor do I fully understand NFTs and other digital assets. But to me the situation today with NFT’s is as clear a sign of a bubble as you can find. The market is marked with frothy exuberance. We are long past the stages of rationality. And now you see celebrities, businesses, and even non-profit organizations trying to mint their own NFT’s to take advantage of the moment. Greater Fools abound who are buying these things up, but the bottom is going to fall out eventually and it won’t be pretty.

Other Bubbles?

An interesting question that keeps bubbling up is whether the price of Bitcoin and other cryptocurrencies like Etherium are examples of the Greater Fool Theory at work. I think in many ways they are. One difference between Bitcoin and an NFT, however, is that Bitcoin is more liquid and can be transacted as an actual currency. Businesses around the world and even some governments have started to use and allow cryptocurrencies for transactions. With NFT’s, on the other hand, there are ways to sell them and plenty of interested investors, but it’s not as easy as buying or selling cryptocurrencies.

Cryptocurrencies also have a limits built into their codes so there will only be a certain number of each that can be created, which gives some certainty to the market. Indeed this is one of the compelling justifications for the existence of cryptocurrencies; if a government runs out of money it can just print more, which dilutes the value of existing dollars and can lead to inflation, but there will only ever be a maximum of 21 million Bitcoins. So for that reason cryptocurrencies do have some actual utility in a way that an NFT, in my opinion, does not.

The problem, of course, is that who knows what one Bitcoin is actually worth. Yes, at the time of this writing one Bitcoin is worth about $48,000, but that is not pegged to anything with inherent value. The value of one Bitcoin is just what the marketplace of Bitcoin users and investors believe and collectively tell themselves it is.

I actually think there is a long-term role for cryptocurrencies in the global economy. I’m only just touching the surface here today on the many compelling reasons why a global digital currency makes sense. I have not talked about the drawbacks, though, including the environmental impact of so-called digital mining, which requires an enormous amount of energy, or of the propensity for illegal and illicit behavior to be carried out using digital currencies. But it’s clear there is plenty of interest in having a global currency and a digital one at that, so I expect Bitcoin and others will be around for years to come, maybe forever.

But back to the Greater Fool question. What is one Bitcoin worth? Well as I write this today on Saturday, December 4th, 2021, one Bitcoin is worth $48,281. Investors and speculators should be aware (and I’m sure many are) that this price is about $10,000 less than Bitcoin was worth two days ago. You read that right: Bitcoin and other cryptocurrencies have been getting crushed over the last 48 hours. Whether this is a bubble popping or just a resetting before these coins continue their climb remains to be seen. But as I see ads on Twitter and Facebook propping up the price of Bitcoin and other cryptocurrencies and digital assets and urging investors to pour money into them, it feels to me that a lot of holders of these assets are looking for just one thing: fools who will pay more.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Here are some links to things around the web that caught my eye this week.

Per Maine Biz, Old Orchard Beach, which has a population of 8,960 that grows to over 75,000 in the summer, is getting 55 new rental units that will target older residents: https://www.mainebiz.biz/article/affordable-housing-development-breaks-ground-in-old-orchard-beach

The job market remains on fire yet people’s perceptions of the economy are in the tank. There is more going on. I wrote about this a bit Thanksgiving week.

Quick peek at the labor market:

One Good Read

I enjoy the Pivot Podcast, which is about technology, finance, and politics. The co-hosts are not always right, but their banter is great and they touch on a lot of topics that are of interest to me and I think that might interest you too. Here is a link to Pivot.

Regarding this week’s “One Good Read,” one of the co-hosts of Pivot, Scott Galloway, wrote an advice-to-graduates column last June. It won’t be for everybody, but it resonated with me a lot especially thinking back to the early days of my professional life. I have shared it with a couple of the younger people I work with now and today I share it with you. Scott Galloway: Advice to Grads, Be Warriors, Not Wokesters:

Be mentally and physically … warriors. Lift heavy weights and run long distances, in the gym and in your mind. Many tasks you’ll be asked to perform early in your career will be tedious. Don’t do what you are asked to do, but what you are capable of doing. Think of it as boot camp before being sent to battle, as there are millions of other warriors fighting to win the same regions of prosperity. Get strong, really strong. You should be able to walk into a room and believe you could overpower, outrun, or outlast every person in the room.

Like I said, not for everyone, but read the whole article and you might find tidbits of wisdom relevant to you or to people in your life.

Have a great week, everybody!