Lately in these articles I’ve been taking stock of where things stand as we embark upon a new year. If you are new to The Sunday Morning Post, you might enjoy my recent articles on The State of the Housing Market and The State of the Rental Market. Today I thought it would be worth taking a look at the State of the Consumer, especially as consumer spending makes up nearly 70% of our Gross Domestic Product. As the consumer goes, so goes the economy. So how are people feeling these days? And perhaps even more importantly, how are people behaving these days? Recent data provides some clues.

Consumer Sentiment

The University of Michigan Consumer Sentiment Index, which has been tracking data since the 1940s, was chock full of interesting bits of information for the month of January. In general, the survey found that consumers are feeling better than they were a month ago, and also better than they were feeling a year ago. From the report:

The current conditions index soared 15% above December, with improving assessments of both personal finances and buying conditions for durables, supported by strong incomes and easing price pressures. That said, there are considerable downside risks to sentiment, with two-thirds of consumers expecting an economic downturn during the next year. Notably, the debt ceiling debate looms ahead and could reverse the gains seen over the last several months.

The continued deceleration of inflation combined with a strong labor market and rising incomes have people generally feeling positive. Lower gas prices of late also have people feeling more upbeat. Although as noted above, two-thirds of people expect a more troubled economy in the months ahead. The gridlock in Washington and a possible government shutdown amid the debt ceiling debate are major causes for concern. But in general, consumers are feeling more positive of late.

Consumer Spending

Although consumer sentiment is improving, consumer spending was down in December for the second straight month on a seasonally adjusted basis. Changes in consumer spending over the past five months show a possible topping out of spending, at least on a short-term basis:

August: +0.7%

September: +0.6%

October: +0.8%

November: -0.1%

December: -0.2%

Consumers are likely pulling back for a variety of reasons. Inflation has been on a lot of people’s minds and hit wallets and family budgets particularly hard in November and December. The higher cost of borrowing has slowed down all types of purchases from cars to home repairs. And there has been a general feeling that the economy is tightening. Repeated by the media enough, sometimes these things can almost feel self-inducing; although, to be sure, when so much of your paycheck is being spent on higher costs on food, energy, and other items including higher rents, it definitely feels like a more dour economic environment. The inflation effect is real, and it has people spending less.

Labor Market

The last time the unemployment rate was as low as it is today, the #1 song in the country was Aquarias/Let the Sun Shine In by The Fifth Dimension. The month was May 1969. Today, as then, the unemployment rate is a paltry 3.4% with 517,000 new jobs created last month according to the January jobs report, which was released on Friday. Economists had only expected that 187,000 new jobs would have been created, so this was quite the blowout. Per Axios:

This is a rip-roaring labor market, in stark defiance of months of recession chatter — and the Federal Reserve's efforts to slow things down…American workers — outside of a handful of sectors — are experiencing some of the most plentiful opportunities in generations — even as inflation has been coming down.

So people are working, and that is good for consumer spending. But what about wages? Well, it’s more of a mixed story there, depending on your perspective. On the one hand, wage growth is starting to ease off; wage growth in January was 0.3%, down slightly from the 0.4% number in December. For the 12-month period, wage growth was 4.4% through January, which is down from the previous 12-month period.

Why it this a mixed bag? Well, if you are a worker, you of course want to make as much as possible. Plus strong wage growth especially at the low and middle points of the wage spectrum fuels further economic growth, makes individuals and families more well-off, and decreases expenditures on government benefits because people who are working do not typically need or obtain as much in government support. However, as Fed Chairman Jerome Powell has pointed out many times over the past year, such strong wage growth has itself contributed to inflation, which erodes the benefits of much of that positive economic growth.

Economic theory generally holds that inflation is unlikely to be tamed without a significant slowing of wage growth plus actual job losses. The fact that the unemployment rate is low, wages are still rising but moderating, and inflation is on its way down is, truth be told, the dream scenario for the Federal Reserve at this point. Hopefully these trends will last.

It is lastly worth noting, however, that although wages did rise 4.4% through January, that is still less than the overall rise in prices over the last year, so people getting a 4.4% pay increase are not quite breaking even even if their wages are nominally rising. So I wish nothing but robust wage inflation for all of you, my dear readers, overall inflation be damned.

Credit Card Balances

The above data paints a fairly optimistic picture of the state of the consumer. Consumers are feeling good, spending is down a bit but that may be attributable to the more acute impact of high inflation in November and December, and inflation itself is on its way down, which could lead the Fed to soften their pace of interest rate increases.

