The Housing Supply Gap

Significant challenges abound in the current housing market. Whether it is housing for the homeless, rental units for low and moderate income renters, single-level senior housing, mid-range homes for first time homebuyers, or available homes for existing homebuyers who are just looking for something larger, prices are rising and there is not enough supply in all manner of housing.

According to Freddie Mac, we need 3.8 million more homes to close the housing gap. A recent study by Realtor.com (via CNBC) put the number at 5.24 million. The National Low Income Housing Coalition calculates there is a shortage of 6.8 million affordable rental units for extremely-low income renters. This all comes as prices for both homes and rental units have surged over the last 18 months thanks to low interest rates, strong demand from people who have become more mindful of their homes life during the pandemic, and a variety of other factors including the fact that Americans’ balance sheets and creditworthiness are both stronger than ever thanks in large part to a recovering economy and multiple rounds of federal stimulus payments.

Ultimately, though, the price problem and the supply problem are two sides of the same coin: when demand is strong and supply is low, prices will rise, which is exactly what is happening. Absent a notable increase in supply and assuming demand continues to stay strong, prices will stay high and even continue to rise.

Closing the Gap

There are countless policy proposals out there for how to close the housing gap, many of which are worthy and worthwhile. I wrote about one small idea several weeks ago, which is to adjust code requirements to require fewer parking spaces for each rental unit, which would allow more rental units to be built on certain parcels of land. In the great scheme of things, however, ideas like that one are just nibbling around the edges. More significant levers need to be pulled, all of which will ultimately come back to the government, non-profit agencies, and for-profit builders working together to increase rates of construction of new units and rehabilitation of existing units.

In September, the Biden Administration released a list of policy proposals to help close the housing gap. The ideas include:

Increasing Freddie Mac and Fannie Mae financing for manufactured homes, which are more affordable for many buyers than traditional stick-built homes.

Increase Freddie Mac and Fannie Mae financing for 2-4 unit homes where the homeowner occupies one of the units, which could help prospective homeowners acquire a property that would also produce rental income that could help cover the mortgage payments.

Increase Low Income Housing Tax Credits to developers who build low income housing, which would incentivize and financially reward builders for creating new low income units.

Make additional funding available to construct new housing units for low and moderate income tenants through the Neighborhood Homes Investment Act and other programs.

Incentivize less restrictive zoning rules to encourage multifamily development. (Note: California recently loosened up their state requirements to allow people to build duplexes, multi-families, and accessory-dwelling units also known as ADUs on lots zoned for single-family residences).

The Biden Administration believes that this set of proposals will help create over two million housing units in the years to come.

The limited-government side of me tingles a bit when government gets involved with a significant issue like this, but it is clearly evident that the private sector is not sufficient to meet the current supply-related challenges in the housing market. And there are collective benefits when more people are housed for all manner of reasons ranging from home ownership being a traditional pillar of the American Dream and upward mobility to the fact the people who struggle to find housing including the homeless are, well, expensive to society. The cost to taxpayers to pay for one night in an emergency room, jail, or even a shelter is a lot less than the cost of housing someone in safe permanent housing (this point alone could fill its own article at some point in the future).

Plus, government would never be able to solve these challenges on its own; it could only do so by partnering with the private sector. If either the federal government or various state governments were to embark on a significant home-building project, the immediate beneficiaries of such a program (besides future homeowners and tenants) would be the builders themselves. It is not like the government has a magic wand or a stable full of government-employed homebuilders it can tap; the work would have to be done by contractors, construction crews, and homebuilders in the private sector. So rather than compete with the private sector to solve the housing crisis, government would, indeed, need to partner with it. Government funding for the creation of new housing units would itself be a form of stimulus by the way, as funds would end up flowing to homebuilders, suppliers, and others involved with the home construction and real estate markets in different ways.

