Where Are Interest Rates Going in 2025?

I am currently researching and ruminating upon my 2025 “Housing Market Preview” and “Rental Market Preview” articles that I’ve written similar versions of each of the last several Januarys, but I thought I would set the table for those pieces today by taking a look at interest rates. Where will rates end 2025? And what will happen between now and then? As I said last week, no one knows. But we can indulge in some semi-educated speculation and look at what markets are telling us about implied rates going forward. But first, a review of 2024.

The Year That Was - Or, the Perils of Prediction

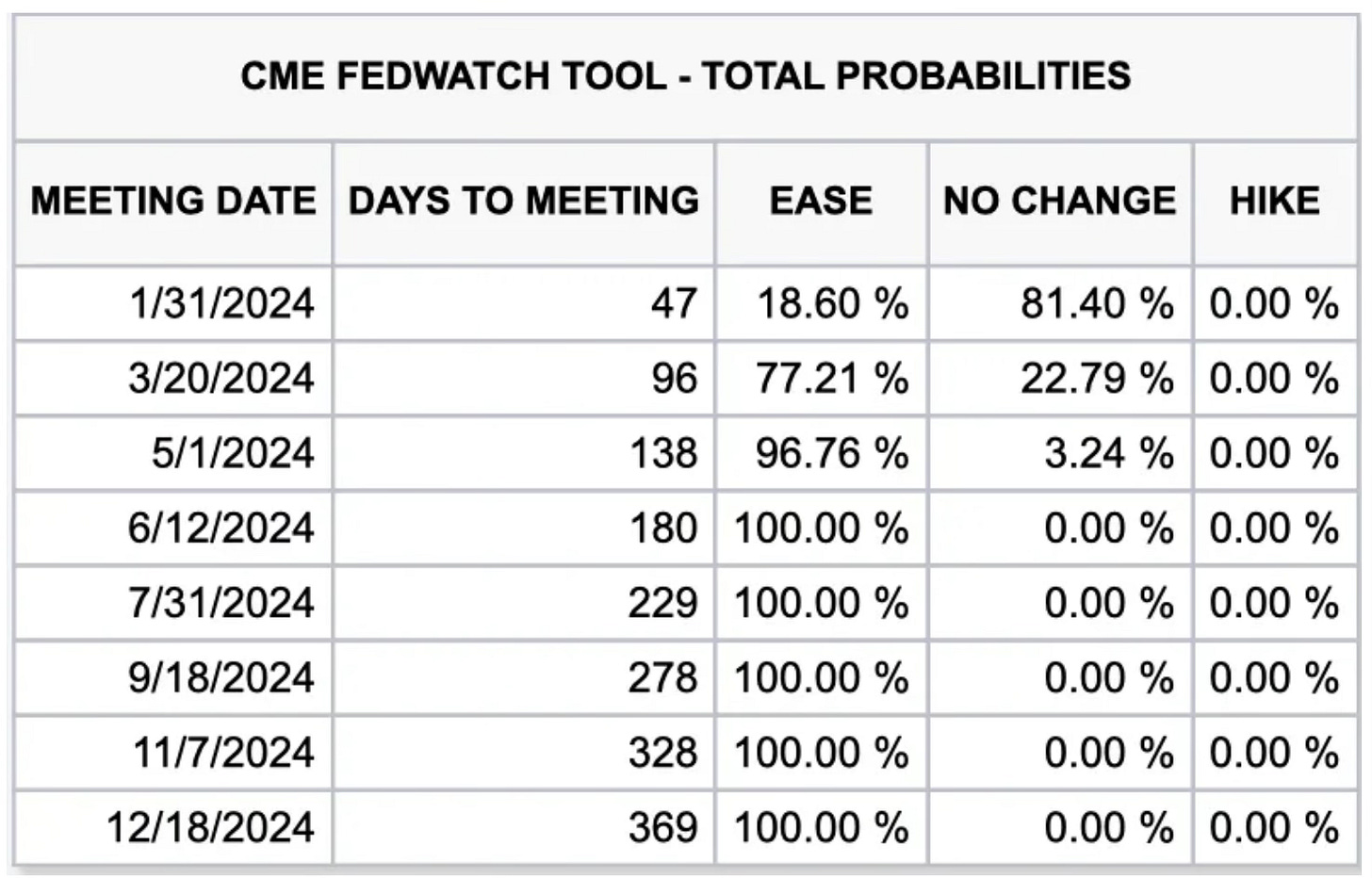

A little over a year ago, economists and Fed prognosticators gave a 100% chance that the Fed would start cutting interest rates by the time of its June meeting. In fact, the screenshot below is from a resource I frequently check called the CME FedWatch Tool taken in December 2023, which shows just that:

As it turns out, the Fed did not cut rates until its September meeting. So much for 100%. This serves as a reminder that even the best economists and seasoned Fed observers often get it wrong.

