Disclaimer: I am not a licensed investment advisor. The following is meant to be informational only. Consult a licensed advisor and accountant before making investment decisions.

Millions of Americans were liberated from trillions of dollars of their retirement savings this week in one of the worst two-day periods in stock market history. The Dow Jones Industrial Average dropped by nearly 1700 points on Thursday before falling by over 2200 points on Friday. The S&P 500 notched similar losses and the tech-heavy NASDAQ fell by even more.

It’s hard not to be fearful right now, especially if you are approaching retirement, in retirement, or investing dollars that you just cannot afford to lose. The old investment axioms like, “Be fearful when others are greedy, and be greedy when others are fearful,” have indeed withstood the tests of time for a reason, but these things are also easier said than done. Old sayings can feel trite on the heels of significant losses in such a short span of time.

The fear is especially palpable when there is a clear catalyst for the losses. Markets eased downward for the past three months amid the uncertainty of President Trump’s economic plans (and his general unpredictable and combative nature, among other things). Then on Wednesday, during a press conference in the Rose Garden at the White House, stock markets around the world tanked in real time as Trump announced his plans for implementation of his tariffs. On Friday, the market freefall doubled down on itself as China and other nations around the world retaliated with tariffs of their own against the United States.

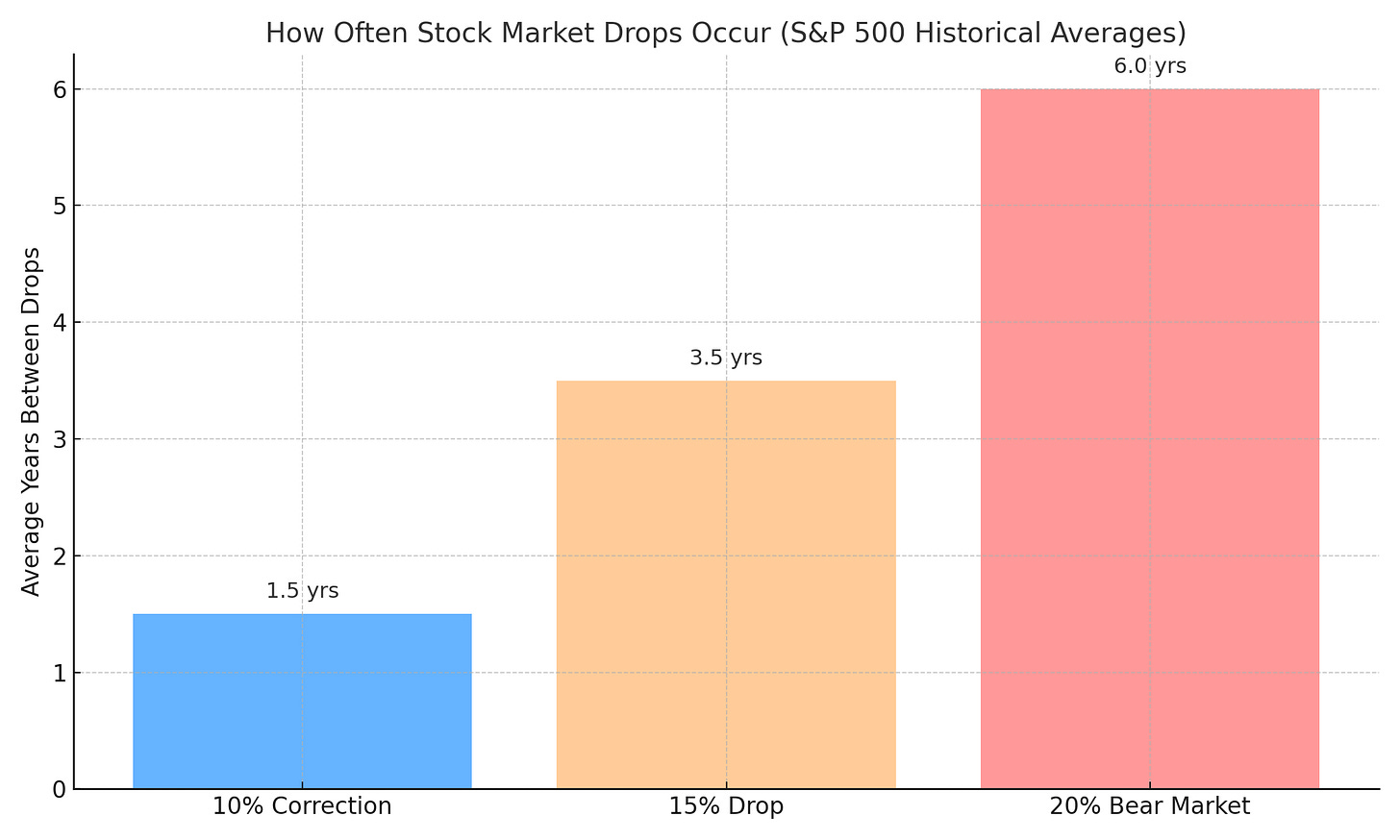

The S&P 500 is down about 15% since Election Day. If not for the catalyst of the Trump tariffs, it would actually not be out of the ordinary to see the stock market drop by 10-15% over the course of months, weeks, or even sometimes days. In fact, a peak-to-trough drop of 10% in the stock market happens, on average, about once every 19 months. A drop of 15% happens about once every 3-4 years, and a drop of 20% happens, on average, once every six years.

I asked a few people this week as I was working on this piece when they thought the last bear market drop of 20% was. I got a handful of guesses of March 2020 (the outset of COVID) and then some other guesses in the 2010s and one guess of 2008, but not a single person was correct: the actual most recent drop of 20% in U.S. stocks from peak to trough was January 2022-October 2022. This was just three years ago, but it might as well be ancient history in the minds of many.

