What Was Built in 2023

Plus: top ten articles from the year

Thank you for reading The Sunday Morning Post, where each week I write about the economy with a focus on real estate and investing (and occasionally other things). If you were forwarded this email or happened upon it another way and would like to receive these articles each week, just click Subscribe below.

What Was Built in 2023

A healthy portion of the housing crunch and rising rents we have seen from 2019 to 2023 can be attributed to a period of under-building from 2006-2013 as the economy was mired in the depths of the Great Recession and then struggled to rebound in certain areas like residential construction. Consider the chart below of new-home starts over the past 25 years. The prolonged drop in construction of new homes is evident from 2006 onward. The rate of construction has never even fully recovered to the level it was at in the early 2000s:

From 2001 to 2006, there were an average of 1.83 million new homes built each year. But from 2008 to 2013, there were an average of just 726,000 new homes built. In fact, it took until 2021 when 1.6 million homes were built to get back to the same level as twenty years prior in 2001!*

*for the sake of analysis and flow, a new home started is considered to be the same as a new home built, although the two statistics will vary ever so slightly from time to time as a small number of homes are started and not completed or a home started in 2004, for example, may not have been completed until 2005, which skews the statistics slightly).

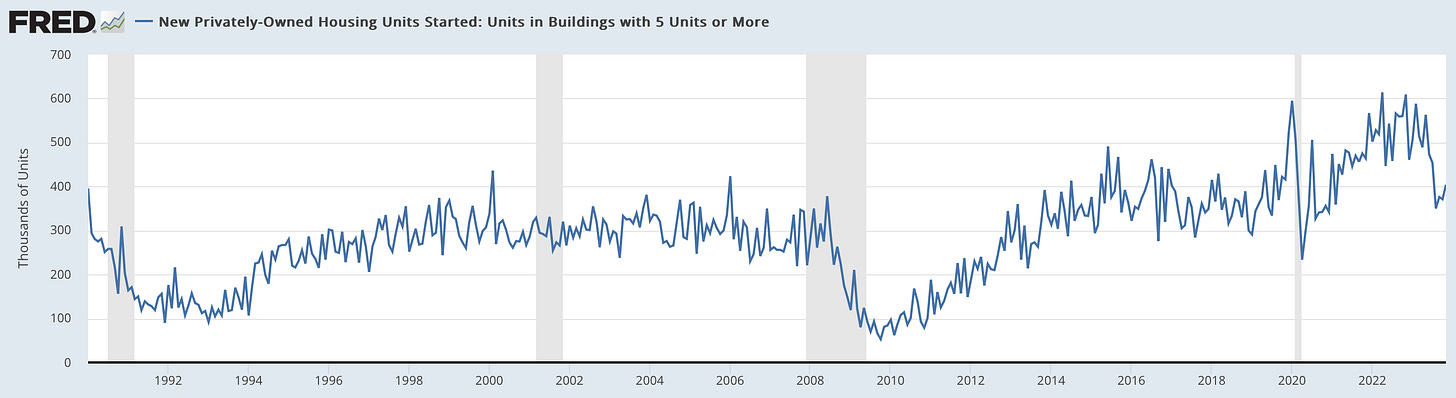

The trajectory of new starts for multiunit rental properties, which is defined as buildings/projects with five units or more, is similar to the data for single-family homes. You can clearly see the trough in the chart below of multifamily starts from 2008-2013, although interestingly enough multiunit construction in recent years has outpaced the rate of construction in the early 2000s:

The period of under-building from 2008-2013 (and really into the latter part of the decade) is one of the primary reasons why both home prices and rents have risen so much: there is not enough inventory due in large part to the missing homes that were not built post-Great Recession.

The Past Year

With all of the policy concern out there about housing shortages and rising rents, it is worth a look at how much new housing was built (or at least started) in 2023. The story is a bit of a mixed bag.

As anyone involved in the construction or building trades industries can attest, it has been a very busy few years. The recent peak of single-family home construction according to data from the Federal Reserve was April 2022, when the nation was building new single-family homes at an annualized pace of 1.8 million homes per year. Interestingly enough, the recent peak of multifamily construction was also April 2022, at which time the annualized pace of multiunit construction was running at 614,000 per year.

Since the spring of 2022, however, new single-family home and new multiunit construction have both been easing back. By the start of 2023, single-family home construction had declined from a pace of 1.8 million homes per year to 1.3 million homes per year while multiunit construction had declined from 614,000 projects/year to 506,000 projects/year.

From January 2023 onward is where the correlation between single-family home and multiunit construction does start to diverge a bit. Construction for single-family homes actually improved for much of 2023. The line graph below is a big jagged due to the short time horizon and the fluctuations that come with that, but what is evident is that although we started the year at a pace of 1.3 million new homes per year, by November the pace had actually increased to 1.56 million:

This is good news. While the 1.56 million homes pace is still below the average rate from the years prior to the Great Recession, the pace is running stronger than most of all of the years since. I credit a positive economy (even though the vibes are off) including a strong labor market and the wealth effect of a strong stock market. Perhaps above all else, though, there is the inventory factor. This past year saw fewer existing homes for sale than in any recent time. People are not moving as many people feel locked in pre-2022 interest rates of 3.0% or better and do not want to move in a market of higher prices and (much) higher interest rates. With fewer homes for sale, prospective homebuyers are choosing to build instead, which has boosted new-home construction significantly.