Why did the Fed not cut earlier in 2024 as people expected? For one, the economy held up well throughout most of the year, and second, Fed Chair Jerome Powell has been particularly hawkish on inflation and did not want to ease rates until he was sure that inflation was under control. These are familiar topics to readers of The Sunday Morning Post, so I won’t dwell on them more here. The Fed did start cutting rates in September because there were some signs of potential weakness in the economy, and inflation was more or less under control (at least for now), and then the Fed cut again in both November and December.

Interest Rate Divergence

Rates for commercial loans as well as various types of consumer loans (although not credit cards) have eased down since the Fed starting cutting in September. That is because banks commonly price commercial loans around Fed rates, including Prime Rate. There hasn’t been this huge plunge that many borrowers may be looking for, but bit by bit, rates have started to inch downward on the commercial side of the coin.

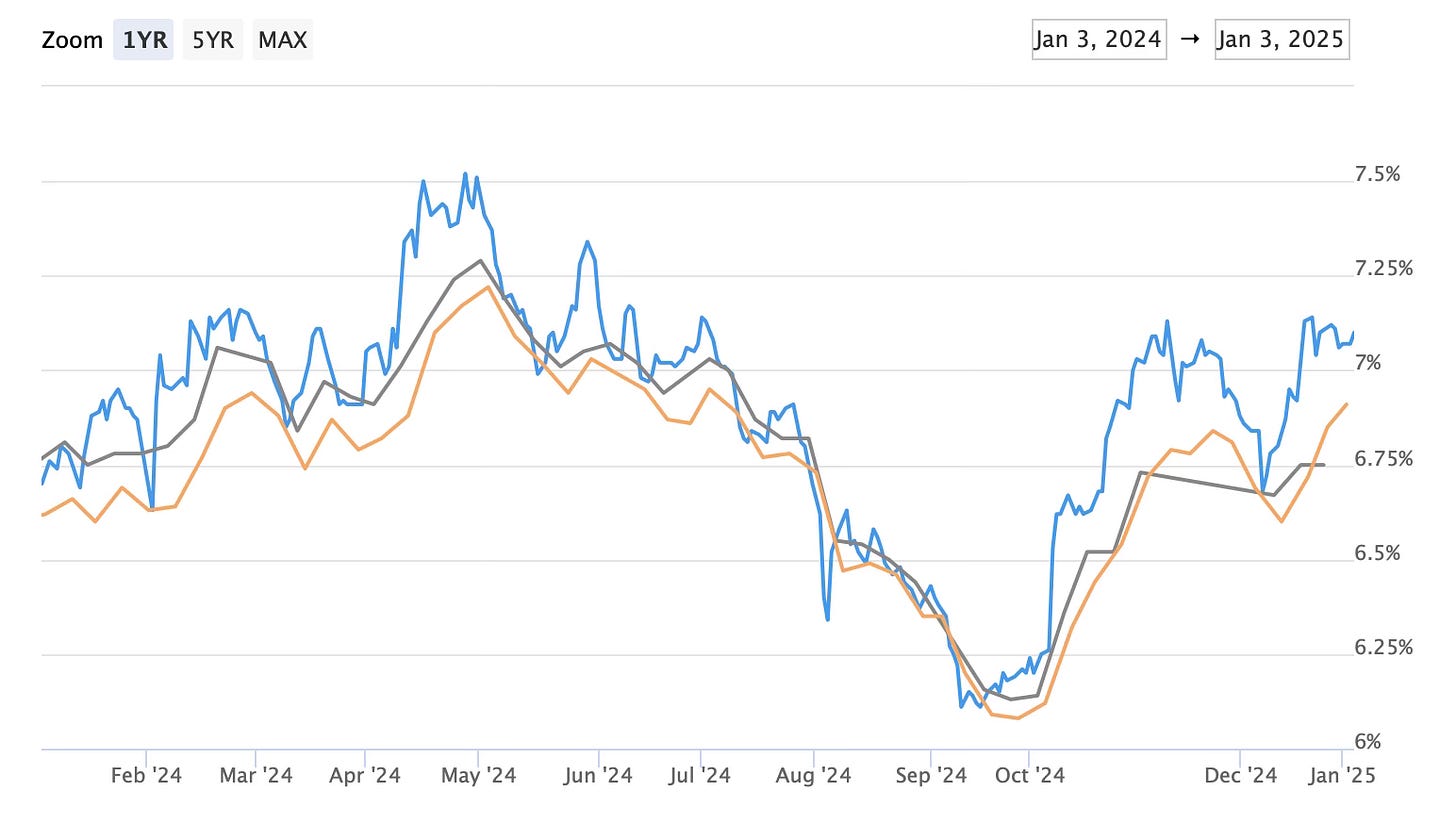

Home mortgage rates have not declined, however, and that is a big problem for the real estate market and would-be homeowners (more on this next week). In fact, home mortgage rates have continued to go up.

The average yield on a 30-year fixed mortgage to begin the 2024 calendar year was around 6.7%. As shown in the chart below, by the end of the summer, rates had dropped to about 6.1% before climbing back to the very same levels they started the year. And then in the final three weeks of the year, rates jogged higher once again to their current levels of about 7.1%. (The three differently colored lines in the chart represent three different data sources. I tend to lean the most on the blue Mortgage News Daily data as I think it is the most accurate and closest to real time data).

