Thanks for reading The Sunday Morning Post newsletter! Click below to subscribe for free and get future articles in your inbox each Sunday morning.

What’s Up, What’s Down?

The year 2021 is half over, and safe to say economists will be studying this period of time for years to come. Today’s children and their children after them will be reading case studies about COVID-induced supply chain issues if they are lucky enough (or unlucky enough, depending on your perspective) to find themselves in some sort of economics course in high school or college. “Dad, what did you do during the pandemic,” I can picture mine asking. “Well, your mother and I waited a few months to replace the back deck and we saved a thousand bucks!”

We are in uncharted waters and have been there since the first quarter of 2020 when it became clear that COVID-19 was going to be a serious and lingering issue. Never before has there been a global non-military event on the scale of COVID-19 that has disrupted so much. But similarly, never has there been such massive government intervention to prop up the economy. Multiple rounds of stimulus funding, enhanced unemployment benefits here in the United States and elsewhere, massive amounts of money pushed into the economy for COVID testing and vaccination clinics: major levers have been pushed and pulled in various directions as policymakers try to keep the economic ship of state afloat and more or less between the navigational buoys.

For business owners, investors, or anyone with a passing interest in the economy, the wild swings in the prices of certain assets have been frustrating to some, profitable to others, and baffling to virtually everyone.

As we gaze upon the economic landscape from here at the halfway point of the year, it’s worth a temperature check to see what is happening to certain assets and commodities. While past performance is not indicative of future results and all the usual disclaimers should apply about consulting an investment advisor, CPA, and lawyer when making decisions financial or otherwise, what follows is an overview of where things stand at the end of June 2021.

What’s Up

Stocks: with all the more high-profile investment vehicles out there these days, it’s easy to forget about the actual stock market, which continues its steady, decade-long rise out of the 2008-2009 financial crisis. The S&P 500 is up 13.97% YTD, which is all the more notable when you consider it was up 18.4% in 2020 despite the onset of COVID-19 and up 31.5% in 2019. The Dow Jones and the tech-heavy NASDAQ have performed similarly well. Among the top performing stock market sectors? Energy (+45%), Financials (+24%), and Real Estate (+23%). According to Fidelity, every single stock market sector is up for the year so far with only Utilities (+2%), Consumer Staples (+3%), and Consumer Discretionary (+9%) not returning double digit growth already this year.

Gas: from the consumer’s perspective, rising gas prices are not ideal. No one wants to pay more at the pump. And gas prices have shot up this year a staggering 62% for unleaded. Crude oil is up 52%. It’s always more complicated, though, as rising gas prices can be an indication of increased demand from a strengthening economy, which is generally a good thing. That is certainly one of the factors at play here as travel rebounds after a year of pent-up demand. But prices are also directly impacted by global politics including how much the OPEC nations limit or ease supply. Global markets also interpreted a Biden-Harris victory in November as an indication that drilling for oil in the United States might become more limited, thereby limiting supply, which pushed prices higher. All in all, gas prices are complicated, but what is not in doubt is that prices have risen fairly significantly so far this year.

Corn: corn prices are up 35% YTD and a staggering 100% since July 2020, a legitimate doubling in price in twelve months. Like gas, corn is more complicated than meets the eye. Prices are driven by consumer demand, global politics, and the actual weather. Other food commodities are also up on the year including Hogs (+41%), Coffee (+20%), Feeder Cattle (+12%), and Sugar (+11%), although it should be noted that virtually all commodities are only still up for the year because of a roaring first quarter of the year; nearly everything has dropped in price over the past thirty to sixty days. In fact, the 35% YTD number above bakes in the fact that corn futures have actually dropped by nearly 18% since the beginning of May! By the way, while rising labor costs have undoubtedly impacted prices at restaurants and grocery stores, rising ingredient costs for things like corn have also hit menu prices. Yes, your burrito at Chipotle costs a little bit more because the person making it is getting paid more, but also because just about every ingredient inside that burrito costs more than it did a year ago. And that cost gets passed on to the consumer.

Tin: the metal that has risen the most in 2021 is not gold or silver, but tin, which is up 57% year-to-date. According to Joe Wallace in the Wall Street Journal, “High demand for consumer electronics and difficulties shipping metal out of Asia have created a shortage of tin, pushing prices for the metal close to records for the first time in a decade.” Aluminum and Copper are also both up on the year, 23% and 21%, respectively.

