The Simple Reason Home Prices Are Rising

When something rises in value in a surprising, unexpected, and notable way, we try to come up with ways to make sense of it. It makes for a good story and an easy explanation to say people are being greedy or irrational or that they just don’t understand the value of certain things. And, to be sure, there are plenty of examples throughout history of investment bubbles formed by shortsighted frenzies. I wrote about NFT’s in my article just last week: The Greater Fool, noting, “Human beings are rarely rational. We are at various times impulsive, impatient, anxious, greedy, delusional, or just plain bored. In short, we are emotional creatures. And emotions do strange things to us especially when it comes to money.”

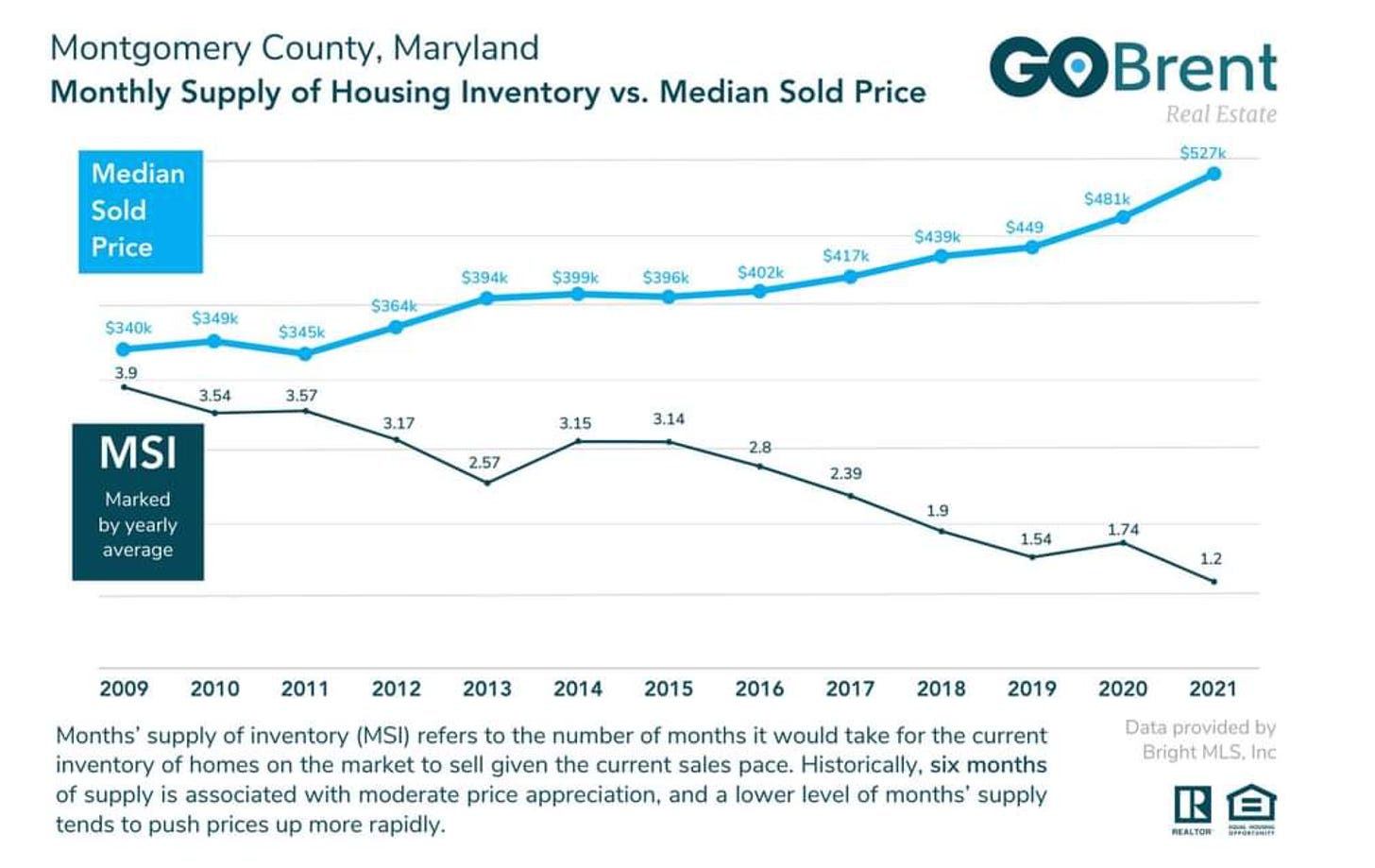

But sometimes, the explanation can be much simpler. I have written a lot about rising home values over the past few months. This week in doing some further research I happened upon the chart below that shows the relationship between home prices and the supply of homes available for sale in Montgomery County, Maryland:

Now, you could make a case that Montgomery County is not exactly representative of the United States as a whole. It is located just outside of Washington D.C. and is one of the most affluent counties in the country. The $527,000 median home price in 2021 noted in the chart above is far above the national average. Nonetheless, I think if you were to look at a similar chart for almost any other county in the United States, the trajectory of the lines would be nearly the same even if the values were different.