If you’re wondering why mortgage rates rose almost exactly when the Fed started cutting rates in September, I wrote about this phenomenon in October and would point you there for further discussion. Since I wrote that piece, as noted above, the Fed has cut rates twice more, and home mortgage rates have continued to rise, showing the bond market is still spooked about certain aspects of the economy not to mention the prospect of long-term inflationary pressures.

Looking Ahead to 2025

So what is the outlook for 2025? The talk gets a bit wonky, but there is a concept of implied rates out there that measures the difference between current rates and expectations of future rates. Right now, these implied rates are hinting at a Fed that’s more worried about doing too much than too little. The persistence of sticky inflation in key sectors has tethered policymakers to their higher-for-longer mantra. But traders are betting on an economic slowdown by late 2025, with rate cuts creeping back into the picture as economic growth cools and geopolitical uncertainty casts its long shadow over global markets. Still, the pace of expected cuts is subdued.

In one conversation I had with a fellow banker this past week, he likened it to less like a dramatic drop and more like a slow exhale after holding your breath for too long, which I thought was a good analogy. In other words, markets are pricing in a continued cautious turn with rate cuts penciled in, but the scope of those anticipated cuts is likely to remain modest. There is not going to be a rapid easing of rates, but a deliberate adjustment, accelerated only if economic data shows slowing growth or meaningful cracks of any kind.