So absent the Trump tariff trigger, if markets had been down by 10-15% at this time of the year, most long-term investors would have shrugged it off, as it would have not been out of the ordinary. In fact, in my article about expectations for the stock market in 2025, I said, “I would not be surprised to see markets drop by 10-15% in the first half of the year and then perhaps bounce back after a period of stabilization.” After gains of more than 20% each of the last two years, markets may have been looking for reasons to ease back. And yet, clearly the current turmoil feels different than a normal market rollover.

The Trigger

There is not enough ink in these digital pages to give an overview of the benefits and tradeoffs of global trade. To simplify things for the purpose of today’s discussion, Americans want manufacturing jobs and thriving local economies, but we also want cheap goods and an abundance of choices. Therein lie tensions and impossibilities.

Adding to barriers to trade will lead to higher prices and fewer choices. The economic benefits from companies re-establishing production in the United States may be years away, and these hypothetical gains may be countered by the loss of jobs in the meantime from current U.S. companies that export to other markets that are now going to be less profitable due to retaliatory tariffs.

Even President Trump himself has acknowledged there may be “some pain” associated with the tariffs in the short-to-intermediate term. The unknown question for investors is how long that “pain” will last. There is a wide range of possible outcomes from the most extreme, which is that the world finds itself embroiled in a multi-year global trade war to the detriment of all, to the most shallow of impacts, which is that Trump and other world leaders essentially strike deals to lessen the tariffs or remove them all together.

Here is what my gut tells me, and, again, I wouldn’t base your investment decisions around what I am about to say because all I’m doing is reading tea leaves and bringing one person’s perspective to the conversation. But here it is: although Trump is stubborn and emboldened and has literally no one in his inner circle who seems willing to speak truth to power, I think the reality of the stock market pressures, which are already generating bad headlines that Trump doesn’t want, and the combination of political pressures from fellow Republicans including donors and various supporters in the business community, who all have a lot to lose in a trade war and a concurrent stock market collapse, will push him to tack a more moderate course on tariffs than he is indicating at the moment.

What it will look like is this: Trump will soften his stance, other world leaders will do the same, and Trump will claim victory an invoke his deal-making abilities even though everything will more or less go back to the way it was before the bull entered the China shop. Tensions with other nations around the world especially our friends in Canada and Mexico will remain high and relationships will continue to be fractured, but at least outwardly, everyone will try to play nice.