YTD chart for Tin:

Homes: as anyone in the real estate market can attest, home prices continue to rise. Nationwide in May, the median home price was up 18.1% versus May 2020. Here in Maine, the Bangor Daily News reports that the median home price in May was up 28% in May and the average home sold in just six days! My prediction is the housing market will eventually find equilibrium as demand remains strong, interest rates remain low, but building costs ease, thereby opening up inventory a bit. Nationally the number of homes sold in May actually declined by nearly 6%, which suggests that high prices have cooled the mood of some buyers at least for the time being. Prices going up but the number of transactions going down suggests to me that a near-term equilibrium will be found.

Sports Cards: Nate Schwartz wrote a nice overview in Deseret News about the recent surge in sports card sales, noting that the number of card sales on eBay grew by 4 million in 2020 versus 2019. Per Yahoo, as of March 2021, eight of the ten most expensive sports cards in history were sold within the previous ten months. People have been bored during the pandemic and have spent time cleaning out their closets and attics, hence the surge in activity. And, of course, oftentimes the momentum in something becomes a force of itself and the sports card market has been surging, which in turn has drawn in more and more participants, thereby pushing prices higher and higher.

What’s Down?

Lumber: what a difference a month makes! After an unprecedented surge over the last year, lumber futures have been sawed in half since early May. In my April 25th newsletter, I wrote the following:

Market forces on the demand side of the equation should take hold at some point too. As prices continue to rise, consumers will pull back from renovation projects and new home construction will soften. Even as demand is currently robust, there are some anecdotal examples of developers pulling back on projects and waiting for prices to stabilize and perhaps decrease. Market peaks whether they are in stocks, tulips, or lumber can reverse quite quickly with a return to normal prices, which is what some developers who have started to pull back from new projects are counting on.

I am not an expert in the pricing of commodities, but based on history and a study of human behavior it is clear that markets respond, bubbles burst, artificially high prices reverse, and normalcy typically returns. The question, of course, is in the timing. If the price of lumber is over $1,000 per thousand board feet in April 2022 I would be surprised, however; a price around $600-$700 is more likely based on my read of demand and other market forces.

The reversal has started and it has been fast. After a peak in early May of just over $1,700 per thousand board feed, lumber futures closed at $779.30 this past Friday, a staggering drop of well over 50% in less than two months! While prices are still up significantly as compared to a year ago, normalcy is returning in the lumber market, although it may still take some time for prices to settle out at the store; lumber companies have been stockpiling inventory at higher prices for months and now they need to get rid of it. Fortunately for sellers, demand from consumers remains strong.

1 Year+ chart for lumber futures showing the sharp rise but even steeper fall over the last two months:

Bitcoin: while the cryptocurrency known as Bitcoin is up 246% in the past twelve months and an astonishing 4,700% in the last five years, the story over the last three months has been a different one as the price of one Bitcoin has been cut in half from just over $63,000 in early April to just under $32,000 today. To be honest I don’t know enough about cryptocurrencies to offer a more robust analysis here, but it is a topic worth learning more about and one I intend to write about in the future. The question for me is not whether cryptocurrencies like Bitcoin have a role to play in the global economy, which they undoubtedly do, but rather what a fair market value is for each one, which I simply do not know. The volatility in cryptocurrencies is an interesting story both in terms of investments and human behavior, though.

Bitcoin 12-month chart showing the April 2021 peak and subsequent decline:

Gold: above I mentioned Tin as being the most significant riser in the metals market so far in 2021. The biggest loser? Gold, which is down 6.4%. Silver is also down, albeit it a more marginal 1.2%. Why are prices down? Well, both gold and silver prices rose pretty significantly in 2020 as a hedge against weakness in other asset classes. Now that the global economy is rebounding, there is just not as much interest in precious metals as an investment hedge. People are putting their money into other things.

Cocoa: most commodity prices have surged over the last year, all except one: cocoa, which is down 9.9% YTD. Why is cocoa down? Over 70% of the world’s cocoa comes from Ivory Coast and Ghana. Exports of cocoa from Ghana were up 25% between October and May and the flood of supply seems to have had a detrimental impact on prices. To be honest I don’t know much about the cocoa market and it’s probably not directly relevant for too many readers of The Sunday Morning Post other than the random chocolate fiend here or there, I just think it’s interesting that during a period of time when virtually every other commodity has risen in price, cocoa has dropped.

