I make it a point to avoid the mall area on Black Friday, but I did have to make my way over there early this past Friday morning to buy some electrical tape at Home Depot. We have a 40-foot pine tree in our front yard that we decked out in Christmas lights last year only to lose the lights on the top third of the tree when one of the plugs came loose on one particularly windy December night, hence the need for more electrical tape to keep this year’s lights aglow.

Unsurprisingly even at the relatively early hour of 8:00 am on this Black Friday it was already quite busy in the Bangor Mall area. As a quick aside, I think malls get a bit of a bad rap. Yes, empty storefronts in malls abound and it feels kind of sad walking through most American malls today. We all have great memories in malls, and there is a lot of nostalgia for the thriving, bustling mall days of yore. Deferred maintenance and notable capital needs are plentiful both in the actual buildings themselves and just as commonly on the access roads and parking lots. Bangor car mechanics are probably putting their kids through college on the shock, strut, and wheel replacements triggered by everyday rides around Bangor Mall Boulevard.

But malls in some ways have been victims of their own success. Yes, I said it, success. What do I mean by that? Well, the peripheries of most malls in this country including here in Maine are actually quite strong. Not to dwell on Bangor too much here, but if you look at the area surrounding the Bangor Mall the activity is pretty robust. Take Stillwater Plaza, for example, which is the area behind the Texas Roadhouse. You have an L.L. Bean outet store, a Kohl’s, Old Navy, Party City, Pet Smart, Bed Bath and Beyond and several other stores. If you took just the stores in Stillwater Plaza, which is really just a stone’s throw from the Bangor Mall itself, and hypothetically put them in the actual Bangor Mall, well the story of the mall wold be completely different. Instead of being on its virtual death knell (some might say), the Bangor Mall with these stores as a part of it would be thriving.

Funnily enough when I served on the Bangor City Council from 2011 to 2020, someone once complained about the closure of the Bed Bath and Beyond, which was formerly next to the Toys R Us building. “Woe to the mall area!” was the general tone this person took, who bemoaned the loss of Bed Bath and Beyond. I had to speak up and say, “Hey, the Bed Bath and Beyond didn’t close, it just moved into a larger location on the other side of the mall!”

So why aren’t those stores actually in the Bangor Mall itself? Well, for lots of reasons. Maybe their rent is less or the facilities are nicer where they are now. Or maybe they just wanted what felt like more dedicated parking closer to their storefronts rather than being part of a larger complex. Consumer preferences evolve over time and these days people want to be able to park right in front of where they are going. That is not always possible at a large mall, but it is feasible at one of these smaller properties nearby a larger traditional mall.

And what of the rest of the Bangor Mall periphery? It’s actually pretty thriving right now too! Consider all the restaurants that have come in within the last ten years that did not exist there before: Chipotle, Chik-fil-A, Buffalo Wild Wings, Five Guys, Las Palapas (Mexican), Sweet Frog, and several others. I have heard rumors that the Olive Garden in Bangor is one of the busiest and most profitable ones in the country. And where is it located? Right near the Bangor Mall.

Why did each of these businesses and restaurants set up shop where they did? Because they wanted to be in the “Mall Area.” Although other parts of Bangor certainly have bustling activity, the Mall Area is still a key economic focal point of the city and where a lot of businesses want to be. The Bangor Mall itself might be a shadow of its former self (although there are certainly some strong businesses there and very popular events like craft fairs and more), but the success the Mall has had in drawing countless other businesses to the area over the years cannot be denied. The City of Bangor certainly collects a large amount of property tax dollars each year from the periphery businesses and property owners including restaurants, other retail, car dealerships, big box stores, and more, and none of that would have been possible without the success of the Bangor Mall itself since it was first built in the late 1970s.

Anyway, I did not plan to write so much defending the Bangor Mall because we all know they’ve had their problems as have many malls around the country thanks in large part to a permanent shift in consumer behavior to online shopping to the lasting detriment of brick-and-mortar retail not to mention the significant underinvestment by mall management groups in the face of declining tenancy and struggling sales.