Now that is obviously a very optimistic scenario. There are, of course, many around the world who will never forget or forgive this moment in time. America’s image (or at least that of the current American president) will never be salvaged in the eyes of many. But the world as a whole will continue to spin and trade skeptics will give in, acknowledging that, for better or worse, we live amidst a global fabric where the transfer of goods and services across borders and oceans is ultimately a good and necessary thing.

I think, too, when the actual impact on the ground (i.e. in Small Town America with businesses that actually rely on cheap imports and the ability to export without additional cost), the tide will turn against Trump on this. It won’t just be stock market related, but, more importantly, a grassroots reaction to higher prices and fewer choices at the grocery store, on the car dealership lot, and on the shelves at Walmart.

But What if He Doesn’t?

There is another possible scenario that could blunt the potential of an all-out trade war, and I would consider the following to be Best Case 2.0. It would require a Congress that is actually willing to stand together on something, however, so the likelihood of this Best Case 2.0 is probably low. But here is the thing: the U.S. Constitution actually provides the power to enact tariffs to Congress and not to the Executive Branch (i.e. the President). Article 1, Section 8 of the Constitution says, “The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises..” So if Congress would simply reassert its Constitutional power of tariffs, perhaps this mess would be sorted out much quicker.

I think it is completely a fair question about why Trump is able to enact these tariffs when the Constitution clearly lays the power in the hands of the Legislative Branch. More people should be asking this question. Congress is getting steamrolled by Trump and Musk in a lot of ways, but perhaps this is where they fill find the will to stand up for the separation of powers and checks and balances.

As a point of information, Trump is claiming the power to enact tariffs under State of Emergency powers granted to the President and in the interest of national security. At some point, the Judicial Branch if not the Legislative Branch may need to chime in on this, as well, because those are vague terms and for all the talk on the political Right about defending the Constitution and holding true to our founding values, the actual Founders themselves never meant for that much power to end up in the hands of one man.

(Scroll down for some additional content that did not really flow in the context of today’s article, but I wrote anyway thinking it might).

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Addendum - Other Recent Stock Market Drops

Although we haven’t seen anything quite like the current situation, it is worth looking at previous recent drops of 15% in the stock market to gauge possible scenarios over the coming months.

2022: The S&P 500 fell over 20% amid rate hikes and inflation – as noted above, this was a full bear market. It took until June 2023 to get back to the starting point (17 months from the start of the drop; eight months from the trough).

2018: Nearly a 20% drop from September to December due to Fed tightening and trade war fears. It took until April 2019 to recover the losses (seven months from the start of the drop; four months from the trough).

2011: a 19% drop from April to October over concerns about the U.S. debt ceiling and European debt crisis. It took until February 2012 to get back to the start (ten months from the start of the drop; four months from the trough).

2015-2016: About a 15% drop from May 2015 to February 2016 due to China slowdown fears and oil price collapse. It took until July 2016 for full recovery (14 months from the peak, five months from the trough).

If you take the averages of the four drops above, it would be about 12 months until recovery from the peak or about five months from the trough. The peak of this current stock market was in November 2024, which would put the recovery time at this coming November (2025), which is about seven months away from us today. Although, quite importantly, it is not clear if we are in trough at this point or not. There may be more downside to come, despite my rosy look at the possible scenarios noted above. Time will tell.

Ben, One more point from the Scott Bessent interview.

“ Summer of 2024, Americans took more European vacations than they had in history. Summer of 2024, more Americans were using food banks than they ever have in history. I went into two food banks near my hometown to ask, what's the story?”

Americans knew past policy wasn’t working.

Ben, great column as always.

Good perspective of the downs and ups of the market in recent years. Treasury Secretary Scott Bessent made a couple interesting points in an interview with Tucker Carlson yesterday. He said when he looks at the first Trump term, “ The bottom 50% of households, their net worth increased faster than the top 10% of households.

And I'm not happy with what's going on in the market today, but the distribution of equities across households, the top 10% of Americans own 88% of equities, 88% of the stock market. The next 40% owns 12% of the stock market.

The bottom 50 has debt. They have credit card bills, they rent their homes, they have auto loans, and we've got to give them some relief. That I was struck by the statistic from last year.“

Betsy Chapman