On the multiunit side of things, construction did not increase this past year. To start the year, the country saw a pace of 506,000 projects on an annualized basis. Much like on the single-family side of things, this was down from the April 2022 peaks. But contrary to single-families, rather than rebound as the year progressed, multiunit construction slide to a rate of 305,000 projects by August 2023 and only rebounded very modestly to a rate of 404,000 by November, which is the most recent month for which data is available.

The reason why multiunit is different than single-family has to do with interest rates. The vast majority of these projects are financed. Sure, some are probably done with cash by large investors with deep pockets, but the majority are financed through banks whether they are being done by small-to-medium developers, mom-and-pop types, or homebuilders who are building rental properties for their own portfolios on the side. As commercial interest rates rose this year, the number of new projects declined.

It is an unfortunate irony of the interest rate environment over the past two years that at the exact time when significant new supply of housing is needed, interest rates have risen to levels that make construction of new units much more challenging. Projects just do not cash flow as well (or at all) when commercial interest rates are in the 8.0% range as they do when they are in the 4.0% range. And when the math doesn’t work, projects don’t take place. I can say from my perspective as a commercial lender who has financed dozens if not hundreds of rental properties including construction of new units, the volume dropped precipitously as the year progressed. It is worth remembering, of course, that the Federal Reserve’s dual mandate is to contain inflation to an annualized rate of 2.0% per year and promote full employment; it is not its mandate to ensure a healthy and thriving housing market (although hopefully Fed officials still keep these things in mind).

What Comes Next

The inverse of the unfortunate irony noted above is that for there to be a boost of new housing supply, it will likely require a dropping of interest rates so that more projects will take place. As I’ve written about just recently, a drop in rates is, in fact, likely to come by the spring or summer of 2024.

That would certainly be good news for a lot of builders and developers as well as the eventual tenants who would live in newly constructed units. In the meantime, however, it’s not all bad news out there for the multiunit housing market. The number of multiunit units under construction for practically all of 2023 through to the current day has been at all-time highs. This is kind of a two-part story: there are more units currently under construction because the number of new units started in 2022 and early 2023 was quite high and the process of getting a multiunit project from start to finish has lengthened. What once took 12 months to build is now commonly taking 18 thanks to a tight labor market, supply chain issues, and other pandemic and post-pandemic oddities. So while the number of new multiunit starts is low, which will show up in a lower number of completions 6-18 months from now, the number of units actively under construction is high, which represents a glut of new rental inventory that will be hitting the market in 2024. This is good news for tenants and the policymakers and others who are trying to ease the housing crunch. It is also something for existing real estate investors to keep in mind. As all of this new rental supply hits the market, the leverage will swing from property owners to tenants.

I will have more on all this in upcoming housing and rental market 2024 preview articles, which I am working on for sometime in January. Stay tuned. And in the meantime, happy new year and best wishes for the start of 2024!

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Top Ten Sunday Morning Post Articles from 2023

The Sunday Morning Post was read over 100,000 times this year by readers from almost every U.S. state (come on, North Dakota and Wyoming!) and 19 countries. The states with the most readers are Maine, which is where my natural network is, followed by Massachusetts, New York, California, and Florida. Canada is the second-most common country of readership, followed by Germany, The Netherlands, and India! If you’re reading from aboard, give me a shout because it’s always fun to hear from people.

Here were the most read articles from the past year along with one key line or insight from each one:

You have to keep in mind other variables that do not suggest we are about to experience some major economic collapse. For starters, the labor market remains very strong. People are working and wages are generally rising. Consumer spending also remains high despite consumer sentiment being low…I am optimistic that future inflation readings throughout the first half of 2023 are going to show continued declines in inflation with or without more intervention from the Fed. The key thing to watch will be the tension between further rate increases, inflation, and all the other key variables in the economy like employment, wages, and spending that will need to not weaken too much in order to prevent a true housing crash. I think the path is there to a soft landing, but only if the Fed recognizes that inflation is already on the decline.

Fueled by the run-up in prices, sellers may be psychologically anchored to high prices that they believe they can achieve. But there is a mismatch developing between what sellers want to get and what buyers are willing to pay. The shorthand version I’m hearing in the industry these days from some is, “Sellers are anchored to 2022 prices but buyers are in 2023.”

The Risks of Investing in Vacation Rentals

The risks to the real estate investor (to say nothing of the risks to the community, which I will expound upon a bit below) are clear: at a certain point, just like with an oil field with too many pump jacks in it, there’s not enough juice left for everybody. What it will look like in some of these communities is greater vacancy rates as a result of surplus supply of available units, depressed prices as consumers have more choices of where to rent, and tighter margins for investors if not outright losses.

