Rapidly rising interest rates present an obvious challenge to the housing market as the cost of borrowing has increased for buyers. Rising rates are hitting the housing market in another way, too, in that they are also preventing some new inventory from reaching the market.

I have spoken to several homeowners in the past three weeks who have been considering a move, and all are frustrated at the prospect of buying into a market where home prices are still rising and in which they will need to take on a mortgage north of 5.00% (and rising). Many if not most homeowners have been able to finance or refinance their homes at 2.50-3.50% interest rates over the past several years, and some are now reluctant to move and give up those attractive rates in the process. As these potential buyers stay on the sidelines, it could on the one hand mean there are fewer buyers in the competition for new homes, which could be good for others who are searching. But on the other hand, if existing hoemowners do not move, it means their homes will not hit the market, and right now the market is bone dry of inventory. The market needs homes to sell, and there are just not enough.

Prices Up, Transactions Down

There was an interesting juxtaposition in the home sales market here in Maine in the month of March: home prices were up 21% and the number of transactions was down 21%. These figures were pointing in the same directions but more exaggerated than the nationwide numbers, which according to the National Association of Realtors showed that home prices across the country were up 15.0% in March but the number of transactions was down just 4.5%. This was the eighth consecutive month, however, of seasonally-adjusted declines in the number of transactions nationwide, which reflects a definite trend that home sales are slowing down (at least in quantity).

The Inventory Problem

What is happening? A combination of things. First, as noted at the outset, interest rates are sharply rising, which I won’t dwell on today because I’ve written a lot about that lately; rates are now at the highest level since 2009.

But the other driving variable is that the inventory of homes is just so low. There aren’t enough homes for sale, which means that the homes that are for sale are going for higher prices. This is a basic principle of economics: if the supply of a desired good or service is limited even in an environment of stable demand let alone roaring, pent-up demand, prices will rise, which is exactly what has happened.