What Does It All Mean?

I have written a couple of times recently about inflation, saying, “There is a risk of overheating in all this. Significant government stimulus + a snapback economy + rising wages + leveraging up of corporate debt feels to me like a formula for inflation.” The fact that some assets and commodities have dropped in price over the last three months, however, is a sign that their previous rises were at least partially the result of transitory factors like acute supply chain issues. And, as noted previously in the discussion about lumber, markets respond and supply chain issues work themselves out. Take corn, for example. When the price of something like corn increases as significantly as it has over the last twelve months, producers respond by increasing production. That is part of the reason why corn futures have actually declined by 18% since the beginning of May. Higher production means more supply, which generally results in lower prices.

The demand side of the equation responds, too. Eric Kingsley, who is a logging industry expert and consultant with Innovative Natural Resource Solutions, has frequently said on Twitter and elsewhere, “The solution to high prices is high prices.” In other words, once prices get too high, consumers react by pulling back, which causes sellers and producers to react by lowering prices. With both participants on the supply side and the demand side responding to changing prices, markets tend to find equilibrium even if it is not always immediate.

Apart from the inflation debate, a review of what is happening in different investments and asset classes underscores the importance of maintaining a diversified portfolio if you are investor. While it is not as much fun as hitting the flavor of the week and doubling your money overnight, the way to long-term wealth in the investment world is still, in my opinion, through the slow and steady engine of compounding growth year by year and not by chasing the latest fad. Lots of people have been pouring their money into trendy investments like Bitcoin. If you bought Bitcoin a year ago (or more!) you’re feeling pretty good. If you bought it three months ago on the other hand, your investment has already been cut in half.

What will the second half of 2021 bring? Anyone who says they know for certain is selling you a bill of goods. I have to think the stock market is due for a 10-20% pullback at some point, which would not be out of the ordinary, and yet the state of the American consumer continues to strengthen. I am not invested in Bitcoin or any other cryptocurrency because I respect the advice of Warren Buffett, who has said “don’t invest in something you don’t understand.” But if the price of Bitcoin continues to drop, who knows; everything has its price. As for commodities, it seems like many are in correction territory and there is bound to be significant volatility as supply chain issues and general market momentum sort themselves out. Time will tell.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Here are some links to a few things that caught my eye this week:

Kathy Baughman McLeod in The Atlantic: More people die in heat waves than any other weather-related event and it’s too hot this summer already. https://www.theatlantic.com/ideas/archive/2021/06/summer-normal-heat-season-deadly/619302/

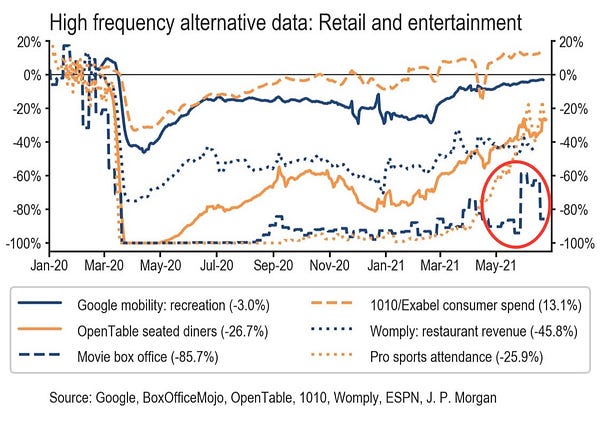

Carl Quintanilla ponders whether headwinds among moviegoers are the result of ubiquitous streaming options at home:

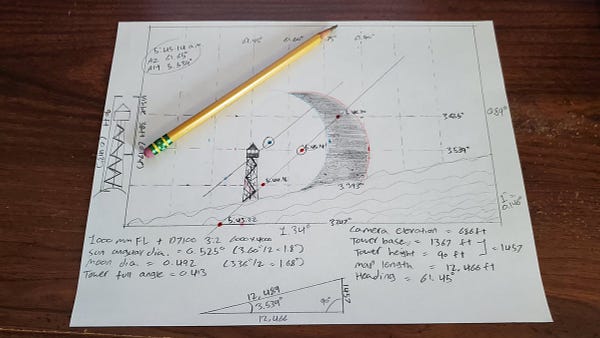

Photographer Julian Diamond shows his set up for a photo and the end result:

Got news tips or story ideas? Email me at bsprague1@gmail.com. Have a great week, everybody.