But people still have lots of stuff. And they still are buying things whether it be online or in-person, which brings me to the actual topic I wanted to discuss today.

Here’s a fun fact you can impress your friends with at your next office holiday party: according to industry watcher and analyst SpareFoot Storage Beat, as of January 2021 more than 10% of American households now rent a storage unit at an average monthly cost of $89. This number is up considerably over the past decade. One in ten households!

Investors and developers have taken note. Per Forbes, “From 2009 to 2018, self-storage facilities averaged an annual ROI of 16.9%. This number was higher than office, industrial, retail or apartments during that time.” I am sure the data would continue to show strength through 2021 (the article I found only had the data through 2018). The mix of self-storage facility users is dominated by residential, but it includes commercial and other tenants as well. According to Colliers International, “The typical tenant mix for facilities is approximately 77% residential users, 19% commercial users, 2% military personnel and 2% students.”

Storage units as an investment have become quite popular. For starters, they are relatively easy to build. In general the costs of construction are not extremely high (although the price of materials has been higher in recent times). Land especially in rural areas is typically pretty cheap. Tenant management is easy all things considered and a lot can be done through apps these days. And other than for short-term needs like a move or waiting or a home to be built, storage unit renters are typically pretty long-term tenants (in a non-traditional sense of the word). If a person cares enough about their stuff to rent a storage unit to keep it in, they probably also don’t want to throw it away in the future. As long as people can afford the monthly rent, they might rent that storage unit for quite a long time.

(All typical disclaimers should apply here about how I am not a licensed investment advisor. This article is meant for educational purposes only and not as a source of investment advice or guidance. Consult a CPA, attorney, financial advisor, and your significant other before making investment decisions, or any major decisions for that matter).