A Word of Caution for Rental Property Owners

What is good for one set of people is not necessarily good for another, and I want to offer a word of caution to the owners of existing rental properties, which I know many of my readers are. There are risks with any endeavor and the challenges of tenant management, inevitable renovation needs, and possible legislative changes are always there. Certainly there have been many landlords and property owners who have experienced challenges over the last 18 months from tenants not paying their rents and the property owners being left with little recourse due to eviction moratoriums. It is not easy to be a property owner and landlord, but at the same time, I think we can all acknowledge that it is a pretty good time to be one. Property values are appreciating rapidly, there is no shortage of available tenants, rents are steadily rising, and interest rates are fairly low, which allows for both the easier acquisition of new properties and the financing of renovations and improvements to existing properties. All things being equal, landlords and property owners have a lot of things going for them right now.

My word of caution is this: markets correct themselves. It is a principal of economics and a pillar of our capitalist society: when a profit opportunity exists, people seeking to take advantage of this opportunity will enter the market, and in doing so, the opportunity may dwindle as more and more market participants may end up watering down the profit margin. Think of oil wells: an opportunity may be identified, profit seems assured, but eventually there are so many straws in the drink that people are not making as much money as the earlier participants were or they might not make any money at all.

I’m not saying rental property owners are not going to make money or that it might all go bust. People will always need places to live. And the market has a long way to go before the housing gap is closed. It may take 10-15 years of building to get anywhere close to closing the gap and, in fact, we may never get there. But the gap will narrow. I see it everyday in my work as a banker. I see homebuilders building new rental units, I see mom and pop landlords converting single-family homes to duplexes or three-units, I see larger developers building subdivisions and large multiunit rental projects that are more like mini-communities than one-off projects. Everyone is trying to take advantage of the hot rental market. And then I see government taking more proactive steps like the ones listed above to incentivize more housing development. All of this leads me to conclude that the supply gap will close or at least narrow in the years to come.

So file this away in the back of your heads, all you readers who are also rental property owners: the nightmare scenario for property owners is that in 5-7 years interest rates have risen so the cost of borrowing is higher, the economy is in a trough so tenants are in financial peril themselves and are having trouble making their rent payments, which could also lead to the reversal of rent inflation, and there are millions of new housing units that have been built and hundreds of thousands of more landlords and property owners offering potential places to live. The rental market might not be quite so hot (or profitable) for property owners in such a landscape.

So remember again, markets react and correct. These things are hard to predict and it may take many years, but right now there is a lot of reaction to the profit opportunity that exists today in owning and managing rental properties. And the scenario I have described above is not so far fetched that parts of it, at least, may come to pass.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Here are a few things from around the web that caught my eye this week:

Eric Scigliano discusses in Politico the work-from-home revolution and how communities may revamp themselves to attract people who can work remotely: https://www.politico.com/news/2021/10/21/covid-americans-cities-remote-work-515998

The Fed Beige Book noted recently that businesses are finding it easier to pass price increases along to customers, which I interpret as a sign of demand-driven inflation: https://www.federalreserve.gov/monetarypolicy/beigebook202109.htm

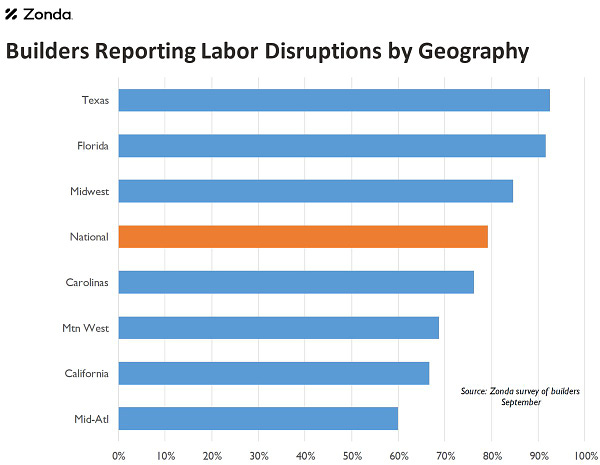

Ali Wolf highlights an issue that is leading to headwinds for the home-construction market even amid roaring demand, which is that there are not enough workers:

More on demand being a key inflation driver via Derek Thompson:

Have a great week, everybody! Email me at ben.sprague@thefirst.com (professionally) or bsprague1@gmail.com (personally) with feedback, suggestions, and story ideas.