Another helpful point in the consumer question is that after a down year in 2022, stocks have been on a tear in 2023 so far. While the Dow Jones is up a more modest 2.4% for the year (which is really not bad in one month, to be fair), the S&P 500 is up 7.7%, and the NASDAQ is up a staggering 14.4% so far in 2023. This made for the best January for the NASDAQ since 2001. Stock markets helping investors to recoup a portion of their 2022 losses may make consumers with investable assets (including 401(k)’s and other retirement accounts) feel a little more comfortable as we look ahead to the rest of the year. The so-called wealth effect could loosen up spending if these market gains can hold.

But there are also some warning signs out there. One thing that does worry me is that credit card interest rates have surged in the past couple of months, as shown in the chart below:

After being in the 14-15% range for much of 2019 to 2021, the average interest rate on a credit card nationwide in November was 19.07! That is quite a jump. The last time credit card rates were that high was, well, never; rates topped out around 16% in the mid-1990’s and the early 2000’s but have never been as high as 19% as far as I can tell.

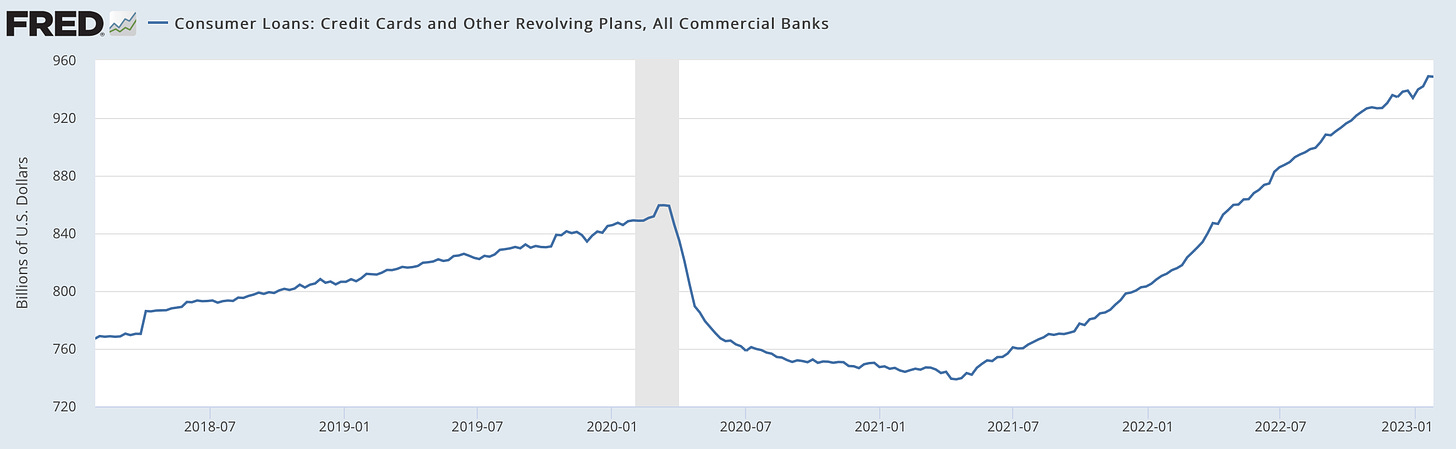

The double whammy, and you probably already suspect this next chart is coming, is that credit card balances are also at an all-time high:

Ruh roh. It’s very interesting to see how total nationwide credit card balances fell during COVID. Not only were most Americans receiving multiple rounds of stimulus funds that many used at least in part to pay down debt, but most people were not traveling or dining our as frequently. All sorts of discretionary spending declined, so people took on less debt and paid down what debt they had. But then once that stimulus petered out and the world re-opened….bang! Americans went back to their credit cards.

It doesn’t take an economist to identify the risk to the broader economy here. The unemployment rate is historically low, credit card balance are historically high, and the interest that credit card holders are paying on that credit card debt is also the highest it has ever been and by a quite large margin, too. Americans are over leveraged, but eventually that debt needs to be paid down. And paying down this consumer debt will divert dollars from being spent on other things, which will have a damping effect on future consumer spending.

What It All Means

To me, it feels that we are at an in-between moment. Despite the negative tone of the immediate previous paragraphs, there is a lot to like in the current economy. But as I’ve often said, economies and the people in them evolve. The unemployment rate won’t always be 3.4%.

My own opinion is that the Fed has hiked interest rates too much, too fast. This puts me in company with the likes of both Elon Musk and Elizabeth Warren - strange political bedfellows.