The massive levers that drive prices in any market are supply and demand. Florida has seen increasing demand and limited supply to meet that demand over the past decade, particularly in the last 3+ years. That is a formula for rising prices. But now these levers are starting to reverse, with demand weakening due to less in-migration plus the rising costs of home ownership through increased insurance premiums. At the same time, supply is increasing through new construction and new inventory from people deciding to list their existing homes. Declining demand and increasing supply is, of course, a formula for falling prices.

I have two sets of very good friends who have both been in the market for a new home for much of the past year (or more). Each of them has expressed to me at different times this summer that they have essentially given up. Fresh data out this week illustrates the reasons why: the challenges for new homebuyers in the current market are essentially unprecedented.

The Vibes-Are-off Thanskgiving

Lastly, the vibes are bad because all of us (Democrats, Republicans, everyone in-between including those of us who don’t feel like they have a political home) are living in a world where the negative is amplified. Negativity sells better. It gets more media attention, it gets splashier headlines, and the algorithms on Facebook, Twitter, and the like typically fuel rage and frustration more robustly than joy and camaraderie. The constant drip, drip, drip of negativity is impacting our brains in ways that I don’t think we really fully understand yet. It also feels overwhelming: like the world is more complicated than any one person can influence or control, which leads to feelings of negativity and stress. People have a general sense that something is wrong, but they can’t quite figure out what to do about it.

What it Feels Like Inside a 3D-Printed Home

The vision for the 3D-printed home is that someday it can be mass-produced in laboratories like the one at the University of Maine. The production will greatly reduce supply chain challenges as the bio materials themselves are widely available right here in Maine and elsewhere. Labor needs, too, will be significantly reduced. At this particularly model home, a kitchen was fully installed after completion and there was the aforementioned electrical work plus plumbing, but the need for contractors and laborers will be significantly less with a 3D-printed process like this one.

The 16th Largest Bank in the United States is No More

Shockwaves ripped through the Bay Area and beyond on Friday as an old-fashioned bank run took down America’s 16th largest bank. Although just one week prior it had been worth billions with a $284/share price on the New York Stock Exchange, by mid-morning on Friday, March 10th, Silicon Valley Bank was in the hands of the Federal Deposit Insurance Corporation (FDIC). It’s the second largest bank failure in U.S. history, trailing only that of Washington Mutual, whose own failure was a key domino in the cascading 2008 financial crisis. Now depositors are waiting to hear what they will be able to get out, and investors have lost nearly everything.

The average monthly mortgage payment today is only slightly higher than the average monthly mortgage payment in 1983, adjusted for inflation, even though home prices are a lot higher. And mortgage payments today as a percentage of individual income are exactly the same, while as a percentage of household income are actually lower today than than they were in 1983.

But the question of prices is a major one: remember, home prices are almost double today what they were in 1983, adjusted for inflation. This presents a high hurdle for younger homebuyers, those who are just getting started out, or traditionally underrepresented demographics in the home buying market, all of whom may not have had the time and opportunity to build up a nest-egg for a 10% down payment or to cover the ongoing costs associated with owning a home.

New Rule in Maine Slows Down Mobile Home Park Sales

With relatively little fanfare, the Maine Legislature passed a measure earlier this year that will significantly change the way mobile home parks in Maine are transacted. The measure is meant to offer mobile home park residents a chance for equity ownership and, if you listen to proponents of the measure, to guard against the greed of absentee investors seeking purely to maximize cash flow. People of differing minds and opinions may disagree on whether these motivations will actually be served by the new rules, but there is no doubt that these changes introduce new hurdles in any potential sale of one of Maine’s 700+ mobile home parks. The rules also speak to an often under-appreciated risk in real estate investing: legislative/political risk.

Bonus Article: my most read and widely-shared article from the year, in fact, more so than any single thing I wrote, was Thoughts from the Week in Maine, which I wrote on the heels of a mass shooting that took the lives of 18 Mainers in October. It achieved the most reads becuase it was shared so much within my Maine-based network, but I also appreciated the kind words from so many readers around the country who were monitoring the story. I know the majority of readers check their inboxes each Sunday morning for the content about real estate and the economy, but I am grateful you let me indulge in other topics when the moment is right, especially ones as meaningful as this one was.

Lewiston, Maine, is a particularly unique community marked by a true blue collar ethic and a brand of independence and togetherness that is particularly rugged. Lewiston is an authentic place full of genuine people, the kind you’d like to have as your own neighbors and friends. The faces of those 18 people who lost their lives resonate so deeply because they are so regular….so Maine. They include a bowling coach and his wife, a sign language interpreter as well as several other members of the Maine deaf community, a freshman in high school and his dad, a pipe fitter, an umpire, bar and bowling alley staff, among others. They were fathers and mothers, husbands and wives, children and friends.

With that, my Sunday Morning Post friends, I sign off for 2023. Here’s to a great year ahead!