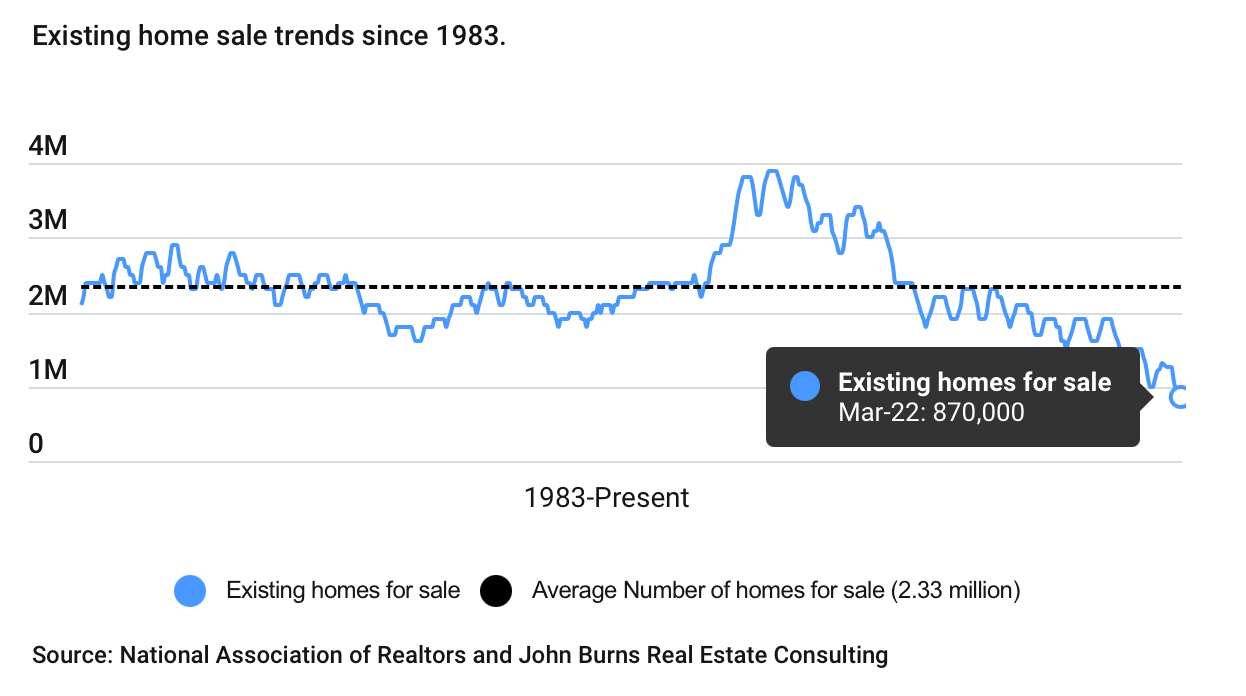

The inventory situation in the United States is dire. According to the National Association of Realtors and John Burns Real Estate Consulting, there were just 827,000 homes for sale nationwide in late March. The chart below shows the steady downward trend in homes-for-sale inventory over the past ten years. The number of homes for sale peaked in late 2007 at 3.9 million in the summer of 2007 just before the Great Recession and has been steadily dropping ever since:

Here in Maine, the average home stayed on the market in March for an average of just nine days, down from eleven days in March 2021 but down significantly from an average of 70 days in March 2019, nearly one full year ahead of the pandemic. Buyers know there are so few options out there that they have to snap up what they can as soon as it becomes available.

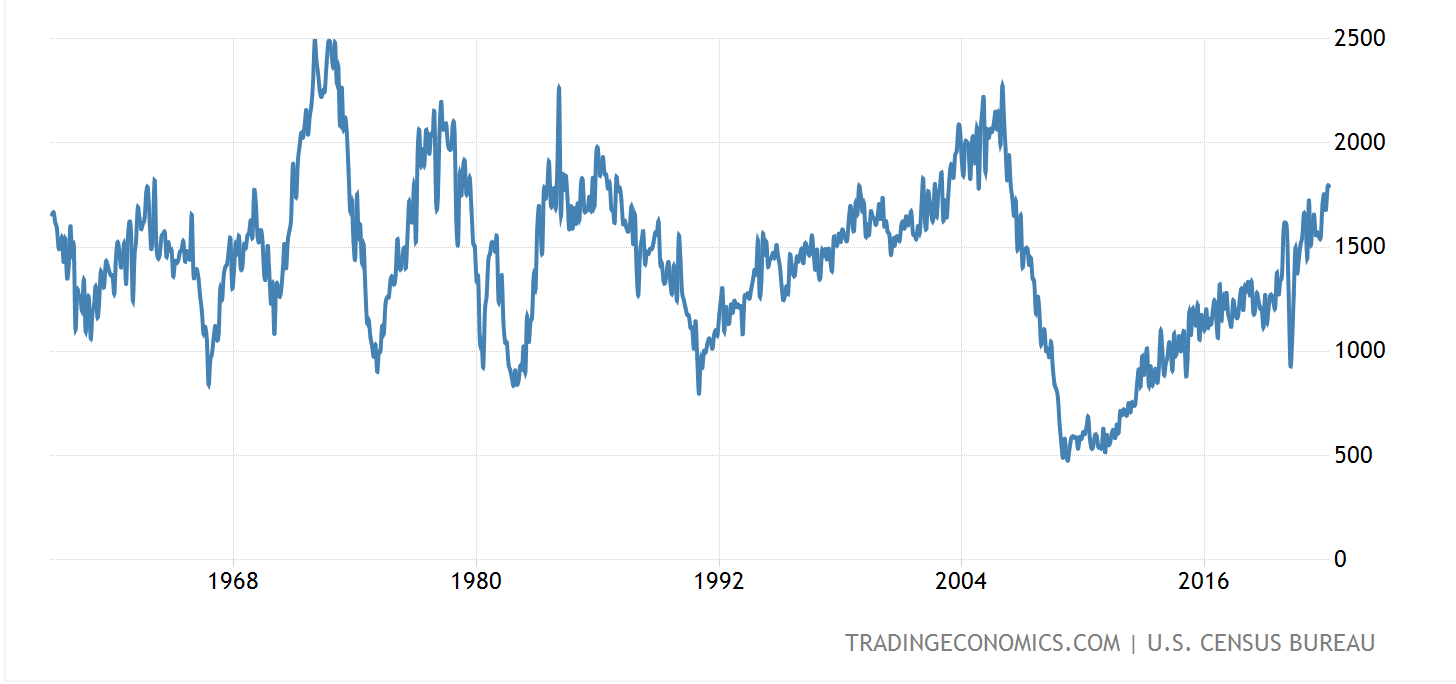

Until inventory picks up in a meaningful way, home prices will continue to stay high, to the detriment of low and moderate-income homebuyers, first-time homebuyers, and others who have historically been excluded from the market. The good news is that new home construction is steadily climbing, but as shown in the chart below of housing starts (i.e. new home construction; listed in thousands), historically speaking we under-built for about 8-10 years following the 2007 peak. We are seeing the results of that now in the form of low inventory and significantly rising prices:

Big Banks and Mortgage Brokers Reacting Already

After its first quarter mortgage originations were down significantly, Wells Fargo announced last week that it is laying off an undisclosed number of mortgage processors and underwriters. Posts on the anonymous message board The Layoff suggest employees were hit in multiple markets including Des Moines, Charlotte, Phoenix, San Antonio, and Minneapolis. Other lenders are following suite, including:

Flagstar Bank, which just laid off 420 mortgage operations staff representing 20% of their overall employee base

Mortgage tech company Blend Labs, which just laid off 200 people representing 10% of its workforce

Better.com, an online mortgage company, which is carrying out its third round of layoffs after its first two recent rounds laid off 4,000 people representing half of its workforce

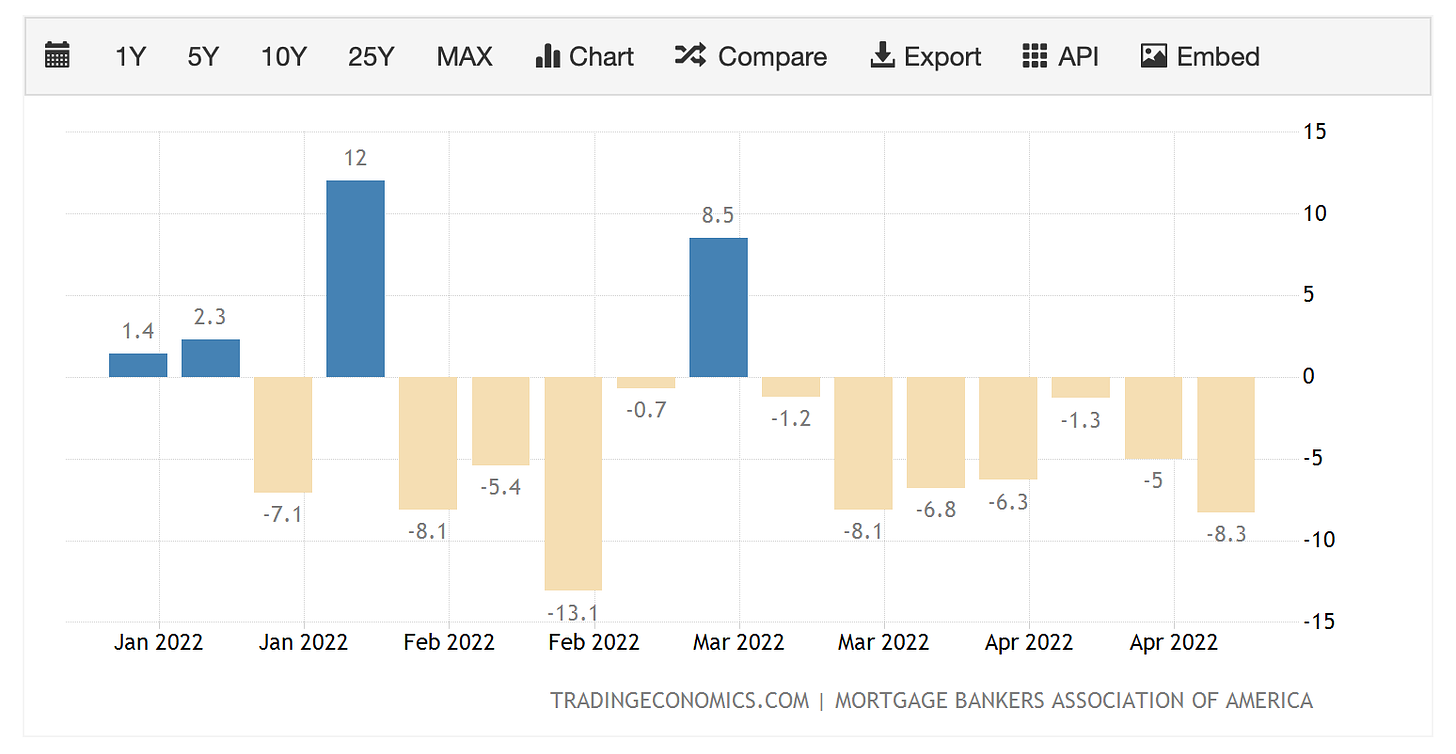

Statements from all of these lenders and mortgage brokers referenced the same thing: rising rates are decreasing the number of transactions, which means not as many staff are needed. Indeed, the number of mortgage applications has decreased year-over-year for seven straight weeks and eleven of the last twelve according to Trading Economics:

What Comes Next

You can’t judge a housing market based on prices alone. Prices continue to climb. But the number of transactions is an important indicator too. And right now transactions are falling off a cliff.

There is still so much demand among homebuyers that prices are likely to stay high. I wrote just last week about how I don’t think we are in a housing bubble, but I do anticipate the rate of increase in home prices to level off a bit. Unfortunately for a lot of people, those in the strongest position right now remain cash buyers, who can not only offer more competitive offers with fast closing times due to not needing financing, but they are also not subject to higher interest rates if they are simply buying in cash (or contributing an especially large down payment and closing with a comparatively smaller loan).

As to the impact on the overall economy? Well, the rising rates are already starting to hit things exactly the way they were expected to: fewer transactions, less overall economic activity, and layoffs. The stock market has certainly reacted negatively to a number of things in recent weeks. In my opinion, this all points to both the capping of inflationary pressures, a mild recession on the horizon, and a housing market that people need to keep an eye on.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram.

Weekly Round-Up

Here are some things that caught my eye this week:

AirBNB announced that their employees can work from home, anywhere in the world, forever. They also continue to work in an office setting if they so choose. You can read the full letter from AirBNB CEO Brian Chesky to his employees here. One key line for me:

We want to hire and retain the best people in the world (like you). If we limited our talent pool to a commuting radius around our offices, we would be at a significant disadvantage. The best people live everywhere, not concentrated in one area. And by recruiting from a diverse set of communities, we will become a more diverse company.

The CEO also said that employees’ compensation will not change based on what market they live in. So why not make New York City wages and live wherever you want to be? Like Maine!

Via Lily Katz and Sheharyar Bokhari in RedFin, almost 90% of flood insurance policyholders in Texas, Mississippi, and Florida are seeing premium increases thanks in large part to climate change and the prospect of rising seawaters (and the chronically underfunded federal flood insurance program). I wrote about the prospect of this happening last year.

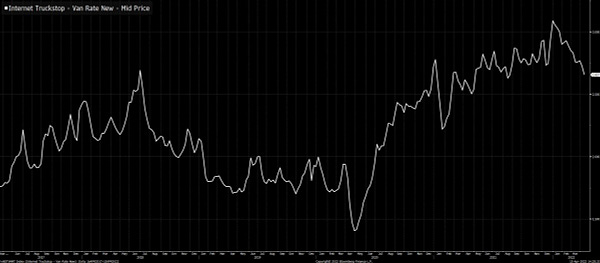

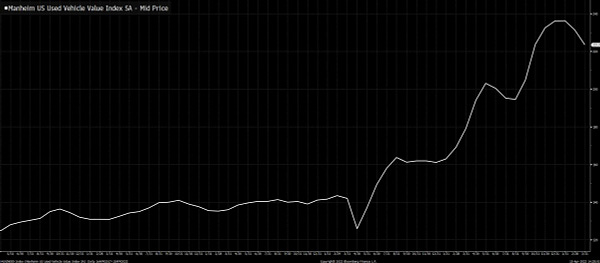

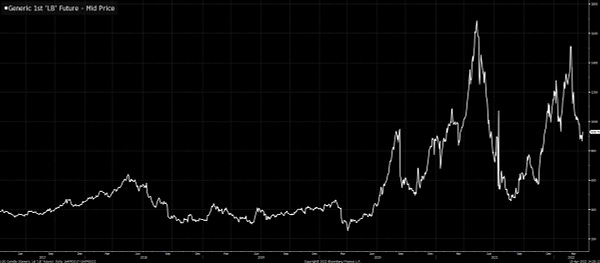

Some of the leading indicators of inflation are now starting to go the opposite direction, lending credence to the view that we have already hit “peak inflation.” Via Joe Weisenthal:

Have a great week, everybody!