While the Fed is in a good position at the moment, there is a risk that they may have already overshot on rates as it will take several months for the impact from all of these hikes to filter through the economy. The Fed seems to be recognizing this, as they increased interest rates this past week by a mere 0.25%, which was the smallest single rate increase in nearly a year (all other rate hikes have been 0.50% or 0.75%). This is a sign of a shift in policy, or at least of a recognition that we might want to take a wait-and-see approach for a bit.

It would be easy for me to point to the credit card data as the seeds of a pending economic collapse. I sometimes think that if I wanted to grow a newsletter subscriber list of hundreds of thousands of readers, I could do it by delivering doomsday predictions every week as there is plenty of appetite for that out there. But that is not my style or temperament or what I actually believe the data shows.

What I think the case is at the moment at least, is that the job market is strong and showing no real signs of an immediate downturn and inflation is on its way back to a more reasonable level of 2-3%, likely by the end of this year. It is hard to have a major recession when so many people are working. And the easing of inflation is going to boost spending rather than contract it as people feel more comfortable going to the store and will have more money in their pockets thanks to lower prices on food, gas, and utilities (hopefully) not to mention homes and rent.

My view at this point is that the American consumer is relatively strong. It has been a strange few years. But some of the weirdness is shaking out. If we do go into a recession, I believe it will be a shallow one. It is just hard to fathom a deep economic collapse when so many Americans are working and wages have been rising. For now, we should celebrate both a robust labor market and declining inflation and, as I mentioned above, hope that these trends continue well into 2023.

Ben Sprague lives and works in Bangor, Maine as a Senior Vice President/Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Weekly Round-Up

If the unemployment rate is not this low for another 53 years, let the record show the #1 song in the country was Flowers by Miley Cyrus.

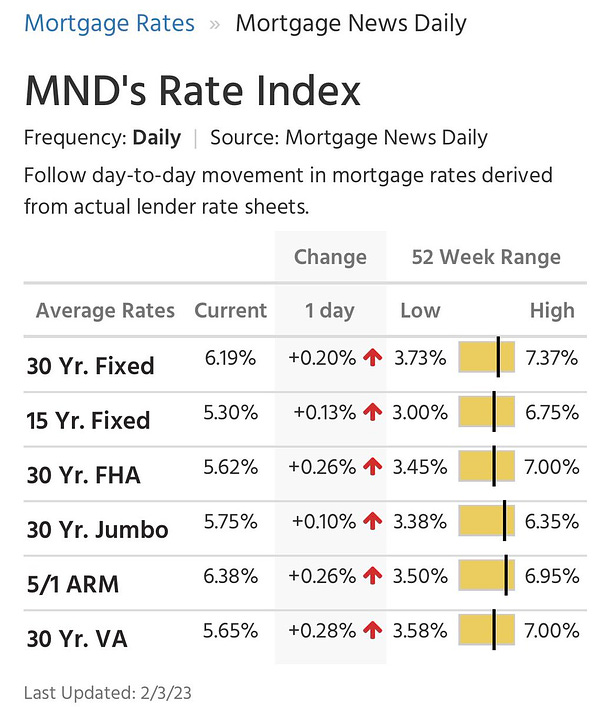

The average 30-year fixed interest rate briefly touched 5.99% on Thursday, which was the lowest it has been since September. The average rate did climb back to 6.19% on Friday, per Lance Lambert.

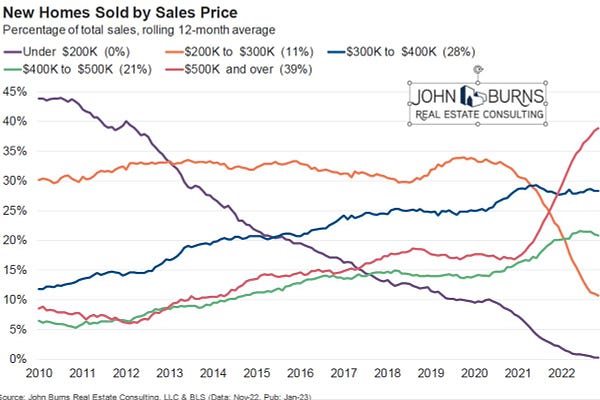

There are no new homes for less than $200,000 anymore, which is a problem for new and first-time homebuyers that I wrote about in August 2021, Homes Cost (A Lot) Less 50 Years Ago.

Want a laugh? Watch this 9 second clip of the Philadelphia Eagles coach after their NFC Championship Game victory last weekend.

Speaking of kids, I had a great time at the Valentines Dance on Friday evening with my daughter here in Bangor, Maine. By the end of the night it was a frigid -16 degrees with a -38 degree windchill, but we had fun.

Have a great week, everybody. If you’re here in the northeast, stay warm up out there!