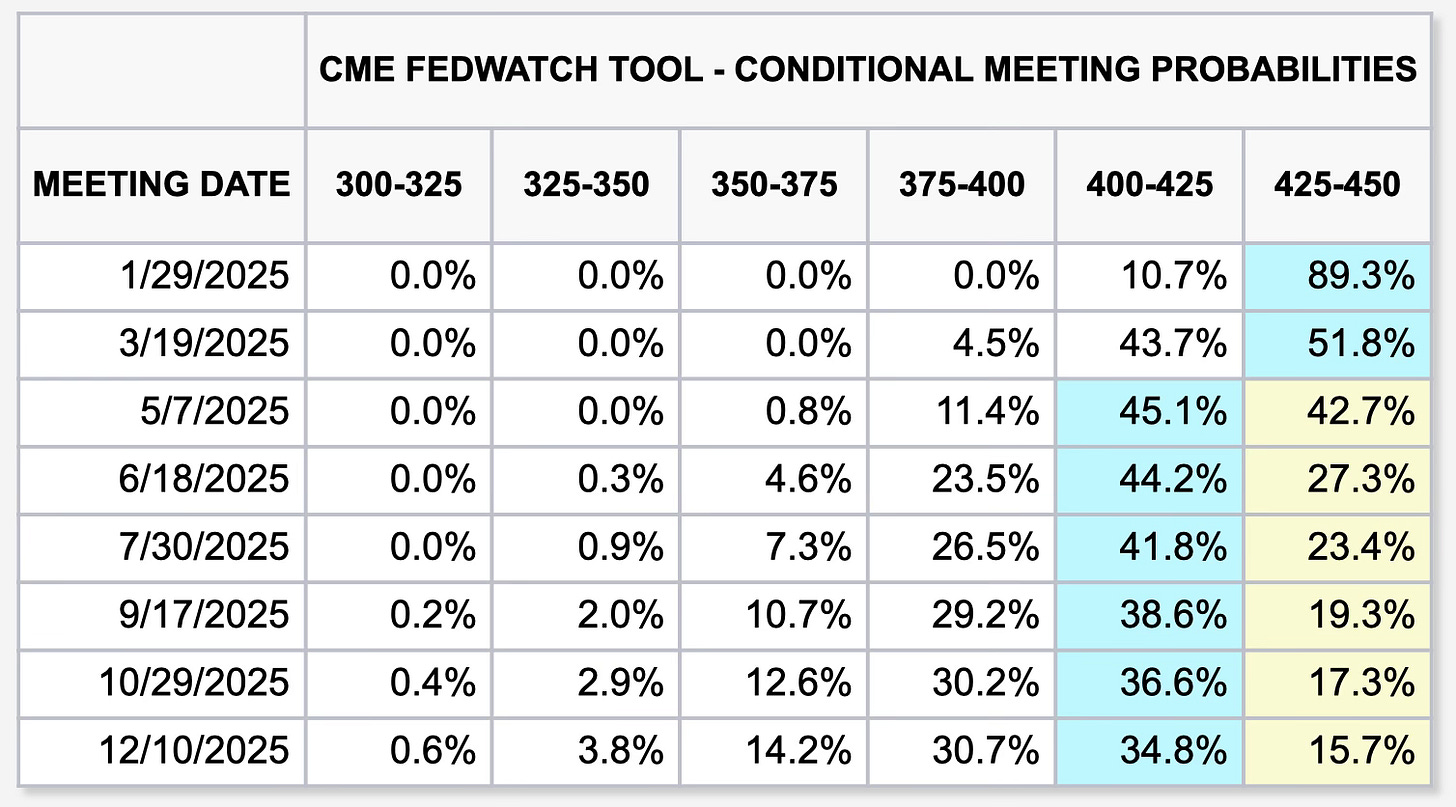

Yes, keeping in mind the tool below was not accurate in 2024, it is still interesting to see specifically what the market and various prognosticators are saying for 2025. The current Fed Funds range as of today is 425-450 (in layman’s terms: 4.25-4.50%). The chart below shows an 89.3% change the range will stay the same through the January meeting (i.e. the Fed will not cut in January), a 51.8% chance the range will be the same through March, and then a 42.7% chance the range will be the same through May (with a slightly better chance of a 25-basis point cut by the May meeting).

As you can see, even by next December, the odds for the various rate ranges show that the highest odds are, in fact, for only a cut of 25 basis points in all of 2025, although it should be noted if you were to aggregate the odds for all of the ranges lower than that, it would actually outpace the odds of this more modest cut.

In general, what this all means is a year of relative stasis. This is barring any major economic setbacks or geopolitical calamities, which is a big assumption.

Commercial rates, which are more commonly priced around what the Fed is doing than residential rates are, are likely to hover around their current levels and ease downward slightly, but without some precipitous fall that many business owners, governmental bodies, and others who borrow would like to see.

Home loan rates are less predictable, as they depend on a number of variables beyond the Fed’s moves. Those looking for relief in the home mortgage market, however, may not immediately find it in 2025. More on that and the topic of the state of the housing market more broadly speaking in next week’s article.

A Quick Final Note on Deposit Rates

Rates for savers are not specifically tied to the Fed, but they do tend to move in correlation. For many years in the 2000s and 2010s, savers were earning next to nothing on savings and checking accounts not to mention CDs and Money Market account. Deposit rates soared from 2022 to 2024, however, although they have been easing down a bit in recent months, mirroring the Fed’s own decreases in rates.

Rates are not likely to spike for savers this years, and many savers may see a similar phenomenon of the air letting out of a balloon that borrowers will see, difference being a rate decline for borrowers is mathematically positive while a rate decline for depositors, not so much. Bear in mind, however, banks and credit unions operate in a competitive environment with one another and all banks are eager for deposits. These competitive pressures may keep rates boosted for savers throughout 2025.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

A Follow-up

Following up on last week’s article, the S&P 500 did finish off the year with a total gain of 23%. This marked the second straight year of 20%+ gains, which is the first time that has happened since the 1990s. Although the Dot Com Bubble is widely remembered as what followed such robust growth in the 1990s, and although I was throwing some cold water last week on prospects for further investment gains in 2025, if you’re looking to compare the mid 2020s with the 1990s, keep in mind that the S&P 500 actually achieved 20%+ returns FIVE straight years from 1995-1999, which shows that just because a market has done well, sometimes there is still further room to run.

Have a great week, everybody!