So what are we looking at here? The upper light blue line is the median price of homes sold, which has risen pretty steadily over the last ten years with a particular surge upward over the past two years. The lower dark blue line is the “months’ supply of inventory,” which the makers of the chart define as “the number of months it would take for the current inventory of homes on the market to sell given the current sales pace.” The drop in that line reflects the fact that homes are selling faster and faster. Right now there are only 1.2 months of inventory on the market in Montgomery County, which is the lowest level since before 2009 (and probably ever!).

Supply, not just demand

For all the talk in the current housing market of bubbles and irrational exuberance, to use a phrase coined by former Fed Chair Alan Greenspan in the 1990s just as the Dot Com Bubble was getting underway, there is a pretty simple explanation for why home values are increasing in value so much: a lack of supply amid roaring demand. When this is the case, prices will rise. This is a principle of economics and was written about by the likes of John Locke and Adam Smith hundreds of years ago. It is the same with virtually any other good or service: if the demand is stronger than the current supply is able to meet, sellers (i.e. the holders of the supply) can and will increase the prices they are selling things for. It’s really as simple as that. With homes, there is more demand than supply, so the price of the supply is rising simply because…it can. Demand will still be there, so sellers are able to sell for more because, needless to say, sellers want to maximize the price they can sell for.

Now, of course, the demand side matters too and there are a lot of reasons why demand is so strong. I wrote about this several months ago in my article “2021 is Different Than 2007.” If you’re really interested in this topic I would encourage you to read that piece, but to briefly recap:

Interest rates are low and you can buy a lot more home at a 3.00% interest rate than, say, a 6.00% interest rate.

Homebuyers are in stronger positions financially today than they were in 2007.

There are a lot of new homebuyers (i.e. Millennials and Gen Z) coming into their prime home-buying years.

Rents are high, so for those who are able to, why not buy instead?

In short, the housing market is strong and the reasons why are not overly complicated. Yes, demand is strong. But supply is also low. These factors combined lead me to conclude that this is not a bubble in the traditional way that people think of such things. The home market has room to run.

I do think as interest rates inevitably rise over the next two years things will slow down. Even amid this, though, the question for policymakers and others is how to increase supply, which would be helpful to bring the housing market back to equilibrium and ease the pressure on buyers, but that is a topic for a future week.

Do you have a topic, suggestion, or feedback for The Sunday Morning Post? Leave a comment below. 👇

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Here are a few things that caught my eye around the web this week:

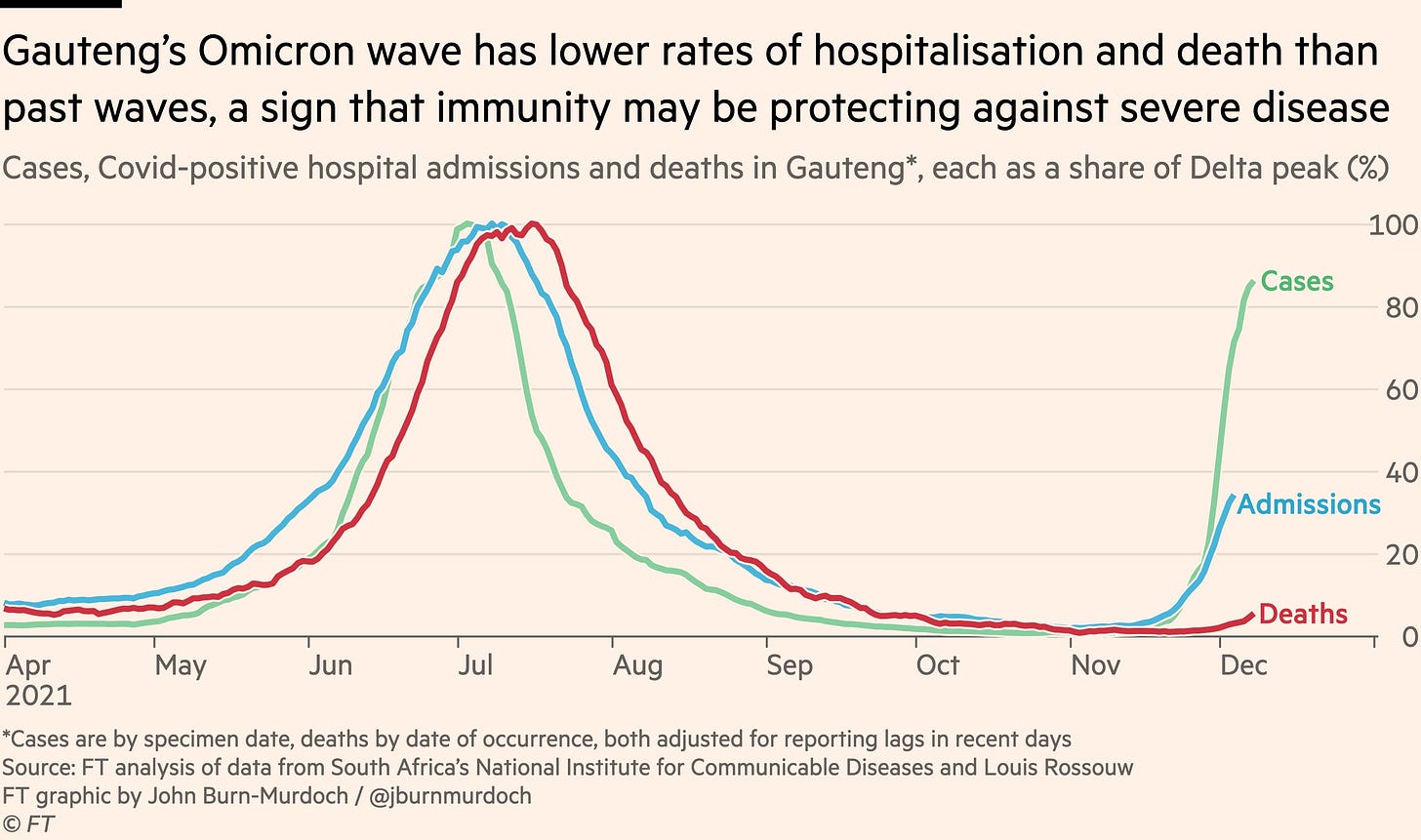

A chart by John Burn-Murdoch suggests the Omicron Variant is spreading quickly, but the deadliness of the virus is tempered by both vaccinations and previous COVID infections, which provided some immunity. In Financial Times, Burn-Murdock and his co-authors note, “Four percent of [hospitalized] patients died, compared with a fifth in the other waves of infection, according to the data.” This gives me some hope, although it does also underscore the importance of getting vaccinated. The chart via John Burn-Murdoch on Twitter:

Via Carl Quintanilla, Morgan Stanley expects interest rate hikes by September 2022:

After collapsing last summer following a steep run-up, lumber prices are back on the move: https://www.bloomberg.com/news/articles/2021-12-10/lumber-soars-to-six-month-high-as-buyers-scurry-to-find-wood. From the article:

Lumber is the most common building material for homes in North America, and this latest rally increases the likelihood that housing costs will rise further at a time when consumers are already facing soaring inflation in vital products such as food and fuel.

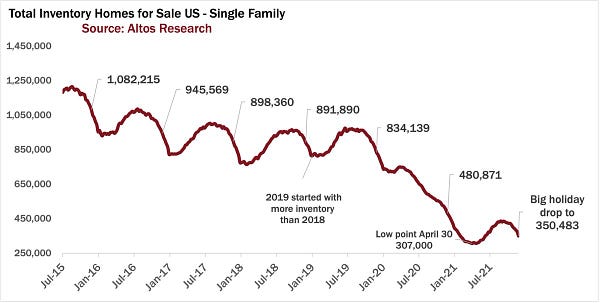

Underscoring my main point from this week’s article, nationwide inventory of homes-for-sale is at or near its lowest levels in years:

One Good Read

I enjoyed this piece in DownEast Magazine, “The Maine Winters I Remember - And the Ones Yet to Come,” by Porter Fox, in which he illustrates a nostalgic look at Maine winters’ past while considering the winters of the future. He writes of the past:

When it finally came, the ice on Mount Desert Island came all at once, locking Echo Lake, Long Pond, Eagle Lake, and the tight, rocky circle that hems in Somes Pond in a thin, glassy layer. It spanned the depths, sagging a bit in the middle and flaking along the shoreline. If it snowed, then we were done. The flakes mixed with lake water and formed an impenetrable slush we could neither shovel nor skate through. When the cold came fast, with a high-pressure system and no precipitation, the entire island transformed overnight.

One Last Thing

I had some fun this week creating a meme related to the McDonald’s in Freeport, Maine. If you’re not familiar, the Freeport McDonald’s is fancy. I have heard it is because of town regulations that prohibit certain types of signage (i.e. Golden Arches, etc.). It does not look or feel from the outside like a McDonalds, but it is a McDonalds nonetheless. In driving north to Bangor from Portland this past week, I was tempted to pull off I-95 in Freeport just to go to this McDonald’s, which I have been to many times mostly with my kids, who love it. I thought of the Winnie-the-Pooh meme that floats around from time to time and when I got back to Bangor I created the following:

That simple tweet has been reviewed over 90,000 times. It was also shared on the popular Maine Memes Facebook page, where it has been liked over 1,500 times and shared nearly 900 times as of the time of this writing. As I said in a follow-up tweet, I am grateful to everyone who enjoyed the joke and shared it and I will always remember the 24-hour period I helped to unite Maine Twitter around our shared fascination with the Freeport McDonald’s.

Have a great week, everybody!