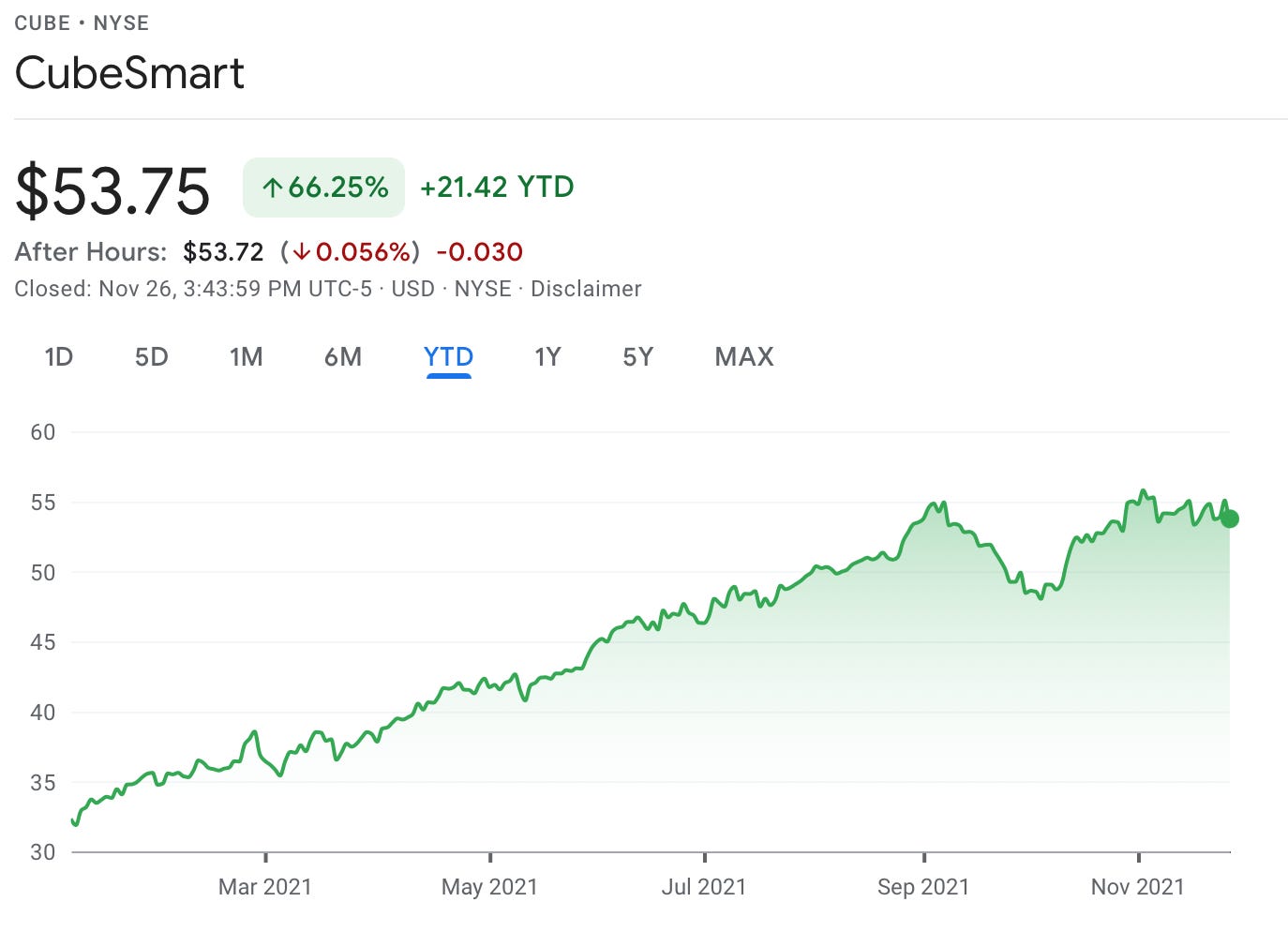

If you’re looking for a way to tap into the storage unit market without actually building or acquiring your own facility, there are several publicity traded companies that own large portfolios of self-storage facilities that you can invest in. CubeSmart (CUBE), for example, is a real estate investment trust (REIT) that owns hundreds of self-storage facilities around the country. It is up 66% for the year so far:

Other publicly traded companies in this same category include Extra Space Storage, Inc. (EXR), which is up 80% for the year, and the non-flashily named Public Storage (PSA), which is up 49% for the year. Oh, for a time machine to go back to invest in these companies one year ago. Investors should keep in mind what I wrote two weeks ago, which is that once a trend has been identified it may be too late to invest in it. In other words, the ship may have sailed at least for now on these companies. Investors might be wise to wait for a dip, but again, I am not a financial planner or investment advisor.

What is the future of storage units? I think it is pretty stable. In the investment space, the trend is towards both growth and consolidation as some of the large national corporations noted above continue to grow their portfolios of properties by not just building new units but acquiring existing companies.

Americans have lots of stuff and are only buying more. This has been especially true during the pandemic, when larger ticket items like RV’s, ATV’s, boats, tools, and equipment have been flying off the shelves and out of the lot. People need a place to store those too, and the storage market is evolving to respond. Higher end consumers are looking for all the perks that come with climate-controlled and, often, concierges service. That is a big market. In my opinion it is a pretty good bet to bank on American consumerism and people will always need somewhere to put their stuff, so the self-storage boom likely has room to run.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Thank to everyone who offered such positive feedback on last week’s article, “The Tired Thanksgiving.” It seems to have struck a nerve with people in a positive way as we are all dealing with a lot these days. Welcome to everyone who found their way to The Sunday Morning Post by reading that article. I am happy you’re here!

Our family spent the week getting ready for Thanksgiving, which also happened to be my mom’s birthday. I tried to not spend as much time online this week as usual in the spirit of my “Tired Thanksgiving” article, so I don’t have any articles to share for this week’s Weekly Round-Up. We did get our front-yard Christmas Tree lit on Saturday night and it was a big hit with the neighborhood kids. I hope that someday when these kids are home visiting from college or wherever they will still come share this tradition with us.

Have a great week, everybody!